Exhibit 99.2 Company Overview December 2015

Notice Regarding Forward-looking Statements These slides and the accompanying oral presentation (the “Presentation”) include forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, which are based on current expectations, estimates and projections based on information currently available to management. These forward-looking statements include, among others, statements relating to our current GAAP and non-GAAP guidance; estimates of 2015 and 2016 revenue, adjusted EBITDA, and adjusted EBITDA margin; our expectations regarding the impact of competitive bidding and changing reimbursement rates under competitive bidding and the Centers for Medicare & Medicaid Services rules; the size and estimates of growth in the oxygen therapy market; our expectations with respect to our needs for additional capital; and our anticipated future product releases. All statements other than statements of historical facts contained in this Presentation, including statements regarding our future results of operations and financial position, business strategy, prospective products, plans and objectives of management for future operations, and future results of current and anticipated products are forward-looking statements. Forward-looking statements are typically identified by words like “believe,” “anticipate,” “could,” “should,” “estimate,” “expect,” “intend,” “plan,” “project,” “will,” “forecast,” “budget,” “pro forma,” and similar terms. Forward-looking statements are subject to numerous risks and uncertainties that could cause actual results to differ materially from currently anticipated results, including but not limited to, risks arising from the possibility that we will not realize anticipated revenue; the impact of reduced reimbursement rates in connection with the implementation of the competitive bidding process under Medicare and the Centers for Medicare & Medicaid Services rules; the possible loss of key employees, customers, or suppliers; and intellectual property risks if we are unable to secure and maintain patent or other intellectual property protection for the intellectual property used in our products. In addition, our business is subject to numerous additional risks and uncertainties, including, among others, risks relating to market acceptance of our products; our ability to successfully launch new products and applications; competition; our sales, marketing and distribution capabilities; our planned sales, marketing, and research and development activities; interruptions or delays in the supply of components or materials for, or manufacturing of, our products; seasonal variations in customer operations; unanticipated increases in costs or expenses; and risks associated with international operations. The known risks and uncertainties are described in detail under the caption “Risk Factors” and elsewhere in our Quarterly Report on Form 10-Q for the period ended September 30, 2015 filed with the Securities and Exchange Commission (SEC) on November 10, 2015. Accordingly, our actual results may materially differ from our current expectations, estimates and projections. Forward-looking statements represent our management’s beliefs and assumptions only as of November 30, 2015, and we undertake no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by applicable law. You should read our Annual Report on Form 10-K, quarterly reports of Form 10-Q, and other documents that we have filed and may file from time to time with the SEC for more complete information about Inogen, Inc. You may get these documents for free by visiting EDGAR on the Securities and Exchange Commission Web site at www.sec.gov. Use of Non-GAAP Financial Measures This Presentation includes certain non-GAAP financial measures as defined by SEC rules. The non-GAAP financial measures are not intended to be considered in isolation or as a substitute for results prepared in accordance with GAAP. As required by Regulation G, we have provided a reconciliation of these non-GAAP measures to the most directly comparable GAAP measures, which is available in the Appendix following this Presentation. For future periods, we are unable to provide a reconciliation of Adjusted EBITDA and Adjusted Net Income to net income/(loss) as a result of the uncertainty regarding, and the potential variability of, the amounts of interest income, interest expense, depreciation and amortization, stock-based compensation, provisions for income taxes, and certain other infrequently occurring items, such as acquisition related costs, that may be incurred in the future.

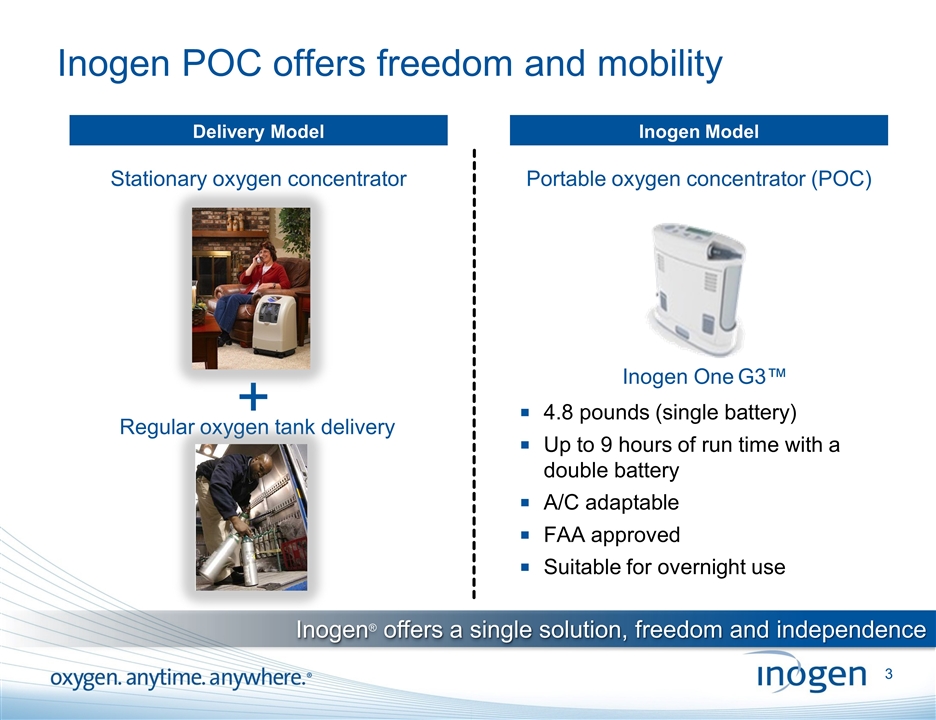

Inogen POC offers freedom and mobility Stationary oxygen concentrator + Regular oxygen tank delivery Delivery Model Inogen Model 4.8 pounds (single battery) Up to 9 hours of run time with a double battery A/C adaptable FAA approved Suitable for overnight use Portable oxygen concentrator (POC) Inogen® offers a single solution, freedom and independence Inogen One G3™

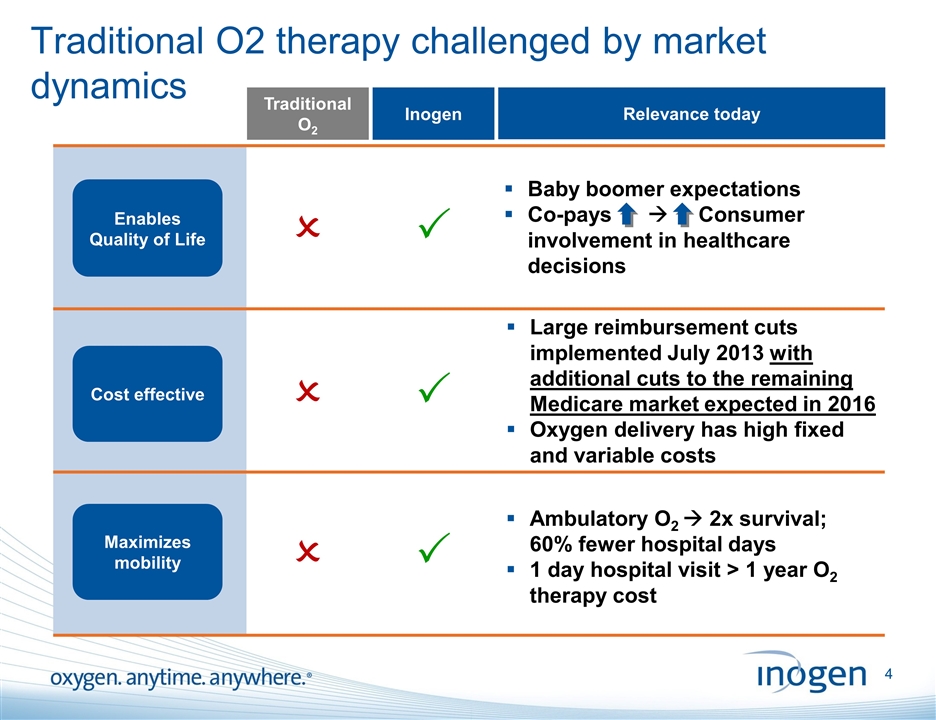

Traditional O2 therapy challenged by market dynamics Traditional O2 P Inogen Cost effective Maximizes mobility P P O O O Relevance today Large reimbursement cuts implemented July 2013 with additional cuts to the remaining Medicare market expected in 2016 Oxygen delivery has high fixed and variable costs Ambulatory O2 à 2x survival; 60% fewer hospital days 1 day hospital visit > 1 year O2 therapy cost Baby boomer expectations Co-pays à Consumer involvement in healthcare decisions Cost effective Enables Quality of Life

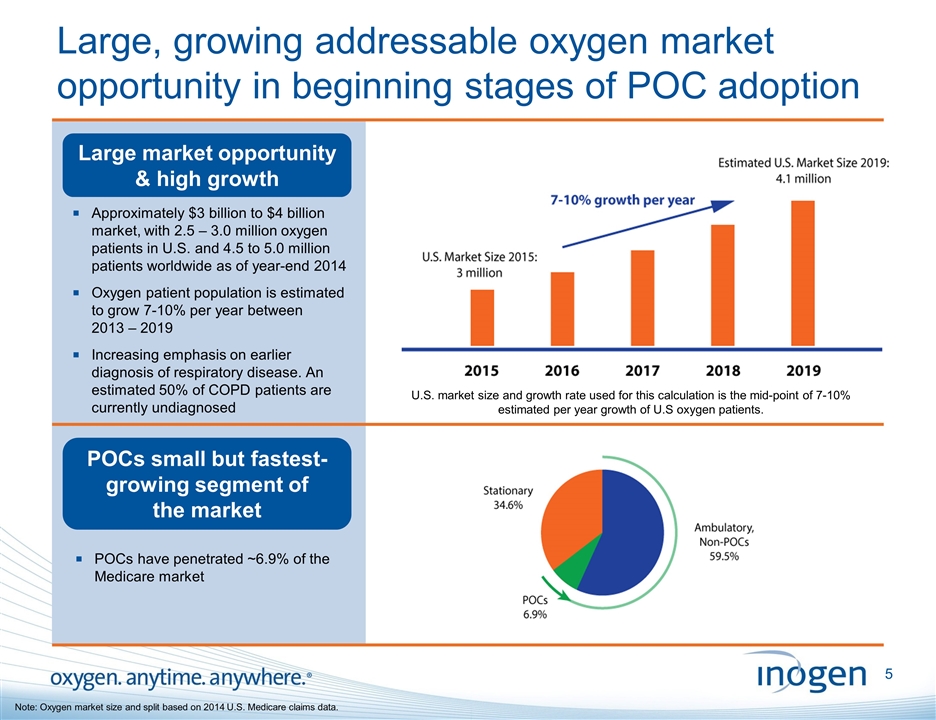

Large, growing addressable oxygen market opportunity in beginning stages of POC adoption Large market opportunity & high growth POCs small but fastest-growing segment of the market Note: Oxygen market size and split based on 2014 U.S. Medicare claims data. Approximately $3 billion to $4 billion market, with 2.5 – 3.0 million oxygen patients in U.S. and 4.5 to 5.0 million patients worldwide as of year-end 2014 Oxygen patient population is estimated to grow 7-10% per year between 2013 – 2019 Increasing emphasis on earlier diagnosis of respiratory disease. An estimated 50% of COPD patients are currently undiagnosed POCs have penetrated ~6.9% of the Medicare market U.S. market size and growth rate used for this calculation is the mid-point of 7-10% estimated per year growth of U.S oxygen patients.

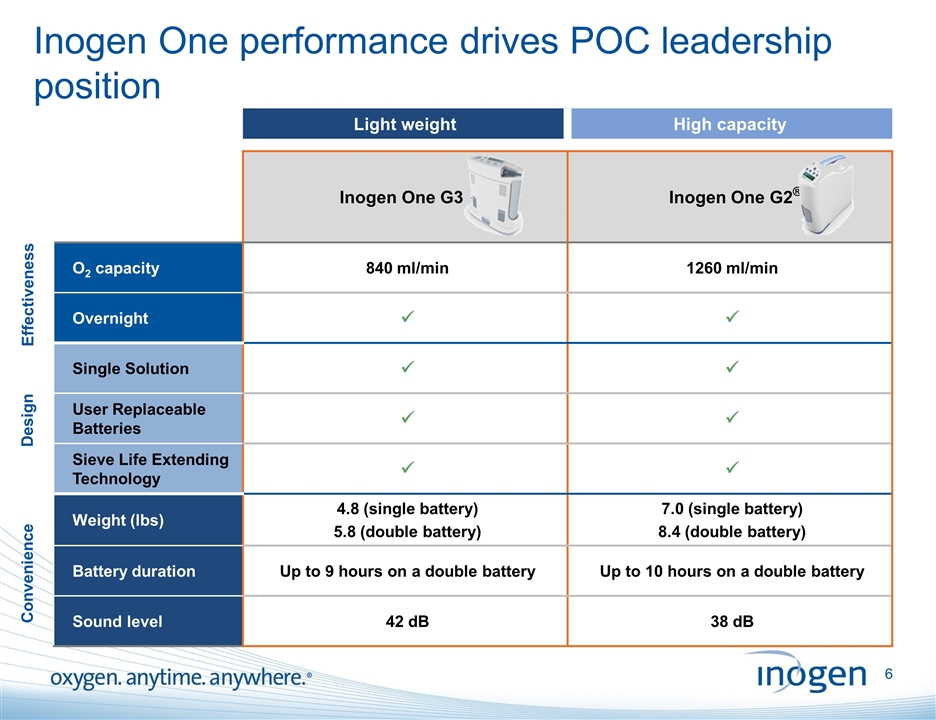

Inogen One performance drives POC leadership position Light weight High capacity Inogen One G3 Inogen One G2® O2 capacity 840 ml/min 1260 ml/min Overnight ü ü Single Solution ü ü User Replaceable Batteries ü ü Sieve Life Extending Technology ü ü Weight (lbs) 4.8 (single battery) 5.8 (double battery) 7.0 (single battery) 8.4 (double battery) Battery duration Up to 9 hours on a double battery Up to 10 hours on a double battery Sound level 42 dB 38 dB Effectiveness Design Convenience

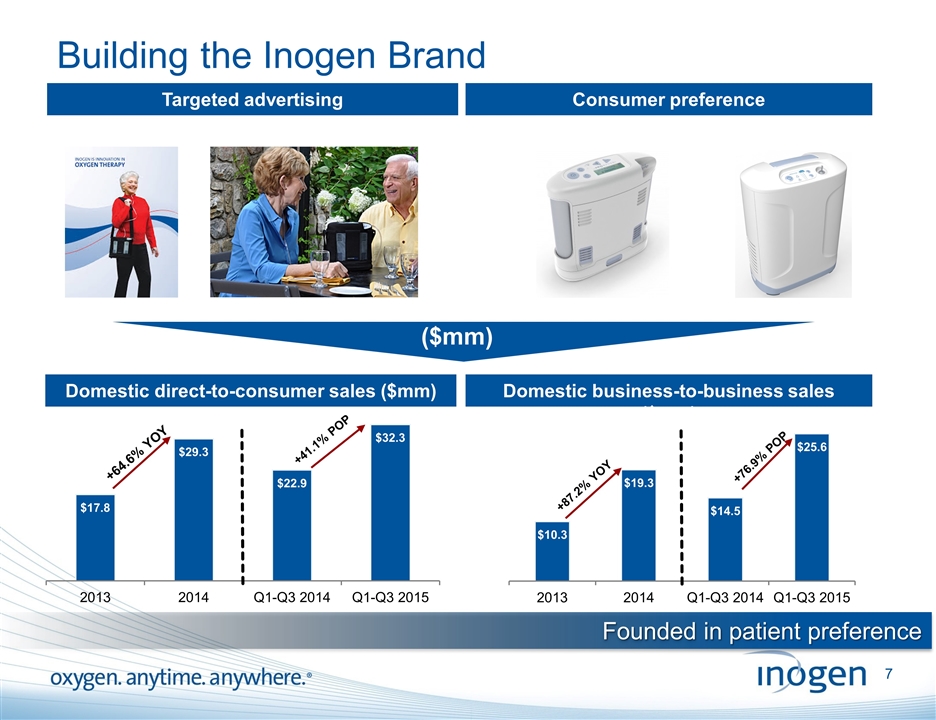

Building the Inogen Brand Targeted advertising Consumer preference Domestic direct-to-consumer sales ($mm) Domestic business-to-business sales ($mm) +41.1% POP +64.6% YOY +76.9% POP +87.2% YOY ($mm) Founded in patient preference

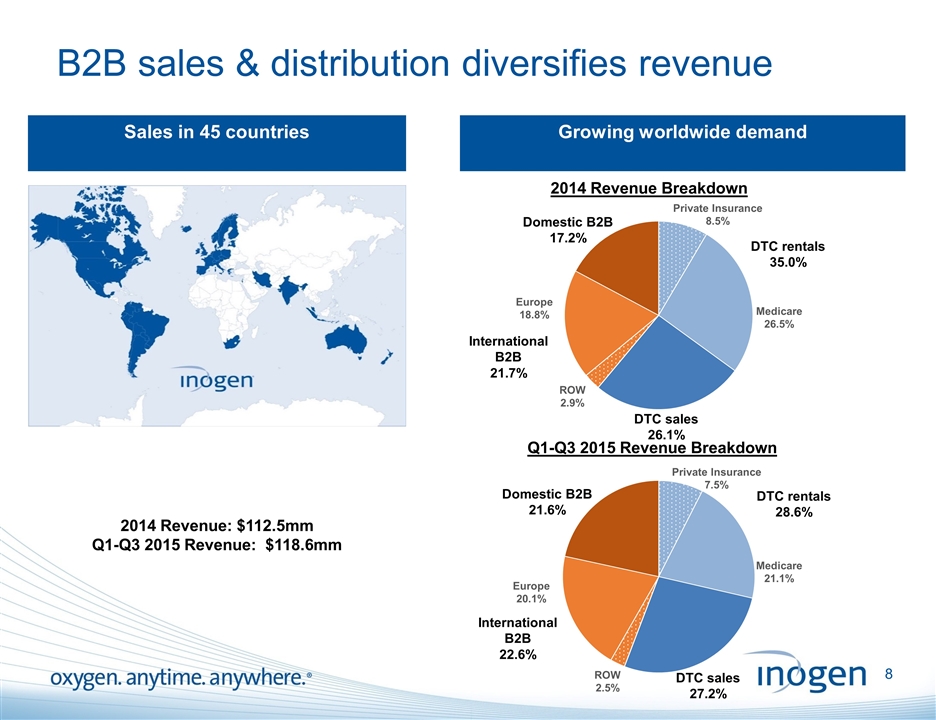

B2B sales & distribution diversifies revenue Sales in 45 countries Growing worldwide demand 2014 Revenue: $112.5mm Q1-Q3 2015 Revenue: $118.6mm Medicare 21.1% Europe 20.1% Medicare 26.5% Europe 18.8%

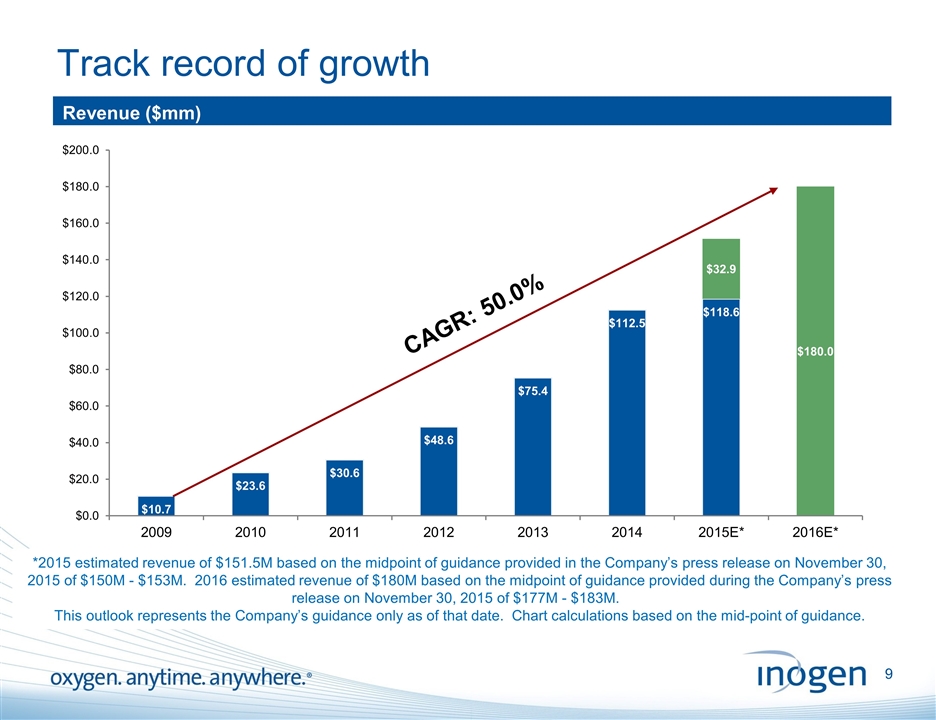

Track record of growth Revenue ($mm) CAGR: 50.0% *2015 estimated revenue of $151.5M based on the midpoint of guidance provided in the Company’s press release on November 30, 2015 of $150M - $153M. 2016 estimated revenue of $180M based on the midpoint of guidance provided during the Company’s press release on November 30, 2015 of $177M - $183M. This outlook represents the Company’s guidance only as of that date. Chart calculations based on the mid-point of guidance.

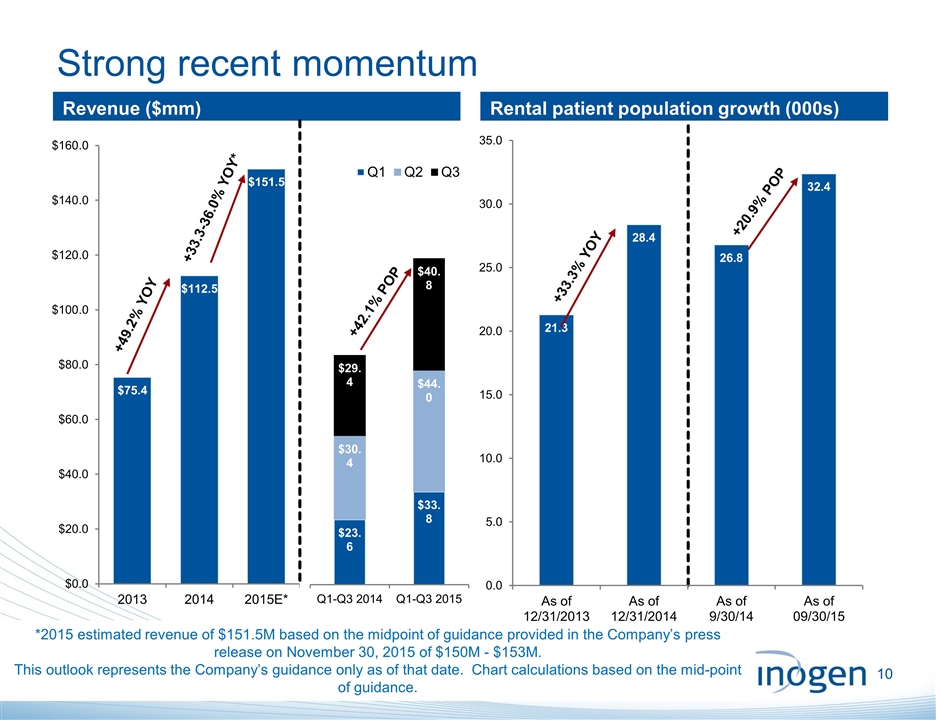

Strong recent momentum Revenue ($mm) Rental patient population growth (000s) *2015 estimated revenue of $151.5M based on the midpoint of guidance provided in the Company’s press release on November 30, 2015 of $150M - $153M. This outlook represents the Company’s guidance only as of that date. Chart calculations based on the mid-point of guidance. +49.2% YOY

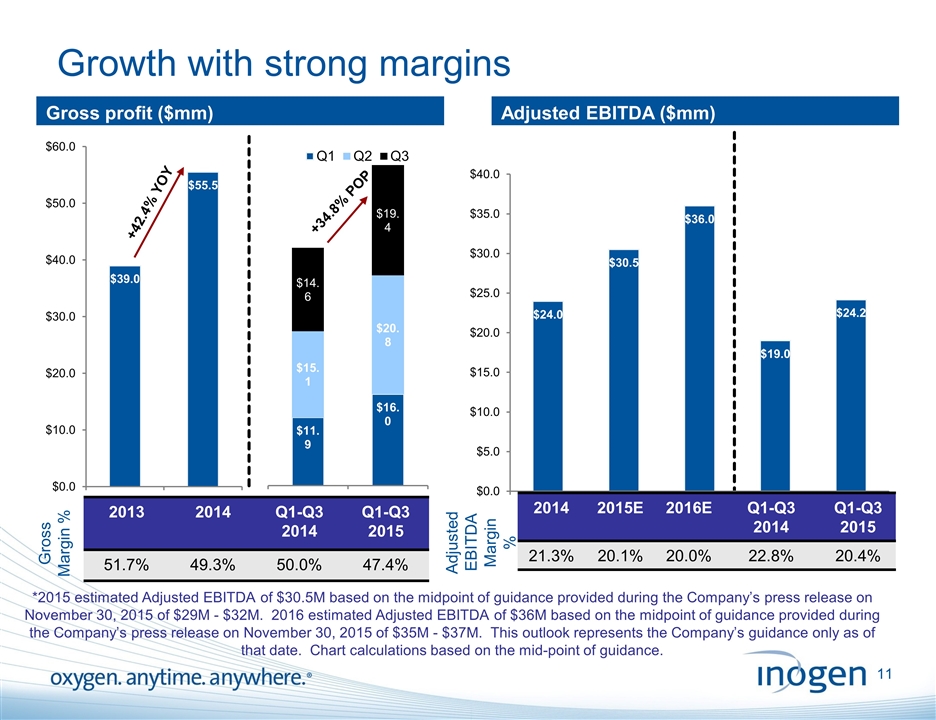

Growth with strong margins *2015 estimated Adjusted EBITDA of $30.5M based on the midpoint of guidance provided during the Company’s press release on November 30, 2015 of $29M - $32M. 2016 estimated Adjusted EBITDA of $36M based on the midpoint of guidance provided during the Company’s press release on November 30, 2015 of $35M - $37M. This outlook represents the Company’s guidance only as of that date. Chart calculations based on the mid-point of guidance. Gross profit ($mm) Adjusted EBITDA ($mm) Adjusted EBITDA Margin % +42.4% YOY 2013 2014 Q1-Q3 2014 Q1-Q3 2015 51.7% 49.3% 50.0% 47.4% Gross Margin % 2014 2015E 2016E Q1-Q3 2014 Q1-Q3 2015 21.3% 20.1% 20.0% 22.8% 20.4%

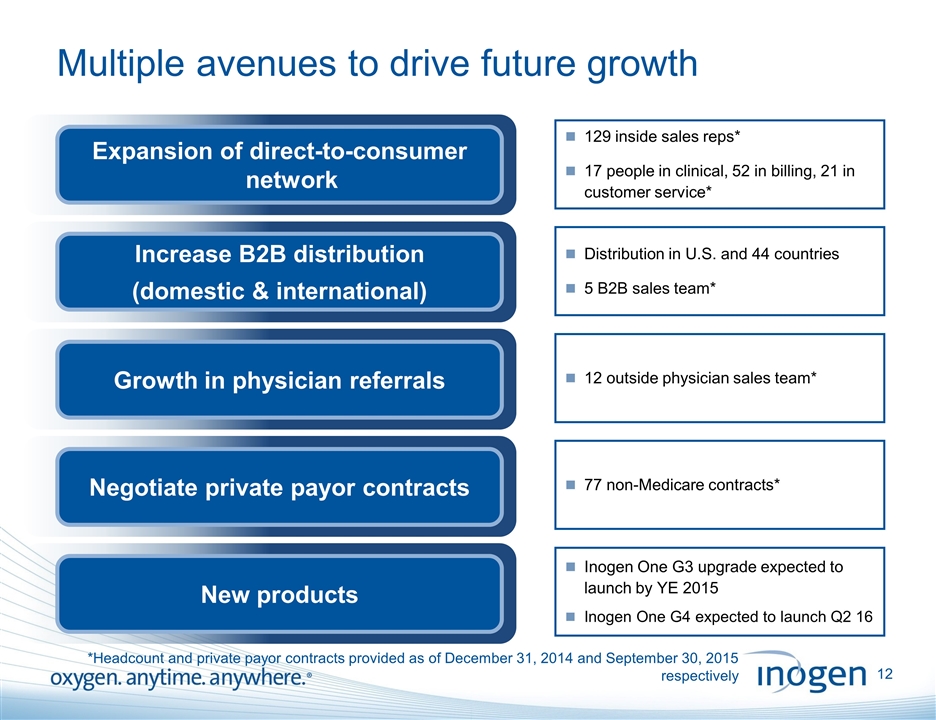

Multiple avenues to drive future growth Expansion of direct-to-consumer network Increase B2B distribution (domestic & international) Growth in physician referrals Negotiate private payor contracts 129 inside sales reps* 17 people in clinical, 52 in billing, 21 in customer service* Distribution in U.S. and 44 countries 5 B2B sales team* 12 outside physician sales team* 77 non-Medicare contracts* New products Inogen One G3 upgrade expected to launch by YE 2015 Inogen One G4 expected to launch Q2 16 *Headcount and private payor contracts provided as of December 31, 2014 and September 30, 2015 respectively

Company highlights Market leader in large, growing, underpenetrated market DTC model enables innovation and customer access Differentiated product portfolio with commitment to R&D Seasoned management team with proven track record Attractive financial profile

Proprietary and Confidential

Inogen At Home® stationary oxygen concentrator October 2014 launch Retail price $1,495 Lightest 5 LPM continuous flow oxygen concentrator on the market Low power consumption Designed for patient preference and reliability Expands product portfolio to fulfill the clinical requirements of most oxygen therapy patients Worldwide electrical compatibility reduces manufacturing and distribution complexity

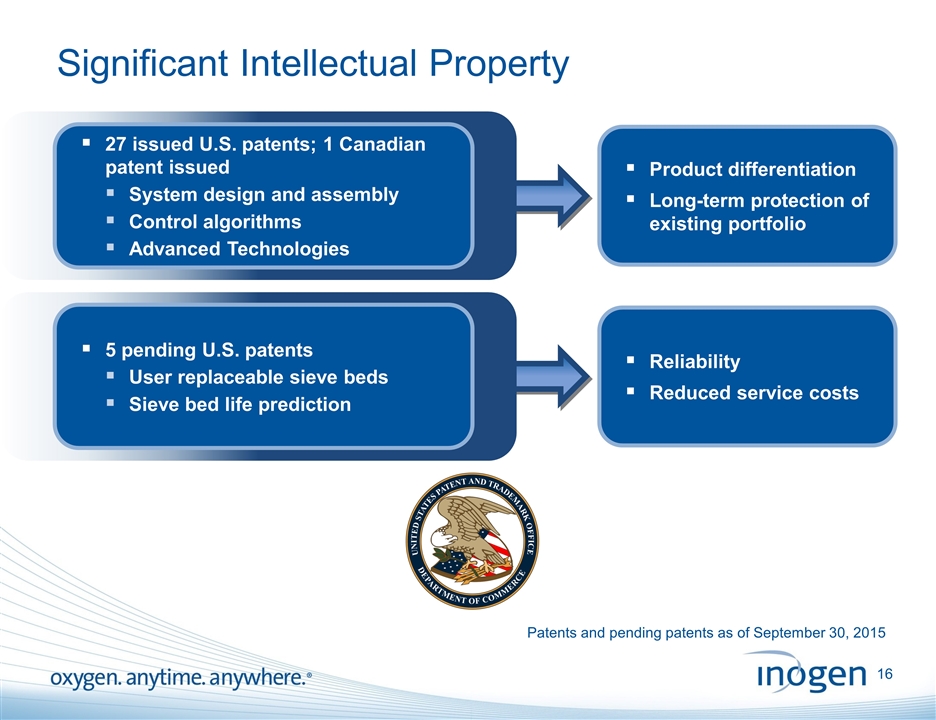

Significant Intellectual Property 27 issued U.S. patents; 1 Canadian patent issued System design and assembly Control algorithms Advanced Technologies 5 pending U.S. patents User replaceable sieve beds Sieve bed life prediction Product differentiation Long-term protection of existing portfolio Reliability Reduced service costs Patents and pending patents as of September 30, 2015

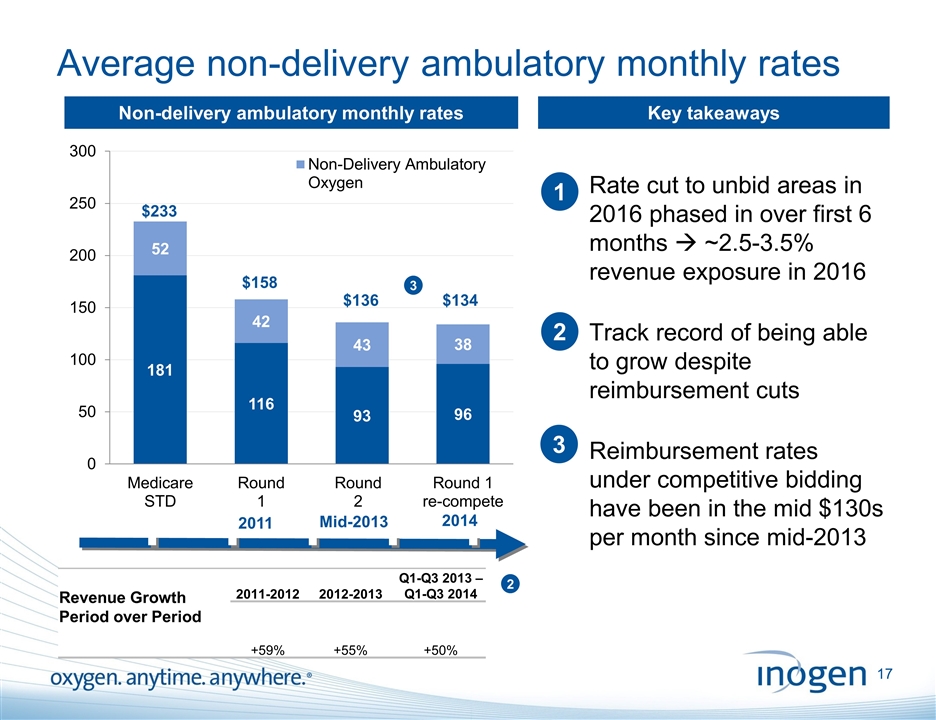

Revenue Growth Period over Period 2011-2012 2012-2013 Q1-Q3 2013 – Q1-Q3 2014 +59% +55% +50% Average non-delivery ambulatory monthly rates Non-delivery ambulatory monthly rates Key takeaways $233 $136 $134 2011 Mid-2013 2014 Rate cut to unbid areas in 2016 phased in over first 6 months à ~2.5-3.5% revenue exposure in 2016 Track record of being able to grow despite reimbursement cuts Reimbursement rates under competitive bidding have been in the mid $130s per month since mid-2013 1 2 3 2 3 $158

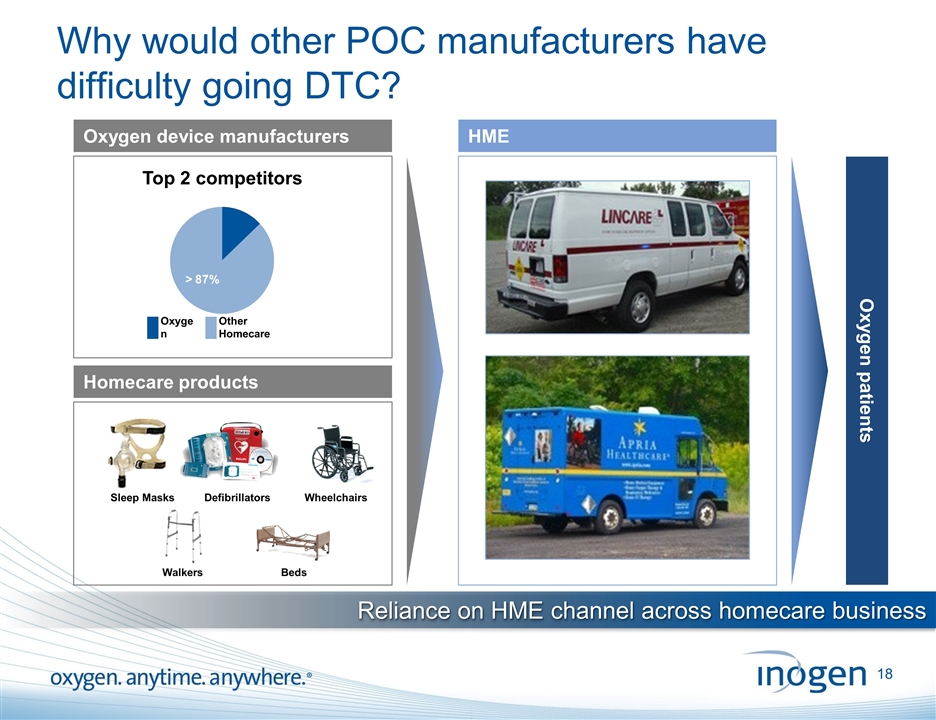

HME 1 Why would other POC manufacturers have difficulty going DTC? Oxygen device manufacturers HME Oxygen Other Homecare Oxygen patients Homecare products Beds Defibrillators Wheelchairs Sleep Masks Walkers Top 2 competitors Reliance on HME channel across homecare business

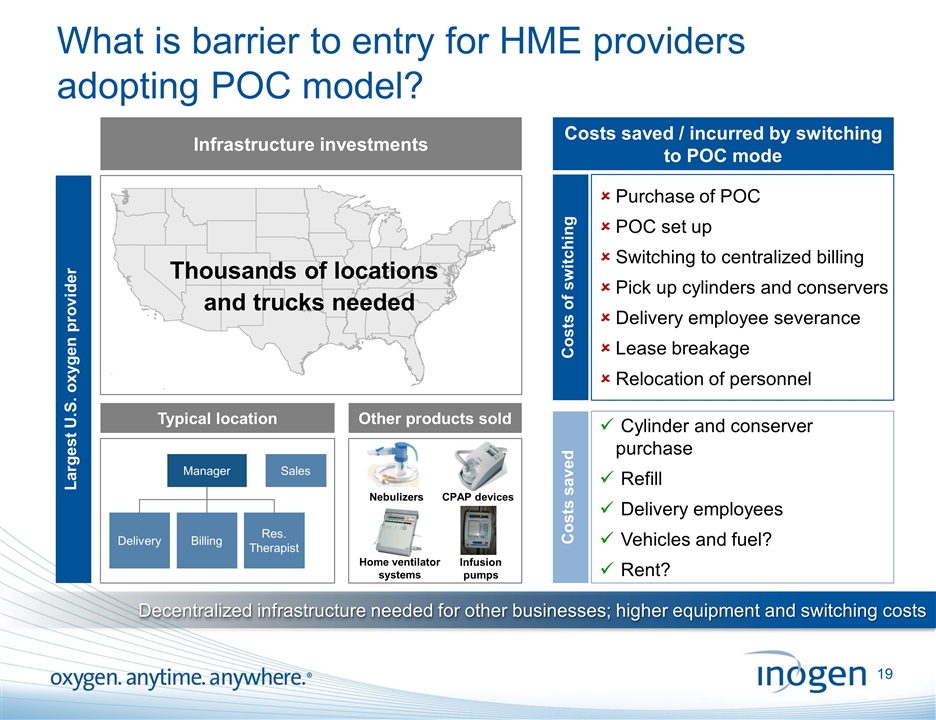

Decentralized infrastructure needed for other businesses; higher equipment and switching costs Nebulizers CPAP devices Home ventilator systems Infusion pumps What is barrier to entry for HME providers adopting POC model? Infrastructure investments Costs saved / incurred by switching to POC mode Purchase of POC POC set up Switching to centralized billing Pick up cylinders and conservers Delivery employee severance Lease breakage Relocation of personnel Largest U.S. oxygen provider Manager Delivery Res. Therapist Sales Billing Typical location Other products sold Costs of switching Costs saved Cylinder and conserver purchase Refill Delivery employees Vehicles and fuel? Rent? Thousands of locations and trucks needed

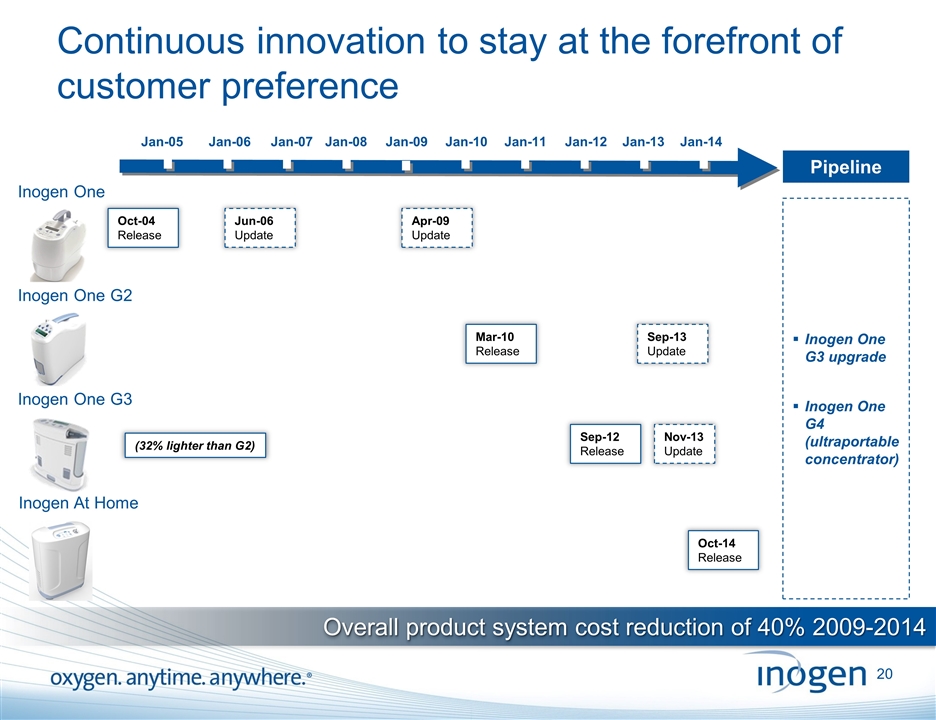

Continuous innovation to stay at the forefront of customer preference Jan-05 Jan-06 Jan-07 Jan-08 Jan-09 Jan-10 Jan-11 Jan-12 Jan-13 Oct-04 Release Jun-06 Update Pipeline Inogen One G3 upgrade Inogen One G4 (ultraportable concentrator) Inogen One Inogen One G2 Inogen One G3 Apr-09 Update Mar-10 Release Sep-13 Update Sep-12 Release (32% lighter than G2) Overall product system cost reduction of 40% 2009-2014 Nov-13 Update Jan-14 Inogen At Home Oct-14 Release

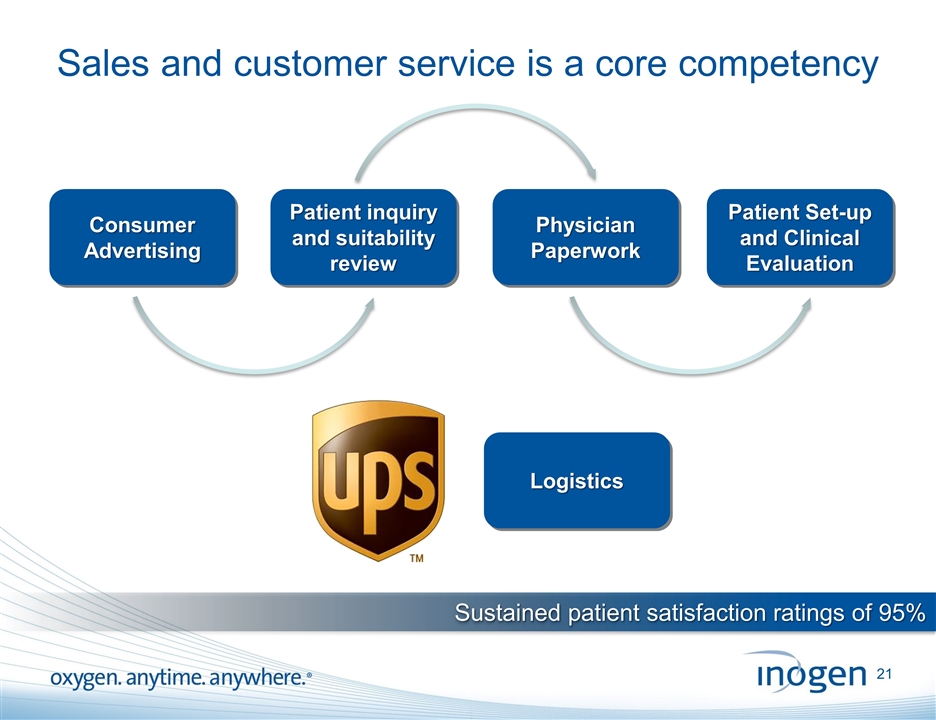

Sustained patient satisfaction ratings of 95% Consumer Advertising Patient inquiry and suitability review Physician Paperwork Patient Set-up and Clinical Evaluation Sales and customer service is a core competency Logistics

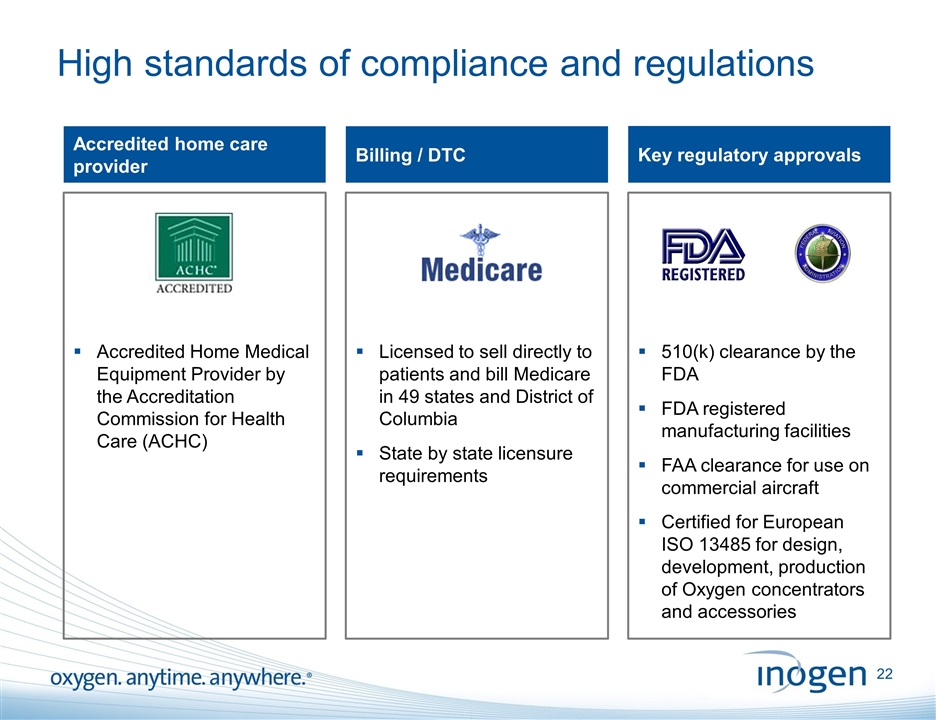

510(k) clearance by the FDA FDA registered manufacturing facilities FAA clearance for use on commercial aircraft Certified for European ISO 13485 for design, development, production of Oxygen concentrators and accessories Licensed to sell directly to patients and bill Medicare in 49 states and District of Columbia State by state licensure requirements Accredited Home Medical Equipment Provider by the Accreditation Commission for Health Care (ACHC) High standards of compliance and regulations Accredited home care provider Billing / DTC Key regulatory approvals

A proven team built for success Ray Huggenberger Chief Executive Officer Ali Bauerlein Chief Financial Officer Scott Wilkinson Executive Vice President, Sales & Marketing 10 years with Sunrise Medical Inc., President & COO from ‘02 to ’04 Spinoff of German TA Healthcare division and sale to Warburg Pincus Co-founder of Inogen has raised over $92 million in VC funding Has successfully facilitated the sale of over 6.9 million shares with a market value over $124 million in the public sector 25 years of leadership with Johnson & Johnson, Kimberly-Clark, Invacare in operations, R&D, product management, sales & marketing Launched $100 million O2 product line segment at Invacare Matt Scribner Executive Vice President, Operations 20 years of operations experience with 15 years in medical device companies Executive roles with Computer Motion, acquired by Intuitive Surgical Brenton Taylor Executive Vice President, Engineering Co-founder of Inogen with over a decade of experience in medical device product development and manufacturing Successfully obtained 23 approved U.S. patents for POC development Byron Myers Vice President, Marketing Co-founder of Inogen with direct responsibility for DTC marketing efforts MBA, UCSD Rady School of Management

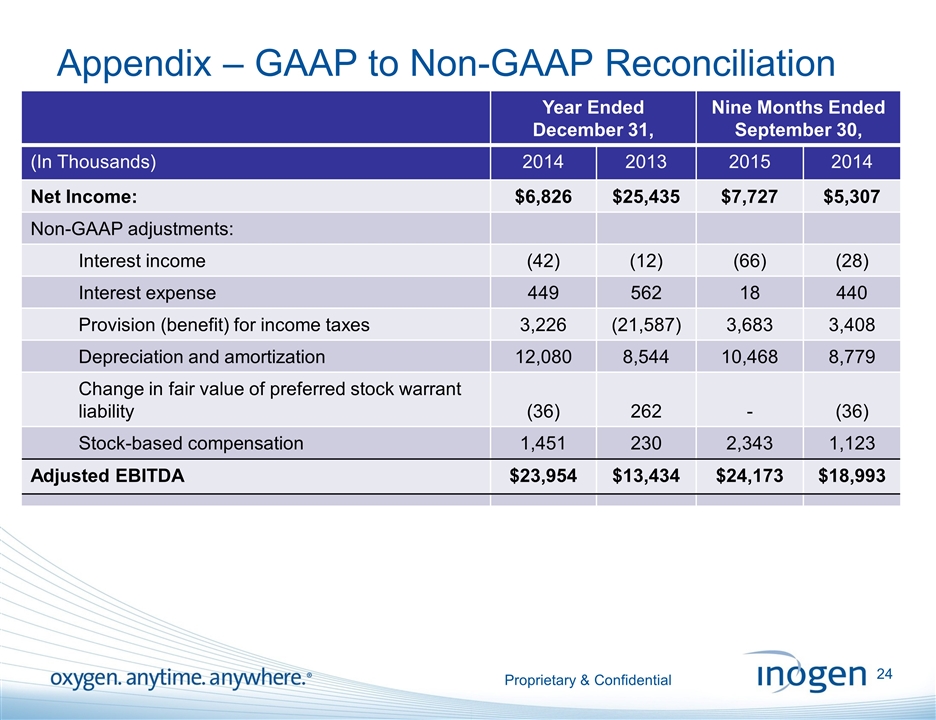

Appendix – GAAP to Non-GAAP Reconciliation Year Ended December 31, Nine Months Ended September 30, (In Thousands) 2014 2013 2015 2014 Net Income: $6,826 $25,435 $7,727 $5,307 Non-GAAP adjustments: Interest income (42) (12) (66) (28) Interest expense 449 562 18 440 Provision (benefit) for income taxes 3,226 (21,587) 3,683 3,408 Depreciation and amortization 12,080 8,544 10,468 8,779 Change in fair value of preferred stock warrant liability (36) 262 - (36) Stock-based compensation 1,451 230 2,343 1,123 Adjusted EBITDA $23,954 $13,434 $24,173 $18,993 Proprietary & Confidential

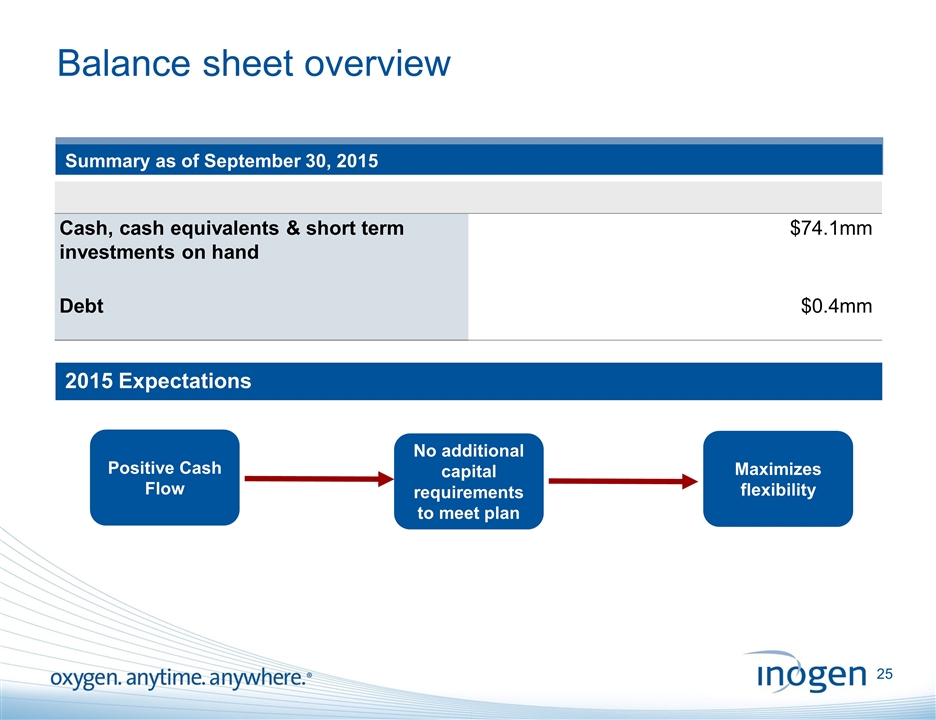

Balance sheet overview [Insert object title] Summary as of September 30, 2015 Cash, cash equivalents & short term investments on hand $74.1mm Debt $0.4mm No additional capital requirements to meet plan Positive Cash Flow Maximizes flexibility 2015 Expectations