Exhibit 10.18

LEASE AGREEMENT

CARDINAL PARK

1. DEFINITIONS AND BASIC PROVISIONS.

A. “Effective Date”: April , 2012

B. “Landlord”: Bayview (TX) Holding, LLC, a Delaware limited liability company

C. Landlord’s Address: 5055 Keller Springs Road, Suite 300, Addison, Texas 75001

D. “Tenant”: Inogen, Inc., a Delaware corporation

E. Tenant’s Address: Before the Commencement Date: 326 Bollay Drive, Goleta, CA 93117

F. Tenant’s Address: After the Commencement Date: 1125 E. Collins Blvd. Suite 200 Richardson, TX 75081

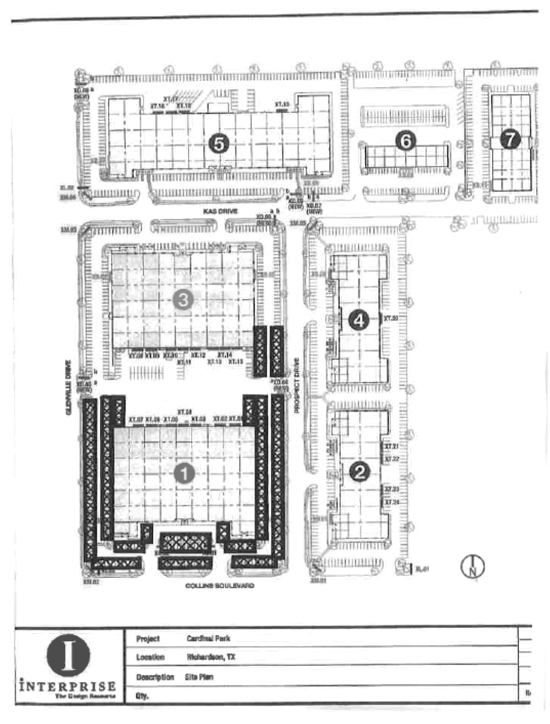

G. “Building”: The structure commonly known as Cardinal Park I, 1125 E. Collins Blvd and which is located on the tract of land (the “Land”) described by on Exhibit “B” attached to this Lease and made a part of this Lease for all purposes.

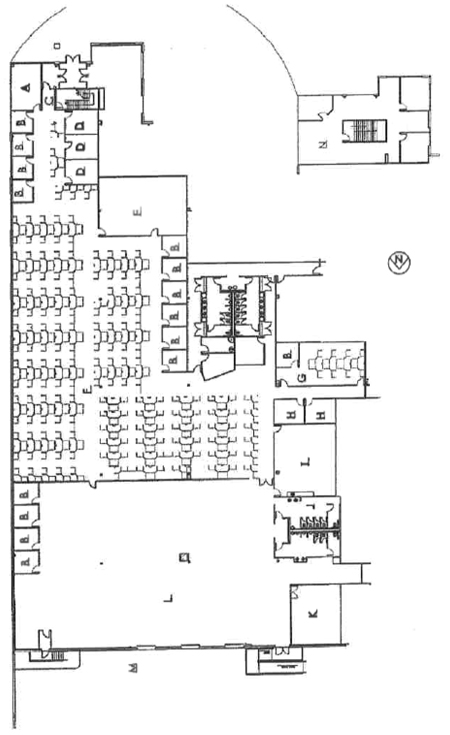

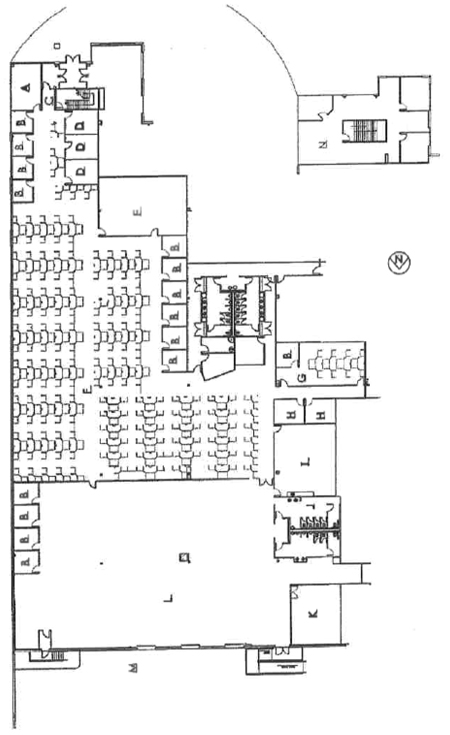

H. “Premises”: Suite No. 200 in the Building, consisting of approximately 31,204 square feet of Net Rentable Area (the “Rentable Area in the Premises”), and as outlined and hatched on the plan attached hereto as Exhibit “A” and made a part hereof for all purposes. As used herein, the term “Net Rentable Area” means that area, on either a single tenancy floor or a floor to be occupied by more than one tenant, that is determined by measuring and computing rentable area on each type of floor in accordance with the Standard Method for Measuring Floor Area in Office Buildings promulgated by Building Owners and Managers Association International (ANSI/BOMA Z65.1-1996). Following the completion of the Tenant Improvements, Landlord may re-measure the Net Rentable Area of the Premises in accordance with the foregoing standard in which case, the decision of an independent architect mutually agreed upon by Landlord and Tenant, but whose fee shall be paid at the sole cost and expense of Landlord, shall be final, binding and conclusive. After the Rentable Area in the Premises has been determined, if such Rentable Area in the Premises agreed to differs from the square feet of Rentable Area set forth above, Landlord and Tenant shall promptly execute a certificate stipulating and agreeing to the same as of the date of such certificate. All payments of Rent shall be made as and when required in this Lease and shall be based on the Rentable Area in the Premises set forth in this Section 1.H. unless and until a Rent Certificate has been executed by Landlord and Tenant, whereupon any overpayment or any underpayment theretofore made shall be adjusted by increasing or reducing, as the case may be, the next installment(s) of Base Rental coming due by the amount of such underpayment or overpayment, as applicable (and no interest or penalty shall be applied thereto).

I. “Project”: The Building, the parking facilities, and other structures, improvements, landscaping, fixtures, appurtenances and other Common Areas owned or controlled by Landlord now or hereafter, constructed or erected on the Land.

J. “Rentable Area in the Project”: 100,354 square feet of Net Rentable Area unless modified as provided herein.

K. “Tenant’s Proportionate Share”: 31.09%, which is the ratio between the Rentable Area in the Premises as of the Effective Date and the Rentable Area in the Project. If the Rentable Area in the Premises and/or the Rentable Area in the Project changes, Tenant’s Proportionate Share shall be adjusted effective as of the date of such change, provided that a mutually acceptable Rent Certificate has been executed by Landlord and Tenant memorializing such change.

L. “Commencement Date”: Subject to the provisions of the Exhibit “D” attached hereto, the commencement date is June 1, 2012. Upon Landlord’s request, Tenant agrees to execute and deliver a written declaration (the “Rent Certificate”) expressing the Commencement Date hereof.

M. “Term”: Commencing on the Commencement Date and ending 90 full calendar months after the Commencement Date, plus any partial calendar month following the Commencement Date, subject to (i) adjustment and earlier termination as provided in this Lease or by operation of law and (ii) the terms of Exhibit “F” (Extension of Term).

N. “Base Rental”: The amounts set forth in the table below. Each monthly installment of Base Rental shall be due and payable in accordance with Section 3.

| Months |

Annual Base Rental |

Monthly Base Rental |

Annual Rental/SF |

|||||||||

| 1 - 6 | $ | 0.00 | $ | 00.00 | $ | 00.00 | ||||||

| 7 - 18 | $ | 8.00 | $ | 20,802.67 | $ | 249,632.00 | ||||||

| 19 - 30 | $ | 8.50 | $ | 22,102.83 | $ | 265,234.00 | ||||||

| 31 - 42 | $ | 9.25 | $ | 24,053.08 | $ | 288,637.00 | ||||||

| 43 - 54 | $ | 9.50 | $ | 24,703.17 | $ | 296,437.92 | ||||||

| 55 - 90 | $ | 10.00 | $ | 26,003.33 | $ | 312,040.00 | ||||||

O. “Prepaid Rental”: $20,802.67, to be applied to the first accruing monthly installment of Base Rental (e.g., Base Rental for month seven (7) of the Term).

P. “Security Deposit”: $26,003.33.

Q. “Permitted Use”: The Premises shall be used only for general office, production, testing and distribution purposes, and for such other lawful purposes as are consistent with such uses in Richardson, Texas, and for no other purpose without Landlord’s prior written consent. No retail showroom shall be permitted within the Premises. The Premises shall not be used for any use that is disreputable or for any use that is a public nuisance.

-2-

R. “Common Areas”: That part of the Project designated by Landlord from time to time for the common use of all tenants, including among other facilities, sidewalks, service corridors, curbs, truck ways, loading areas, private streets and alleys, lighting facilities, delivery passages, parking areas, decks and other parking facilities, landscaping and other areas not leased or held for lease within the Building.

S. “Tenant’s Broker”: Henry S. Miller, Jim Turano.

T. “Rent”: The Base Rental and the Additional Rental.

U. “Additional Rental”: Electrical Costs, Tenant’s Share of Operating Expenses (defined below) and all other payments and reimbursements required to be made by Tenant under this Lease.

V. “Tenant Party(ies)”: Tenant, any assignees claiming by, through, or under Tenant, any subtenants claiming by, through, or under Tenant, and any of their respective agents, contractors, employees, and invitees.

W. “Operating Expense Stop”: The actual cost and expense paid or incurred by Landlord during calendar year 2012 (the “Base Year”) for Operating Expenses, as hereinafter defined, divided by the Rentable Area in the Project.

X. “TI Allowance”: Subject to the terms of Exhibit “D” (the “Work Letter”), an allowance of $11.50 per square foot of Rentable Area in the Premises ($358,846.00).

Y. “Parking Spaces”: Five parking spaces for every 1000 square feet of Net Rentable Area in the Premises (estimated to be 155 spaces as of the Effective Date). Shown on Exhibit “H-1”. The Parking Spaces will be within the area cross-hatched on Exhibit “H-1” attached hereto. Hence, the “Parking Area”, as defined in Exhibit “H” shall be the area reflected on Exhibit “H-1”.

Z. “Guarantor”: None.

Each of the foregoing definitions and basic provisions shall be construed in conjunction with the references thereto contained in the other provisions of this Lease and shall be limited by such other provisions. Each reference in this Lease to any of the foregoing definitions and basic provisions shall be construed to incorporate each term set forth above under such definition or provision.

2. GRANTING CLAUSE. In consideration of the obligations of Tenant to pay Rent as herein provided and in consideration of the other terms, covenants and conditions hereof, Landlord hereby demises and leases to Tenant, and Tenant hereby leases from Landlord, the Premises as described above, to have and to hold such Premises for the Term of this Lease, all upon the terms and conditions set forth in this Lease. Notwithstanding the terms of Section 1.L, and upon Substantial Completion of the Premises, Tenant may occupy the Premises prior to the Commencement Date for purposes of installing furniture, fixtures and equipment therein, and any such early occupancy by Tenant shall be subject to all provisions of this Lease other than those relating to payment of Base Rental, including provisions relating to liability for loss or damage, insurance, compliance with laws and delays caused by Tenant and penalties therefor.

-3-

3. BASE RENTAL. As Rent for the lease and use of the Premises, Tenant will pay Landlord or Landlord’s assigns, in 12 equal monthly installments on the first day of each calendar month, in advance and without deduction, abatement or setoff, the Base Rental in the then applicable amount set forth in Section I.N. hereof, in lawful money of the United States. All installments of Rent shall be paid to Landlord at the address set forth in Section 1.C. (or such other address as may be designated by Landlord from time to time). Landlord hereby agrees to provide Tenant with sufficient information necessary for Tenant to make all payments to Landlord due under this Lease via Automatic Clearing House (“ACH”) payment, wire transfer or other form of electronic payment as may be requested by Tenant.

If the Commencement Date is other than the first day of a calendar month or if this Lease expires or terminates on other than the last day of a calendar month, then the installments of Base Rental for such month or months shall be prorated and the installment or installments so prorated shall be paid in advance. Said installments for such prorated month or months shall be calculated by multiplying the equal monthly installment by a fraction, the numerator of which shall be the number of days of the Term occurring during said commencement or expiration month, as the case may be, and the denominator of which shall be the number of days in said month.

All past due installments of Rent or other payments specified in this Lease shall bear interest from the first day which is five days after Tenant receives a written notice from Landlord that the same is past due until payment is received at the rate (the “Interest Rate”) equal to the lesser of (i) a per annum rate equal to the “prime rate” or “base rate” announced by JPMorgan Chase Bank or its successor, from time to time (“Prime Rate”) (or if the “prime rate” or “base rate” is discontinued, the rate announced by such bank as that being charged to its most creditworthy commercial borrowers), plus 2%, or (ii) the maximum contract interest rate per annum allowed by law; provided, however, if Tenant shall fail to pay any Rent when due and such failure shall occur more than two times in any 12-month period, upon the third such failure all past due Rent then owing shall bear interest at the Interest Rate from the date due (without the requirement of notice from Landlord or the five day grace period). In addition, Tenant shall pay Landlord upon demand a late charge in an amount equal to 5% of any installments of Rent or other payments specified herein if such Rent is not paid within five days after Tenant receives a notice from Landlord that the same is past due. The provision for such late charge shall be in addition to all of Landlord’s other rights and remedies hereunder or at law, and shall not be construed as liquidated damages or as limiting Landlord’s remedies in any manner.

For purposes of making other payments due under this Lease (i.e. payments other than Base Rental, Additional Rental and any other payments for which a specific time period for payment is specified in this Lease), unscheduled payments due from Tenant to Landlord hereunder shall be due hereunder 30 days after Tenant’s receipt of a written notice and an invoice therefor from Landlord (accompanied by receipts or other reasonably adequate documentation) specifying the amount due by Tenant.

4. ADDITIONAL RENTAL AND OPERATING EXPENSES.

4.1. Tenant shall pay as Additional Rental the Electrical Costs (as hereinafter defined) and, subject to Section 4.4 below, Tenant’s Share of Operating Expenses (as hereinafter defined)

-4-

(i.e., Tenant’s Proportionate Share of the amount by which the Operating Expenses exceed the Operating Expense Stop), in the same manner and at the same time and location as set forth in Section 3 for the payment of Base Rental.

4.2. The term “Electrical Costs” means: (i) the cost of any sub metered electricity used in the Premises; plus (ii) Tenant’s Proportionate Share of the remainder of (1) the cost of all electricity used by the Project minus (2) the cost of any sub metered or separately metered electricity used by Tenant or other tenants of the Project minus (3) the cost of electricity allocable to other tenants leased premises within the Project that are reimbursable to Landlord by such other tenants. Each installment is payable according to Landlord’s estimate of the amount due for each month. From time to time, Landlord may estimate and re-estimate the Electrical Costs payable by Tenant and deliver a copy of the estimate or re-estimate to Tenant Thereafter, the monthly installments of Electrical Costs payable by Tenant shall be appropriately adjusted in accordance with those estimations.

4.3. The term “Operating Expenses” shall mean all expenses, costs and disbursements of every kind and nature which Landlord pays or becomes obligated to pay because of or in connection with the ownership, operation, maintenance, repair, replacement, protection and security of the Building and Project, determined in accordance with sound accounting principles consistently applied, including without limitation the following:

(a) Salaries and wages of all employees engaged in the operation, maintenance and security of the Project, including taxes, insurance and benefits (including pension, retirement and fringe benefits) relating thereto;

(b) Cost of supplies and materials used in the operation, maintenance and security of the Project including the cost of repairs, replacements and services which are performed by Landlord pursuant to Section 4.3;

(c) Cost of all utility service (including water and sewage service) supplied to the Project, with the exception of Electrical Costs and utility services supplied to tenants of the Project for use within their respective leased premises, regardless of whether the costs of such utilities are to be directly paid by such tenants to the applicable utility providers;

(d) Cost of all maintenance, repair and replacement of, and any service agreements for the Project and the equipment therein, including without limitation, any of the following (if provided): parking facilities, landscaping, fire protection, sprinklers, trash removal, window cleaning, and elevator maintenance;

(e) Cost of all insurance relating to the Project, including the cost of casualty, rental and liability insurance applicable to the Project and Landlord’s personal property used in connection therewith;

(f) All taxes, assessments and governmental charges (foreseen or unforeseen, general or special, ordinary or extraordinary) whether federal, state, county or municipal and whether they be levied by taxing districts or authorities presently taxing the Project or by others

-5-

subsequently created or otherwise, and any other taxes and assessments attributable to the Project or its operation, and all taxes of whatsoever nature that are imposed in substitution for or in lieu of any of the taxes, assessments or other charges herein defined (collectively, the “Taxes”); and the cost of any tax consultant employed to assist Landlord in determining the fair tax valuation of the Building, Land and Project, provided, however, that Operating Expenses shall not include taxes paid by tenants of the Project as a separate charge on the value of their leasehold improvements, death taxes, excess profits taxes, franchise taxes and state and federal income taxes except to the extent imposed in substitution for or in lieu of any Taxes;

(g) Cost of repairs and general maintenance and reasonable depreciation charges applicable to all equipment used in repairing and maintaining the Project, but specifically excluding repairs and general maintenance paid by proceeds of insurance or by Tenant or by other third parties;

(h) Cost of improvement items, including installation thereof, that, although capital in nature, are (1) expected, to reduce the normal operating costs (including any utility costs) of the Building (2) expected to avoid increases in operating costs (including any utility costs) of the Building based on Landlord’s good faith determination or (3) reasonably calculated to improve the safety of tenants of the Building and their guests and invitees, based on Landlord’s good faith determination as well as all capital improvements made in order to comply with any Law hereafter promulgated by any governmental authority, as amortized over the useful economic life of such improvements as determined by Landlord (without regard to the period over which such improvements may be depreciated or amortized for federal income tax purposes) (collectively, “Unanticipated Expenses”);

(i) Cost of repair and maintenance of the landscape and parking areas; and

(j) Reasonable management fees paid by Landlord to third parties or to management companies owned by, or management divisions of, Landlord.

To the extent that any Operating Expenses are attributable to the Project and other projects of Landlord, a fair and reasonable allocation of such Operating Expenses shall be made between the Project and such other projects.

Notwithstanding anything seemingly to the contrary contained herein, Operating Expenses shall not include the following:

(i) Costs for capital improvements made to the Building and/or the Project other than amortization of the cost described in subsection (h) above and except for items that, though capital for accounting purposes, are properly considered maintenance and repair items, such as painting of common areas, replacement of carpet in Common Areas and the like;

(ii) Costs of repairs, restoration, replacements or other work occasioned by (1) Casualty of an insurable nature (whether such destruction be total or partial) and (aa) payable (whether paid or not) by insurance required to be obtained by Landlord under this Lease (whether or not such insurance is actually carried), (bb) otherwise paid by insurance then in effect obtained by Landlord, or (cc) not so paid by insurance to the extent such deductible exceeds customary

-6-

deductibles for other office buildings in Richardson, Texas that are comparable to the Building (“Comparable Buildings”), (2) the exercise by an governmental authority of the right of eminent domain, whether such Taking be partial or total, and (3) the gross negligence or willful misconduct of Landlord, or its agents and employees or any other tenant of the Project;

(iii) Subject to subsection (h) and subsection (i) above, payments of interest and principal on loans to Landlord and other finance charges made on any debt and rental payments made under any ground or underlying lease or leases, except to the extent that a portion of such payments is expressly for ad valorem/real estate taxes or insurance premiums on the Project,

(iv) Deductions for depreciation and amortization of the Project and the Project equipment (except as provided in subsection (h) and subsection (i) above);

(v) Real estate commissions, leasing commissions, legal fees, tenant incentives, reasonable marketing and advertising expenses and other costs, disbursements and other expenses incurred by Landlord in leasing or attempting to lease the Project, including negotiations for leases with tenants, other occupants, or prospective tenants or other occupants of the Project, or similar costs incurred in connection with disputes with tenants, other occupant, or prospective tenants or other occupant of the Project;

(vi) Allowances, concessions, or other costs (including the cost of plans, permits, licenses and inspection fees) incurred with respect to the installation of tenant improvements made for other tenants in the Project or in renovating or otherwise improving, decorating, painting or redecorating vacant space for tenants or other occupants of the Project;

(vii) Costs and expenses attributable to the initial construction of the Project, repairs resulting from any defect in the original design or construction of the base building improvements in the Project, the leasehold improvements of other occupants of the Project, Project equipment or failure of the Project to be constructed in accordance with Law in effect as of the Effective Date;

(viii) Costs of designing, installing, operating and maintaining any specialty facility, including but not limited to, a luncheon club, athletic or recreational club, cafeteria or dining facility, hair salon, restaurant, or other retail use, other than the costs of Building standard services provided to tenants generally and paid for by any such facility through a contribution towards Operating Expenses of the Project;

(ix) Costs incurred by Landlord for legal, auditing, consulting and professional fees paid or incurred in connection with negotiations for the sale, financing, refinancing or mortgaging of the Building or the Project;

(x) Landlord’s general corporate overhead costs (including salaries, equipment, supplies, accounting and legal fees, rent and other occupancy costs) relating solely to the operation and internal organization and function of Landlord as a business entity (i.e. trustee’s fees and partnership organizational expenses) (as opposed to maintenance, ownership and operation of the Project);

-7-

(xi) Any penalty charges incurred by Landlord due to Landlord’s late payment of taxes, utility bills or other amounts included in Operating Expenses except to the extent the interest or penalties arise from late payments beyond Landlord’s control or because Landlord was contesting the payment of such item in good faith, provided, however, the foregoing does not excuse Landlord from not having sufficient funds to pay such taxes, utility bills or other costs but does include interest or penalties arising from late payments due to Landlord not receiving the applicable bills in time to pay them prior to incurring the penalty;

(xii) Any fines or penalties incurred due to Landlord’s violation of Laws; provided that such violation is not caused by Tenant or is not the result of a future change in Laws and that the costs of any capital improvements resulting therefrom are subject to subsection (h) and subsection (i) above;

(xiii) Costs of acquiring, insuring and maintaining (to the extent the maintenance is in excess of Building standard maintenance) fine art work in the Project, whether permanent or temporary;

(xiv) Any compensation paid to clerks, attendants or other persons employed in commercial concessions operated by Landlord for a profit in leasable space in the Building;

(xv) Costs incurred by Landlord to encapsulate or remove any Hazardous Substances (defined below) that were not caused by the actions of Tenant, its agents, employees, contractors, subtenants, assignees or invitees to the extent Laws in effect prior to the Effective Date require Landlord to take affirmative action to encapsulate or remove such Hazardous Substance which was located in the Project prior to the Effective Date and such action was not taken by Landlord prior to the Effective Date; provided, however, the foregoing does not include , the routine cleaning of any such Hazardous Materials (e.g., oil spots from cars in the Parking Area).

(xvi) Costs incurred by Landlord for any items not otherwise excluded to the extent Landlord (A) is actually reimbursed by insurance, (B) would have been reimbursed by insurance had Landlord maintained the insurance required by Section 12.2 on which a claim is made or (C) is otherwise compensated (other than as part of Operating Expenses), including without limitation, direct reimbursement by any tenant;

(xvii) All amounts which would otherwise be included in Operating Expenses which are paid to any affiliate of Landlord to the extent the costs of such services exceed the amount which would have been paid in the absence of such relationship for similar services of comparable level, quality and frequency rendered by persons of similar skill, competence and experience (but Operating Expenses shall include any such amounts specifically provided for or permitted in this Lease [including without limitation, the sums permitted to (a) and (j) above] for which the provisions of this Lease shall control);

(xviii) Costs or expenses for services of a type or quantity which Tenant is not entitled to receive (and does not receive) but which are provided to another tenant or occupant of the Project;

-8-

(xix) Costs, fees, dues, contributions or similar expenses for political, charitable, industry associations or similar organizations;

(xx) Any penalties or legal costs paid by Landlord due to the violation by Landlord of the terms of this Lease or any other lease pertaining to the Project, except to the extent caused by Tenant;

(xxi) Landlord’s costs of any services sold to tenants for which Landlord is entitled to be reimbursed by such tenants as an additional charge or rental over and above the Base Rental and Operating Expenses payable under the lease with such tenant or other occupant

(xxii) Subject to subsection (h) and subsection (ii) above, payments for rented equipment, the cost of which equipment would constitute a capital expenditure (as defined in accordance with generally accepted amounting principles) if the equipment were purchased

(xxiii) Subject to subsection (a) above, salaries or other compensation paid to executive employees above the grade of senior property manager or the salaries of non-management employees, except to the extent of actual time expended at or on behalf of the Project by such non-management employees;

(xxiv) Increased insurance premiums caused by Landlord’s or any other tenants acts;

(xxv) Costs incurred (less costs of recovery) for any items to the extent covered by a manufacturer’s, materialman’s, vendor’s or contractor’s warranty (a “Warranty”) which are paid by such manufacturer, materialman, vendor or contractor (Landlord shall pursue a breach of warranty claim for items covered by a Warranty unless Landlord determines in good faith that such action would not be in the best interest of the tenants of the Project);

(xxvi) Costs or expenses of utilities directly metered to tenants of the Project and payable separately by such tenants and costs of additional electrical equipment installed in premises of other tenants of the Project and costs of electricity consumed through such additional electrical equipment, whether or not such costs are payable by such other tenants, and the costs of heating, ventilating and air-conditioning services provided to the premises of other tenants of the Project, whether or not such costs are payable by such other tenants;

(xxvii) Costs of any work or service performed for the benefit of any improvements other than those comprising the Project; and

(xxviii) Costs resulting from the gross negligence or intentional tort of Landlord, or any subsidiary or affiliate of Landlord, or any representative, employee or agent of same.

4.4. For purposes hereof, “Tenant’s Share of Operating Expense” shall mean Tenant’s Proportionate Share of the amount by which Operating Expenses exceed the Operating Expense Stop. Landlord shall submit to Tenant before the expiration of the Base Year and the beginning of each calendar year thereafter, or as soon thereafter as reasonably practicable, a statement of

-9-

Landlord’s estimate of Tenant’s Share of Operating Expenses during such calendar year_ Commencing upon the expiration of the Base Year and in additional to Base Rental, Tenant shall pay to Landlord monthly on the first day of each calendar month during such calendar year in question, as Additional Rental, an amount equal to one twelfth ( 1/12th) of the estimated amount of Tenant’s Share of Operating Expenses. From time to time during any calendar year, Landlord may estimate and re-estimate Tenant’s Share of Operating Expenses to be due by Tenant for that calendar year and deliver a copy of the estimate or re-estimate to Tenant. Thereafter, the monthly installments of Tenant’s Share of Operating Expenses payable by Tenant shall be appropriately adjusted in accordance with the estimations so that, by the end of the calendar year in question, Tenant will have paid all of Tenant’s Share of Operating Expenses as estimated by Landlord. Any amounts paid based on such an estimate shall be subject to adjustment pursuant to Section 4.5 of this Lease when actual Operating Expenses are available for each year. If Landlord does not provide an updated estimate of Tenant’s Share of Operating Expenses prior to the expiration of the Base Year or the beginning of a calendar year, then until such time as an estimate of Tenant’s Share of Operating Expenses with respect to any particular calendar year is delivered to Tenant, Tenant shall pay to Landlord, on the first day of January and the first day of each calendar month thereafter during such calendar year in question the amount of such Additional Rental which shall have been payable by Tenant under this Section 4.4 with respect to the month of December of the immediately preceding calendar year. Thereafter, at such time as the estimate of Tenant’s Share of Operating Expenses with respect to such calendar year is delivered to Tenant, Tenant shall pay to Landlord within 30 days following receipt of such estimate the amount by which (i) the product of one twelfth (1/12th) of the amount of such estimate multiplied by the number of calendar months in such calendar year which shall have wholly or partially expired exceeds (ii) the amount of such Additional Rental which shall have been theretofore paid under this Section 4.4 with respect to such calendar months.

4.5. Landlord shall provide to Tenant a statement of the Operating Expanses and Electrical Costs incurred with respect to each calendar year on or before 120 days (or as soon thereafter as reasonably possible) following the end of such calendar year. If the Electrical Costs or Tenant’s Share of Operating Expenses (as applicable) actually incurred with respect to any calendar year exceeds the estimate of Electrical Costs or Tenant’s Share of Operating Expenses (as applicable) theretofore paid by Tenant for such calendar year, then Tenant shall pay to Landlord the amount of such excess within 30 days following receipt of notice from Landlord setting forth the Electrical Costs and/or Tenant’s Share of Operating Expenses for the calendar year in question. If the Electrical Costs or Tenant’s Share of Operating Expenses (as applicable) actually incurred with respect to any calendar year is less than the estimate of Electrical Costs or Tenant’s Share of Operating Expenses (as applicable) theretofore paid by Tenant for such calendar year, then Landlord shall credit the difference to Tenant against the next due installments of the estimated amount of Electrical Costs or Tenant’s Share of Operating Expenses (as applicable). If the Commencement Date of this Lease is not the first day of a calendar year or the expiration or termination date of this Lease is not the last day of a calendar year, then Electrical Costs or Tenant’s Share of Operating Expenses (as applicable) with respect to such calendar year shall be prorated. The provisions of this Section 4.5 shall survive the expiration or earlier termination of this Lease. Tenant’s electricity in the initial Premises shall be submetered and unique to the Premises.

4.6. Notwithstanding any other provision herein to the contrary, it is agreed that if the Project is not occupied to the extent of 100% of the Net Rentable Area thereof, then an adjustment

-10-

shall be made in computing the Operating Expenses and Electrical Costs for such calendar year so that the Operating Expenses and Electrical Costs are compiled as though the Project had been occupied to the extent of 100% of the Rentable Area in the Project during such calendar year. With respect to the calendar year in which the expiration date of the Term occurs, Landlord and Tenant agree to the following: (1) that the calendar year shall be deemed to have commenced on January 1 of that year and ended on the expiration date of the Term (the “Final Calendar Year”) and (2) unless Tenant makes written exception to any item within 30 days after Landlord provides Tenant with a statement of Operating Expenses, the Operating Expenses for the Final Calendar Year shall be considered as final and accepted by Tenant.

4.7. Provided no Event of Default is then in existence and is continuing, Tenant may, after giving Landlord 30 days prior written notice thereof, inspect or have an independent, nationally or regionally recognized firm of certified public accountants audit Landlord’s records relating to Operating Expenses for the immediately preceding lease year; however, no review may cover periods before the Commencement Date. Tenant’s audit or inspection shall be conducted only during Landlord’s normal business hours. Tenant shall pay the cost of such audit or inspection unless the annual statement described in Section 4.5 for the time period in question is determined to be in error by more than 5% and, as a result thereof, Tenant paid to Landlord 5% more than the actual Tenant’s Share of Operating Expenses due for such time period, in which case Landlord shall pay Tenant’s audit costs and expenses (not to exceed $1,500). Tenant may not conduct an inspection or have an audit performed more than once during any calendar year. Tenant shall complete its review within 60 days of the commencement of such review and shall notify Landlord of its results, If such inspection or audit reveals that an error was made in the Operating Expenses previously charged to Tenant and Tenant paid more than its share of Operating Expenses during the year in question, then Landlord shall credit the difference to Tenant against the next due installments of the estimated amount of Tenant’s Share of Operating Expenses (or upon expiration or earlier termination of this Lease, Landlord shall pay such difference to Tenant in cash or its equivalent within 30 days after the completion of such audit); likewise, if Tenant paid less than its share of Operating Expenses during such year, then Tenant shall pay Landlord such deficiency within 30 days after such determination is made. Tenant shall maintain the results of each such audit and inspection confidential and shall not be permitted to use any third party to perform such audit and inspection unless such third party is (i) an independent, nationally or regionally recognized firm or is otherwise reasonably acceptable to Landlord, (ii) agrees with Landlord in writing to maintain the results of such audit or inspection confidential, and (iii) not to be compensated on a contingency fee basis for such audit.

4.8. Should Tenant desire any additional services beyond those which Landlord is expressly obligated to provide pursuant to this Lease or should Tenant desire rendition of any of such services outside the normal times provision of such services by Landlord or its agents or employees, Landlord may (at Landlord’s option), upon reasonable advance notice front Tenant to Landlord, furnish such services, and Tenant agrees to pay Landlord such charges as may be agreed on between Landlord and Tenant, but in no event at a charge less than Landlord’s actual cost plus overhead for the additional services provided.

4.9. Landlord and Tenant are knowledgeable and experienced in commercial transactions and agree that the terms of this Lease for determining charges, amounts, Electrical Costs and

-11-

Tenant’s Share of Operating Expenses payable by Tenant are commercially reasonable and valid even though such methods may not state a precise mathematical formula for determining such charges.

5. TAXES.

5.1. Tenant shall be liable for the timely payment of all taxes levied or assessed against personal property, furniture or fixtures or equipment placed by Tenant in the Premises. If any such taxes for which Tenant is liable are levied or assessed against Landlord or Landlord’s property and if Landlord elects to pay the same, or if the assessed value of Landlord’s property is increased by inclusion of personal property, furniture or fixtures or equipment placed by Tenant in the Premises, and Landlord elects to pay the taxes based on such increase, Tenant shall pay to Landlord upon within 30 days of Tenant’s receipt of a written notice and an invoice from Landlord therefor, that part of such taxes for which Tenant is liable hereunder.

5.2. If at any time during the Term of this Lease, a tax or excise on rental, a sales tax or other tax however described (except any inheritance, estate, gill, or federal income tax or franchise tax imposed upon Landlord) is levied or assessed against Landlord by any taxing authority having jurisdiction on account of Landlord’s interest in this Lease, or the rentals or other charges payable hereunder, as a substitute in whole or in part for, or in addition to, the taxes described elsewhere in this Section 5.2 (including, without limitation, all taxes attributable to taxable margin levied pursuant to Chapter 171 of the Texas Tax Code or any amendment, adjustment or replacement thereof), the amount of such tax or excise shall be included in the calculation of Operating Expenses to be paid by Tenant in Additional Rent in equal portions over the remaining months of the then current lease year. In the event that any such Tax or excise is levied or assessed directly against Tenant, Tenant shall pay the same at such times and in such manner as such taxing authority shall require.

5.3. Landlord may from time to time contest the Taxes. If Landlord elects to contest the Taxes, then Landlord may bill Tenant for Tenant’s Proportionate Share of the costs and expenses of such contest as and when incurred, and those amounts shall constitute part of the Taxes. To the extent Landlord has so billed and received payment from Tenant, such costs and expenses shall not be reduced as described below by the abatement or refund, if any, ultimately received with respect to that contest. The Taxes shall be reduced by any net abatement or refund paid to Landlord by the taxing authorities as a result of any contest after recovering all of Landlord’s costs and expenses of securing such abatement or refund. Should Landlord elect not to contest the Taxes, Tenant shall have the right to contest the Taxes. If Tenant elects to contest the Taxes, then Tenant shall pay in full to Landlord the Taxes which Tenant is liable to pay hereunder, plus any additional amounts as Landlord may reasonably estimate Tenant may incur in penalties and interest if Tenant loses the contest in whole or in part and the Landlord shall, at Tenant’s expense, cooperate fully with Tenant in connection therewith; however, Landlord shall have no obligation to take any action to which Landlord reasonably objects. Landlord shall refund to Tenant Tenant’s Proportionate Share amounts, if any, received by Landlord as a rebate of Taxes actually paid by Tenant to Landlord, less all costs and fees, if any, including professional, incurred by Landlord in connection with obtaining such refund. The Taxes shall be reduced by any net abatement or refund paid to Landlord by the taxing authorities as a result of any contest after recovering all of Landlord’s costs and expenses of securing such abatement or refund.

-12-

6. PREPAID RENTAL AND SECURITY DEPOSIT. Landlord acknowledges receipt from Tenant of the sum stated in Section 1.O hereof to be applied to the first accruing monthly installment of Base Rental (e.g., Base Rental for month seven (7) of the Term. Landlord further acknowledges receipt from Tenant of a Security Deposit in the amount stated in Section 1.P hereof to be held by Landlord, without obligation for interest, as security for Tenant’s performance hereunder, it being expressly understood that the Security Deposit is not an advance rental deposit or measure of Landlord’s damages in case of Tenant’s default. Upon the occurrence of any Event of Default by Tenant, Landlord may, without prejudice to any other remedy provided herein or by law, use the Security Deposit to pay any arrears in Rent and any other damage, injury, expense (including legal expenses) or liability caused by such Event of Default. If any or all of such Security Deposit is so used, Tenant agrees to restore such Security Deposit within 30 days of Tenant’s receipt of written demand from Landlord therefor. The Security Deposit shall be Landlord’s property. If no Event of Default by Tenant exists under this Lease, Landlord shall return any remaining balance of such Security Deposit to Tenant (less the cost that Landlord incurs in restoring the Premises to the condition required by this Lease) within the time required by applicable Law, provided that Tenant has delivered a notice to Landlord of Tenant’s address for the purpose of refunding the Security Deposit. If Landlord sells or transfers the Premises, or a substantial part thereof, Landlord shall transfer such Security Deposit to the transferee (which transfer may be accomplished by a credit to the transferee upon such a transfer), and the transferor will be thereupon released from all liability for return of such Security Deposit provided that the transferee has agreed to assume all of Landlord’s obligations under this Lease. If the transferee has agreed to assume all of Landlord’s obligations under this Lease, then Tenant will look solely to such transferee for the return of the Security Deposit.

7. ACCEPTANCE OF PREMISES. Taking physical possession of the Premises by Tenant for purposes of conducting its business therein shall be conclusive evidence that Tenant accepts the Premises in an “AS IS, WHERE IS” with all faults and condition subject to completion of the work described on Exhibit “D”, Landlord’s repair and maintenance obligations set forth in this Lease, and the completion of punch list items, if any, relating to the Tenant Improvements and Landlord’s repair and maintenance obligations set forth in this Lease. Notwithstanding the foregoing, Landlord shall deliver the Premises to Tenant in good order and “broom clean” condition and in compliance with all applicable Laws. Landlord shall have no obligation to perform or pay for any repair or other work, other than as set forth in this Lease; provided, however, nothing in this Section 7 shall relieve Landlord of its repair and maintenance obligations under this Lease, including with respect to latent defects in the base building improvements.

8. USE OF PREMISES. The Premises shall be used and occupied only for the Permitted Use stated in Section 1.Q hereof and not otherwise. Notwithstanding the foregoing and subject to Section 31 without Landlord’s prior written consent, Tenant shall not receive, store or otherwise handle any product, material or merchandise which is explosive, or highly inflammable or hazardous. Tenant will conduct its business and control its agents in such a manner that such use of the Premises will not create any nuisance or unreasonably interfere with, annoy or disturb other tenants of the Project, if any, or the Landlord in its management or leasing of the Building Tenant shall, at its own expense, obtain any and all governmental licenses and permits necessary for the conduct of its business. Tenant shall not use the Premises as living or sleeping quarters or a residence. Tenant shall not permit any objectionable or unpleasant odors, smoke, dust, gas, light,

-13-

noise or vibrations to emanate from the Premises; nor at any time sell, purchase or give away food in the Premises except through vending machines or catering services in employees’ lunch or rest areas within the Premises for use by Tenant only. Tenant shall not take any other action that would constitute a public or private nuisance or would disturb the quiet enjoyment of any other tenant of the Building, or unreasonably interfere with, or endanger Landlord or any other person. If, because of Tenant’s sole acts, the rate of insurance on the Building or its contents increases, then Tenant shall pay to Landlord the amount of such increase as Additional Rent hereunder, and acceptance of such payment shall not constitute a waiver of any of Landlord’s other rights.

9. REPAIR AND MAINTENANCE.

9.1. Tenant understands and agrees that Landlord’s maintenance, repair and replacement obligations which are paid by Landlord and not reimbursed by Tenant, through Operating Expenses or otherwise, are limited to those set forth in this Section 9.1, Landlord at its own cost and expense, shall be responsible only for (a) replacement of the roof and roof membrane and the structural components of the roof and (b) repair and replacement of only the foundation of the Building, and the structural members of the exterior walls of the Building. Landlord’s obligations under clauses (a) and (b) shall not include windows, glass or plate glass, doors, special store fronts or office entries. Landlord’s liability with respect to any defects, repairs, replacement or maintenance for which Landlord is responsible hereunder shall be limited to the cost of such repairs or maintenance or the curing of such defect. Subject to the provisions of Section 4 of this Lease, Landlord shall further maintain the Common Areas and the Parking Areas (defined in Exhibit “H”). Tenant shall give immediate written notice to Landlord of the need for maintenance, repairs or corrections, but the failure of Tenant to provide any such notice shall not constitute a waiver of any rights or remedies available to Tenant hereunder except as to any matter for which Tenant does not give Landlord written notice within sixty (60) days after Tenant has notice thereof. Landlord shall not be required to make any improvements, replacements or repairs of any kind or character to the Premises except as expressly set forth in this Section 9.1. In addition to the provisions of Section 4 above, it is expressly understood that Tenant shall pay for any damage to the roof, foundation or to the structural soundness of the Building that is caused by the act of Tenant, or of Tenant’s employees, agents or invitees or that is caused by and Event of Default.

9.2. Tenant shall, at its own risk and expense, maintain all other parts of the Premises in good repair and condition (including all necessary replacements), including, but not limited to, all fixtures installed by Tenant, walls, carpeting and other floor covering, plumbing which is located in and serves the Premises, windows, window glass (excluding window frames), plate glass, doors (excluding door frames), heating, ventilation and air conditioning systems (the “HVAC Systems”), fire protection sprinkler system, downspouts, and other electrical, mechanical, and electromotive installation, equipment, and fixtures located in, under or above the Premises and which exclusively serve the Premises, any trash removal equipment, any utility repairs in the Premises related to use of such utilities in the Premises in ducts conduits, pipes and wiring located in, under or above the Premises, and any sewer stoppage located in, under, and above the Premises and caused exclusively by the use of the Premises. Tenant shall take good care of all leasehold improvements and fixtures, and suffer no physical waste. Tenant shall be responsible for all pest control and extermination within the Premises. Should Tenant neglect to keep and maintain the Premises, then Landlord shall have the right, but not the obligation, to have the work done and any costs reasonably incurred in

-14-

connection therewith shall be charged to Tenant as Additional Rental and shall become payable by Tenant with the payment of the Rent next due. At the termination of this Lease, Tenant shall deliver the Premises “broom clean” in the same good order and condition as existed at the Commencement Date ordinary wear and tear (and condemnation and fire or other casualty damage, as to which Sections 17 and 19 shall control) excepted.

Throughout the Term of the Lease, Tenant shall contract with a qualified and properly insured contractor to service and maintain the HVAC Systems on a regularly scheduled basis, but not less than once every three months, Such service shall include, but not be limited to, cleaning of the coil and condenser units on each unit; checking the electrical connections, the oil and refrigerant for leaks, the safety device, the blower belt for wear, tension and alignment, the expansion valve, coil temperature, and condensate drain; and maintaining the lubrication and addition of coolants. Tenant shall secure, at its sole cost and expense, and shall provide Landlord with a copy of the service contract, providing for the maintenance as described in above, within 60 days following the Commencement Date of this Lease, and thereafter, Tenant shall renew such service contract to Landlord prior to expiration of the then existing service contract.

9.3. Tenant agrees it shall not locate or install or cause to be located or installed any improvements in the Common Areas, including any bike racks, newspaper holder stands, vending machines of any kind, mailboxes, telephone booths, mobile homes, fences, or any other device of a similar nature which would impede or obstruct the Common Areas. Notwithstanding the foregoing, Tenant shall have the right to locate a trash compactor and/or baler in a location that is mutually agreeable to Landlord and Tenant for the handling of trash and other refuse. Tenant will not place any trash or other refuse in the Common Areas, except in those portions of the Common Area designated for use by tenants of the Building for trash or refuse collection, and if Tenant does place trash or other refuse in the Common Areas, Landlord may clean up for Tenant at Tenant’s cost and without notice to Tenant.

10. ALTERATIONS, ADDITIONS AND IMPROVEMENTS.

10.1. Tenant shall not make any changes, modifications, alterations, additions or improvements to the Premises, or install any heat or cold generating equipment, or other equipment, machinery or devices in the Premises or any other part of the Building without the prior written consent of Landlord, which shall not be unreasonably withheld. Tenant shall not create any openings in the roof or exterior walls, or make any alterations, additions, or improvements to the Premises or install any structures or equipment on the roof of the Building or any portion of the Common Areas without the prior written consent of Landlord, which shall not be unreasonably withheld, conditioned or delayed. Tenant expressly agrees to indemnify Landlord for any and all damages resulting from or caused by Tenant penetrating the roof or exterior walls of the Premises. Tenant shall have the right, without obtaining Landlord’s consent, to erect or install shelves, bins and machinery in the Premises, provided that Tenant complies with all applicable Laws. Notwithstanding the foregoing, Tenant shall have the right to make non-structural, interior alterations and physical additions to the Premises required in the ordinary course of Tenant’s business without Landlord’s consent provided: (i) Tenant notifies Landlord and furnishes plans and specifications of all significant alterations or additions at least seven days prior to undertaking them, (ii) such alterations or additions are not visible from the exterior of the Premises or the Building,

-15-

(iii) the modifications are in compliance with all applicable Laws, (iv) such additions and alterations will not affect the Building’s structure, the provision of services to other Building tenants or materially affect the Building’s electrical, plumbing, HVAC, life safety or mechanical systems; (v) Tenant coordinates its activities with the Building’s property management, (vi) such additions and alterations will not unreasonably interfere with the business operations of other tenants in the Building; (vii) the cost of the work for such additions and/or alterations does not exceed $25,000 in any single instance or series of related additions or alterations performed within a six-month period (provided that Tenant shall not perform any improvements, alterations or additions to the Premises in stages as a means to subvert this provision); and (viii) Tenant secures any and all permits, licenses and approvals required to construct and install such alterations (collectively “Permitted Alterations”). Tenant shall notify Landlord before performing any Permitted Alterations if the anticipated Permitted Alterations could disrupt any other tenants or occupants of the Building or interfere with Landlord’s operation of the Building. All of Tenant’s alterations shall be made in accordance with all applicable Laws and in a good and first-class, workmanlike manner and in accordance with the terms of this Lease. All such alterations, additions and improvements shall be constructed, maintained and used by Tenant at its sole risk and expense, in accordance with all applicable Laws. Tenant shall have the right to remove at the termination of this Lease, such trade fixtures so installed by Tenant in the Premises, provided no Event of Default by Tenant then exists; however, Tenant shall, prior to the termination of this Lease, repair any damage caused by such removal and, if requested by Landlord, offer Landlord (prior to such removal) sufficient security to insure Landlord that the proper repairs will be made.

10.2. All alterations, additions or improvements made by Tenant (including, without limitation, HVAC Systems, offices and improvements in and pertaining to such offices, partitions, floor coverings, etc., but excluding the trade fixtures referenced in Section 10.1 above) shall become the property of Landlord when the alterations, additions and improvements are made together with such other property as Tenant leaves in or on the Premises at the termination of this Lease, and Tenant waives all rights to any payment, reimbursement or compensation for the property that must remain at the Premises in accordance with this subsection however, Tenant shall promptly remove, if Landlord so elects, any or all alterations, additions, and improvements (except for those improvements installed by Landlord pursuant to Exhibit “D”) specified by Landlord, pursuant to written notice delivered to Tenant prior to commencing construction of such alterations, additions or improvements and any other property placed in the Premises by Tenant, and Tenant shall repair any damage caused by such removal. The provisions of this Section 10.2 shall survive the expiration or earlier termination of this Lease.

10.3. Landlord retains the exclusive right to make additions, changes or improvements, whether structural or otherwise, in and about the Building, or any part thereof, and for such purposes to enter upon the Premises, and, during the continuance of any of said work, to temporarily close doors, entryways, public space and corridors in the Building, to interrupt or temporarily suspend Building services and facilities, and to change the arrangement and location of entrances or passageways, doors and doorways, corridors, elevators, stairs, toilets, or other public parts of the Building, all without abatement of Rent or affecting any of Tenant’s obligations hereunder, so long as the Premises are reasonably accessible and provided that Tenant receives not less than 48 hours advance written notice from landlord therefor (except in the case of an emergency, when no notice is required).

-16-

11. SIGNS. Tenant shall not, without Landlord’s prior written consent not unreasonably withheld, conditioned or delayed, (a) install, alter or replace any exterior lighting, decorations paintings, awnings, canopies or the like, or (b) erect, install, alter or replace any signs, window or door lettering, placards, decorations or advertising media of any type which can be viewed from the exterior of the Premises. All signs (including the Exterior Sign), lettering, placards, decorations and advertising media must conform in all respects to the sign criteria established by Landlord for the Project from time to time in the exercise of its sole discretion, and shall be subject to the prior written approval of Landlord as to construction, method of attachment, size, shape, height, lighting, color and general appearance. Tenant shall be solely responsible for all costs associated with the installation and maintenance of such signs. All signs are subject to applicable Laws and deed restrictions and must conform to any national, local or municipal ordinance or regulation. All signs shall be kept in good condition and in proper operating order at all times. At Landlord’s option and request, Tenant shall remove all signs including the Exterior Sign at the expiration or earlier termination of this Lease, and shall repair any damage and close any holes caused by such removal, with such repairs to be made in good workmanlike manner. Except as expressly permitted in this Section 11, Tenant shall not erect any signs on the roof or paint or otherwise deface the exterior walls of the Building.

12. INSURANCE.

12.1. Tenant shall not permit the Premises to be used in any way that would, in the reasonable opinion of Landlord, be extra hazardous (on account of fire or otherwise) or in any way increase the cost of or render void any insurance coverage in place with respect to the Building or any contents in the Building belonging to other tenants in the Building. Tenant warrants to Landlord that the Permitted Use as defined in Section 1.Q herein accurately reflects Tenant’s original intended use of the Premises, and that the minimum insurance coverage required by this Section 12 shall be obtained by Tenant and in force as of the Commencement Date. If, at any time during the Term of this Lease, the State Board of Insurance or other insurance authority, or any insurer disallows any of Landlord’s sprinkler credits or imposes an additional penalty or surcharge in Landlord’s sprinkler credits or imposes an additional penalty or surcharge in Landlord’s insurance premiums because of Tenant’s original or subsequent placement or use of storage racks or bins, method of storage or nature of Tenant’s inventory or any other act of Tenant, Tenant agrees to pay as Additional Rental the increase in Landlord’s insurance premiums as a result of such placement or use or method or nature of storage by Tenant. If an increase in the fire and extended coverage premium paid by Landlord for the Building is caused by Tenant’s use or occupancy of the Premises, or if Tenant wrongfully abandons the Premises and causes an increase, then Tenant shall pay as Additional Rental the amount of such increase to Landlord.

12.2. Landlord shall keep the Building and the Project (excluding leasehold improvements and the personal property of tenants) insured against loss or damage by fire or other casualty, with Special Cause of Loss Form and such other insurance as from time to time Landlord’s Mortgagee requires or Landlord otherwise deems advisable, in amounts not less than 80% of the full replacement cost thereof above foundation walls, or such greater amounts as Landlord deems advisable, and with such deductibles as Landlord deems advisable. Landlord may, at Landlord’s sole option, maintain time element insurance covering the loss of rental income that may occur as a result of loss or damage to the Building caused by an insured peril. Said insurance shall be maintained at

-17-

the expense of Landlord (which expense is to be included in Operating Expenses) with an insurance company authorized to insure properties in the State of Texas. Payments for losses thereunder shall be made solely to Landlord or Landlord’s Mortgagees as their respective interests shall appear. Tenant shall maintain at its expense, in an amount equal to full replacement cost, Special Cause of Loss Form insurance issued by and binding upon a company meeting the requirements set forth below in this paragraph, on the leasehold improvements and all of Tenant’s personal property, including removable trade fixtures, located within the Premises. Tenant shall provide Landlord with current certificates of insurance evidencing Tenant’s compliance with this Section 12. Each policy required to be maintained by Tenant shall be with companies rated A-X or better in the most current issue of Best’s Insurance Reports and will contain endorsements that (1) such insurance may not lapse with respect to Landlord or its property manager or be canceled or amended with respect to Landlord or its property manager without Tenant’s insurance company giving Landlord at least 30 days prior written notice of every expiration, cancellation or amendment, and (2) Tenant shall be solely responsible for payment of premiums and (3) in the event of payment of any loss covered by any policy, Landlord or Landlord’s designees shall be paid first by the insurance company for Landlord’s loss and Tenant’s insurance shall be primary in the event of overlapping coverage with insurance which may be carried by Landlord.

12.3. Tenant shall each maintain separate policies of commercial general liability insurance, issued by and binding upon an insurance company authorized to transact business in the State of Texas and of good financial standing, and providing minimum protection of not less than $3,000,000 combined single limit coverage of bodily injury or death and/or property damage or combination thereof. Tenant’s liability insurance shall include Landlord, Landlord’s property manager, and Landlord’s Mortgagees as additional insureds and loss payees against any and all covered claims for bodily injury or death and property damage occurring in or about the Premises arising from or in connection with Tenant’s use or occupancy of the Premises. Landlord shall not be required to maintain insurance against thefts within the Premises, Building or Project In no event shall the limits of Tenant’s insurance limit its liability under this Lease. Without limitation of the foregoing, Tenant may comply with its insurance coverage requirements under this Section 12.3 through a blanket policy, provided Tenant, at Tenant’s sole expense, procures a “per location” endorsement, or an equivalent reasonably acceptable to Landlord, so that the general aggregate and other limits apply separately and specifically to the Premises.

12.4. Except as otherwise provided herein, any insurance which may be carried by Landlord or Tenant against any loss or damage to the Building and other improvements situated on the Project or in the Premises shall be for the sole benefit of the party carrying such insurance and under its sole control. Tenant’s insurance obligations under this Section 12 are freestanding obligations which are not dependent on any other conditions or obligations under this Lease.

13. WAIVER OF SUBROGATION. NOTWITHSTANDING ANY PROVISION IN THIS LEASE TO THE CONTRARY, LANDLORD AND TENANT EACH HEREBY WAIVES ANY AND ALL RIGHTS OF RECOVERY, CLAIM, ACTION, OR CAUSE OF ACTION, AGAINST THE OTHER, ITS AGENTS, OFFICERS, OR EMPLOYEES, FOR ANY LOSS OR DAMAGE THAT MAY OCCUR TO THE PREMISES, OR ANY IMPROVEMENTS THERETO, OR THE BUILDING OF WHICH THE PREMISES ARE A PART, OR ANY IMPROVEMENTS THERETO, OR ANY PERSONAL PROPERTY OF SUCH PARTY

-18-

THEREIN, BY REASON OF FIRE, THE ELEMENTS, OR ANY OTHER CAUSE WHICH IS OR WOULD BE INSURED AGAINST UNDER THE TERMS OF THE PROPERTY INSURANCE POLICIES CARRIED OR REQUIRED TO BE CARRIED UNDER THE TERMS OF THIS LEASE BY THE RESPECTIVE PARTIES HERETO, REGARDLESS OF CAUSE OR ORIGIN, INCLUDING NEGLIGENCE OF THE OTHER PARTY HERETO, ITS AGENTS, OFFICERS, OR EMPLOYEES. LANDLORD AND TENANT EACH COVENANTS THAT NO INSURER WILL HOLD ANY RIGHT OF SUBROGATION AGAINST SUCH OTHER PARTY, AND LANDLORD AND TENANT SHALL CAUSE THEIR APPLICABLE INSURANCE POLICIES TO BE AMENDED OR ENDORSED TO REFLECT SUCH WAIVER OF SUBROGATION. This waiver of subrogation provision shall be effective to the full extent, but only to the extent, that it does not impair the effectiveness of insurance policies of Landlord and Tenant. Notwithstanding the foregoing, Landlord’s waiver of liability under this Section 13 shall not apply to Landlord’s right to seek compensation from Tenant or any Tenant Party for any deductible amounts under Landlord’s insurance.

14. LANDLORD’S RIGHT OF ENTRY.

14.1. Upon giving no less than 48 hours prior written notice (except in the case of an emergency, when no notice is required), Landlord and its authorized agents shall have the right to enter the Premises during normal working hours for the following purposes: (a) inspecting the general condition and state of repair of the Premises, (b) making of repairs required or authorized herein, (c) showing the Premises to any current or prospective purchaser, tenant, mortgagee or any other party, (d) or for any other reasonable purpose. During the final 180-day period of the Term of this Lease, Landlord and its authorized agents shall have the right to erect on or about the Premises a customary sign advertising the property for lease or for sale. Furthermore, in the event of any emergency (defined to be any situation in which Landlord reasonably perceives imminent danger or injury to person and/or damage or loss of property), Landlord and its authorized agents shall have the right to enter the Premises at any time without notice.

14.2. In any circumstance where Landlord is permitted to enter upon the Premises, whether for the purpose of curing any default of Tenant, repairing damage resulting from fire or other casualty or an eminent domain taking or is otherwise permitted hereunder or by law to go upon the Premises, no such entry shall constitute an eviction or disturbance of Tenant’s use and possession of the Premises or a breach by Landlord of any of Landlord’s obligations hereunder or render Landlord liable for damages for loss of business or otherwise or entitle Tenant to be relieved from any of Tenant’s obligations hereunder or grant Tenant any right of setoff or recoupment or other remedy; in connection with any such entry incident to the performance of repairs, replacements, maintenance or construction; all of the aforesaid provisions shall be applicable notwithstanding that Landlord may elect to take building materials in, to or upon the Premises that may be required or utilized in connection with such entry by Landlord; provided, however, Landlord shall use reasonable efforts to not disturb or unreasonably interfere with access to or the use of the Premises by Tenant and its employees.

-19-

15. UTILITY SERVICES.

15.1. Tenant shall obtain and pay for all electricity that is separately metered to the Premises and telephone services used on or at the Premises, together with any taxes, penalties, surcharges or the like pertaining to the Tenant’s use of the Premises and any maintenance charges, tap fees and other similar assessments made in connecting the Premises to such utilities and imposed by the applicable utility provider for the provision of such utilities. Electricity and gas serving Tenant’s Premises shall, at Landlord’s expense, be separately metered directly from the public utilities supplying service to the Premises. Tenant shall be responsible for making arrangements for and paying the cost of the installation, maintenance and repair of its own telephone system.

15.2. No interruption or malfunction of any of such services shall constitute an eviction or disturbance of Tenant’s use and possession of the Premises or the Building or a breach by Landlord of any of Landlord’s obligations hereunder or render Landlord liable for damages or entitle Tenant to be relieved from any of Tenant’s obligations hereunder (including the obligation to pay rent) or grant Tenant any right of setoff or recoupment. In the event of any such interruption, however, Landlord shall use reasonable diligence to restore such service or cause same to be restored in any circumstances in which such restoration is within the reasonable control of Landlord and the interruption was not caused in whole or in part by Tenant’s fault. Tenant expressly agrees to notify any utility service requesting or requiring such notice of Tenant’s intention to vacate the Premises. This notice requirement shall be in addition to any other notice requirement specified herein.

Notwithstanding the foregoing, if (i) any essential utility service to be provided as set forth in the preceding paragraph is interrupted or curtailed for a period of 48 hours from the time Tenant notifies Landlord (either orally or in writing), (ii) as a result thereof, Tenant’s use of the Premises is materially, adversely affected (including failure of HVAC system) and (iii) such interruption is caused by Landlord or lies within Landlord’s control, then the Base Rent for the Premises shall completely abate from such 48 hour period and continue until such services are restored to the point where Tenant’s use of the Premises is no longer materially, adversely affected.

16. ASSIGNMENT AND SUBLEASING.

16.1. Except with respect to a Permitted Transfer, Tenant shall not, without the prior written consent of Landlord (which may be withheld in Landlord’s sole discretion, subject to the terms of this Section 16): (i) assign, transfer or encumber this Lease or any estate or interest herein, whether directly or by operation of Law; (ii) permit any other entity to become Tenant hereunder by merger, consolidation or other reorganization (and for purposes of this Section 16 the surviving or resulting entity in any such merger, consolidation or other reorganization may be considered an entity other than Tenant, notwithstanding any applicable Law to the contrary); (iiii) if Tenant is an entity other than a corporation whose stock is publicly traded, permit the transfer of an ownership interest in Tenant so as to result in a change in the current control of Tenant (iv) sublet any portion of the Premises; (v) grant any license, concession or other right of occupancy of any portion of the Premises; or (vi) permit the use of the Premises by any parties other than Tenant (any of the events listed in Sections 16.1(i) through (vi) being a “Transfer”) and any attempt to do any of the foregoing without the prior written consent of Landlord shall be void and no effect Provided no Event of Default then exists, Landlord shall not unreasonably withhold, condition or delay its consent to

-20-

(a) Tenant’s advertising that all or a portion of the Premises is available for sublease or assignment or (b) any assignment or subletting of the Premises, provided that Landlord may take into consideration all relevant factors surrounding the proposed sublease and assignment. Notwithstanding the foregoing, Landlord may withhold its consent, in its sole discretion, to any proposed Transfer to an assignee or subtenant that is a tenant in any other space in the Building or the Project, provided Landlord may object to an assignee or sublessee on the basis set forth in this sentence only if Landlord or its affiliates are capable of and willing to lease space in the Building or the Project to such other tenant at market rates. In any case where Landlord consents to Transfer, the undersigned Tenant will nevertheless remain directly and primarily liable for the performance of all covenants, duties and obligations of Tenant and Landlord shall be permitted to enforce the provisions of this Lease against the undersigned Tenant and/or any assignee, subtenant or other transferee without demand upon or proceeding in any way against any other person. The acceptance of an assignment or subletting of the Premises by any assignee or subtenant shall be construed as a promise on the part of such assignee or subtenant to be bound by and perform all of the terms, conditions and covenants in this Lease by which Tenant is bound, No Transfer shall be construed to constitute a novation or to waive the requirement for obtaining consent to any Transfer. In the event of default by Tenant after this Lease has been assigned or while the Premises are sublet, Landlord, in addition to any other remedies provided herein (or provided by law), may at Landlord’s option, collect directly from such assignee or subtenant all rents becoming due to Tenant under such assignment or subletting, and Landlord may apply such Rent against any sums due to Landlord by Tenant hereunder. No direct collection by Landlord from any such assignee or subtenant shall release Tenant from Tenant’s primary responsibility under this Lease (as aforesaid) and from the further performance of Tenant’s obligations hereunder. Tenant shall pay to Landlord, promptly after receipt thereof, 50% of the excess of (A) the net compensation received by Tenant for a Transfer (other than a Permitted Transfer) after deduction of the costs reasonably incurred by Tenant with unaffiliated third parties in connection with such Transfer (i.e., marketing costs, brokerage commissions, legal fees and tenant finish work) over (B) the Rent allocable to the portion of the Premises covered thereby.

16.2. Notwithstanding Section 16.1 provided no Event of Default then exists, Tenant may Transfer all of its interest in this Lease or all of the Premises (a “Permitted Transfer”) to the following types of entities (a “Permitted Transferee”) without the prior written consent of Landlord, subject to the terms of this Section 16.2: (i) any Affiliate of Tenant (ii) any corporation, limited partnership, limited liability partnership, limited liability company or other business entity in which, with which or to which Tenant, or its corporate successors or assigns, is merged, consolidated or sold (provided such sale is of all or substantially all of the assets or equity ownership interests of Tenant), in accordance with applicable statutory provisions and other Laws governing merger, consolidation and sale of business entities or other non-bankruptcy reorganization, so long as (1) Tenant’s obligations hereunder are assumed by the entity surviving such merger or created by such consolidation; and (2) the Tangible Net Worth of the surviving or created entity is not less than the Tangible Net Worth of Tenant or on the Effective Date. Tenant shall promptly notify Landlord of any such Permitted Transfer. Tenant shall remain liable for the performance of all of the obligations of Tenant hereunder, or if Tenant no longer exists because of a merger, consolidation or acquisition, the surviving or acquiring entity shall expressly assume in writing the obligations of Tenant hereunder. Not more than 30 days after the effective date of any Permitted Transfer, Tenant shall furnish Landlord with copies of the instrument effecting any of the foregoing Transfers and documentation establishing Tenant’s satisfaction of the requirements set forth above applicable to

-21-

any such Transfer. The occurrence of a Permitted Transfer shall not waive Landlord’s rights as to any subsequent Transfers. “Tangible Net Worth” means the excess of total assets over total liabilities, in each case as determined in accordance with generally accepted accounting principles consistently applied (“GAAP”), excluding, however, from the determination of total assets all assets that would be classified as intangible assets under GAAP, including goodwill, licenses, patents, trademarks, trade names, copyrights and franchises “Affiliate” means any person or entity that, directly or indirectly, controls, is controlled by or is under common control with the party in question.

16.3. Tenant shall pay to Landlord, as Landlord’s cost of processing each proposed Transfer (whether or not the same is ultimately approved by Landlord or consummated by Tenant) an amount equal to Landlord’s reasonable attorneys’ fees in an amount not to exceed $1030.

16.4. Landlord shall have the right to transfer, assign, mortgage, or convey all or any part of the Premises and this Lease without Tenant’s consent, and nothing contained in this Lease shall be construed as a restriction upon Landlord’s right to do any of the foregoing. If Landlord transfers this Lease, either specifically or by virtue of a transfer of all or any part of the Premises, then Landlord shall thereby be released from all obligations arising hereunder after such transfer, and Tenant agrees to look solely to such assignee for performance of such obligations.

17. FIRE AND CASUALTY DAMAGE.