Registration No. 333-199313

As filed with the Securities and Exchange Commission on October 27, 2014.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1 TO

FORM S-1

REGISTRATION STATEMENT

Under

The Securities Act of 1933

INOGEN, INC.

(Exact name of registrant as specified in its charter)

|

Delaware |

5960 |

33-0989359 |

|

(State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

326 Bollay Drive

Goleta, California 93117

(805) 562-0500

(Address, including ZIP code, and telephone number, including area code, of registrant’s principal executive offices)

Raymond Huggenberger

326 Bollay Drive

Goleta, California 93117

(805) 562-0500

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

|

Martin J. Waters Daniel R. Koeppen Wilson Sonsini Goodrich & Rosati, Professional Corporation 633 West Fifth Street, 15th Floor Los Angeles, CA 90071 Telephone: (323) 210-2900 Facsimile: (866) 974-7329 |

|

Charles K. Ruck B. Shayne Kennedy Latham & Watkins LLP 650 Town Center Drive, 20th Floor Costa Mesa, CA 92626-1925 Telephone: (714) 540-1235 Facsimile: (714) 755-8290 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, as amended, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer |

|

¨ |

|

Accelerated filer |

|

¨ |

|

|

|

|

|

|||

|

Non-accelerated filer |

|

x (Do not check if a smaller reporting company) |

|

Smaller reporting company |

|

¨ |

CALCULATION OF REGISTRATION FEE

|

|

||||||||

|

Title of each class of securities to be registered |

|

Amount to be |

|

Proposed maximum |

|

Proposed maximum |

|

Amount of |

|

Common Stock, $0.001 par value per share |

|

2,415,891 |

|

$20.15 |

|

$48,680,203.65 |

|

$5,656.64 |

|

|

||||||||

|

|

||||||||

|

(1) |

Includes 315,116 shares or offering price of shares that the underwriters have the option to purchase. |

|

(2) |

Estimated solely for the purpose of calculating the registration fee based on the average of the high and low prices for the registrant’s common stock on the NASDAQ Global Select Market on October 21, 2014, pursuant to Rule 457(c) under the Securities Act of 1933, as amended. |

|

(3) |

Of this amount, $5,810.00 was previously paid in connection with a prior filing of this Registration Statement. |

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment that specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to such Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. The selling stockholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and is it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to completion, dated October 27, 2014

Preliminary Prospectus

2,100,775 shares

Common Stock

The selling stockholders identified in this prospectus are offering 2,100,775 shares of common stock of Inogen, Inc. We will not receive any proceeds from the sale of shares of our common stock by the selling stockholders. Inogen, Inc. is not offering any of the shares to be sold in the offering contemplated by this prospectus.

Our common stock is listed on the NASDAQ Global Select Market under the symbol “INGN.” On October 24, 2014, the last reported sale price of our common stock on the NASDAQ Global Select Market was $21.38 per share.

We are an “emerging growth company,” as that term is defined in the Jumpstart Our Business Startups Act of 2012 and, as such, have elected to comply with certain reduced public company reporting requirements for this prospectus and future filings.

Investing in our common stock involves a high degree of risk. See “Risk factors” beginning on page 12.

|

|

|

Per |

|

|

Total |

|

||

|

Public offering price |

|

$ |

|

|

|

$ |

|

|

|

Underwriting discounts and commissions(1) |

|

$ |

|

|

|

$ |

|

|

|

Proceeds to selling stockholders |

|

$ |

|

|

|

$ |

|

|

(1) See “Underwriting” for additional disclosure regarding underwriting discounts, commissions and estimated offering expenses.

The selling stockholders have granted the underwriters an option to purchase up to an additional 315,116 shares of common stock at the offering price less the underwriting discount. We will not receive any of the proceeds from the shares of common stock sold by the selling stockholders pursuant to any exercise of the underwriters' option to purchase additional shares.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares to purchasers on or about , 2014.

J.P. Morgan

William Blair

|

Leerink Partners |

|

Needham & Company |

Prospectus dated , 2014

Table of contents

|

|

|

Page |

|

|

|

1 |

|

|

|

12 |

|

|

|

34 |

|

|

|

35 |

|

|

|

35 |

|

|

|

36 |

|

|

|

37 |

|

|

|

38 |

|

|

|

43 |

|

|

|

60 |

|

|

|

72 |

|

|

|

74 |

|

|

|

76 |

|

|

|

80 |

|

Material U.S. federal income tax consequences to non-U.S. holders of common stock |

|

82 |

|

|

|

85 |

|

|

|

89 |

|

|

|

89 |

|

|

|

89 |

|

|

|

90 |

Neither we, the selling stockholders nor the underwriters have authorized anyone to provide any information other than that contained in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we have referred you. Neither we nor the selling stockholders take responsibility for, or can provide any assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus, regardless of the time of delivery of this prospectus or any sale of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

For investors outside of the United States: Neither we, the selling stockholders nor the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than the United States. Persons outside of the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of common stock and the distribution of this prospectus outside of the United States.

-i-

The items in the following summary are described in more detail later in this prospectus or incorporated by reference into this prospectus from our Annual Report on Form 10-K for the year ended December 31, 2013, our Quarterly Report on Form 10-Q for the quarter period ended June 30, 2014 and our other filings with the Securities and Exchange Commission listed in the section of the prospectus entitled “Incorporation by reference.” This summary provides an overview of selected information and does not contain all of the information you should consider before buying our common stock. Therefore, you should read the entire prospectus carefully, especially the “Risk factors” section beginning on page 12 and our financial statements and the related notes incorporated by reference into this prospectus from our Annual Report on Form 10-K for the year ended December 31, 2013 and our Quarterly Report on Form 10-Q for the quarter ended June 30, 2014, before deciding to invest in our common stock. In this prospectus, unless the context otherwise requires, references to “we,” “us,” “our” or “Inogen” refer to Inogen, Inc.

Overview

We are a medical technology company that primarily develops, manufactures and markets innovative portable oxygen concentrators used to deliver supplemental long-term oxygen therapy to patients suffering from chronic respiratory conditions. Traditionally, these patients have relied on stationary oxygen concentrator systems for use in the home and oxygen tanks or cylinders for mobile use, which we call the delivery model. The tanks and cylinders must be delivered regularly and have a finite amount of oxygen, which requires patients to plan activities outside of their homes around delivery schedules and a finite oxygen supply. Additionally, patients must attach long, cumbersome tubing to their stationary concentrators simply to enable mobility within their homes. Our proprietary Inogen One systems concentrate the air around the patient to offer a single source of supplemental oxygen anytime, anywhere with a portable device weighing approximately 4.8 or 7.0 pounds. Our Inogen One G3 and G2 have up to 4.5 and 5 hours of battery life, respectively, with a single battery and can be plugged into an outlet when at home, in a car or in a public place with outlets available. Our Inogen One systems reduce the patient’s reliance on stationary concentrators and scheduled deliveries of tanks with a finite supply of oxygen, thereby improving patient quality of life and fostering mobility.

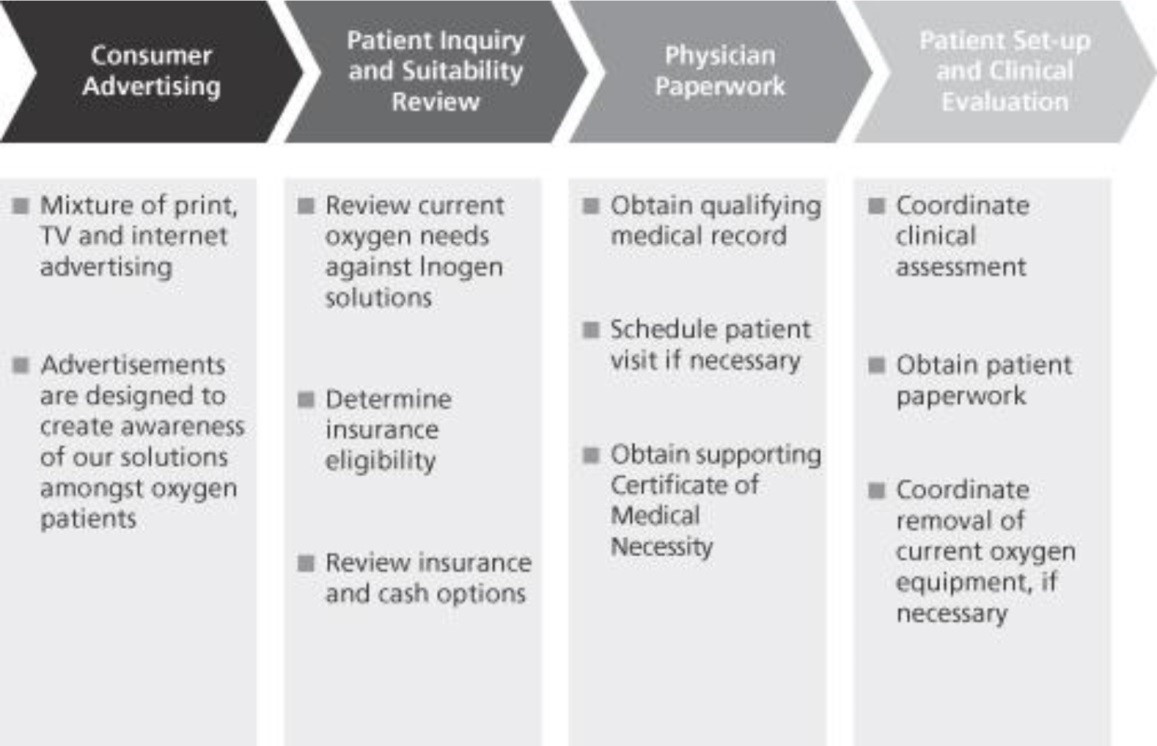

Although portable oxygen concentrators represent the fastest-growing segment of the Medicare oxygen therapy market, we estimate based on 2012 Medicare data that patients using portable oxygen concentrators represent approximately 4% to 5% of the total addressable oxygen market in the United States. Based on 2012 industry data, we were the leading worldwide manufacturer of portable oxygen concentrators, as well as the largest provider of portable oxygen concentrators to Medicare patients, as measured by dollar volume. We believe we are the only manufacturer of portable oxygen concentrators that employs a direct-to-consumer strategy in the United States, meaning we market our products to patients, process their physician paperwork, provide clinical support as needed and bill Medicare or insurance on their behalf. To pursue a direct-to-consumer strategy, our manufacturing competitors would need to meet national accreditation and state-by-state licensing requirements and secure Medicare billing privileges, as well as compete with the home medical equipment providers that many rely on across their entire homecare business.

We believe our direct-to-consumer strategy has been critical to driving patient adoption of our technology. Other portable oxygen concentrator manufacturers access patients by selling through home medical equipment providers, which we believe are disincentivized to encourage adoption of portable oxygen concentrators. In order to facilitate the regular delivery and pickup of oxygen tanks, home medical equipment providers have invested in geographically dispersed distribution infrastructure consisting of delivery vehicles, physical locations and delivery personnel within each area. Because portable oxygen concentrators eliminate the need for a physical distribution infrastructure, but have higher initial equipment costs than the delivery model, we believe converting to a portable oxygen concentrator model would require significant restructuring and capital investment for home medical equipment providers. Our direct-to-consumer marketing strategy allows us to sidestep the home medical equipment channel, appeal to patients directly and capture both the manufacturing and provider margin associated with long-term oxygen therapy. We believe our ability to capture this top-to-bottom margin, combined with our portable oxygen concentrator technology that eliminates the need for the service and infrastructure costs associated with the delivery model, gives us a cost structure advantage over our competitors.

Since adopting our direct-to-consumer strategy in 2009 following our acquisition of Comfort Life Medical Supply, LLC, which had an active Medicare billing number but few other assets and limited business activities, we have directly sold or rented our Inogen One systems to more than 40,000 patients, growing our revenue from $10.7 million in 2009 to $23.6 million in 2010, $30.6 million in 2011, $48.6 million in 2012, and $75.4 million in 2013. In 2013, 22.2% of our revenue came from our international markets and 40.5% of our revenue came from oxygen rentals. Our percentage of rental revenue increased from 35.8% in 2011, increasing our proportion of recurring revenue. Additionally, we have increased our gross margin from 48.0% in 2011, to 49.3% in 2012 and to 51.7% in 2013, primarily due to the change in sales mix toward direct-to-consumer from provider sales, improving system reliability, reducing material cost per system and lowering overhead cost per system. Our net loss was $2.6 million in 2009 transitioning to net income of $25.4 million in 2013. Adjusted net income excluding a one-time tax benefit was $3.6 million in 2013.

-1-

Our market

Overview of oxygen therapy market

We believe the current total addressable oxygen therapy market in the United States is approximately $3 billion to $4 billion, based on 2012 Medicare data and our estimate of the ratio of the Medicare market to the total market. We estimate that more than 2.5 million patients in the United States and more than 4.5 million patients worldwide use oxygen therapy, and more than 60% of oxygen therapy patients in the United States are covered by Medicare. The number of oxygen therapy patients in the United States is projected to grow by approximately 7% to 10% per year between 2013 and 2019, which we believe is the result of earlier diagnosis of chronic respiratory conditions, demographic trends and longer durations of long-term oxygen therapy.

Long-term oxygen therapy has been shown to be a cost-efficient and clinically effective means to treat hypoxemia, a condition in which patients have insufficient oxygen in the blood. Hypoxemic patients are unable to convert oxygen found in the air into the bloodstream in an efficient manner, causing organ damage and poor health. Chronic obstructive pulmonary disease, or COPD, is a leading cause of hypoxemia. Approximately 70% of our patient population has been diagnosed with COPD, which we believe is reflective of the long-term oxygen therapy market in general. Industry sources estimate that 24 million people in the United States suffer from COPD, of which one-half are undiagnosed.

According to our analysis of 2011 and 2012 Medicare data, approximately two-thirds of U.S. oxygen users require ambulatory oxygen and the remaining one-third require only stationary or nocturnal oxygen. Clinical data has shown that ambulatory patients that use oxygen twenty-four hours a day, seven days a week, or 24/7, regardless of whether such patients rely on portable oxygen concentrators or the delivery model, have approximately two times the survival rate and spend at least 60% fewer days annually in the hospital than non-ambulatory 24/7 patients. The cost of one year of oxygen therapy is less than the cost of one day in the hospital. Of the ambulatory patients, we estimate that approximately 85% rely upon the delivery model, which has the following disadvantages:

|

• |

limited flexibility outside the home, dictated by the finite oxygen supply provided by tanks and cylinders and dependence on delivery schedules; |

|

• |

restricted mobility and inconvenience within the home, as patients must attach long, cumbersome tubing to a noisy stationary concentrator to move within their homes; |

|

• |

products are not cleared for use on commercial aircraft and cannot plug into a vehicle outlet for extended use; and |

|

• |

high costs driven by the infrastructure necessary to establish a geographically diverse distribution network to serve patients locally, as well as personnel, fuel and other costs, which have limited economies of scale and generally increase over time. |

Portable oxygen concentrators were developed in response to many of the limitations associated with traditional oxygen therapy. Portable oxygen concentrators are designed to offer a self-replenishing, unlimited supply of oxygen that is concentrated from the surrounding air and to operate without the need for oxygen tanks or regular oxygen deliveries, enhancing patient independence and mobility. Additionally, because portable oxygen concentrators do not require the physical infrastructure and service intensity of the delivery model, we believe portable oxygen concentrators can provide long-term oxygen therapy with a lower cost structure. Despite the ability of portable oxygen concentrators to address many of the shortcomings of traditional oxygen therapy, we estimate based on 2012 Medicare data that the amount spent by patients with portable oxygen concentrators represents approximately 5% to 6% of total oxygen therapy spend. We believe the following has hindered the market acceptance of portable oxygen concentrators:

|

• |

to obtain portable oxygen concentrators, patients are dependent on home medical equipment providers, which have made significant investments in the physical distribution infrastructure to support the delivery model and which we believe are therefore disincentivized to encourage adoption of portable oxygen concentrators; |

|

• |

constrained manufacturing costs of conventional portable oxygen concentrators, driven by home medical equipment provider preference for products that have lower upfront equipment cost; and |

|

• |

limitations of conventional portable oxygen concentrators, including bulkiness, poor reliability and lack of suitability beyond intermittent or travel use. |

-2-

Our solution

Our Inogen One systems provide patients who require long-term oxygen therapy with a reliable, lightweight single solution product that improves quality of life, fosters mobility and eliminates dependence on both oxygen tanks and oxygen cylinders as well as stationary concentrators. We believe our direct-to-consumer strategy increases our ability to effectively develop, design and market our Inogen One solutions, as it allows us to:

|

• |

drive patient awareness of our portable oxygen concentrators through direct marketing, sidestepping the home medical equipment channel that other manufacturers rely upon across their homecare businesses, and that is incentivized to continue to service oxygen patients through the delivery model; |

|

• |

capture the manufacturer and home medical equipment provider margins, allowing us to focus on the total cost of the solution and to invest in the development of product features instead of being constrained by the price required to attract representation from a distribution channel. For example, we have invested in features that improve patient satisfaction, product durability, reliability and longevity, which increase the cost of our hardware, but reduce the total cost of our solution by reducing our maintenance and repair cost; and |

|

• |

access and utilize direct patient feedback in our research and development efforts, allowing us to innovate based on this feedback and stay at the forefront of patient preference. For example, we have integrated a double battery into our product offering based on direct patient feedback. |

We believe the combination of our direct-to-consumer strategy with our singular focus on designing and developing oxygen concentrator technology has created the best-in-class portfolio of portable oxygen concentrators. Our two current portable product offerings, the Inogen One G3 and Inogen One G2, at approximately 4.8 and 7.0 pounds, respectively, are amongst the most lightweight portable oxygen concentrators on the market. We believe our Inogen One solutions offer the following benefits:

|

• |

Single solution for home, ambulatory, travel (including on commercial aircraft) and nocturnal treatment. We believe our Inogen One solutions are the only portable oxygen concentrators marketed as a single solution, by which we mean a patient can use our Inogen One systems as their only supplemental oxygen source with no need to also use a stationary concentrator regularly. Our compressors are specifically designed to enable our patients to run our portable oxygen concentrators 24/7, whether powered by battery or plugged into an outlet at home or in a car while the battery is recharging. |

|

• |

Reliability. We have made product performance a priority and have improved reliability with each generation. For example, we have introduced patented air-dryer and patent-pending user-replaceable sieve beds to our products, which have improved product performance and, as a result, patient satisfaction. Reliability is not only critical to patient satisfaction, but also cost management, as our minimal physical infrastructure makes product exchanges more costly to us than providers with greater local physical infrastructure. |

|

• |

Effective for nocturnal use. Our Intelligent Delivery Technology enables our portable oxygen concentrators to provide consistent levels of oxygen during sleep despite decreased respiratory rates. As a result, patients can rely on the Inogen One G3 and Inogen One G2 portable oxygen concentrators overnight while sleeping. |

|

• |

Unparalleled flow capacity. Our 4.8 pound Inogen One G3 has at least 50% more flow capacity than other sub-5 pound portable oxygen concentrators, and our 7.0 pound Inogen One G2 has at least 15% more flow capacity than other sub-10 pound portable oxygen concentrators. |

|

• |

User friendly features. Our systems are designed with multiple user friendly features, including long battery life and low noise-levels in their respective weight categories. |

-3-

Our strengths

We believe our products and business model position us well to compete not only against other oxygen device manufacturers, but also to increase our share of the overall oxygen therapy market. We believe we have the following advantages relative to both traditional oxygen therapy providers and other oxygen device manufacturers:

|

• |

Attractive economic model. Our non-delivery model allows us to receive a premium monthly Medicare reimbursement for deployment of our devices to oxygen patients versus the delivery model. Standard Medicare reimbursement for ambulatory patients using the delivery model is $208.21 per month versus $229.87 per month for our portable oxygen concentrator model, representing a premium of $21.66 per month. A similar premium was maintained in the round one recompete ($19.09 per month) and in the round two ($23.30 per month) competitive bidding areas. In addition, we believe our portable oxygen concentrator technology and direct-to-consumer strategy allow us to provide our solutions through a more efficient cost structure. The delivery model requires ongoing gaseous or liquid oxygen container refills and regular home deliveries with accompanying costs, while our portable oxygen concentrator non-delivery model eliminates oxygen container refills and regular deliveries of oxygen containers and their associated costs. Following the first two rounds of competitive bidding and the round one recompete, we retained access to approximately 90% of the U.S. long-term oxygen therapy market, with the majority of contracts through mid-2016, while many providers were priced out of this market. Notwithstanding these Medicare reimbursement cuts, we have been able to show a consistent track record of growth in year-over-year revenue with growth of 59% from 2011 to 2012, 55% from 2012 to 2013 and 51% in the first six months of 2014 versus the comparative period in 2013. |

|

• |

Direct-to-consumer capabilities. We believe our direct-to-consumer strategy enables patient access and retention as well as innovation and investment in our product portfolio. Pursuing a direct-to-consumer strategy requires national accreditation, state-by-state licensing and Medicare billing privileges. We are unaware of any manufacturing competitor that currently markets on a direct-to-consumer basis, and so we do not believe any of these manufacturers possesses the necessary qualification to do so. If any of our manufacturing competitors were to pursue a direct-to-consumer strategy, they would risk negative reaction from the home medical equipment providers that sell their other homecare products, which generally represent significantly larger portions of their businesses than oxygen therapy products. |

|

• |

Commitment to customer service. We are focused on providing our patients with the highest quality of customer service. We guide them through the reimbursement and physician paperwork process, perform clinical titration and offer 24/7 telephone support, which includes clinical support as required. We have a sustained patient satisfaction rating of approximately 95%, as measured by our customer satisfaction surveys. |

|

• |

Patient-friendly, single-solution, sub-5 and sub-10 pound portable oxygen concentrators. Our Inogen One G3 and Inogen One G2 portable oxygen concentrators are sub-5 and sub-10 pound portable oxygen concentrators that can operate reliably and cost-effectively to service long-term oxygen therapy patients on a 24/7 basis, similar to a stationary oxygen concentrator or replacement portable oxygen concentrators. We believe the technology in our Inogen One portable oxygen concentrators is effective for nocturnal use, allowing patients to receive oxygen therapy around the clock from a single device. |

|

• |

Commitment to research and development and developing intellectual property portfolio. We have a broad patent portfolio relating to the design and construction of our oxygen concentrators and system optimization. Additionally, we have made significant investments in research and development and have a robust product pipeline of next-generation oxygen concentrators. |

|

• |

Management team with proven track record and cost focus. Our management team has built our direct-to-consumer capabilities and launched our two current primary product offerings, Inogen One G2 and Inogen One G3, as well as, most recently, the Inogen At Home. We continue to realize meaningful product manufacturing cost savings of approximately 40% from 2009 to 2013 as a result of management’s improvements in design, sourcing and reliability, as well as higher production volumes. |

|

• |

Revenue growth, profitability and recurring revenue. We have grown our revenue from $10.7 million in 2009 to $75.4 million in 2013, representing a continuous annual growth rate of 47.8%. In 2013, our recurring rental revenue represented 40.5% of total revenue. Our net income was $25.4 million after a one-time tax benefit of $21.8 million, or $3.6 million before the $21.8 million benefit compared to a net loss of $2.6 million in 2009. |

Our strategy

Our goal is to design, build and market oxygen solutions that redefine how oxygen therapy is delivered. To accomplish this goal, we will continue to invest in our product offerings and our commercial infrastructure to:

|

• |

expand our sales and marketing channels, including more internal and physician-based salespeople, increased direct-to-consumer advertising and greater international distribution; |

|

• |

develop innovative products, including next-generation oxygen concentrators and other innovations that improve quality of life; |

|

• |

secure contracts with private payors and Medicaid in order to become in-network with non-Medicare payors, which represent at least 30% of our home oxygen therapy patients, and we believe represent a younger and more active patient population; and |

-4-

|

• |

continue to focus on cost reduction through scalable manufacturing, reliability improvements, asset utilization and service cost reduction. |

Risks associated with our business

Our ability to implement our business strategy is subject to numerous risks that you should be aware of before making an investment decision. These risks are described more fully in the section entitled “Risk factors” immediately following this prospectus summary. These risks include, among others:

|

• |

A significant majority of our customers have health coverage under the Medicare program, and recently enacted and future changes in the reimbursement rates or payment methodologies under Medicare and other government programs have and could continue to materially and adversely affect our business and operating results; |

|

• |

The implementation of the competitive bidding process under Medicare could negatively affect our business and financial condition; |

|

• |

We face intense national, regional and local competition and if we are unable to compete successfully, it could have an adverse effect on our revenue, revenue growth rate, if any, and market share; |

|

• |

If we are unable to continue to enhance our existing products, develop and market new products that respond to customer needs and preferences and achieve market acceptance, we may experience a decrease in demand for our products and our business could suffer; |

|

• |

If we fail to expand and maintain an effective sales force or successfully develop our international distribution network, our business, financial condition and operating results may be adversely affected; and |

|

• |

If we are unable to secure and maintain patent or other intellectual property protection for the intellectual property used in our products, we will lose a significant competitive advantage. |

Recent Developments

The following financial information for the quarter ended September 30, 2014 is based upon our preliminary estimates and is subject to completion of our quarter-end financial closing procedures. This estimate has been prepared by and is the responsibility of management and has not been reviewed or audited by our independent registered public accounting firm. Accordingly, our independent registered public accounting firm does not express an opinion or any other form of assurance with respect to this preliminary estimate. This estimate is not a comprehensive statement of our financial results for the quarter, and our actual results may differ from this estimate. We currently estimate total revenue of at least $28 million in the third quarter of fiscal year 2014, representing at least 41% year-over-year growth.

Corporate history and information

We were incorporated in Delaware in November 2001. Our principal executive offices are located at 326 Bollay Drive, Goleta, California 93117. Our telephone number is (805) 562-0500. Our website address is www.inogen.com. Information contained on the website is not incorporated by reference into this prospectus, and should not be considered to be part of this prospectus.

We use “Inogen,” “Inogen One,” “Inogen One G2,” “Inogen One G3,” “oxygen.anytime.anywhere,” “Inogen At Home,” and other marks as trademarks in the United States and other countries. This prospectus contains references to our trademarks and service marks and to those belonging to other entities. Solely for convenience, trademarks and trade names referred to in this prospectus, including logos, artwork and other visual displays, may appear without the ® or ™ symbols, but such references are not intended to indicate in any way that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensor to these trademarks and trade names. We do not intend our use or display of other entities’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, any other entity.

Emerging growth company status

We are an “emerging growth company,” as that term is defined in Section 2(a) of the Securities Act of 1933, as amended, or the Securities Act, as modified by the Jumpstart Our Business Startups (JOBS) Act of 2012. For as long as we qualify as an emerging growth company, we have taken, and may continue to take, advantage of certain exemptions from various reporting requirements that are applicable to other public companies that do not qualify as emerging growth companies, including, without limitation, not being required to comply with the auditor attestation requirements of Section 404(b) of the Sarbanes-Oxley Act of 2002, reduced disclosure obligations relating to executive compensation and exemptions from the requirements of holding advisory “say-on-pay,” “say-when-on-pay,” and “golden parachute” executive compensation votes.

-5-

Under the JOBS Act, we will remain an emerging growth company until the earliest of:

|

• |

the last day of the fiscal year during which we have total annual gross revenues of $1 billion or more; |

|

• |

the last day of the fiscal year following the fifth anniversary of our initial public offering (or December 31, 2019); |

|

• |

the date on which we have, during the previous three-year period, issued more than $1 billion in non-convertible debt; or |

|

• |

the date on which we are deemed to be a “large accelerated filer” under the Securities Exchange Act of 1934, as amended, (i.e., the first day of the fiscal year after we have (i) more than $700 million in outstanding common equity held by our non-affiliates, measured each year on the last day of our second fiscal quarter, and (ii) been public for at least 12 months). |

The JOBS Act also provides that an emerging growth company can utilize the extended transition period provided in Section 7(a)(2)(B) of the Securities Act, for complying with new or revised accounting standards. We have elected to avail ourselves of this exemption and, as a result, our financial statements may not be comparable to the financial statements of issuers who are required to comply with the effective dates for new or revised accounting standards that are applicable to public companies. We cannot predict whether investors will find our common stock less attractive if we rely on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be reduced or more volatile.

For certain risks related to our status as an emerging growth company, see “Risk factors – Risks related to being a public company – We are an “emerging growth company” and the reduced disclosure requirements applicable to the emerging growth companies may make our common stock less attractive to investors.”

-6-

The offering

|

Common stock offered by the selling stockholders |

|

2,100,775 shares |

|

|

|

|

|

Common stock to be outstanding after this offering |

|

18,710,926 shares |

|

|

|

|

|

Underwriters’ option to purchase additional shares |

|

315,116 shares |

|

|

|

|

|

Use of proceeds |

|

We will not receive any of the proceeds from the sale of shares of common stock by the selling stockholders. |

|

|

|

|

|

Risk factors |

|

You should read the “Risk factors” section of this prospectus for a discussion of factors to consider carefully before deciding to invest in shares of our common stock. |

|

|

|

|

|

NASDAQ Global Select Market symbol |

|

“INGN” |

The number of shares of common stock to be outstanding following this offering is based on 18,710,926 shares of common stock outstanding as of September 30, 2014 and excludes:

|

• |

2,534,075 shares of common stock issuable upon the exercise of options to purchase common stock outstanding as of September 30, 2014, at a weighted average exercise price of $5.68 per share (which amount does not include options to purchase 144,253 shares of common stock which will be exercised for cash and sold by Raymond Huggenberger in connection with the consummation of this offering): |

|

• |

445,885 shares of common stock reserved for future grants under our stock-based compensation plans as September 30, 2014, consisting of: |

|

• |

297,174 shares of common stock reserved for future grants under our 2014 Equity Incentive Plan; and |

|

• |

148,711 shares of common stock reserved for future issuance under our 2014 Employee Stock Purchase Plan; |

|

• |

15,218 shares of common stock issuable upon the exercise of warrants outstanding as of September 30, 2014, at a weighted average exercise price of $0.30 per share (which amount does not include warrants to purchase 129,871 shares of common stock which were cash exercised by Novo A/S on October 15, 2014, and will be sold in this offering); and |

|

• |

Any shares of common stock that become available subsequent to this offering under our 2014 Equity Incentive Plan and 2014 Employee Stock Purchase plan pursuant to provisions thereof that automatically increase the share reserves under such plans each year, as more fully described in “Employee benefit and stock plans.” |

Unless otherwise indicated, this prospectus reflects and assumes the following:

|

• |

No exercise by the underwriters of their option to purchase additional shares; and |

|

• |

No exercise of outstanding stock options or warrants subsequent to September 30, 2014, except |

|

• |

The cash exercise of options to purchase 144,253 shares of common stock which will be exercised and sold by Raymond Huggenberger in connection with the consummation of this offering; and |

|

• |

The cash exercise of warrants to purchase 129,871 shares of common stock which were exercised by Novo A/S on October 15, 2014, and will be sold in this offering. |

-7-

Summary financial data

We have derived the following summary of statements of operations data for the years ended December 31, 2013, 2012 and 2011 from audited financial statements incorporated by reference in this prospectus from our Annual Report on Form 10-K for the fiscal year ended December 31, 2013, or our 2013 Annual Report. We derived the following statements of operations data for the six months ended June 30, 2014 and 2013 and the balance sheet data as of June 30, 2014 from unaudited interim financial statements incorporated by reference in this prospectus from our Quarterly Report on Form 10-Q for the quarter ended June 30, 2014, or our June 2014 Quarterly Report. In the opinion of management, the unaudited financial statements reflect all adjustments, which include only normal recurring adjustments necessary for a fair statement of results of operations and financial position. You should read this data together with our financial statements and related notes, as well as the information under the captions “Selected financial data” herein and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our 2013 Annual Report and June 2014 Quarterly Report, which are incorporated by reference herein. Our historical results are not necessarily indicative of our future results, and results of interim periods are not necessarily indicative of results for the entire year.

|

|

Year ended December 31, |

|

|

Six months ended June 30, |

|

||||||||||||||

|

|

|

2013 |

|

|

|

2012 |

|

|

|

2011 |

|

|

|

2014 |

|

|

|

2013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(unaudited) |

|

|||||

|

(amounts in thousands, except share and per share amounts) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total revenue |

$ |

75,443 |

|

|

$ |

48,576 |

|

|

$ |

30,634 |

|

|

$ |

54,026 |

|

|

$ |

35,904 |

|

|

Total cost of revenue |

|

36,452 |

|

|

|

24,627 |

|

|

|

15,930 |

|

|

|

26,974 |

|

|

|

16,730 |

|

|

Gross profit |

|

38,991 |

|

|

|

23,949 |

|

|

|

14,704 |

|

|

|

27,052 |

|

|

|

19,174 |

|

|

Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

2,398 |

|

|

|

2,262 |

|

|

|

1,789 |

|

|

|

1,514 |

|

|

|

1,143 |

|

|

Sales and marketing |

|

18,375 |

|

|

|

12,569 |

|

|

|

9,014 |

|

|

|

12,069 |

|

|

|

8,742 |

|

|

General and administrative |

|

13,754 |

|

|

|

8,289 |

|

|

|

5,623 |

|

|

|

7,957 |

|

|

|

6,264 |

|

|

Total operating expenses |

|

34,527 |

|

|

|

23,120 |

|

|

|

16,426 |

|

|

|

21,540 |

|

|

|

16,149 |

|

|

Income (loss) from operations |

|

4,464 |

|

|

|

829 |

|

|

|

(1,722 |

) |

|

|

5,512 |

|

|

|

3,025 |

|

|

Total other expense, net |

|

(616 |

) |

|

|

(247 |

) |

|

|

(267 |

) |

|

|

(271 |

) |

|

|

(227 |

) |

|

Income (loss) before provision (benefit) for income taxes |

|

3,848 |

|

|

|

582 |

|

|

|

(1,989 |

) |

|

|

5,241 |

|

|

|

2,798 |

|

|

Provision (benefit) for income taxes |

|

(21,587 |

) |

|

|

18 |

|

|

|

13 |

|

|

|

2,067 |

|

|

|

108 |

|

|

Net income (loss) |

$ |

25,435 |

|

|

$ |

564 |

|

|

$ |

(2,002 |

) |

|

$ |

3,174 |

|

|

$ |

2,690 |

|

|

Less deemed dividend on redeemable convertible preferred stock |

|

(7,278 |

) |

|

|

(5,781 |

) |

|

|

(3,027 |

) |

|

|

(987 |

) |

|

|

(3,508 |

) |

|

Net income (loss) before preferred rights dividend |

$ |

18,157 |

|

|

$ |

(5,217 |

) |

|

$ |

(5,029 |

) |

|

$ |

2,187 |

|

|

$ |

(818 |

) |

|

Less preferred rights dividend on redeemable convertible preferred stock |

|

(7,165 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Less undistributed earnings to preferred stock |

|

(10,781 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Net income (loss) attributable to common stockholders |

$ |

211 |

|

|

$ |

(5,217 |

) |

|

$ |

(5,029 |

) |

|

$ |

2,187 |

|

|

$ |

(818 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic net income (loss) per share attributable to common stockholders |

$ |

0.76 |

|

|

$ |

(19.97 |

) |

|

$ |

(20.15 |

) |

|

$ |

0.13 |

|

|

$ |

(2.98 |

) |

|

Diluted net income (loss) per share attributable to common stockholders |

$ |

0.68 |

|

|

$ |

(19.97 |

) |

|

$ |

(20.15 |

) |

|

$ |

0.11 |

|

|

$ |

(2.98 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average number of shares used in calculating income (loss) per share attributable to common stockholders (note 1): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic common shares |

|

276,535 |

|

|

|

261,268 |

|

|

|

249,519 |

|

|

|

13,843,803 |

|

|

|

274,396 |

|

|

Diluted common shares |

|

2,008,156 |

|

|

|

261,268 |

|

|

|

249,519 |

|

|

|

15,826,754 |

|

|

|

274,396 |

|

|

(1) |

See note 2 to our 2013 Annual Report and our interim financial statements included in our June 2014 Quarterly Report for an explanation of the calculations of our basic and diluted net income (loss) per share attributable to common stockholders. |

|

|

|

As of December 31, |

|

|

As of June 30, |

|

||||||||||

|

(amounts in thousands) |

|

2013 |

|

|

2012 |

|

|

2011 |

|

|

2014 |

|

||||

|

|

|

|

|

|

(unaudited) |

|

||||||||||

|

Balance sheet data: |

|

|

|

|

|

|

|

|

|

|

||||||

|

Cash and cash equivalents |

|

$ |

13,521 |

|

|

$ |

15,112 |

|

|

$ |

3,906 |

|

|

$ |

69,046 |

|

|

Working capital |

|

|

13,159 |

|

|

|

12,880 |

|

|

|

1,302 |

|

|

|

71,394 |

|

|

Total assets |

|

|

82,397 |

|

|

|

47,586 |

|

|

|

24,131 |

|

|

|

145,466 |

|

|

Total indebtedness |

|

|

10,649 |

|

|

|

8,936 |

|

|

|

9,629 |

|

|

|

13,413 |

|

|

Deferred revenue |

|

|

2,263 |

|

|

|

1,094 |

|

|

|

594 |

|

|

|

3,531 |

|

|

Total liabilities |

|

|

26,098 |

|

|

|

19,011 |

|

|

|

16,575 |

|

|

|

34,652 |

|

|

Redeemable convertible preferred stock |

|

|

118,671 |

|

|

|

109,345 |

|

|

|

83,122 |

|

|

|

— |

|

|

Total stockholders’ (deficit) equity |

|

$ |

(62,372 |

) |

|

$ |

(80,770 |

) |

|

$ |

(75,666 |

) |

|

$ |

110,814 |

|

-8-

|

Revenue by sales channel |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(amounts in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six months ended June 30, |

|

|

Change 2014 vs. 2013 |

|

|

% of Revenue |

|

|||||||||||||||

|

|

|

2014 |

|

|

2013 |

|

|

$ |

|

|

% |

|

|

2014 |

|

|

2013 |

|

||||||

|

Revenue by region and category |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business-to-business domestic sales |

|

$ |

8,938 |

|

|

$ |

4,926 |

|

|

$ |

4,012 |

|

|

|

81.4 |

% |

|

|

16.6 |

% |

|

|

13.7 |

% |

|

Business-to-business international sales |

|

|

10,602 |

|

|

|

8,330 |

|

|

|

2,272 |

|

|

|

27.3 |

% |

|

|

19.6 |

% |

|

|

23.2 |

% |

|

Direct-to-consumer domestic sales |

|

|

15,781 |

|

|

|

8,390 |

|

|

|

7,391 |

|

|

|

88.1 |

% |

|

|

29.2 |

% |

|

|

23.4 |

% |

|

Direct-to-consumer domestic rentals |

|

|

18,705 |

|

|

|

14,258 |

|

|

|

4,447 |

|

|

|

31.2 |

% |

|

|

34.6 |

% |

|

|

39.7 |

% |

|

Total revenue |

|

$ |

54,026 |

|

|

$ |

35,904 |

|

|

$ |

18,122 |

|

|

|

50.5 |

% |

|

|

100.0 |

% |

|

|

100.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Twelve months ended December 31, |

|

|

Change 2013 vs. 2012 |

|

|

% of Revenue |

|

|||||||||||||||

|

|

|

2013 |

|

|

2012 |

|

|

$ |

|

|

% |

|

|

2013 |

|

|

2012 |

|

||||||

|

Revenue by region and category |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business-to-business domestic sales |

|

$ |

10,335 |

|

|

$ |

6,584 |

|

|

$ |

3,751 |

|

|

|

57.0 |

% |

|

|

13.7 |

% |

|

|

13.6 |

% |

|

Business-to-business international sales |

|

|

16,766 |

|

|

|

13,038 |

|

|

|

3,728 |

|

|

|

28.6 |

% |

|

|

22.2 |

% |

|

|

26.8 |

% |

|

Direct-to-consumer domestic sales |

|

|

17,805 |

|

|

|

9,082 |

|

|

|

8,723 |

|

|

|

96.0 |

% |

|

|

23.6 |

% |

|

|

18.7 |

% |

|

Direct-to-consumer domestic rentals |

|

|

30,537 |

|

|

|

19,872 |

|

|

|

10,665 |

|

|

|

53.7 |

% |

|

|

40.5 |

% |

|

|

40.9 |

% |

|

Total revenue |

|

$ |

75,443 |

|

|

$ |

48,576 |

|

|

$ |

26,867 |

|

|

|

55.3 |

% |

|

|

100.0 |

% |

|

|

100.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Twelve months ended December 31, |

|

|

Change 2012 vs. 2011 |

|

|

% of Revenue |

|

|||||||||||||||

|

|

|

2012 |

|

|

2011 |

|

|

$ |

|

|

% |

|

|

2012 |

|

|

2011 |

|

||||||

|

Revenue by region and category |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business-to-business domestic sales |

|

$ |

6,584 |

|

|

$ |

5,207 |

|

|

$ |

1,377 |

|

|

|

26.4 |

% |

|

|

13.6 |

% |

|

|

17.0 |

% |

|

Business-to-business international sales |

|

|

13,038 |

|

|

|

7,929 |

|

|

|

5,109 |

|

|

|

64.4 |

% |

|

|

26.8 |

% |

|

|

25.9 |

% |

|

Direct-to-consumer domestic sales |

|

|

9,082 |

|

|

|

6,522 |

|

|

|

2,560 |

|

|

|

39.3 |

% |

|

|

18.7 |

% |

|

|

21.3 |

% |

|

Direct-to-consumer domestic rentals |

|

|

19,872 |

|

|

|

10,976 |

|

|

|

8,896 |

|

|

|

81.0 |

% |

|

|

40.9 |

% |

|

|

35.8 |

% |

|

Total revenue |

|

$ |

48,576 |

|

|

$ |

30,634 |

|

|

$ |

17,942 |

|

|

|

58.6 |

% |

|

|

100.0 |

% |

|

|

100.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP financial measures

EBITDA, Adjusted EBITDA and Adjusted net income (loss) are financial measures that are not calculated in accordance with generally accepted accounting principles in the United States, or GAAP. We define EBITDA as net income or loss excluding interest income, interest expense, taxes and depreciation and amortization. Adjusted EBITDA also excludes the change in the fair value of our preferred stock warrant liability and stock-based compensation. Below, we have provided a reconciliation of EBITDA, Adjusted EBITDA and Adjusted net income (loss) to our net income or loss, the most directly comparable financial measure calculated and presented in accordance with GAAP. EBITDA, Adjusted EBITDA and Adjusted net income (loss) should not be considered alternatives to net income or loss or any other measure of financial performance calculated and presented in accordance with GAAP. Our EBITDA, Adjusted EBITDA and Adjusted net income (loss) may not be comparable to similarly titled measures of other organizations because other organizations may not calculate EBITDA, Adjusted EBITDA, and Adjusted net income (loss) in the same manner as we calculate these measures.

We include EBITDA, Adjusted EBITDA and Adjusted net income (loss) in this prospectus because they are important measures upon which our management assesses our operating performance. We use EBITDA, Adjusted EBITDA and Adjusted net income (loss) as key performance measures because we believe they facilitate operating performance comparisons from period to period by excluding potential differences primarily caused by variations in capital structures, tax positions, the impact of depreciation and amortization expense on our fixed assets, changes related to the fair value re-measurements of our preferred stock warrant, and the impact of stock-based compensation expense. Because EBITDA, Adjusted EBITDA and Adjusted net income (loss) facilitate internal comparisons of our historical operating performance on a more consistent basis, we also use EBITDA, Adjusted EBITDA and Adjusted net income (loss) for business planning purposes, to incentivize and compensate our management personnel, and in evaluating acquisition opportunities. In addition, we believe EBITDA, Adjusted EBITDA and Adjusted net income (loss) and similar measures are widely used by investors, securities analysts, ratings agencies, and other parties in evaluating companies in our industry as a measure of financial performance and debt-service capabilities.

Our use of EBITDA, Adjusted EBITDA and Adjusted net income (loss) have limitations as analytical tools, and you should not consider them in isolation or as a substitute for analysis of our results as reported under GAAP. Some of these limitations are:

|

• |

EBITDA, Adjusted EBITDA and Adjusted net income (loss) do not reflect our cash expenditures for capital equipment or other contractual commitments; |

|

• |

Although depreciation and amortization are non-cash charges, the assets being depreciated and amortized may have to be replaced in the future, and EBITDA, Adjusted EBITDA and Adjusted net income (loss) do not reflect capital expenditure requirements for such replacements; |

-9-

|

• |

EBITDA, Adjusted EBITDA and Adjusted net income (loss) do not reflect changes in, or cash requirements for, our working capital needs; |

|

• |

EBITDA, Adjusted EBITDA and Adjusted net income (loss) do not reflect the interest expense or the cash requirements necessary to service interest or principal payments on our indebtedness; and |

|

• |

Other companies, including companies in our industry, may calculate EBITDA, Adjusted EBITDA and Adjusted net income (loss) measures differently, which reduces their usefulness as a comparative measure. |

In evaluating EBITDA, Adjusted EBITDA and Adjusted net income (loss) you should be aware that in the future we will incur expenses similar to the adjustments in this presentation. Our presentation of EBITDA, Adjusted EBITDA and Adjusted net income (loss) should not be construed as an inference that our future results will be unaffected by these expenses or any unusual or non-recurring items. When evaluating our performance, you should consider EBITDA, Adjusted EBITDA and Adjusted net income (loss) alongside other financial performance measures, including our net loss and other GAAP results.

-10-

The following table presents a reconciliation of EBITDA, Adjusted EBITDA and Adjusted net income (loss) to our net income or loss, the most comparable GAAP measure, for each of the periods indicated:

|

(amounts in thousands) |

|

Year ended December 31, |

|

|

Six months ended June 30, |

|

||||||||||||||

|

EBITDA (1) |

|

2013 |

|

|

2012 |

|

|

2011 |

|

|

2014 |

|

|

2013 |

|

|||||

|

Unaudited |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) |

|

$ |

25,435 |

|

|

$ |

564 |

|

|

$ |

(2,002 |

) |

|

$ |

3,174 |

|

|

$ |

2,690 |

|

|

Non-GAAP adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

562 |

|

|

|

493 |

|

|

|

261 |

|

|

|

336 |

|

|

|

199 |

|

|

Interest income |

|

|

(12 |

) |

|

|

(88 |

) |

|

|

(113 |

) |

|

|

(18 |

) |

|

|

(6 |

) |

|

Provision (benefit) for income taxes |

|

|

(21,587 |

) |

|

|

18 |

|

|

|

13 |

|

|

|

2,067 |

|

|

|

108 |

|

|

Depreciation and amortization |

|

|

8,544 |

|

|

|

4,984 |

|

|

|

3,198 |

|

|

|

5,586 |

|

|

|

3,653 |

|

|

EBITDA |

|

|

12,942 |

|

|

|

5,971 |

|

|

|

1,357 |

|

|

|

11,145 |

|

|

|

6,644 |

|

|

Change in fair value of preferred stock warrant liability |

|

|

262 |

|

|

|

(148 |

) |

|

|

119 |

|

|

|

(36 |

) |

|

|

243 |

|

|

Stock-based compensation |

|

|

230 |

|

|

|

60 |

|

|

|

144 |

|

|

|

666 |

|

|

|

51 |

|

|

Adjusted EBITDA |

|

$ |

13,434 |

|

|

$ |

5,883 |

|

|

$ |

1,620 |

|

|

$ |

11,775 |

|

|

$ |

6,938 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) (GAAP) |

|

$ |

25,435 |

|

|

$ |

564 |

|

|

$ |

(2,002 |

) |

|

$ |

3,174 |

|

|

$ |

2,690 |

|

|

One-time benefit from reversal of deferred tax valuation adjustment |

|

|

(21,807 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Adjusted net income (loss) |

|

$ |

3,628 |

|

|

$ |

564 |

|

|

$ |

(2,002 |

) |

|

$ |

3,174 |

|

|

$ |

2,690 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(amounts in thousands, except share and per share amounts) |

|

Year ended December 31, |

|

|

|

|

|

|

Six months ended June 30, |

|

||||||||||

|

Pro-forma non-GAAP results of EPS calculation (2)(3)(4) |

|

2013 |

|

|

2012 |

|

|

|

|

|

|

2014 |

|

|

2013 |

|

||||

|

Unaudited |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Numerator - basic and diluted: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

25,435 |

|

|

$ |

564 |

|

|

|

|

|

|

$ |

3,174 |

|

|

$ |

2,690 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pro-forma net income per share - basic common stock |

|

$ |

1.74 |

|

|

$ |

0.04 |

|

|

|

|

|

|

$ |

0.18 |

|

|

$ |

0.19 |

|

|

Pro-forma net income per share - diluted common stock |

|

$ |

1.55 |

|

|

$ |

0.04 |

|

|

|

|

|

|

$ |

0.16 |

|

|

$ |

0.17 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Denominator: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pro-forma weighted-average common shares - basic common stock |

|

|

14,636,950 |

|

|

|

14,601,861 |

|

|

|

|

|

|

|

17,308,133 |

|

|

|

14,530,870 |

|

|

Pro-forma weighted-average common shares - diluted common stock |

|

|

16,368,571 |

|

|

|

15,486,487 |

|

|

|

|

|

|

|

19,291,084 |

|

|

|

15,654,526 |

|

|

(1) |

For a discussion of our use of EBITDA, Adjusted EBITDA and Adjusted net income (loss) and their calculations, please see “—Non GAAP financial measures.” |

|

(2) |

The pro forma EPS calculations gives effect to: the automatic conversion of the outstanding convertible preferred stock into a weighted average of 14,219,001 and 14,216,838 shares of common stock, for the years ended December 31, 2013 and 2012 and 14, 219,001 and 14,057,509 for the six months ended June 30, 2014 and 2013. |

|

(3) |

The pro forma EPS calculations give effect to: the cash exercise of warrants to purchase an aggregate of 142,495 shares of common stock, which was expected to occur prior to closing of the initial public offering as the warrants would have otherwise expired at that time for the years ended December 31, 2013 and 2012 and 130,385 for the six months ended June 30, 2013. |

|

(4) |

The pro forma EPS calculations give effect to the reclassification of our preferred stock warrant liability to additional paid-in-capital upon the closing of our initial public offering. |

-11-

Investing in our common stock involves a high degree of risk. You should consider carefully the risks and uncertainties described below, together with all of the other information in this prospectus or incorporated by reference into this prospectus from our 2013 Annual Report, our June 2014 Quarterly Report and our other filings with the Securities Exchange Commission listed in the section of the prospectus entitled “Incorporation by reference,” before deciding whether to purchase shares of our common stock. If any of the following risks are realized, our business, financial condition, results of operations and prospects could be materially and adversely affected. In that event, the price of our common stock could decline and you could lose part or all of your investment.

Risks related to our business and strategy

A significant majority of our customers have health coverage under the Medicare program, and recently enacted and future changes in the reimbursement rates or payment methodologies under Medicare and other government programs have affected and could continue to materially and adversely affect our business and operating results.

As a provider of oxygen product rentals, we have historically depended heavily on Medicare reimbursement as a result of the higher proportion of elderly persons suffering from chronic respiratory conditions. Medicare Part B, or Supplementary Medical Insurance Benefits, provides coverage to eligible beneficiaries that include items of durable medical equipment for use in the home, such as oxygen equipment and other respiratory devices. We believe that more than 60% of oxygen therapy patients in the United States have primary coverage under Medicare Part B. For the six months ended June 30, 2014 and June 30, 2013, we derived approximately 25.0% and 29.5%, respectively, of our total revenue from the Medicare’s program or beneficiaries (including patient co-insurance obligations). There are increasing pressures on Medicare to control healthcare costs and to reduce or limit reimbursement rates for home medical products.

Legislation, including the Medicare Prescription Drug, Improvement, and Modernization Act of 2003, the Deficit Reduction Act of 2005, the Medicare Improvements for Patients and Providers Act of 2008, and the Patient Protection and Affordable Care Act, contain provisions that directly impact reimbursement for the durable medical equipment products provided by us:

|

• |

The Medicare Prescription Drug, Improvement, and Modernization Act of 2003 significantly reduced reimbursement for inhalation drug therapies beginning in 2005, reduced payment amounts for certain durable medical equipment, including oxygen, beginning in 2005, froze payment amounts for other covered home medical equipment items through 2008, established a competitive bidding program for home medical equipment and implemented quality standards and accreditation requirements for durable medical equipment suppliers. |

|

• |

The Deficit Reduction Act of 2005 limited the total number of continuous rental months for which Medicare will pay for oxygen equipment to 36 months, after which time there is generally no additional reimbursement to the supplier (other than for periodic, in-home maintenance and servicing). The Deficit Reduction Act of 2005 also provided that title of the equipment would transfer to the beneficiary, which was later repealed by the Medicare Improvements for Patients and Providers Act of 2008. For purposes of the rental cap, the Deficit Reduction Act of 2005 provided for a new 36-month rental period that began January 1, 2006 for all oxygen equipment. After the 36th continuous month during which payment is made for the oxygen equipment, the supplier is generally required to continue to furnish the equipment during the period of medical need for the remainder of the useful lifetime of the equipment, provided there are no breaks in service due to medical necessity that exceed 60 days. The reasonable useful lifetime for portable oxygen equipment is 60 months. After 60 months, if the patient requests, the rental cycle starts over and a new 36-month capped rental period begins. There are no limits on the number of 60-month cycles over which a Medicare patient may receive benefits and an oxygen therapy provider may receive reimbursement, so long as such equipment continues to be medically necessary for the patient. We anticipate that the Deficit Reduction Act of 2005 oxygen payment rules will continue to negatively affect our net revenue on an ongoing basis, as each month additional customers reach the 36-month capped service period, resulting in potentially two or more years without rental income from these customers. We cannot state with certainty the number of patients in the capped rental period or the potential impact to revenue associated with patients in the capped rental period. |

|

• |

The Medicare Improvements for Patients and Providers Act of 2008 retroactively delayed the implementation of competitive bidding for 18 months from previously established dates and decreased the 2009 fee schedule payment amounts by 9.5% for product categories included in competitive bidding. In addition to the 9.5% reduction under Medicare Improvements for Patients and Providers Act of 2008, the Centers for Medicare & Medicaid Services implemented a reduction to the monthly payment amount for stationary oxygen equipment. The monthly payment rate for non-delivery ambulatory oxygen in the relevant period was flat at $51.63. The table below summarizes the increases and decreases in the monthly payment amounts for stationary oxygen equipment. |

|

(dollars in hundreds) |

|

2009 |

|

|

2010 |

|

|

2011 |

|

|

2012 |

|

|

2013 |

|

|

2014 |

|

||||||

|