Registration No. 333-192605

As filed with the Securities and Exchange Commission on February 12, 2014.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 5

TO

FORM S-1

REGISTRATION STATEMENT

Under

The Securities Act of 1933

INOGEN, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 5960 | 33-0989359 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

326 Bollay Drive

Goleta, California 93117

(805) 562-0500

(Address, including ZIP code, and telephone number, including area code, of registrant’s principal executive offices)

Raymond Huggenberger

326 Bollay Drive

Goleta, California 93117

(805) 562-0500

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Martin J. Waters Robert F. Kornegay Wilson Sonsini Goodrich & Rosati, Professional Corporation 633 West Fifth Street, 15th Floor Los Angeles, CA 90071 Telephone: (323) 210-2900 Facsimile: (866) 974-7329 |

Charles K. Ruck B. Shayne Kennedy Latham & Watkins LLP 650 Town Center Drive, 20th Floor Costa Mesa, CA 92626-1925 Telephone: (714) 540-1235 Facsimile: (714) 755-8290 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, as amended, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ |

Accelerated filer ¨ | Non-accelerated filer x | Smaller reporting company ¨ | |||

| (Do not check if a smaller reporting company) |

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment that specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to such Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We and the selling stockholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to completion, dated February 12, 2014

Prospectus

4,411,763 shares

Common stock

This is an initial public offering of common stock of Inogen, Inc. We are selling 3,529,411 shares of common stock, and the selling stockholders are selling 882,352 shares of common stock. We will not receive any proceeds from the sale of shares by the selling stockholders. The estimated initial public offering price is expected to be between $16.00 and $18.00 per share.

Prior to this offering, there has been no public market for our common stock. We intend to apply to list our common stock on the NASDAQ Global Market under the symbol “INGN.”

We are an “emerging growth company” under applicable Securities and Exchange Commission rules and will be subject to reduced public company reporting requirements.

| Per share | Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discounts and commissions(1) |

$ | $ | ||||||

| Proceeds to Inogen, Inc., before expenses |

$ | $ | ||||||

| Proceeds to selling stockholders |

$ | $ | ||||||

| (1) | See “Underwriting” for additional disclosure regarding underwriting discounts, commissions and estimated offering expenses. |

The selling stockholders have granted the underwriters a 30-day option to purchase up to an additional 661,764 shares of common stock.

Investing in our common stock involves a high degree of risk. See “Risk factors” beginning on page 14.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares to purchasers on or about , 2014.

J.P. Morgan

Leerink Partners

| William Blair | Stifel | |

| , 2014 | ||

| Page | ||||

| 1 | ||||

| 14 | ||||

| 47 | ||||

| 48 | ||||

| 49 | ||||

| 50 | ||||

| 52 | ||||

| 55 | ||||

| Management’s discussion and analysis of financial condition and results of operations |

59 | |||

| 99 | ||||

| 125 | ||||

| 137 | ||||

| 152 | ||||

| 155 | ||||

| 159 | ||||

| 166 | ||||

| Material U.S. federal income tax consequences to non-U.S. holders of common stock |

169 | |||

| 173 | ||||

| 181 | ||||

| 181 | ||||

| 181 | ||||

| 182 | ||||

| Index to financial statements, as of and for the years ended December 31, 2012 and 2011 |

F-1 | |||

| Index to financial statements, as of and for the nine months ended September 30, 2013 and 2012 |

F-42 | |||

Neither we, the selling stockholders nor the underwriters have authorized anyone to provide any information other than that contained in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We, the selling stockholders and the underwriters are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus, regardless of the time of delivery of this prospectus or any sale of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

Until , 2014 (25 days after the commencement of this offering), all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to

-i-

deliver a prospectus. This is in addition to the dealers’ obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

For investors outside of the United States: Neither we, the selling stockholders nor the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than the United States. Persons outside of the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of common stock and the distribution of this prospectus outside of the United States.

-ii-

The items in the following summary are described in more detail later in this prospectus. This summary provides an overview of selected information and does not contain all of the information you should consider before buying our common stock. Therefore, you should read the entire prospectus carefully, especially the “Risk factors” section beginning on page 12 and our financial statements and the related notes appearing at the end of this prospectus, before deciding to invest in our common stock. In this prospectus, unless the context otherwise requires, references to “we,” “us,” “our” or “Inogen” refer to Inogen, Inc.

Overview

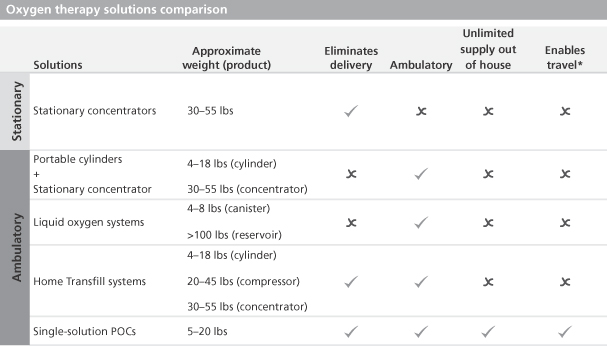

We are a medical technology company that develops, manufactures and markets innovative portable oxygen concentrators used to deliver supplemental long-term oxygen therapy to patients suffering from chronic respiratory conditions. Traditionally, these patients have relied on stationary oxygen concentrator systems for use in the home and oxygen tanks or cylinders for mobile use, which we call the delivery model. The delivery model limits lifestyle flexibility by requiring patients to plan their activities around a finite oxygen supply outside the home and to be tethered to a stationary concentrator in the home. Our proprietary Inogen One systems concentrate the air around the patient to offer a single source of supplemental oxygen anytime, anywhere with a portable device weighing approximately 4.8 or 7.0 pounds. Our systems reduce the patient’s reliance on stationary concentrators and scheduled deliveries of tanks with a finite supply of oxygen, thereby improving patient quality of life and fostering mobility.

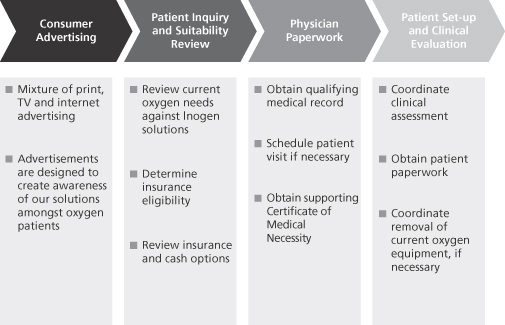

Although portable oxygen concentrators represent the fastest-growing segment of the Medicare oxygen therapy market, we estimate based on Medicare data from 2012 that patients using portable oxygen concentrators represent approximately 4% to 5% of the total addressable oxygen market in the United States. Based on 2012 industry data, we were the leading worldwide manufacturer of portable oxygen concentrators, as well as the largest provider of portable oxygen concentrators to Medicare patients, as measured by dollar volume. We believe we are the only manufacturer of portable oxygen concentrators that employs a direct-to-consumer strategy in the United States, meaning we market our products to patients, process their physician paperwork, provide clinical support as needed and bill Medicare or private payors on their behalf.

We believe our direct-to-consumer strategy has been critical to driving patient adoption of our technology. Other portable oxygen concentrator manufacturers access patients by selling through home medical equipment providers, which we believe are disincentivized to encourage adoption of portable oxygen concentrators due to their investments in the physical infrastructure and personnel required for the delivery model. Because portable oxygen concentrators eliminate the need for a physical distribution infrastructure, but have higher initial equipment costs than the delivery model, we believe converting to a portable oxygen concentrator model would require significant restructuring and capital investment for home medical equipment providers. Our direct-to-consumer marketing strategy allows us to sidestep the home medical equipment channel, appeal to patients directly and capture both the manufacturing and provider margin associated with long-term oxygen therapy. We believe our ability to capture this top-to-bottom margin, combined with our technology that eliminates most of the delivery model’s infrastructure and service requirements, gives us a cost structure advantage over our competitors.

-1-

Since adopting our direct-to-consumer strategy in 2009, we have directly sold or rented our Inogen One systems to more than 40,000 patients, growing our revenue from $10.7 million in 2009 to $48.6 million in 2012. In 2012, approximately 60% of our total revenue came from our direct-to-consumer business and approximately 40% came from our business-to-business sales. Of our direct-to-consumer revenue of $29.0 million in 2012, $19.9 million came from our domestic rental business and $9.1 million came from domestic sales of our systems. Of our business-to-business revenue of $19.6 million in 2012, $13.0 million came from international markets, and $6.7 million came from domestic distributors. We have increased our proportion of both recurring revenue and international revenue in 2012 compared to 2011. In 2012, 26.8% of our revenue came from international markets (versus 25.9% in 2011) and 40.9% from oxygen rentals (versus 35.8% in 2011). Additionally, we have increased our gross margin from 48.0% in 2011 to 49.3% in 2012 by increasing rental mix, improving system reliability, reducing material cost per system and lowering overhead cost per system. Our net loss was $2.6 million in 2009 transitioning to net income of $0.6 million in 2012.

Our market

Overview of oxygen therapy market

We believe the current total addressable oxygen therapy market in the United States is approximately $3 billion to $4 billion, based on 2012 Medicare data and our estimate of the ratio of the Medicare market to the total market. We estimate that more than 2.5 million patients in the United States and more than 4.5 million patients worldwide use oxygen therapy, and more than 60% of oxygen therapy patients in the United States are covered by Medicare. The number of oxygen therapy patients in the United States is projected to grow by approximately 7% to 10% per year between 2013 and 2019, which we believe is the result of earlier diagnosis of chronic respiratory conditions, demographic trends and longer durations of long-term oxygen therapy.

Long-term oxygen therapy has been shown to be a cost-efficient and clinically effective means to treat hypoxemia, a condition in which patients have insufficient oxygen in the blood. Hypoxemic patients are unable to convert oxygen found in the air into the bloodstream in an efficient manner, causing organ damage and poor health. Chronic obstructive pulmonary disease, or COPD, is a leading cause of hypoxemia. Approximately 70% of our patient population has been diagnosed with COPD, which we believe is reflective of the long-term oxygen therapy market in general. Industry sources estimate that 24 million people in the United States suffer from COPD, of which one-half are undiagnosed.

According to our analysis of 2011 and 2012 Medicare data, approximately two-thirds of U.S. oxygen users require ambulatory oxygen and the remaining one-third require only stationary or nocturnal oxygen. Clinical data has shown that ambulatory patients that use oxygen twenty-four hours a day, seven days a week, or 24/7, regardless of whether such patients rely on portable oxygen concentrators or the delivery model, have approximately two times the survival rate and spend at least 60% fewer days annually in the hospital than non-ambulatory 24/7 patients. Of the ambulatory patients, we estimate that approximately 85% rely upon the delivery model that has the following disadvantages:

| • | limited flexibility outside the home, dictated by the finite oxygen supply provided by tanks and cylinders and dependence on delivery schedules; |

-2-

| • | restricted mobility and inconvenience within the home, as patients must attach long, cumbersome tubing to a noisy stationary concentrator to move within their homes; |

| • | products are not cleared for use on commercial aircraft and cannot plug into a vehicle outlet for extended use; and |

| • | high costs driven by the infrastructure necessary to establish a geographically diverse distribution network to serve patients locally, as well as personnel, fuel and other costs, which have limited economies of scale and generally increase over time. |

Portable oxygen concentrators were developed in response to many of the limitations associated with traditional oxygen therapy. Portable oxygen concentrators are designed to offer a self-replenishing, unlimited supply of oxygen that is concentrated from the surrounding air and to operate without the need for oxygen tanks or regular oxygen deliveries, allowing patients to enhance their independence and mobility. Additionally, because portable oxygen concentrators do not require the physical infrastructure and service intensity of the delivery model, we believe portable oxygen concentrators can provide long-term oxygen therapy with a lower cost structure. Despite the ability of portable oxygen concentrators to address many of the shortcomings of traditional oxygen therapy, we estimate based on 2012 Medicare data that the amount spent by patients with portable oxygen concentrators represents approximately 5% to 6% of total oxygen therapy spend. We believe the following has hindered the market acceptance of portable oxygen concentrators:

| • | to obtain portable oxygen concentrators, patients are dependent on home medical equipment providers, which have made significant investments in the physical distribution infrastructure to support the delivery model; |

| • | constrained manufacturing costs of conventional portable oxygen concentrators, driven by home medical equipment provider preference for products that have lower upfront equipment cost; and |

| • | limitations of conventional portable oxygen concentrators, including bulkiness, poor reliability and lack of suitability beyond intermittent or travel use. |

Our solution

Our Inogen One systems provide patients who require long-term oxygen therapy with a reliable, lightweight, single solution product that improves quality-of-life, fosters mobility and eliminates dependence on both oxygen tanks and cylinders as well as stationary concentrators. We believe our direct-to-consumer strategy increases our ability to effectively develop, design and market our Inogen One solutions, as it allows us to:

| • | drive patient awareness of our portable oxygen concentrators through direct marketing, sidestepping the home medical equipment channel that other manufacturers rely upon and that is incentivized to continue to service oxygen patients through the delivery model; |

| • | capture the manufacturer and home medical equipment provider margins, allowing us to focus on the total cost of the solution and to invest in the development of product features that improve patient satisfaction, product reliability, durability and longevity; and |

-3-

| • | access and utilize direct patient feedback in our research and development efforts, allowing us to stay at the forefront of patient preference. |

Our two product offerings, the Inogen One G3 and Inogen One G2, at approximately 4.8 and 7.0 pounds, respectively, offer portability without compromising or constraining other patient-friendly features. We believe our Inogen One solutions offer the following benefits:

| • | single solution for home, ambulatory, travel and nocturnal treatment, meaning our portable oxygen concentrators do not need to be used with another oxygen solution in the home; |

| • | patented air-dryer and patent-pending user-replaceable sieve beds, both of which are critical to patient satisfaction, product performance, and our cost management; |

| • | clinical validation for nocturnal use, demonstrating the efficacy of our Intelligent Delivery Technology in providing consistent levels of oxygen during sleep despite decreased patient respiratory rates; |

| • | our 4.8 pound Inogen One G3 has at least 50% more flow capacity than other sub-5 pound portable oxygen concentrators, and our 7.0 pound Inogen One G2 has at least 15% more flow capacity than other sub-10 pound portable oxygen concentrators; and |

| • | our systems are designed with multiple user friendly features, including long battery life and low noise-levels in their respective weight categories. |

Our strengths

We believe our products and business model position us well to compete not only against other oxygen device manufacturers, but also to increase our share of the overall oxygen therapy market. We believe we have the following advantages relative to both traditional oxygen therapy providers and other oxygen device manufacturers:

| • | Attractive economic model. Our non-delivery model allows us to receive a premium monthly Medicare reimbursement for deployment of our devices to oxygen patients versus the delivery model. Standard Medicare reimbursement for ambulatory patients using the delivery model is $208.21 per month versus $229.87 per month for our portable oxygen concentrator model, representing a premium of $21.66 per month. A similar premium was maintained in the round one recompete ($19.09 per month) and in the round two ($23.30 per month) competitive bidding areas. In addition, we believe our portable oxygen concentrator technology and direct-to-consumer strategy allow us to provide our solutions through a more efficient cost structure. The delivery model requires ongoing gaseous or liquid oxygen container refills and regular home deliveries with accompanying costs, while our portable oxygen concentrator non-delivery model eliminates oxygen container refills and regular deliveries of oxygen containers and their associated costs. Following the first two rounds of competitive bidding and the round one recompete, we retained access to approximately 90% of the U.S. long-term oxygen therapy market, with the majority of contracts through mid-2016, while many providers were priced out of this market. |

| • | Direct-to-consumer capabilities. We believe our direct-to-consumer strategy enables patient access and retention as well as innovation and investment in our product portfolio. Pursuing a direct-to-consumer strategy requires national accreditation, state-by-state licensing and |

-4-

| Medicare billing privileges. Given that we are unaware of any manufacturing competitor that currently markets on a direct-to-consumer basis, we do not believe any of these manufacturers possesses the necessary qualification to do so. If any of our manufacturing competitors were to pursue a direct-to-consumer strategy, they would risk negative reaction from the home medical equipment providers that sell their other homecare products, which generally represent significantly larger portions of their businesses than oxygen therapy products. |

| • | Commitment to customer service. We are focused on providing our patients with the highest quality of customer service. We guide them through the reimbursement and physician paperwork process, perform clinical titration and offer 24/7 telephone support, which includes clinical support as required. We have a sustained patient satisfaction rating of approximately 95%, as measured by our customer satisfaction surveys. |

| • | Patient-friendly, single-solution, sub-5 and sub-10 pound portable oxygen concentrators. Our Inogen One G3 and Inogen One G2 portable oxygen concentrators are sub-5 and sub-10 pound portable oxygen concentrators that can operate reliably and cost-effectively to service long-term oxygen therapy patients on a 24/7 basis, similar to a stationary oxygen concentrator or replacement portable oxygen concentrators. We believe the technology in our Inogen One portable oxygen concentrators is effective for nocturnal use, allowing patients to receive oxygen therapy around the clock from a single device. |

| • | Commitment to research and development and developing intellectual property portfolio. We have a broad patent portfolio covering the design and construction of our oxygen concentrators and system optimization. Additionally, we have made significant investments in research and development and have a robust product pipeline of next-generation oxygen concentrators. |

| • | Management team with proven track record and cost focus. Our management team has built our direct-to-consumer capabilities and launched our two current primary product offerings, Inogen One G2 and Inogen One G3. We continue to realize meaningful product manufacturing cost savings of approximately 36% from our Inogen One G1 to our Inogen One G3 as a result of management’s improvements in design, sourcing and reliability, as well as higher production volumes. |

| • | Revenue growth, profitability and recurring revenue. We have grown our revenue from $10.7 million in 2009 to $48.6 million in 2012, representing a year-over-year growth rate of 58.6%. In 2012, our recurring rental revenue represented 40.9% of sales. Our net loss was $2.6 million in 2009 transitioning to net income of $0.6 million in 2012. |

Our strategy

Our goal is to design, build and market oxygen solutions that redefine how oxygen therapy is delivered. To accomplish this goal, we will continue to invest in our product offerings and our commercial infrastructure to:

| • | expand our sales and marketing channels, including more internal and physician-based salespeople, increased direct-to-consumer advertising and greater international distribution; |

| • | develop innovative products, including next-generation oxygen concentrators and other innovations that improve quality of life; |

-5-

| • | secure contracts with private payors and Medicaid in order to become in-network with non-Medicare payors, which represent at least 30% of our home oxygen therapy patients, and we believe represent a younger and more active patient population; and |

| • | continue to focus on cost reduction through scalable manufacturing, reliability improvements, asset utilization and service cost reduction. |

Risks associated with our business

Our ability to implement our business strategy is subject to numerous risks that you should be aware of before making an investment decision. These risks are described more fully in the section entitled “Risk factors” immediately following this prospectus summary. These risks include, among others:

| • | A significant majority of our customers have health coverage under the Medicare program, and recently enacted and future changes in the reimbursement rates or payment methodologies under Medicare and other government programs have and could continue to materially and adversely affect our business and operating results; |

| • | The implementation of the competitive bidding process under Medicare could negatively affect our business and financial condition; |

| • | We face intense national, regional and local competition and if we are unable to compete successfully, it could have an adverse effect on our revenue, revenue growth rate, if any, and market share; |

| • | If we are unable to continue to enhance our existing products, develop and market new products that respond to customer needs and preferences and achieve market acceptance, we may experience a decrease in demand for our products and our business could suffer; |

| • | If we fail to expand and maintain an effective sales force or successfully develop our international distribution network, our business, financial condition and operating results may be adversely affected; and |

| • | If we are unable to secure and maintain patent or other intellectual property protection for the intellectual property used in our products, we will lose a significant competitive advantage. |

Corporate history and information

We were incorporated in Delaware in November 2001. Our principal executive offices are located at 326 Bollay Drive, Goleta, California 93117. Our telephone number is (805) 562-0500. Our website address is www.inogen.com. Information contained on the website is not incorporated by reference into this prospectus, and should not be considered to be part of this prospectus.

We use “Inogen,” “Inogen One,” “Inogen One G2,” “Inogen One G3,” “oxygen.anytime.anywhere” and other marks as trademarks in the United States and other countries. This prospectus contains references to our trademarks and service marks and to those belonging to other entities. Solely for convenience, trademarks and trade names referred to in this prospectus, including logos, artwork and other visual displays, may appear without the ® or ™ symbols, but such references are not intended to indicate in any way that we will not assert, to

-6-

the fullest extent under applicable law, our rights or the rights of the applicable licensor to these trademarks and trade names. We do not intend our use or display of other entities’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, any other entity.

-7-

The offering

| Common stock offered by us |

3,529,411 shares |

| Common stock offered by the selling stockholders |

882,352 shares (or 1,544,116 shares if the underwriters exercise their option to purchase additional shares from the selling stockholders in full) |

| Common stock to be outstanding after this offering |

18,048,936 shares |

| Use of proceeds |

We intend to use the net proceeds from this offering for investments in rental assets; sales and marketing activities; research and product development activities; for facilities improvements or expansions and the purchase of manufacturing and other equipment; and for working capital and other general corporate purposes. We may also use a portion of our net proceeds to acquire and invest in complementary products, technologies or businesses; however, we currently have no agreements or commitments to complete any such transaction. We will not receive any of the net proceeds from the sale of shares of common stock by the selling stockholders. See “Use of proceeds.” |

| Risk factors |

You should read the “Risk factors” section of this prospectus for a discussion of factors to consider carefully before deciding to invest in shares of our common stock. |

| Proposed NASDAQ Global Market symbol |

“INGN” |

The number of shares of common stock to be outstanding following this offering is based on 14,519,525 shares of common stock outstanding as of September 30, 2013 and excludes:

| • | 2,079,338 shares of common stock issuable upon exercise of options outstanding, 1,466,789 of which were vested and then exercisable, at a weighted average exercise price of $1.0876 per share; |

| • | 276,334 shares of common stock issuable upon the exercise of options to purchase common stock granted after September 30, 2013, at a weighted average exercise price of $8.37 per share; |

| • | 1,074,415 shares of common stock reserved for future grants under our stock-based compensation plans as of the date of this prospectus, consisting of: |

| • | 895,346 shares of common stock reserved for future grants under our 2014 Equity Incentive Plan, which will become effective immediately prior to the date of this prospectus, and any shares subject to stock options under our 2012 Equity Incentive Plan or our 2002 Amended Stock Incentive Plan that expire or otherwise terminate without having been exercised in |

-8-

| full and any shares issued pursuant to awards granted under such plans that are forfeited to or repurchased by us, with the maximum number of shares to be added to the 2014 Equity Incentive Plan equal to 2,328,569 shares; |

| • | 179,069 shares of common stock reserved for future issuance under our 2014 Employee Stock Purchase Plan, which will become effective immediately prior to the date of this prospectus; and |

| • | Any shares of common stock that become available subsequent to this offering under our 2014 Equity Incentive Plan and 2014 Employee Stock Purchase Plan pursuant to the provisions thereof that automatically increase the shares reserved for issuance under such plans each year, as more fully described in “Executive compensation — Employee benefit and stock plans;” and |

| • | 268,200 shares of common stock issuable upon the exercise of warrants outstanding as of September 30, 2013, at a weighted average exercise price of $1.4216 per share, after conversion of the convertible preferred stock. |

Unless otherwise indicated, this prospectus reflects and assumes the following:

| • | the conversion of all outstanding shares of our convertible preferred stock into an aggregate of 14,218,319 shares of common stock upon the closing of this offering; |

| • | the cash exercise of warrants to purchase an aggregate of 24,588 shares of common stock at a weighted average exercise price of $10.1635 per share, which we expect will occur prior to the closing of this offering as the warrants will otherwise expire at that time; |

| • | the filing of our amended and restated certificate of incorporation immediately upon the closing of this offering; and |

| • | no exercise by the underwriters of their option to purchase additional shares. |

On November 12, 2013, we effected a three-for-one reverse stock split of our outstanding common and preferred stock. This prospectus gives retroactive effect to the split for all periods presented.

-9-

Summary financial data

We have derived the following summary of statements of operations data for the years ended December 31, 2011 and 2012 from audited financial statements appearing elsewhere in this prospectus. We derived the following statements of operations data for the nine months ended September 30, 2012 and 2013 and the balance sheet data as of September 30, 2013 from unaudited interim financial statements included elsewhere in this prospectus. In the opinion of management, the unaudited financial statements reflect all adjustments, which include only normal recurring adjustments necessary for a fair statement of results of operations and financial position. Historical results are not necessarily indicative of the results that may be expected in the future and the results for the nine months ended September 30, 2013 are not necessarily indicative of the results that may be expected for the full year. The summary financial data set forth below should be read together with the financial statements and the related notes to those statements, as well as the sections of this prospectus captioned “Management’s discussion and analysis of financial condition and results of operations.”

| (amounts in thousands, except

share |

Year

ended December 31, |

Nine

months ended September 30, |

||||||||||||||

| 2011 | 2012 | 2012 | 2013 | |||||||||||||

|

|

||||||||||||||||

| (as restated) | (unaudited) | |||||||||||||||

| Statements of operations: |

||||||||||||||||

| Total revenue |

$ | 30,634 | $ | 48,576 | $ | 34,735 | $ | 55,681 | ||||||||

| Total cost of revenue |

15,930 | 24,627 | 17,821 | 26,865 | ||||||||||||

|

|

|

|||||||||||||||

| Gross profit |

14,704 | 23,949 | 16,914 | 28,816 | ||||||||||||

| Operating expenses |

||||||||||||||||

| Research and development |

1,789 | 2,262 | 1,731 | 1,817 | ||||||||||||

| Selling, general and administrative |

14,637 | 20,858 | 14,558 | 23,088 | ||||||||||||

|

|

|

|||||||||||||||

| Total operating expenses |

16,426 | 23,120 | 16,289 | 24,905 | ||||||||||||

|

|

|

|||||||||||||||

| Income (loss) from operations |

(1,722 | ) | 829 | 625 | 3,911 | |||||||||||

|

|

|

|||||||||||||||

| Total other income (expense), net |

(267 | ) | (247 | ) | (149 | ) | (296 | ) | ||||||||

| Provision for income taxes |

13 | 18 | 20 | 151 | ||||||||||||

|

|

|

|||||||||||||||

| Net (loss) income |

$ | (2,002 | ) | $ | 564 | $ | 456 | $ | 3,464 | |||||||

| Less deemed dividend on redeemable convertible preferred stock |

$ | (3,027 | ) | $ | (5,781 | ) | $ | (4,119 | ) | $ | (5,359 | ) | ||||

|

|

|

|||||||||||||||

| Net loss attributable to common stockholders |

$ | (5,029 | ) | $ | (5,217 | ) | $ | (3,663 | ) | $ | (1,895 | ) | ||||

|

|

|

|||||||||||||||

| Net loss per share attributable to common stockholders—basic and diluted(1) |

$ | (20.15 | ) | $ | (19.97 | ) | $ | (14.02 | ) | $ | (6.91 | ) | ||||

| Weighted average shares used in computing basic and diluted net loss per share(1) |

249,519 | 261,268 | 261,216 | 274,357 | ||||||||||||

| Unaudited pro forma net income per share attributable to common stockholders(1): |

||||||||||||||||

| Basic: |

$ | 0.04 | $ | 0.24 | ||||||||||||

| Diluted: |

$ | 0.04 | $ | 0.21 | ||||||||||||

| Unaudited weighted average shares used in computing pro forma net income per share(1): |

||||||||||||||||

| Basic: |

14,601,861 | 14,516,523 | ||||||||||||||

| Diluted: |

15,486,487 | 16,350,527 | ||||||||||||||

|

|

|

|

|

|||||||||||||

| Other financial data: |

||||||||||||||||

| EBITDA(2) |

$ | 1,357 | $ | 5,971 | $ | 4,224 | $ | 9,913 | ||||||||

| Adjusted EBITDA(2) |

$ | 1,620 | $ | 5,883 | $ | 4,124 | $ | 10,231 | ||||||||

|

|

||||||||||||||||

-10-

| (1) | See note 2 to each of our audited and unaudited financial statements included elsewhere in this prospectus for an explanation of the calculations of our basic and diluted net loss per share attributable to common stockholders and pro forma net loss per share attributable to common stockholders. |

| (2) | For a discussion of our use of EBITDA and Adjusted EBITDA and their calculations, please see “— Non GAAP financial measures” below. |

| As of September 30, 2013 | ||||||||||||

| (in thousands) | Actual | Pro forma(1) | Pro forma as adjusted(2)(3) |

|||||||||

|

|

||||||||||||

| (unaudited) | ||||||||||||

| Balance sheet data: |

||||||||||||

| Cash and cash equivalents |

$ | 17,059 | $ | 17,309 | $ | 70,739 | ||||||

| Working capital |

12,352 | 12,602 | 60,032 | |||||||||

| Total assets |

60,862 | 61,112 | 114,542 | |||||||||

| Preferred stock warrant liability |

201 | 173 | 173 | |||||||||

| Total liabilities |

26,667 | 26,639 | 26,639 | |||||||||

| Redeemable convertible preferred stock |

116,744 | — | — | |||||||||

| Preferred Stock |

247 | — | — | |||||||||

| Common Stock |

1 | 15 | 19 | |||||||||

| Additional paid in capital |

— | 117,255 | 170,681 | |||||||||

| Total stockholders’ (deficit) equity |

(82,549 | ) | 34,473 | 87,903 | ||||||||

|

|

||||||||||||

| (1) | Gives effect to (i) the conversion of all outstanding shares of convertible preferred stock into an aggregate of 14,218,319 shares of common stock upon the closing of this offering, (ii) the cash exercise of warrants to purchase an aggregate of 24,588 shares of common stock, which we expect will occur prior to the closing of this offering as the warrants will otherwise expire at that time, and (iii) the reclassification of our preferred stock warrant liability to additional paid-in-capital upon the closing of this offering. |

| (2) | Gives further effect to our sale of 3,529,411 shares of common stock in this offering at an assumed initial public offering price of $17.00 per share, the midpoint of the range reflected on the cover page of this prospectus, after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. |

| (3) | A $1.00 increase (decrease) in the assumed initial public offering price of $17.00 per share, the midpoint of the price range reflected on the cover page of this prospectus, would increase (decrease) each of pro forma as adjusted cash and cash equivalents, working capital, total assets and total stockholders’ equity by approximately $3.28 million, assuming that the number of shares offered by us, as set forth on the cover of this prospectus, remains the same and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. A 1,000,000 share increase (decrease) in the number of shares offered by us would increase (decrease) each of pro forma as adjusted cash and cash equivalents, working capital, total assets and total stockholders’ equity by approximately $15.81 million after deducting estimated underwriting discounts and commissions and any estimated offering expenses payable by us. |

Non-GAAP financial measures

EBITDA and Adjusted EBITDA are financial measures that are not calculated in accordance with generally accepted accounting principles in the United States, or GAAP. We define EBITDA as net income or loss excluding interest income, interest expense, taxes and depreciation and amortization. Adjusted EBITDA also excludes the change in the fair value of our preferred stock warrant liability and stock-based compensation. Below, we have provided a reconciliation of EBITDA and Adjusted EBITDA to our net income or loss, the most directly comparable financial measure calculated and presented in accordance with GAAP. EBITDA and Adjusted EBITDA should not be considered as alternatives to net income or loss or any other measure of financial performance calculated and presented in accordance with GAAP. Our EBITDA and Adjusted EBITDA may not be comparable to similarly titled measures of other organizations because other organizations may not calculate EBITDA and Adjusted EBITDA in the same manner as we calculate these measures.

-11-

We include EBITDA and Adjusted EBITDA in this prospectus because they are important measures upon which our management assesses our operating performance. We use EBITDA and Adjusted EBITDA as key performance measures because we believe they facilitate operating performance comparisons from period to period by excluding potential differences primarily caused by variations in capital structures, tax positions, the impact of depreciation and amortization expense on our fixed assets, changes related to the fair value remeasurements of our preferred stock warrant, and the impact of stock-based compensation expense. Because EBITDA and Adjusted EBITDA facilitate internal comparisons of our historical operating performance on a more consistent basis, we also use EBITDA and Adjusted EBITDA for business planning purposes, to incentivize and compensate our management personnel, and in evaluating acquisition opportunities. In addition, we believe EBITDA and Adjusted EBITDA and similar measures are widely used by investors, securities analysts, ratings agencies, and other parties in evaluating companies in our industry as a measure of financial performance and debt-service capabilities.

Our use of EBITDA and Adjusted EBITDA have limitations as analytical tools, and you should not consider them in isolation or as a substitute for analysis of our results as reported under GAAP. Some of these limitations are:

| • | EBITDA and Adjusted EBITDA do not reflect our cash expenditures for capital equipment or other contractual commitments; |

| • | Although depreciation and amortization are non-cash charges, the assets being depreciated and amortized may have to be replaced in the future, and EBITDA and Adjusted EBITDA do not reflect capital expenditure requirements for such replacements; |

| • | EBITDA and Adjusted EBITDA do not reflect changes in, or cash requirements for, our working capital needs; |

| • | EBITDA and Adjusted EBITDA do not reflect the interest expense or the cash requirements necessary to service interest or principal payments on our indebtedness; and |

| • | Other companies, including companies in our industry, may calculate EBITDA and Adjusted EBITDA measures differently, which reduces their usefulness as a comparative measure. |

In evaluating EBITDA and Adjusted EBITDA, you should be aware that in the future we will incur expenses similar to the adjustments in this presentation. Our presentation of EBITDA and Adjusted EBITDA should not be construed as an inference that our future results will be unaffected by these expenses or any unusual or non-recurring items. When evaluating our performance, you should consider EBITDA and Adjusted EBITDA alongside other financial performance measures, including our net loss and other GAAP results.

-12-

The following table presents a reconciliation of EBITDA and Adjusted EBITDA to our net income or loss, the most comparable GAAP measure, for each of the periods indicated:

| EBITDA and adjusted EBITDA | Year ended December 31, |

Nine months ended September 30, |

||||||||||||||

| (in thousands) | 2011 | 2012 | 2012 | 2013 | ||||||||||||

|

|

||||||||||||||||

| Net income (loss) |

$ | (2,002 | ) | $ | 564 | $ | 456 | $ | 3,464 | |||||||

| Non-GAAP adjustments: |

||||||||||||||||

| Interest income |

(113 | ) | (88 | ) | (84 | ) | (9 | ) | ||||||||

| Interest expense |

261 | 493 | 381 | 312 | ||||||||||||

| Provision for income taxes |

13 | 18 | 20 | 151 | ||||||||||||

| Depreciation and amortization |

3,198 | 4,984 | 3,451 | 5,995 | ||||||||||||

|

|

|

|||||||||||||||

| EBITDA |

1,357 | 5,971 | 4,224 | 9,913 | ||||||||||||

| Change in fair value of preferred stock warrant liability |

119 | (148 | ) | (148 | ) | 202 | ||||||||||

| Stock-based compensation |

144 | 60 | 48 | 116 | ||||||||||||

|

|

|

|||||||||||||||

| Adjusted EBITDA |

$ | 1,620 | $ | 5,883 | $ | 4,124 | $ | 10,231 | ||||||||

|

|

||||||||||||||||

-13-

Investing in our common stock involves a high degree of risk. You should consider carefully the risks and uncertainties described below, together with all of the other information in this prospectus, including our financial statements and related notes, before deciding whether to purchase shares of our common stock. If any of the following risks are realized, our business, financial condition, results of operations and prospects could be materially and adversely affected. In that event, the price of our common stock could decline and you could lose part or all of your investment.

Risks related to our business and strategy

A significant majority of our customers have health coverage under the Medicare program, and recently enacted and future changes in the reimbursement rates or payment methodologies under Medicare and other government programs have affected and could continue to materially and adversely affect our business and operating results.

As a provider of oxygen product rentals, we have historically depended heavily on Medicare reimbursement as a result of the higher proportion of elderly persons suffering from chronic respiratory conditions. Medicare Part B, or Supplementary Medical Insurance Benefits, provides coverage to eligible beneficiaries that includes items of durable medical equipment for use in the home, such as oxygen equipment and other respiratory devices. We believe that more than 60% of oxygen therapy patients in the United States have primary coverage under Medicare Part B. In 2011 and 2012, we derived approximately 26% and 27%, respectively, of our revenue from Medicare. There are increasing pressures on Medicare to control health care costs and to reduce or limit reimbursement rates for home medical products.

Legislation, including the Medicare Prescription Drug, Improvement, and Modernization Act of 2003, the Deficit Reduction Act of 2005, the Medicare Improvements for Patients and Providers Act of 2008, and the Patient Protection and Affordable Care Act, contain provisions that directly impact reimbursement for the durable medical equipment products provided by us:

| • | The Medicare Prescription Drug, Improvement, and Modernization Act of 2003 significantly reduced reimbursement for inhalation drug therapies beginning in 2005, reduced payment amounts for certain durable medical equipment, including oxygen, beginning in 2005, froze payment amounts for other covered home medical equipment items through 2008, established a competitive bidding program for home medical equipment and implemented quality standards and accreditation requirements for durable medical equipment suppliers. |

| • | The Deficit Reduction Act of 2005 limited the total number of continuous rental months for which Medicare will pay for oxygen equipment to 36 months, after which time there is generally no additional reimbursement to the supplier (other than for periodic, in-home maintenance and servicing). The Deficit Reduction Act of 2005 also provided that title of the equipment would transfer to the beneficiary, which was later repealed by the Medicare Improvements for Patients and Providers Act of 2008. For purposes of the rental cap, the Deficit Reduction Act of 2005 provided for a new 36-month rental period that began January 1, 2006 for all oxygen equipment. After the 36th continuous month during which payment is made for the oxygen equipment, the supplier is generally required to continue to furnish the equipment during the period of medical need for the remainder of the useful lifetime of the equipment, provided there are no breaks in service due to medical necessity that exceed 60 days. The reasonable useful lifetime for portable oxygen equipment is 60 months. After 60 months, if the |

-14-

| patient requests, the rental cycle starts over and a new 36-month capped rental period begins. There are no limits on the number of 60-month cycles over which a Medicare patient may receive benefits and an oxygen therapy provider may receive reimbursement, so long as such equipment continues to be medically necessary for the patient. We anticipate that the Deficit Reduction Act of 2005 oxygen payment rules will continue to negatively affect our net revenue on an ongoing basis, as each month additional customers reach the 36-month capped service period, resulting in potentially two or more years without rental income from these customers. We cannot state with certainty the number of patients in the capped rental period or the potential impact to revenue associated with patients in the capped rental period. |

| • | Medicare Improvements for Patients and Providers Act of 2008 retroactively delayed the implementation of competitive bidding for 18 months from previously established dates and decreased the 2009 fee schedule payment amounts by 9.5% for product categories included in competitive bidding. In addition to the 9.5% reduction under Medicare Improvements for Patients and Providers Act of 2008, the Centers for Medicare & Medicaid Services implemented a reduction to the monthly payment amount for stationary oxygen equipment by 2.3% in 2009 and 1.5% in 2010, which reduced the monthly payment rate to $175.79 and $173.17 in 2009 and 2010, respectively. The stationary oxygen payment rate for 2011 and 2012 was increased by 0.1%, 1.6%, and 0.7% in 2011, 2012, and 2013, respectively, thereby increasing the monthly payment rate to $173.31, $176.06, and $177.36 in 2011, 2012, and 2013, respectively. The monthly payment rate for non-delivery ambulatory oxygen in the relevant period was flat at $51.63. |

| • | The Patient Protection and Affordable Care Act includes, among other things, a deductible excise tax on any entity that manufactures or imports medical devices offered for sale in the United States, with limited exceptions including oxygen products such as ours, which began in 2013; new face-to-face physician encounter requirements for durable medical equipment and home health services; and a requirement that by 2016, the competitive bidding process must be nationalized or prices in non-competitive bidding areas must be adjusted to match competitive bidding prices. |

These legislative provisions, as currently in effect and when fully implemented, have had and will continue to have a material and adverse effect on our business, financial condition and operating results.

Due to budgetary shortfalls, many states are considering, or have enacted, cuts to their Medicaid programs. These cuts have included, or may include, elimination or reduction of coverage for our products, amounts eligible for payment under co-insurance arrangements, or payment rates for covered items. Continued state budgetary pressures could lead to further reductions in funding for the reimbursement for our products which, in turn, would adversely affect our business, financial conditions, and results of operations.

The implementation of the competitive bidding process under Medicare could negatively affect our business and financial condition.

The Medicare Prescription Drug, Improvement, and Modernization Act of 2003 required the Secretary of Health and Human Services to establish and implement programs under which competitive acquisition areas are established throughout the United States for purposes of awarding contracts for the furnishing of competitively priced items of durable medical equipment, including oxygen equipment.

-15-

The Centers for Medicare & Medicaid Services, the agency responsible for administering the Medicare program, conducts a competition for each competitive acquisition area under which providers submit bids to supply certain covered items of durable medical equipment. Successful bidders must meet certain program quality standards in order to be awarded a contract and only successful bidders can supply the covered items to Medicare beneficiaries in the acquisition area. There are, however, regulations in place that allow non-contracted providers to continue to provide products and services to their existing customers at the new competitive bidding payment amounts. The contracts are expected to be re-bid every three years. The Centers for Medicare & Medicaid Services is required to award contracts to multiple entities submitting bids in each area for an item or service, but has the authority to limit the number of contractors in a competitive acquisition area to the number it determines to be necessary to meet projected demand.

Although the Centers for Medicare & Medicaid Services concluded the bidding process for the first round of Metropolitan Statistical Areas in September 2007, in July 2008, Congress enacted Medicare Improvements for Patients and Providers Act of 2008, which retroactively delayed the implementation of competitive bidding. Medicare Improvements for Patients and Providers Act of 2008 also reduced Medicare prices nationwide by 9.5% beginning in 2009 for the product categories, including oxygen, that were initially included in competitive bidding.

In 2009, the Centers for Medicare & Medicaid Services implemented a new bidding process in nine Metropolitan Statistical Areas, covering approximately 9% of the Medicare oxygen market. Reimbursement rates from the re-bidding process were publicly released by the Centers for Medicare & Medicaid Services on June 30, 2010. The Centers for Medicare & Medicaid Services announced average savings of approximately 35% off the current standard Medicare payment rates in effect for the product categories included in competitive bidding. As of January 1, 2011, these payment rates were in effect in the nine markets only. We were offered six three-year contracts to provide oxygen equipment in six of the nine markets, and we accepted and signed those contracts.

The Centers for Medicare & Medicaid Services implemented the second phase of competitive bidding in an additional 100 competitive bidding areas covering approximately 50% of the Medicare oxygen market, with three-year contracts effective July 1, 2013. The Centers for Medicare & Medicaid Services announced average savings of approximately 45% off the current standard Medicare payment rates in effect for the product categories included in competitive bidding. As of July 1, 2013, these payment rates were in effect in the 100 competitive bidding areas. We were offered 89 contracts to provide oxygen equipment in 89 of the 100 Competitive Bidding Areas, and we accepted and signed those contracts.

Round one re-competes are expected or planned to go into effect in January 2014; reimbursement rates from the re-bidding process were publicly released by the Centers for Medicare & Medicaid Services on October 1, 2013. The Centers for Medicare & Medicaid Services announced average savings of approximately 37% off the current standard Medicare payment rates in effect from the product categories included in competitive bidding. We were offered 3 contracts to provide respiratory equipment in 3 of the 9 competitive bidding areas, and we accepted and signed those contracts. We are required to be able to supply additional respiratory products such as sleep and aerosol therapy, which have lower margins than our existing products. This could have a negative impact on our financial conditions and results of operations.

-16-

The Patient Protection and Affordable Care Act legislation requires the Centers for Medicare & Medicaid Services to expand competitive bidding further to additional geographic markets or to use competitive bid pricing information to adjust the payment amounts otherwise in effect for areas that are not competitive acquisition areas by January 1, 2016.

Although we continue to monitor developments regarding the implementation of the competitive bidding program, we cannot predict the outcome of the competitive bidding program on our business when fully implemented, nor the Medicare payment rates that will be in effect in future years for the items subjected to competitive bidding, including our products. We expect that the stationary oxygen and non-delivery ambulatory oxygen payment rates will continue to fluctuate, and a large negative payment adjustment could adversely affect our business, financial conditions and results of operations.

We face intense national, regional and local competition and if we are unable to compete successfully, it could have an adverse effect on our revenue, revenue growth rate, if any, and market share.

The oxygen therapy market is a highly competitive industry. We compete with a number of manufacturers and distributors of portable oxygen concentrators, as well as providers of other oxygen therapy solutions such as home delivery of oxygen tanks or cylinders.

Our significant manufacturing competitors are Invacare Corporation, Respironics (a subsidiary of Koninklijke Philips N.V.), AirSep Corporation and SeQual Technologies (subsidiaries of Chart Industries, Inc.), Inova Labs, Inc. and DeVilbiss Healthcare. Given the relatively straightforward regulatory path in the oxygen therapy device manufacturing market, we expect that the industry will become increasingly competitive in the future. Manufacturing companies compete for sales to providers primarily on the basis of product features, service and price.

Lincare Inc., Apria Healthcare, Inc. Rotech Healthcare, Inc. and American HomePatient, Inc. are among the market leaders in providing oxygen therapy for many years, while the remaining oxygen therapy market is serviced by local providers. Because many oxygen therapy providers were either excluded from contracts in the Medicare competitive bidding process, or will have difficulty providing service at the prevailing Medicate reimbursement rates, we expect more industry consolidation. Oxygen therapy providers compete primarily on the basis of product features and service, rather than price, since reimbursement levels are established by Medicare and Medicaid, or by the individual determinations of private payors.

Some of our competitors are large, well-capitalized companies with greater resources than we have. As a consequence, they are able to spend more aggressively on product development, marketing, sales and other product initiatives than we can. Some of these competitors have:

| • | significantly greater name recognition; |

| • | established relations with healthcare professionals, customers and third-party payors; |

| • | established distribution networks; |

| • | additional lines of products, and the ability to offer rebates or bundle products to offer higher discounts or other incentives to gain a competitive advantage; |

| • | greater history in conducting research and development, manufacturing, marketing and obtaining regulatory approval for oxygen device products; and |

-17-

| • | greater financial and human resources for product development, sales and marketing, patent litigation and customer financing. |

As a result, our competitors may be able to respond more quickly and effectively than we can to new or changing opportunities, technologies, standard regulatory and reimbursement development and customer requirements. In light of these advantages that our competitors maintain, even if our technology and direct-to-consumer distribution strategy is more effective than the technology and distribution strategy of our competitors, current or potential customers might accept competitor products and services in lieu of purchasing our products. We anticipate that we will face increased competition in the future as existing companies and competitors develop new or improved products and distribution strategies and as new companies enter the market with new technologies and distribution strategies. We may not be able to compete effectively against these organizations. Our ability to compete successfully and to increase our market share is dependent upon our reputation for providing responsive, professional and high-quality products and services and achieving strong customer satisfaction. Increased competition in the future could adversely affect our revenue, revenue growth rate, margins and market share.

Healthcare reform measures may have a material adverse effect on our business and results of operations.

In the United States, the legislative landscape, particularly as it relates to healthcare regulation and reimbursement coverage, continues to evolve. In March 2010, the Patient Protection and Affordable Care Act was passed, which has the potential to substantially change health care financing by both governmental and private insurers, and significantly impact the U.S. medical device industry. As discussed above, the Patient Protection and Affordable Care Act, among other things, imposes a new excise tax, which began in 2013, on entities that manufacture, produce or import medical devices in an amount equal to 2.3% of the price for which such devices are sold in the United States, however oxygen products such as ours were exempt. In addition, as discussed above, the Patient Protection and Affordable Care Act also expands the round two of competitive bidding to a total of 91 competitive bidding areas, and by 2016, the process must be nationalized or prices in non-competitive bidding areas must be adjusted to match competitive bidding prices.

In addition, other legislative changes have been proposed and adopted in the United States since the Patient Protection and Affordable Care Act was enacted. On August 2, 2011, the Budget Control Act of 2011 among other things, created measures for spending reductions by Congress. A Joint Select Committee on Deficit Reduction, tasked with recommending a targeted deficit reduction of at least $1.2 trillion for the years 2013 through 2021, was unable to reach required goals, thereby triggering the legislation’s automatic reduction to several government programs. This includes aggregate reductions of Medicare payments to providers up to 2% per fiscal year, which went into effect on April 1, 2013. On January 2, 2013, President Obama signed into law the American Taxpayer Relief Act of 2012 which, among other things, further reduced Medicare payments to certain providers, including physicians, hospitals, imaging centers and cancer treatment centers, and increased the statute of limitations period for the government to recover overpayments to providers from three to five years. We expect that additional state and federal healthcare reform measures will be adopted in the future, any of which could limit the amounts that federal and state governments will pay for healthcare products and services, which could result in reduced demand for our products or additional pricing pressures.

-18-

If we are unable to continue to enhance our existing products and develop and market new products that respond to customer needs and preferences and achieve market acceptance, we may experience a decrease in demand for our products and our business could suffer.

We may not be able to compete as effectively with our competitors, and ultimately satisfy the needs and preferences of our customers, unless we can continue to enhance existing products and develop new innovative products. Product development requires significant financial, technological, and other resources. While we expended $1.8 million and $2.3 million for research and development efforts in 2011 and 2012, respectively, we cannot assure you that this level of investment in research and development will be sufficient to maintain a competitive advantage in product innovation, which could cause our business to suffer. Product improvements and new product introductions also require significant planning, design, development, and testing at the technological, product, and manufacturing process levels and we may not be able to timely develop product improvements or new products. Our competitors’ new products may beat our products to market, be more effective with more features, obtain better market acceptance, or render our products obsolete. Any new products that we develop may not receive market acceptance or otherwise generate any meaningful sales or profits for us relative to our expectations based on, among other things, existing and anticipated investments in manufacturing capacity and commitments to fund advertising, marketing, promotional programs, and research and development.

We depend upon reimbursement from Medicare, private payors and Medicaid for a significant portion of our revenue, and if we fail to manage the complex and lengthy reimbursement process, our business and operating results could suffer.

A significant portion of our revenue is derived from reimbursement by third-party payors. We accept assignment of insurance benefits from customers and, in a majority of cases, invoice and collect payments directly from Medicare, private payors and Medicaid, as well as from customers under co-payment provisions. In 2012, approximately 41% of our revenue was derived from Medicare, private payors and Medicaid, and the balance directly from individual customers and commercial entities.

Our financial condition and results of operations may be affected by the health care industry’s reimbursement process, which is complex and can involve lengthy delays between the time that a product is delivered to the consumer and the time that the reimbursement amounts are settled. Depending on the payor, we may be required to obtain certain payor-specific documentation from physicians and other health care providers before submitting claims for reimbursement. Certain payors have filing deadlines and they will not pay claims submitted after such time. We are also subject to extensive pre-payment and post-payment audits by governmental and private payors that could result in material delays, refunds of monies received or denials of claims submitted for payment under such third-party payor programs and contracts. We cannot ensure that we will be able to continue to effectively manage the reimbursement process and collect payments for our products promptly. If we fail to manage the complex and lengthy reimbursement process, it would adversely affect our business, financial conditions, and results of operations.

-19-

Failure to obtain private payor contracts and future reductions in reimbursement rates from private payors could have a material adverse effect on our financial condition and operating results.

A portion of our revenue is derived from private payors. Based on our patient population, we estimate at least 30% of potential customers have non-Medicare insurance coverage, and we believe these patients represent a younger and more active patient population that will be drawn to the quality-of-life benefits of our solution. Failing to maintain and obtain private payor contracts from private insurance companies and employers and secure in-network provider status could have a material adverse effect on our financial condition and operating results. In addition, private payors are under pressure to increase profitability and reduce costs. In response, certain private payors are limiting coverage or reducing reimbursement rates for the products we provide. We believe that private payor reimbursement levels will generally be reset in accordance with the Medicare payment amounts determined by competitive bidding. We cannot predict the extent to which reimbursement for our products will be affected by competitive bidding or by initiatives to reduce costs for private payors. Failure to obtain or maintain private payor contracts or the unavailability of third-party coverage or inadequacy of reimbursement for our products would adversely affect our business, financial conditions, and results of operations.

We obtain some of the components, subassemblies and completed products included in our Inogen One systems from a single source or a limited group of manufacturers or suppliers, and the partial or complete loss of one of these manufacturers or suppliers could cause significant production delays, an inability to meet customer demand and a substantial loss in revenue.

We utilize single source suppliers for some of the components and subassemblies we use in our Inogen One systems. We have qualified alternate sources of supply sufficient to support future needs and we have taken other mitigating steps to reduce the impact of a change in supplier; however, there may be delays in switching to these alternative suppliers if our primary source is terminated without notice. Our dependence on single source suppliers of components may expose us to several risks, including, among other things:

| • | Our suppliers may encounter financial hardships as a result of unfavorable economic and market conditions unrelated to our demand for components, which could inhibit their ability to fulfill our orders and meet our requirements; |

| • | Suppliers may fail to comply with regulatory requirements, be subject to lengthy compliance, validation or qualification periods, or make errors in manufacturing components that could negatively affect the efficacy or safety of our products or cause delays in supplying of our products to our customers; |

| • | Newly identified suppliers may not qualify under the stringent regulatory standards to which our business is subject; |

| • | We or our suppliers may not be able to respond to unanticipated changes in customer orders, and if orders do not match forecasts, we or our suppliers may have excess or inadequate inventory of materials and components; |

| • | We may be subject to price fluctuations due to a lack of long-term supply arrangements for key components; |

| • | We may experience delays in delivery by our suppliers due to changes in demand from us or their other customers; |

-20-

| • | We or our suppliers may lose access to critical services and components, resulting in an interruption in the manufacture, assembly and shipment of our systems; |

| • | Our suppliers may be subject to allegations by other parties of misappropriation of proprietary information in connection with their supply of products to us, which could inhibit their ability to fulfill our orders and meet our requirements; |

| • | Fluctuations in demand for products that our suppliers manufacture for others may affect their ability or willingness to deliver components to us in a timely manner; |

| • | Our suppliers may wish to discontinue supplying components or services to us; and |

| • | We may not be able to find new or alternative components or reconfigure our system and manufacturing processes in a timely manner if the necessary components become unavailable. |

In addition, we may be deemed to manufacture or contract to manufacture products that contain certain minerals that have been designated as “conflict minerals” under the Dodd-Frank Wall Street Reform and Consumer Protection Act. As a result, in future periods, we may be required to diligence the origin of such minerals and disclose and report whether or not such minerals originated in the Democratic Republic of the Congo or adjoining countries. The implementation of these new requirements could adversely affect the sourcing, availability, and pricing of minerals used in the manufacture of our products. In addition, we may incur additional costs to comply with the disclosure requirements, including costs related to determining the source of any of the relevant minerals and metals used in our products.

If any of these risks materialize, costs could significantly increase and our ability to meet demand for our products could be impacted. If we are unable to satisfy commercial demand for our Inogen One systems in a timely manner, our ability to generate revenue would be impaired, market acceptance of our products could be adversely affected, and customers may instead purchase or use alternative products. In addition, we could be forced to secure new or alternative components and subassemblies through a replacement supplier. Finding alternative sources for these components and subassemblies could be difficult in certain cases and may entail a significant amount of time and disruption. In some cases, we would need to change the components or subassemblies if we sourced them from an alternative supplier. This, in turn, could require a redesign of our Inogen One systems and, potentially, require additional FDA clearance or approval before we could use any redesigned product with new components or subassemblies, thereby causing further costs and delays that could adversely affect our business, financial condition and operating results.

We do not have long-term supply contracts with many of our third-party suppliers.

We purchase components and subassemblies from third-party suppliers, including some of our single source suppliers, through purchase orders and do not have long-term supply contracts with many of these third-party suppliers. Many of our third-party suppliers, therefore, are not obligated to perform services or supply products to us for any specific period, in any specific quantity or at any specific price, except as may be provided in a particular purchase order. We do not maintain large volumes of inventory from most of these suppliers. If we inaccurately forecast demand for components or subassemblies, our ability to manufacture and commercialize our Inogen One systems could be delayed and our competitive position and reputation could be harmed. In addition, if we fail to effectively manage our relationships with these suppliers, we may be required to change suppliers which would be time consuming and disruptive and could adversely affect our business, financial condition and operating results.

-21-

If we fail to comply with U.S. export control and economic sanctions or fail to expand and maintain an effective sales force or successfully develop our international distribution network, our business, financial condition and operating results may be adversely affected.

We currently derive the majority of our revenue from rentals or sales generated from our own direct sales force. Failure to maintain or expand our direct sales force could adversely impact our financial and operating performance. Additionally, we use international distributors to augment our sales efforts, certain of which are exclusive distributors in certain foreign countries. We cannot assure you that we will be able to successfully develop our relationships with third-party distributors internationally. In addition, we are subject to United States export control and economic sanctions laws relating to the sale of our products, the violation of which could result in substantial penalties being imposed against us. In particular, we have secured annual export licenses from the U.S. Treasury Department’s Office of Foreign Assets Control to sell our products to a distributor and hospital and clinic end-users in Iran. The use of this license requires us to observe strict conditions with respect to products sold, end-user limitations and payment requirements. Although we believe we have maintained compliance with license requirements, there can be no assurance that the license will not be revoked, be renewed in the future or that we will remain in compliance. More broadly, if we fail to comply with export control laws or successfully develop our relationship with international distributors, our sales could fail to grow or could decline, and our ability to grow our business could be adversely affected. Distributors that are in the business of selling other medical products may not devote a sufficient level of resources and support required to generate awareness of our products and grow or maintain product sales. If our distributors are unwilling or unable to market and sell our products, or if they do not perform to our expectations, we could experience delayed or reduced market acceptance and sales of our products.

We may be subject to substantial warranty or product liability claims or other litigation in the ordinary course of business that may adversely affect our business, financial condition and operating results.