UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant o

Check the appropriate box:

o Preliminary Proxy Statement

o Confidential, for Use of the Commission Only (as permitted by Rule 14a‑6(e)(2))

o Definitive Proxy Statement

x Definitive Additional Materials

o Soliciting Material Pursuant to §240.14a-12

Inogen, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

x No fee required.

o Fee paid previously with preliminary materials

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

Inogen, Inc. Stockholder Engagement May 2023

Notice Regarding Forward-Looking Statements This presentation and the accompanying oral presentation (the “Presentation”) include forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, which are based on current expectatio©ns, estimates and projections based on information currently available to management. These forward-looking statements include, among others, statements relating to our business strategy; as well as future revenue and profitability potential; the size and estimates of growth in the oxygen therapy market; statements regarding our compensation philosophy and employee compensation plans; estimated share usage, and how long before we may need to request additional shares, under the 2023 Equity Incentive Plan; expectations regarding the period of time over which the additional shares will be granted; and expected terms of future equity awards . All statements other than statements of historical facts contained in this Presentation, including but not limited to the statements identified above, are forward-looking statements. Forward-looking statements are typically identified by words like “believe,” “anticipate,” “could,” “should,” “estimate,” “expect,” “intend,” “plan,” “project,” “will,” “forecast,” “budget,” “pro forma,” and similar terms. Forward-looking statements are subject to numerous risks and uncertainties that could cause actual results to differ materially from currently anticipated results, including but not limited to, risks arising from the possibility that we will not realize anticipated revenue or opportunity for profit; the impact of possible reduced reimbursement rates; the possible loss of key employees, customers, or suppliers; macro economic conditions; changes in our stock price, changes in market compensation terms, or unexpected employee departures or new hires that may result in management of the additional shares more or less quickly than anticipated . In addition, our business is subject to numerous additional risks and uncertainties, including, among others, risks relating to market acceptance of our products; our ability to successfully launch new products and applications; competition; our sales, marketing and distribution capabilities; our planned sales, marketing, and research and development activities; interruptions or delays in the supply of components or materials for, or manufacturing of, our products; seasonal variations; inflationary pressures as well as unanticipated increases in costs or expenses; and risks associated with international operations. The known risks and uncertainties are described in detail under the caption “Risk Factors” and elsewhere in our Annual Report on Form 10-K for the year ended December 31, 2022 and our subsequent reports filed with the Securities and Exchange Commission, or SEC. Accordingly, our actual results may materially differ from our current expectations, estimates and projections. Unless otherwise specified herein, forward-looking statements represent our management’s beliefs and assumptions only as of May [ ], 2023, and we undertake no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by applicable law. For more complete information about Inogen, Inc., please read our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and other documents that we have filed and may file from time to time with the SEC. These documents can be obtained by visiting EDGAR on the SEC website at www.sec.gov. Inogen ©2022 Inogen, Inc. All Rights Reserved. 2

Our Company and Purpose Inogen is a medical technology company. We are a global leader in portable oxygen therapy solutions for patients with chronic respiratory conditions. Our Purpose: Improving Lives through Respiratory Care Inogen ©2022 Inogen, Inc. All Rights Reserved. 3

Inogen Today A global market leader with high quality, innovative, evidence-based chronic respiratory care solutions Locations in California, Ohio, Texas, Netherlands, Czech Republic1 Geographic Reach 60+ countries A Leader in Portable Oxygen Therapy Broad Reach Direct to Patient, Prescriber, HME, Distributors More than 90 Patents Issued and Pending2 Low Portable Oxygen Penetration Rate3 Solid Balance Sheet and Cash Position $377.2M 2022 Annual Revenue 1. Manufacturing facilities in Texas and California and contract manufacturing in the Czech Republic 2. As of December 31, 2022 3. Based on 2020 U.S. Medicare claims data and our estimates of the ratio of the Medicare market to the total market. Value excludes Medicare Advantage, Medicaid, cash pay and private insurance (21.8% POC penetration in 2021 vs 20.9% in 2020) Inogen©2022 Inogen, Inc. All Rights Reserved. 4

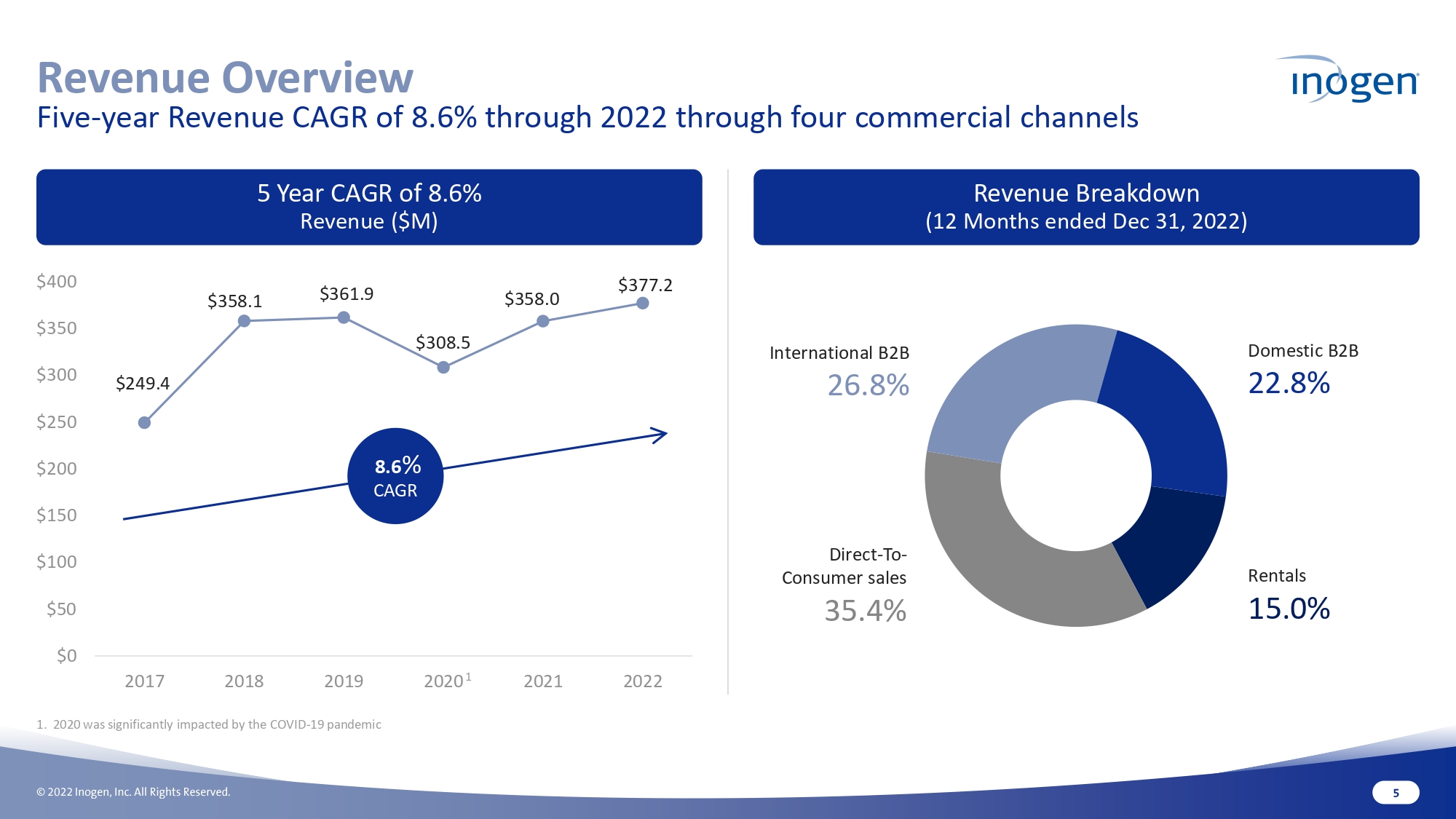

Revenue Overview Five-year Revenue CAGR of 8.6% through 2022 through four commercial channels [LINE_CHART] [CRICEL_CHART] 5 Year CAGR of 8.6% Revenue ($M) Revenue Breakdown (12 Months ended Dec 31, 2022) 1. 2020 was significantly impacted by the COVID-19 pandemic Inogen ©2022 Inogen, Inc. All Rights Reserved. 5

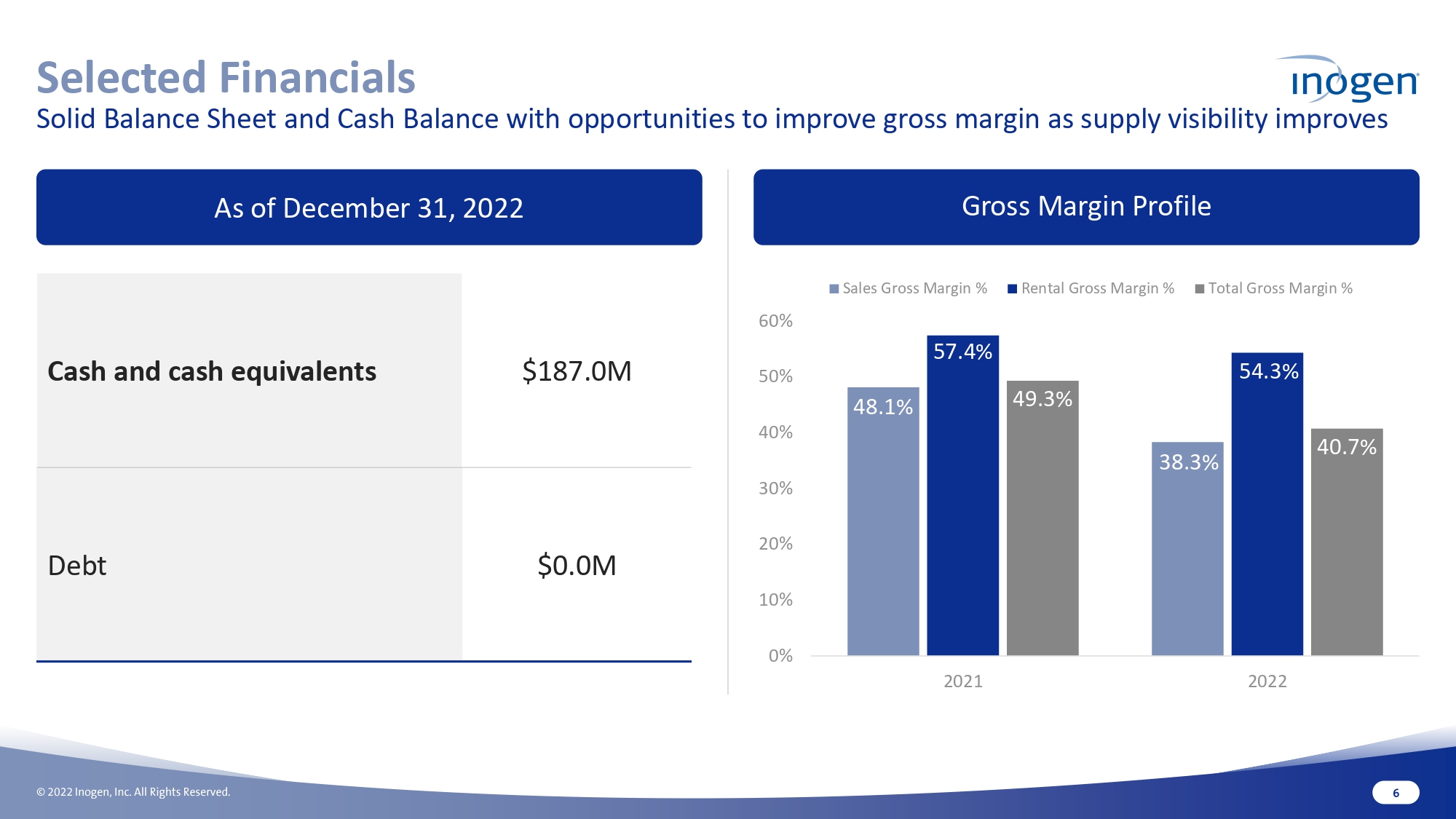

Selected Financials Solid Balance Sheet and Cash Balance with opportunities to improve gross margin as supply visibility improves As of December 31, 2022 Cash and cash equivalents $187.0M [BAR_CHART]Debt $0.0M Gross Margin Profile Inogen ©2022 Inogen, Inc. All Rights Reserved. 6

Board Members with Proven Track Record Beth Mora Chairperson, Compliance Committee Chair Glenn Boehnlein Director, Audit Committee Chair Kevin King Director, Compensation Committee Chair Mary Katherine Ladone Director Tom West Director Heather Rider Director, Nominating and Governance Chair Nabil Shabshab Director, President, Chief Executive Officer Inogen ©2022 Inogen, Inc. All Rights Reserved. 7

Compensation Philosophy Base Salary: Provide base pay that is fair and equitable and reflects current market conditions, roles and responsibilities, and other factors Bonuses: Support company strategy and incentivize achievement of key business objectives at all levels Reward & Recognition: Promote behaviors that align with organizational goals and reward high-performance Benefits: Offer contemporary programs that provide diverse offerings and appeal to a variety of needs Equity: Align awards with performance milestones related to our long-term strategy and value creation through a balanced combination of time- and performance-based awards Inogen©2022 Inogen, Inc. All Rights Reserved. 8

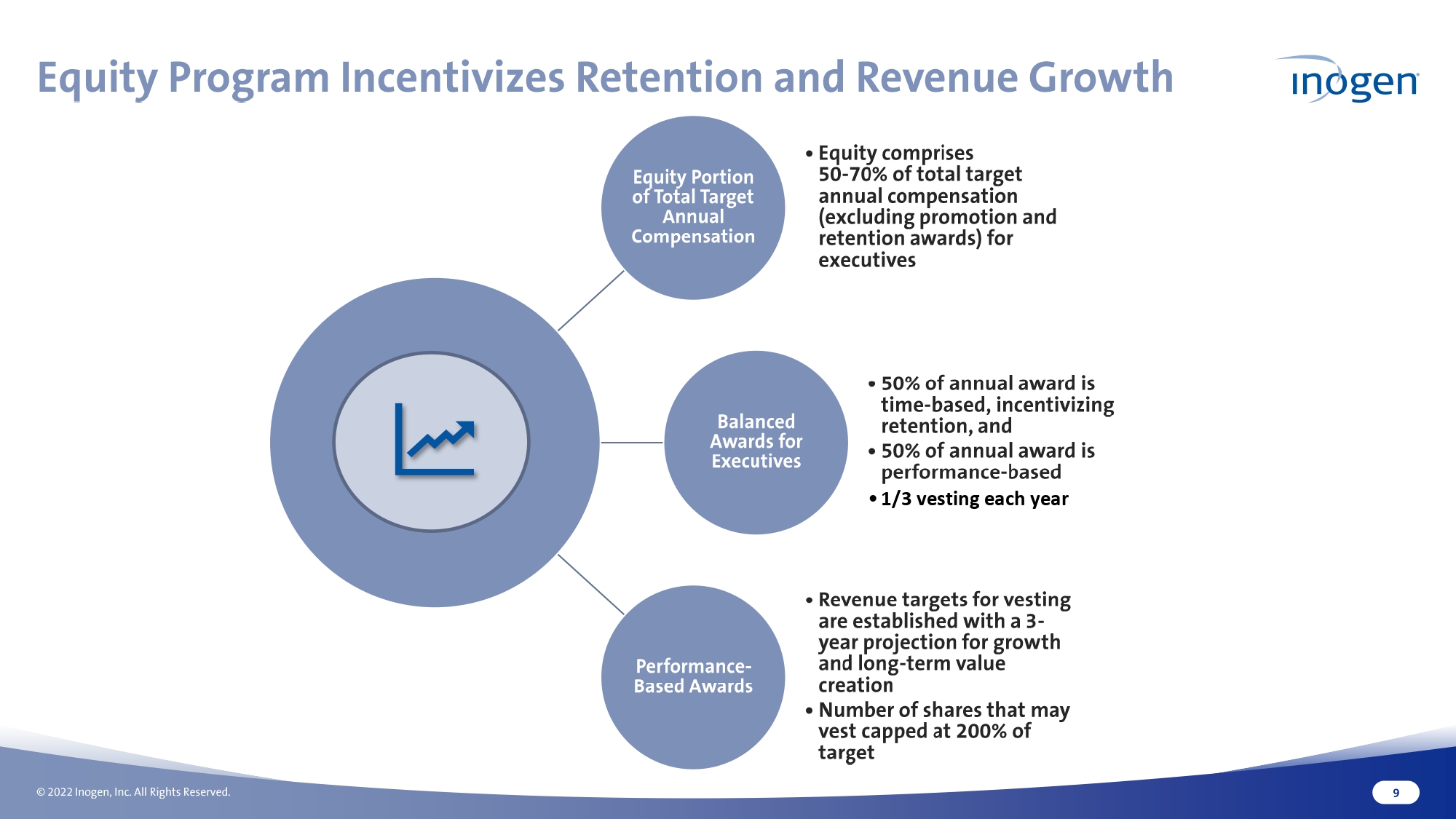

Equity Program Incentivizes Retention and Revenue Growth • Equity comprises 50-70% of total target annual compensation (excluding promotion and retention awards) for executives • Equity Portion of Total Target Annual Compensation • 50% of annual award is time-based, incentivizing retention, and • 50% of annual award is performance-based • 1/3 vesting each year • Revenue targets for vesting are established with a 3-year projection for growth and long-term value creation • Number of shares that may vest capped at 200% of target • Balanced Awards for Executives • Performance-Based Awards Inogen ©2022 Inogen, Inc. All Rights Reserved. 9

Management Proposal: Approval of 2023 Equity Incentive Plan Repricing of awards is prohibited 1-year minimum vesting period (subject to certain limited exceptions) No dividends on unvested awards Outside director compensation limits No evergreen provision Share reserve includes 400,000 new shares, in addition to approx. 690,000 currently available under 2014 Plan, shares from forfeited 2012 and 2014 plan awards, and shares used to pay the exercise/purchase price or tax withholding obligations for 2012 and 2014 plan awards Anticipate meeting needs of Company until May 31, 2024 based on projected share usage according to current assumptions regarding our share price (but actual share usage may differ based on share price fluctuation) Current outstanding Company shares are approx. 21M as of May 1, 2023 Inogen ©2022 Inogen, Inc. All Rights Reserved. 10

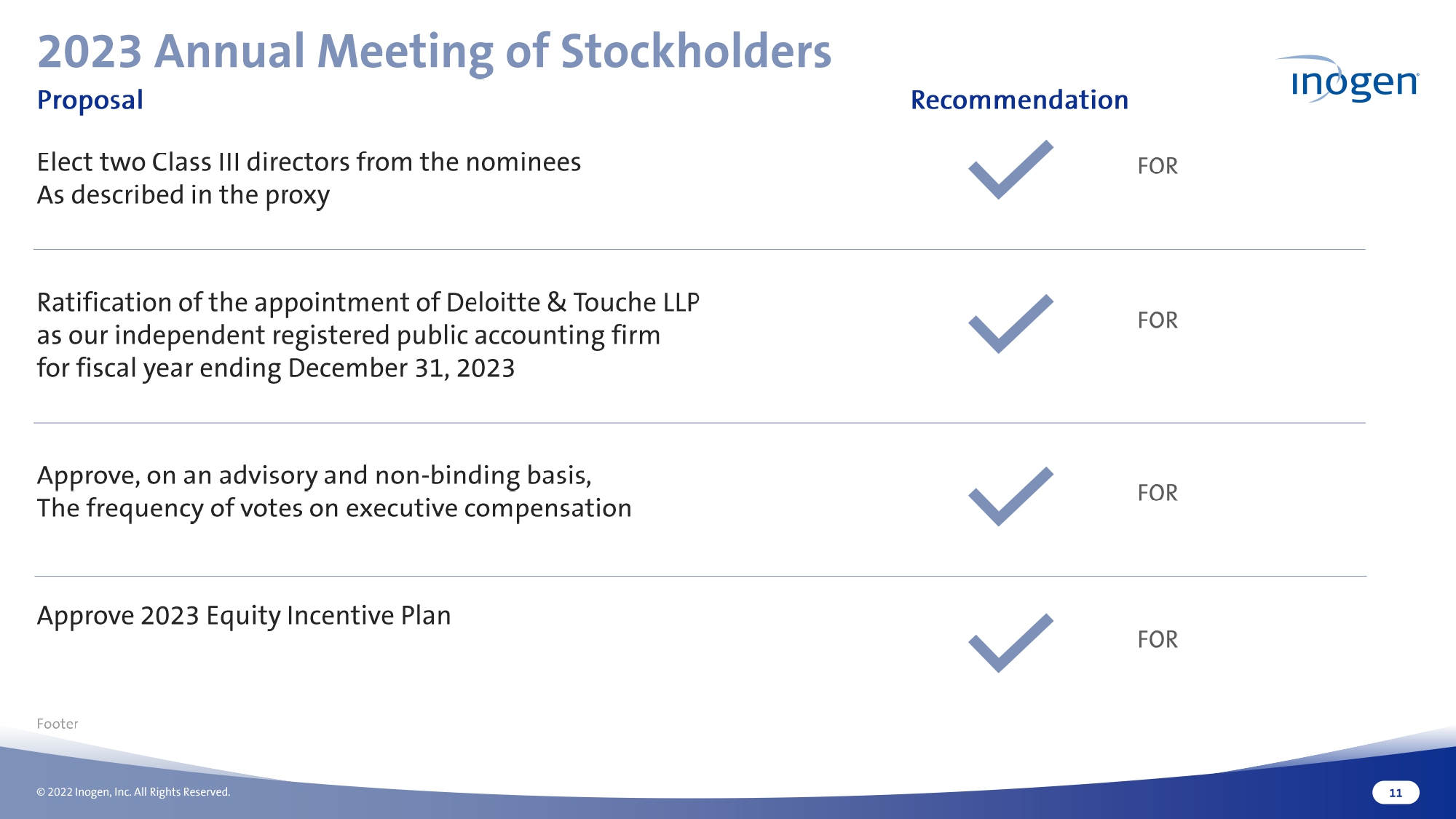

2023 Annual Meeting of Stockholders Proposal Recommendation Elect two Class III directors from the nominees As described in the proxy Ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for fiscal year ending December 31, 2023 Approve, on an advisory and non-binding basis, The frequency of votes on executive compensation Approve 2023 Equity Incentive Plan FOR FOR FOR FOR Inogen©2022 Inogen, Inc. All Rights Reserved. 11

Inogen Improving lives through respiratory care