UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐ |

Preliminary Proxy Statement |

|

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a‑6(e)(2)) |

|

☒ |

Definitive Proxy Statement |

|

☐ |

Definitive Additional Materials |

|

☐ |

Soliciting Material Pursuant to §240.14a-12 |

Inogen, Inc.

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

|

☒ |

No fee required. |

|

☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

|

(1) |

Title of each class of securities to which transaction applies: |

|

|

(2) |

Aggregate number of securities to which transaction applies: |

|

|

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0‑11 (Set forth the amount on which the filing fee is calculated and state how it was determined): |

|

|

(4) |

Proposed maximum aggregate value of transaction: |

|

|

(5) |

Total fee paid: $_____ |

|

☐ |

Fee paid previously with preliminary materials. |

|

☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0‑11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

Amount Previously Paid: |

|

|

(2) |

Form, Schedule or Registration Statement No.: |

|

|

(3) |

Filing Party: |

|

|

(4) |

Date Filed: |

Dear Stockholder:

I am pleased to invite you to attend the Annual Meeting of Stockholders (the “Annual Meeting”) of Inogen, Inc. (“Inogen”), which will be held at our headquarters, located at 326 Bollay Drive, Goleta, California 93117 on May 10, 2018 at 10:00 a.m. Pacific Time. Doors open at 9:00 a.m. Pacific Time.

At the Annual Meeting, we will ask you to consider the following proposals:

|

|

• |

To elect three Class I directors from the nominees described in this proxy statement; |

|

|

• |

To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for fiscal year ending December 31, 2018; |

|

|

• |

To approve, on an advisory and non-binding basis, executive compensation as described in this proxy statement; |

|

|

• |

To transact such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof. |

Our Board of Directors has fixed the close of business on March 16, 2018 as the record date for the Annual Meeting. Only stockholders of record on March 16, 2018 are entitled to notice of and to vote at the Annual Meeting. Further information regarding voting rights and the matters to be voted upon is presented in the accompanying proxy statement.

We are pleased to be furnishing proxy materials to stockholders primarily over the Internet for our Annual Meeting. Consequently, most stockholders will not receive paper copies of our proxy materials. We will instead send to our stockholders a Notice of Internet Availability of Proxy Materials. We believe that this process expedites stockholders’ receipt of proxy materials, lowers the costs of our Annual Meeting, and conserves natural resources.

On or about March 27, 2018 we expect to mail to our stockholders a Notice of Internet Availability of Proxy Materials containing instructions on how to access our proxy statement for our Annual Meeting and our annual report to stockholders (“Annual Report”). The Notice of Internet Availability of Proxy Materials also includes instructions on how you can vote using the Internet, and how you can request and receive, free of charge, a printed copy of our proxy materials. Our proxy statement and our 2017 Annual Report can be accessed directly at the following Internet address: http://www.proxyvote.com. All you have to do is enter the control number located on your proxy card. All stockholders who do not receive a Notice of Internet Availability of Proxy Materials will receive a paper copy of the proxy materials by mail.

YOUR VOTE IS IMPORTANT. Whether or not you plan to attend the Annual Meeting of Stockholders, we urge you to submit your vote via the Internet, telephone or mail.

On behalf of the Board of Directors, I would like to express our appreciation for your interest in Inogen.

Sincerely,

Scott Wilkinson

Chief Executive Officer and President

Goleta, California

March 27, 2018

The Notice of Internet Availability of Proxy Materials is first being mailed to our stockholders on or about March 27, 2018. The proxy materials are first being posted on http://www.proxyvote.com on or about March 27, 2018.

326 Bollay Drive

Goleta, CA 93117

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

|

Time and Date |

Thursday, May 10, 2018 at 10:00 a.m. Pacific Time. |

|

|

|

|

|

|

Place |

Inogen, Inc.’s headquarters, located at 326 Bollay Drive, Goleta, CA 93117. |

|

|

|

|

|

|

Items of Business |

• |

To elect three Class I directors from the nominees described in the proxy statement (Proposal No. 1); |

|

|

• |

To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for fiscal year ending December 31, 2018 (Proposal No. 2); |

|

|

• |

To approve, on an advisory and non-binding basis, executive compensation as described in this proxy statement (Proposal No. 3); and |

|

|

• |

To transact other business that may properly come before the Annual Meeting, or any adjournments or postponements thereof. |

|

|

|

|

|

Record Date |

March 16, 2018 (the “Record Date”). Only stockholders of record at the close of business on the Record Date are entitled to receive notice of, and to vote at, the Annual Meeting.

|

|

|

Notice of Internet Availability of Proxy Materials |

On or about March 27, 2018 we expect to mail to our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access our proxy statement for our annual meeting and our annual report to stockholders (“Annual Report”). This Notice provides instructions on how to vote online or by telephone and includes instructions on how to receive a paper copy of proxy materials by mail. The proxy statement and our Annual Report can be accessed directly at the following Internet address: http://www.proxyvote.com. All you have to do is enter the control number located on your proxy card. |

|

|

|

|

|

|

Voting |

IMPORTANT Your vote is very important. Whether or not you plan to attend the Annual Meeting, we encourage you to read the proxy statement and submit your proxy or voting instructions as soon as possible. For specific instructions on how to vote your shares, please refer to the instructions in the section entitled “Questions and Answers About the Annual Meeting” beginning on page 1 of the proxy statement.

|

|

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to Be Held on May 10, 2018. The notice of annual meeting, proxy statement, proxy card, and Annual Report are available by visiting http://www.proxyvote.com. All you have to do is enter the control number located on your proxy card.

By order of the Board of Directors,

Alison Bauerlein

Corporate Secretary

Goleta, California

March 27, 2018

The Notice of Internet Availability of Proxy Materials is first being mailed to our stockholders on or about March 27, 2018. The proxy materials are first being posted on http://www.proxyvote.com on or about March 27, 2018.

|

|

Page |

|

1 |

|

|

|

|

|

9 |

|

|

|

|

|

9 |

|

|

10 |

|

|

12 |

|

|

12 |

|

|

12 |

|

|

13 |

|

|

13 |

|

|

Compensation, Nominating and Governance Committee Interlocks |

14 |

|

14 |

|

|

15 |

|

|

16 |

|

|

Corporate Governance Principles and Code of Ethics and Conduct |

16 |

|

17 |

|

|

17 |

|

|

19 |

|

|

|

|

|

|

|

|

20 |

|

|

|

|

|

20 |

|

|

20 |

|

|

|

|

|

PROPOSAL NO. 2 RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

21 |

|

|

|

|

Fees Paid to the Independent Registered Public Accounting Firm |

21 |

|

21 |

|

|

21 |

|

|

22 |

|

|

|

|

|

|

|

|

PROPOSAL NO. 3 ADVISORY VOTE ON NAMED EXECUTIVE OFFICER COMPENSATION |

23 |

|

Vote Required |

23 |

|

|

24 |

|

|

|

|

25 |

|

|

|

|

|

27 |

|

|

|

|

|

27 |

|

|

27 |

|

|

30 |

|

|

32 |

|

|

Executive Compensation Elements and Corporate Performance Measure |

34 |

|

39 |

-i-

-ii-

326 Bollay Drive

Goleta, California 93117

PROXY STATEMENT

FOR 2018 ANNUAL MEETING OF STOCKHOLDERS

To Be Held at 10:00 a.m. Pacific Time on May 10, 2018

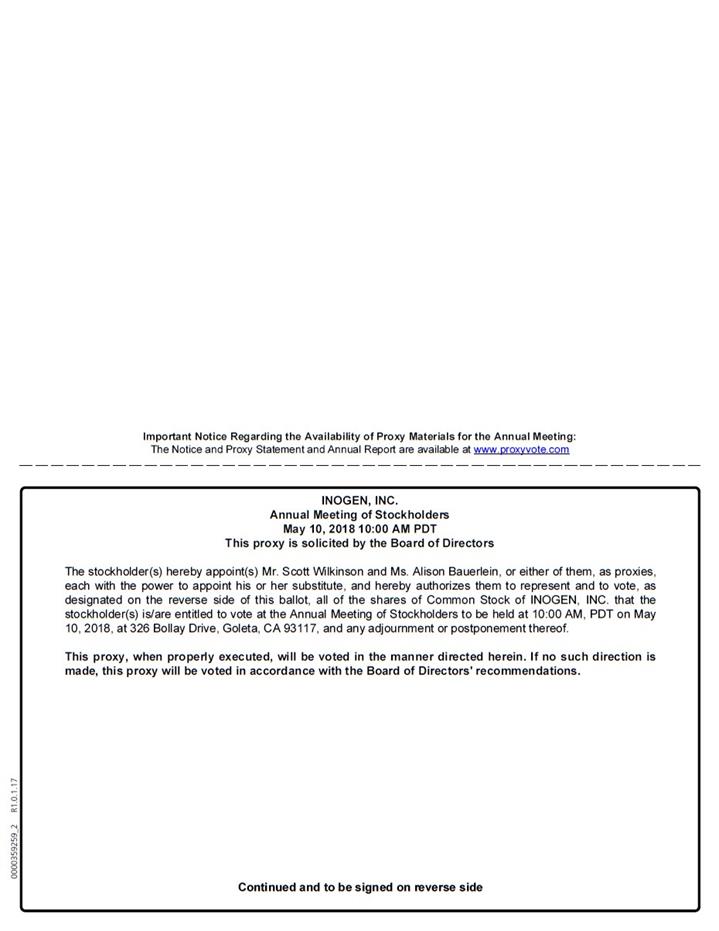

This proxy statement and the accompanying form of proxy are furnished in connection with the solicitation of proxies by our Board of Directors of Inogen, Inc. (“Inogen” or the “Company”) for use at our 2018 Annual Meeting of Stockholders (the “Annual Meeting”), and any postponements, adjournments or continuations thereof. The Annual Meeting will be held on Thursday, May 10, 2018 at 10:00 a.m. Pacific Time, at our headquarters, located at 326 Bollay Drive, Goleta, California 93117. On or about March 27, 2018, we expect to mail to our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access our proxy statement for our Annual Meeting and our annual report to stockholders (“Annual Report”).

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING

The information provided in the “question and answer” format below addresses certain frequently asked questions but is not intended to be a summary of all matters contained in this proxy statement. Please read the entire proxy statement carefully before voting your shares.

What is a proxy?

A proxy is your legal designation of another person to vote the stock you own. The person you designate is your “proxy,” and you give the proxy authority to vote your shares by submitting the accompanying proxy card or voting by telephone or over the Internet. We have designated our Chief Executive Officer and President, Scott Wilkinson, and our Executive Vice President, Finance, Chief Financial Officer, Corporate Secretary, and Corporate Treasurer, Alison Bauerlein, to serve as proxies for the Annual Meeting.

Why am I receiving these materials?

The Board of Directors (the “Board”) of Inogen is providing these proxy materials to you in connection with the Board’s solicitation of proxies for use at the Annual Meeting (and at any adjournment or postponement of such meeting), which will take place on May 10, 2018. Stockholders are invited to attend the Annual Meeting and are requested to vote on the proposals described in this proxy statement. This proxy statement and the accompanying proxy card are being made available on or about March 27, 2018 in connection with the solicitation of proxies on behalf of the Board.

How do I get electronic access to the proxy materials?

The notice of annual meeting, proxy statement, and Annual Report are available by visiting www.proxyvote.com and typing in the control number as set forth (i) on the proxy card (for stockholders of record), or (ii) on the voting instruction form (for individuals who hold shares through a broker, bank, trustee, or nominee).

What information is contained in these materials?

The information included in this proxy statement relates to the proposals to be voted on at the Annual Meeting, the voting process, the compensation of our most highly paid executive officers and our directors, and certain other required information. Inogen’s Annual Report, which includes our audited financial statements, is being made available along with this proxy statement.

-1-

What proposals will be voted on at the Annual Meeting?

The proposals scheduled to be voted on at the Annual Meeting include:

|

|

• |

the election of three Class I directors to hold office until the 2021 Annual Meeting of Stockholders or until their successors are duly elected and qualified; |

|

|

• |

a proposal to ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2018; |

|

|

• |

a proposal to approve, on an advisory and non-binding basis, executive compensation for our fiscal year ended December 31, 2017 as described in this proxy statement; |

|

|

• |

any other business that may properly come before the meeting. |

How does our Board recommend that I vote?

Our Board recommends that you vote:

|

|

• |

FOR the election of each of the three directors nominated by our Board and named in this proxy statement as Class I directors to serve for a three-year term; |

|

|

• |

FOR the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2018; and |

|

|

• |

FOR the approval, on an advisory and non-binding basis, of executive compensation for our fiscal year ended December 31, 2017 as described in this proxy statement. |

Will there be any other items of business on the agenda?

If any other items of business or other matters are properly brought before the Annual Meeting, your proxy gives discretionary authority to the persons named on the proxy card with respect to those items of business or other matters. The persons named on the proxy card intend to vote the proxy in accordance with their best judgment. Our Board does not intend to bring any other matters to be voted on at the Annual Meeting, and we are not currently aware of any matters that may be properly presented by others for consideration at the Annual Meeting.

Who is entitled to vote at the Annual Meeting?

Holders of our common stock at the close of business on March 16, 2018, the record date for the Annual Meeting (the “Record Date”), are entitled to notice of and to vote at the Annual Meeting. Each stockholder is entitled to one vote for each share of our common stock held as of the Record Date. As of the Record Date, there were 21,213,776 shares of common stock outstanding and entitled to vote. Stockholders are not permitted to cumulate votes with respect to the election of directors. The shares you are entitled to vote include shares that are (1) held of record directly in your name, and (2) held for you as the beneficial owner through a stockbroker, bank or other nominee.

What is the difference between holding shares as a stockholder of record and as a beneficial owner?

Stockholder of Record: Shares Registered in Your Name. If, at the close of business on the Record Date, your shares were registered directly in your name with Computershare Trust Company, N.A., our transfer agent, then you are considered the stockholder of record with respect to those shares. As the stockholder of record, you have the right to grant your voting proxy directly to the individuals listed on the proxy card or to vote in person at the Annual Meeting.

Beneficial Owners: Shares Registered in the Name of a Broker, Bank or Other Nominee. If, at the close of business on the Record Date, your shares were held, not in your name, but rather in a stock brokerage account or by a bank or other nominee on your behalf, then you are considered the beneficial owner of shares held in “street name.” As the beneficial owner, you have the right to direct your broker, bank or other nominee how to vote your shares by following the voting instructions your broker, bank or other nominee provides. If you do not provide your broker, bank or other nominee with instructions on how to vote your shares, your broker, bank or other nominee may, in its discretion, vote your shares with

-2-

respect to routine matters but may not vote your shares with respect to any non-routine matters. Please see “What if I do not specify how my shares are to be voted?” below for additional information.

Do I have to do anything in advance if I plan to attend the Annual Meeting in person?

Stockholder of Record: Shares Registered in Your Name. If you were a stockholder of record at the close of business on the Record Date, you do not need to do anything in advance to attend and/or vote your shares in person at the Annual Meeting, but you will need to present government-issued photo identification for entrance to the Annual Meeting.

Beneficial Owners: Shares Registered in the Name of a Broker, Bank or Other Nominee. If you were a beneficial owner at the close of business on the Record Date, you may not vote your shares in person at the Annual Meeting unless you obtain a “legal proxy” from your broker, bank or other nominee who is the stockholder of record with respect to your shares. You may still attend the Annual Meeting even if you do not have a legal proxy. For entrance to the Annual Meeting, you will need to provide proof of beneficial ownership as of the Record Date, such as the notice or voting instructions you received from your broker, bank or other nominee or a brokerage statement reflecting your ownership of shares as of the Record Date, and also present government-issued photo identification.

Please note that no cameras, recording equipment, large bags, briefcases or packages will be permitted at the Annual Meeting.

How can I contact Inogen’s transfer agent?

You may contact our transfer agent by writing Computershare Investor Services, P.O. Box 505000, Louisville, KY 40233, by telephoning (877) 373-6374 or (781) 575-3120 (International), or via its Investor Center at www.computershare.com/investor.

Will the Annual Meeting be webcast?

We do not expect to webcast the Annual Meeting.

How do I vote and what are the voting deadlines?

Stockholder of Record: Shares Registered in Your Name. If you are a stockholder of record, you can vote in one of the following ways:

|

|

• |

by Internet at www.proxyvote.com, 24 hours a day, seven days a week, until 11:59 P.M., Eastern Time, on May 9, 2018 (have your proxy card in hand when you visit the website); |

|

|

• |

by toll-free telephone at 1-800-690-6903, 24 hours a day, seven days a week, until 11:59 P.M., Eastern Time, on May 9, 2018 (have your proxy card in hand when you call); |

|

|

• |

by completing and mailing your proxy card in the postage-paid envelope we have provided or returning it to Vote Processing c/o Broadridge 51 Mercedes Way, Edgewood, NY 11717, which must be received by us no later than the start of the Annual Meeting (if you received printed proxy materials); or |

|

|

• |

by written ballot at the Annual Meeting. |

Beneficial Owners: Shares Registered in the Name of a Broker, Bank or Other Nominee. If you are the beneficial owner of shares held of record by a broker, bank or other nominee, you will receive voting instructions from your broker, bank or other nominee. You must follow the voting instructions provided by your broker, bank or other nominee in order to instruct your broker, bank or other nominee how to vote your shares. The availability of Internet and telephone voting options will depend on the voting process of your broker, bank or other nominee. As discussed above, if you are a beneficial owner, you may not vote your shares in person at the Annual Meeting unless you obtain a legal proxy from your broker, bank or other nominee.

-3-

Can I change my vote or revoke my proxy?

Stockholder of Record: Shares Registered in Your Name. If you are a stockholder of record, you may revoke your proxy or change your proxy instructions at any time before the Annual Meeting by:

|

|

• |

entering a new vote by Internet or telephone; |

|

|

• |

signing and returning a new proxy card with a later date; |

|

|

• |

delivering a written revocation to our Corporate Secretary at Inogen, Inc., 326 Bollay Drive, Goleta, CA 93117, at any time prior to the Annual Meeting; or |

|

|

• |

attending the Annual Meeting and voting in person. |

Attendance at the Annual Meeting will not cause your previously granted proxy to be revoked unless you specifically so request or vote in person at the Annual Meeting.

Beneficial Owners: Shares Registered in the Name of a Broker, Bank or Other Nominee. If you are the beneficial owner of your shares, you must contact the broker, bank or other nominee holding your shares and follow their instructions to change your vote or revoke your proxy.

Is there a list of stockholders entitled to vote at the Annual Meeting?

The names of stockholders of record entitled to vote at the Annual Meeting will be available at the Annual Meeting and for ten days prior to the meeting for any purpose germane to the meeting, between the hours of 9:00 a.m. and 4:30 p.m., at our corporate headquarters at 326 Bollay Drive, Goleta, CA 93117, by contacting our Corporate Secretary.

What is the effect of giving a proxy?

Proxies are solicited by and on behalf of our Board. The persons named in the proxy have been designated as proxy holders by our Board. When a proxy is properly dated, executed and returned, the shares represented by the proxy will be voted at the Annual Meeting in accordance with the instructions of the stockholder. If no specific instructions are given, however, the shares will be voted in accordance with the recommendations of our Board. If any matters not described in this proxy statement are properly presented at the Annual Meeting, the proxy holders will use their own judgment to determine how to vote your shares. If the Annual Meeting is postponed or adjourned, the proxy holders can vote your shares on the new meeting date, unless you have properly revoked your proxy, as described above.

What if I do not specify how my shares are to be voted?

Stockholder of Record: Shares Registered in Your Name. If you are a stockholder of record and you submit a proxy but you do not provide voting instructions, your shares will be voted:

FOR the election of each of the three directors nominated by our Board and named in this proxy statement as Class I directors to serve for a three-year term (Proposal No. 1);

FOR the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2018 (Proposal No. 2); and

FOR the approval, on an advisory and non-binding basis, of executive compensation for our fiscal year ended December 31, 2017 as described in this proxy statement (Proposal No. 3).

In the discretion of the named proxy holders regarding any other matters properly presented for a vote at the Annual Meeting.

Beneficial Owners: Shares Registered in the Name of a Broker, Bank or Other Nominee. If you are a beneficial owner and you do not provide your broker, bank or other nominee that holds your shares with voting instructions, then your broker, bank or other nominee will determine if it has discretion to vote on each matter. Brokers do not have

-4-

discretion to vote on non-routine matters. Proposal No. 1 (election of directors) and Proposal No. 3 (advisory vote to approve executive compensation) are non-routine matters, while Proposal No. 2 (ratification of appointment of independent registered public accounting firm) is a routine matter. As a result, if you do not provide voting instructions to your broker, bank or other nominee, then your broker, bank or other nominee may not vote your shares with respect to Proposal No. 1 or Proposal No. 3, which would result in a “broker non-vote” on each such proposal, but may, in its discretion, vote your shares with respect to Proposal No. 2. For additional information regarding broker non-votes, see “What are the effects of abstentions and broker non-votes?” below.

What is a quorum?

A quorum is the minimum number of shares required to be present at the Annual Meeting for the meeting to be properly held under our bylaws and Delaware law. The holders of a majority of the common stock issued and outstanding and entitled to vote, present in person or represented by proxy, constitutes a quorum for the transaction of business at the Annual Meeting. As noted above, as of the Record Date, there were a total of 21,213,776 shares of common stock outstanding, which means that 10,606,889 shares of common stock must be represented in person or by proxy at the Annual Meeting to have a quorum. If there is no quorum, (i) the chairperson of the Annual Meeting or (ii) the stockholders entitled to vote at the Annual Meeting, present in person or represented by proxy, may adjourn the meeting to a later date.

What are the effects of abstentions and broker non-votes?

An abstention represents a stockholder’s affirmative choice to decline to vote on a proposal. If a stockholder indicates on its proxy card that it wishes to abstain from voting its shares, or if a broker, bank or other nominee holding its customers’ shares of record causes abstentions to be recorded for shares, these shares will be considered present and entitled to vote at the Annual Meeting. As a result, abstentions will be counted for purposes of determining the presence or absence of a quorum and will also count as votes against a proposal in cases where approval of the proposal requires the affirmative vote of a majority of the shares present in person or represented by proxy and entitled to vote at the Annual Meeting (e.g., Proposal No. 2 and Proposal No. 3). However, because the outcome of Proposal No. 1 (election of directors) will be determined by a plurality vote, abstentions will have no impact on the outcome of such proposals as long as a quorum exists.

A broker non-vote occurs when a broker, bank or other nominee holding shares for a beneficial owner does not vote on a particular proposal because the broker, bank or other nominee does not have discretionary voting power with respect to such proposal and has not received voting instructions from the beneficial owner of the shares. Broker non-votes will be counted for purposes of calculating whether a quorum is present at the Annual Meeting but will not be counted for purposes of determining the number of votes cast. Therefore, a broker non-vote will make a quorum more readily attainable but will not otherwise affect the outcome of the vote on any proposal.

How many votes are needed for approval of each proposal?

|

|

• |

Proposal No. 1: The election of Class I directors requires a plurality of the shares of common stock present in person or represented by proxy at the Annual Meeting and entitled to vote thereon to be approved. This means that the three nominees who receive the most FOR votes will be elected. You may (i) vote FOR all nominees, (ii) WITHHOLD your vote as to all nominees, or (iii) vote FOR all nominees except for those specific nominees from whom you WITHHOLD your vote. Any shares not voted FOR a particular nominee (whether as a result of voting withheld or a broker non-vote) will not be counted in such nominee’s favor and will have no effect on the outcome of the election. If you WITHHOLD your vote as to all nominees, you will be deemed to have abstained from voting on Proposal No. 1, and such abstention will have no effect on the outcome of the proposal. |

|

|

• |

Proposal No. 2: The ratification of the appointment of Deloitte & Touche LLP requires the affirmative vote of a majority of the shares of common stock present in person or represented by proxy at the Annual Meeting and entitled to vote thereon to be approved. You may vote FOR, AGAINST or ABSTAIN. If you ABSTAIN from voting on Proposal No. 2, the abstention will have the same effect as a vote AGAINST the proposal. |

-5-

|

|

proxy at the Annual Meeting and entitled to vote thereon. You may vote FOR, AGAINST or ABSTAIN. Abstentions are considered votes present and entitled to vote on this proposal, and thus, will have the same effect as a vote AGAINST the proposal. Broker non-votes will have no effect on the outcome of the vote. However, because this proposal is an advisory vote, the result will not be binding on us or our Board. Our Board and our Compensation, Nominating and Governance Committee will consider the outcome of the vote when establishing or modifying the compensation of our named executive officers. |

How may my brokerage firm or other intermediary vote my shares if I fail to provide timely directions?

Brokerage firms and other intermediaries holding shares of common stock in street name for customers are generally required to vote such shares in the manner directed by their customers. In the absence of timely directions, your broker will have discretion to vote your shares on our sole “routine” matter — the proposal to ratify the appointment of Deloitte & Touche LLP. Absent direction from you, your broker will not have discretion to vote on the election of directors or on the advisory vote regarding named executive officer compensation.

Who will count the votes?

A representative from Broadridge Financial Solutions, Inc. will tabulate the votes and act as inspector of elections.

Why did I receive a Notice of Internet Availability of Proxy Materials instead of a full set of proxy materials?

In accordance with the rules of the Securities and Exchange Commission (“SEC”), we have elected to furnish our proxy materials, including this proxy statement and our Annual Report, primarily via the Internet. The Notice containing instructions on how to access our proxy materials is first being mailed on or about March 27, 2018 to all stockholders entitled to vote at the Annual Meeting. Stockholders may request to receive all future proxy materials in printed form by mail or electronically by e-mail by following the instructions contained in the Notice. We encourage stockholders to take advantage of the availability of our proxy materials on the Internet to help reduce the environmental impact of our annual meetings of stockholders.

How are proxies solicited for the Annual Meeting and who is paying for such solicitation?

Our Board is soliciting proxies for use at the Annual Meeting by means of the proxy materials. We will bear the entire cost of proxy solicitation, including the preparation, assembly, printing, mailing and distribution of the proxy materials. Copies of solicitation materials will also be made available upon request to brokers, banks and other nominees to forward to the beneficial owners of the shares held of record by such brokers, banks or other nominees. The original solicitation of proxies may be supplemented by solicitation by telephone, electronic communication, or other means by our directors, officers, employees or agents. No additional compensation will be paid to these individuals for any such services, although we may reimburse such individuals for their reasonable out-of-pocket expenses in connection with such solicitation. We do not plan to retain a proxy solicitor to assist in the solicitation of proxies.

If you choose to access the proxy materials and/or vote over the Internet, you are responsible for Internet access charges you may incur. If you choose to vote by telephone, you are responsible for telephone charges you may incur.

What does it mean if I received more than one Notice?

If you receive more than one Notice, your shares may be registered in more than one name or in different accounts. Please follow the voting instructions on each Notice to ensure that all of your shares are voted.

Will members of the Board attend the Annual Meeting?

We encourage, but do not require, our Board to attend the Annual Meeting. Those who do attend will be available to answer appropriate questions from stockholders.

-6-

Proxy instructions, ballots and voting tabulations that identify individual stockholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within Inogen or to third parties, except as necessary to meet applicable legal requirements, to allow for the tabulation of votes and certification of the vote, or to facilitate a successful proxy solicitation.

I share an address with another stockholder, and we received only one paper copy of the proxy materials. How may I obtain an additional copy of the proxy materials?

We have adopted an SEC-approved procedure called “householding,” under which we can deliver a single copy of the Notice and, if applicable, the proxy materials to multiple stockholders who share the same address unless we received contrary instructions from one or more of the stockholders. This procedure reduces our printing and mailing costs. Stockholders who participate in householding will continue to be able to access and receive separate proxy cards. Upon written or oral request, we will promptly deliver a separate copy of the Notice and, if applicable, the proxy materials to any stockholder at a shared address to which we delivered a single copy of any of these documents. To receive a separate copy, or, if you are receiving multiple copies, to request that we only send a single copy of next year’s Notice and, if applicable, proxy materials, you may contact us as follows:

Inogen, Inc.

Attention: Corporate Secretary

326 Bollay Drive

Goleta, CA 93117

(805) 562-0500

Stockholders who hold shares in street name may contact their brokerage firm, bank, broker-dealer or other nominee to request information about householding.

How can I find out the results of the voting at the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. In addition, final voting results will be published in a current report on Form 8-K that we expect to file within four business days after the Annual Meeting. If final voting results are not available to us at that time, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an amendment to the Form 8-K to publish the final results.

What is the deadline to propose actions for consideration at next year’s Annual Meeting of Stockholders or to nominate individuals to serve as directors?

Stockholder Proposals

Stockholders may present proper proposals for inclusion in our proxy statement and for consideration at the next Annual Meeting of Stockholders by submitting their proposals in writing to our Corporate Secretary in a timely manner. For a stockholder proposal to be considered for inclusion in our proxy statement for our 2019 Annual Meeting of Stockholders, our Corporate Secretary must receive the written proposal at our principal executive offices not later than November 27, 2018. In addition, stockholder proposals must comply with the requirements of Rule 14a-8 under the Securities Exchange Act of 1934, as amended, or the Exchange Act, regarding the inclusion of stockholder proposals in company-sponsored proxy materials. Stockholder proposals should be addressed to:

-7-

Attention: Corporate Secretary

326 Bollay Drive

Goleta, CA 93117

Our bylaws also establish an advance notice procedure for stockholders who wish to present a proposal before an Annual Meeting of Stockholders but do not intend for the proposal to be included in our proxy statement. Our bylaws provide that the only business that may be conducted at an Annual Meeting is business that is (i) specified in our proxy materials with respect to such meeting, (ii) otherwise properly brought before the Annual Meeting by or at the direction of our Board, or (iii) properly brought before the Annual Meeting by a stockholder of record entitled to vote at the Annual Meeting who has delivered timely written notice to our Corporate Secretary, which notice must contain the information specified in our bylaws. To be timely for our 2019 Annual Meeting of Stockholders, our Corporate Secretary must receive the written notice at our principal executive offices:

|

|

• |

not earlier than January 11, 2019; and |

|

|

• |

not later than February 10, 2019. |

In the event that we hold our 2019 Annual Meeting of Stockholders more than 30 days before or more than 60 days after the first anniversary of the date of the 2018 Annual Meeting, then notice of a stockholder proposal that is not intended to be included in our proxy statement must be received no earlier than the close of business on the 120th day before such Annual Meeting and no later than the close of business on the later of the following two dates:

|

|

• |

the 90th day prior to such Annual Meeting; or |

|

|

• |

the 10th day following the day on which public announcement of the date of such Annual Meeting is first made. |

If a stockholder who has notified us of his, her or its intention to present a proposal at an Annual Meeting does not appear to present his, her or its proposal at such Annual Meeting, we are not required to present the proposal for a vote at such Annual Meeting.

Nomination of Director Candidates

You may propose director candidates for consideration by our Compensation, Nominating and Governance Committee. Any such recommendations should include the nominee’s name and qualifications for membership on our Board and should be directed to our Corporate Secretary at the address set forth above. For additional information regarding stockholder recommendations for director candidates, see “Board of Directors and Corporate Governance—Stockholder Recommendations for Nominations to the Board.”

In addition, our bylaws permit stockholders to nominate directors for election at an Annual Meeting of Stockholders. To nominate a director, the stockholder must provide the information required by our bylaws. In addition, the stockholder must give timely notice to our Corporate Secretary in accordance with our bylaws, which, in general, require that the notice be received by our Corporate Secretary within the time period described above under “Stockholder Proposals” for stockholder proposals that are not intended to be included in a proxy statement.

Availability of Bylaws

A copy of our bylaws may be obtained by accessing our public filings on the SEC’s website at www.sec.gov. You may also contact our Corporate Secretary at our principal executive office for a copy of the relevant bylaw provisions regarding the requirements for making stockholder proposals and nominating director candidates.

-8-

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Our business affairs are managed under the direction of our Board, which is currently comprised of eight members. Six of our eight directors are independent within the meaning of the independent director requirements of the NASDAQ Global Select Market. Our Board is divided into three classes with staggered three-year terms. At each Annual Meeting of Stockholders, a class of directors will be elected for a three-year term to succeed the same class whose term is then expiring.

The following table sets forth the names and ages as of March 16, 2018 and certain other information for each of the directors with terms expiring at the Annual Meeting (who are also nominees for election as a director at the Annual Meeting) and for each of the continuing directors:

|

|

|

|

|

|

|

|

|

|

|

|

|

Expiration |

|

|

|

|

|

|

|

|

|

|

|

|

|

Current |

|

of term |

|

|

|

|

|

|

|

|

|

|

|

Director |

|

term |

|

for which |

|

|

|

Name |

|

Class |

|

Age |

|

Position(s) |

|

since |

|

expires |

|

nominated |

|

|

|

1. Directors with terms expiring at the Annual Meeting/nominees |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

R. Scott Greer(1) |

|

I |

|

59 |

|

Director, Chairperson of the Audit Committee |

|

2015 |

|

2018 |

|

2021 |

|

|

|

Heather Rider(2) |

|

I |

|

58 |

|

Director, Chairperson of the Compensation, Nominating and Governance Committee |

|

2014 |

|

2018 |

|

2021 |

|

|

|

Scott Beardsley(2) |

|

I |

|

50 |

|

Director |

|

2017 |

|

2018 |

|

2021 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. Continuing Directors |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Heath Lukatch, Ph.D.(2) |

|

III |

|

50 |

|

Director, Chairperson of the Board |

|

2006 |

|

2020 |

|

|

— |

|

|

Raymond Huggenberger |

|

III |

|

59 |

|

Director |

|

2008 |

|

2020 |

|

|

— |

|

|

Loren McFarland(1) |

|

II |

|

59 |

|

Director |

|

2013 |

|

2019 |

|

|

— |

|

|

Benjamin Anderson-Ray(1) |

|

II |

|

63 |

|

Director |

|

2013 |

|

2019 |

|

|

— |

|

|

Scott Wilkinson |

|

II |

|

53 |

|

Director, Chief Executive Officer and President |

|

2017 |

|

2019 |

|

|

— |

|

|

(1) |

Member of our Audit Committee |

|

(2) |

Member of our Compensation, Nominating and Governance Committee |

R. Scott Greer has served as a Member of our Board since August 2015 and Chairperson of the Audit Committee effective January 1, 2018. Since June 2003, Mr. Greer has served as Managing Director of Numenor Ventures, LLC, a venture capital firm. In 1996, Mr. Greer co-founded Abgenix, Inc., a company that specialized in the discovery, development and manufacture of human therapeutic antibodies, and from June 1996 through May 2002, he served as its Chief Executive Officer. He also served on the Board of Directors of Abgenix from 1996 and Chairman of the Board of Directors from 2000 until the acquisition of Abgenix by Amgen, Inc. in April 2006. Prior to Abgenix’s formation, Mr. Greer held senior management positions at Cell Genesys, Inc., a biotechnology company, initially as Chief Financial Officer and Vice President of Corporate Development and later as Senior Vice President of Corporate Development, and various positions at Genetics Institute, Inc., a biotechnology research and development company. Mr. Greer currently serves as a Member of the Board of Directors of Nektar Therapeutics, a publicly-traded biopharmaceutical company (NKTR), Sientra, Inc., a publicly-traded commercial stage medical device company (SIEN), and Versartis, Inc., a publicly-traded development stage biotechnology company (VSAR). Mr. Greer holds a Bachelor of Arts in Economics from Whitman College and an M.B.A. from Harvard University. He also was a Certified Public Accountant. The Board believes that he is qualified to serve as a director of Inogen because of his experience as an accountant and as an executive and director of various public and private biotechnology and biopharmaceutical companies.

-9-

Heather Rider has served as a Member of our Board since 2014 and Chairperson of the Compensation, Nominating and Governance Committee effective January 1, 2018. From 2012 to 2013, Ms. Rider served as Vice President, Global Human Resources of Cymer, Inc., a publicly-traded supplier of light sources for semiconductor manufacturing that was acquired by ASML Holding NV in 2013. From October 2010 to September 2012, Ms. Rider served as Senior Vice President, Global Human Resources of Alphatec Holdings, Inc., a publicly-traded medical device company focused on surgical treatment of spine disorders, and from 2006 to 2010, she served as Vice President, Human Resources of Intuitive Surgical, Inc., a publicly-traded manufacturer of robotic surgical systems. From 2001 to 2005, Ms. Rider served as Senior Vice President of Global Human Resources of Sunrise Medical, Inc., a global manufacturer and distributor of durable medical equipment. From 1998 to 2001, Ms. Rider served as Vice President of Human Resources of Biosense Webster, a member of the J & J family of companies, and a medical device manufacturer of intracardiac catheters and location technology. Prior to 1998, Ms. Rider served as Head of Human Resources for City of Hope, a leading research and treatment center for cancer, diabetes and other life-threatening diseases, CAP/MPT, a medical malpractice provider for physicians in California and medical malpractice insurance for large physician groups and hospitals, and Environmental Diagnostics International, a bio-diagnostics company with focus on the detection of environmental compounds and diseases using monoclonal antibody technology. Ms. Rider holds a Bachelor of Arts in Psychology from Claremont McKenna College and an M.B.A. from Pepperdine University. The Board believes that she is qualified to serve as a director of Inogen because of her extensive executive-level experience with healthcare and life science companies.

Scott A. Beardsley has served as a Member of our Board since January 1, 2017. Mr. Beardsley is employed as a Managing Partner by Novo Ventures (US), Inc., which provides certain financial investment consultancy services to Novo Holdings A/S, a Danish limited liability company that manages investments and financial assets. Mr. Beardsley has worked within Novo Holdings A/S and its investment activities since 2009 in several roles: since January 2018, Mr. Beardsley has been employed by Novo Ventures (US) Inc. as a Managing Partner; from January 2016 through 2017, he was employed as a Senior Partner by Novo Ventures (US) Inc.; from December 2012 through 2015, he was employed as a Partner by Novo Ventures (US) Inc.; and from 2009 through 2012, he was employed as a Senior Partner by Novo Holdings A/S. Prior to joining Novo Holdings A/S, Mr. Beardsley was a Managing Director in the Health Care Group at J.P. Morgan, a banking and financial services company, from 2006 through 2008, and a Managing Director in the Health Care Group of US Bancorp Piper Jaffray, an investment bank, from 2001 to 2006. Previously, Mr. Beardsley was an investment banker at US Bancorp, Piper Jaffray, Montgomery Securities, and Kidder, Peabody & Co. Incorporated. From October 2010 through May 2014, Mr. Beardsley served as a member of the Board of Directors of Aerocrine AB, an acquired publicly-traded medical technology company. Mr. Beardsley received his M.B.A. from the Anderson Graduate School of Management at UCLA and his Bachelor of Science in Business Administration from Colorado State University. The Board believes that he is qualified to serve as a director of Inogen due to his extensive financial experience and his experience as a venture capital investor and investment banker in the life sciences industry.

Heath Lukatch, Ph.D. has served as Chairperson of our Board since 2008, and as a director since 2006. Dr. Lukatch is employed as a Partner and Managing Director at TPG Biotech. Dr. Lukatch joined TPG Biotech in 2015. Prior to joining TPG Biotech, Dr. Lukatch was a Partner at Novo Ventures (US) Inc., which provides certain consultancy services to Novo Holdings A/S. Dr. Lukatch joined Novo Ventures (US) Inc. in 2006. From 2001 to 2006, Dr. Lukatch was a Managing Director responsible for biotechnology venture investments at Piper Jaffray Ventures and SightLine Partners, a private equity firm and spin off of Piper Jaffray Ventures. Prior to joining Piper Jaffray Ventures, Dr. Lukatch worked as a strategy consultant with McKinsey & Company, a consulting firm, from 1997 to 2000. Dr. Lukatch also served as co-founder and Chief Executive Officer of AutoMate Scientific, a biotechnology instrumentation company from 1991 to 1997, and held scientific positions with Chiron Corporation, a biotechnology company, from 1990 to 1991, Roche Bioscience, a healthcare company, from 1996 to 1997, and Cetus Corporation, a biotechnology company, in 1987. He currently serves on the Boards of Directors of Adynxx, Flexion Therapeutics, Inc. (FLXN), Halo Neuroscience, Lagunita Bioscience, Engage Therapeutics (Chairman), and Satsuma Pharma (Chairman). Dr. Lukatch previously served on the Board of Directors of Amira Pharmaceuticals, AnaptysBio, Inc., Cianna Medical, Inc., Elevation Pharmaceuticals, Inc., FoldRx Pharmaceuticals, Inc., InSound Medical, Inc., NeuroTherapeutics Pharma, Inc., Nora Therapeutics, Inc., Panmira Pharmaceuticals LLC, Spinifex, Inc., Synosia Therapeutics, Inc., and Verax Biomedical, Inc. Dr. Lukatch received his Ph.D. in Neuroscience from Stanford University where he was a DOD USAF Fellow, and his Bachelor of Arts in Biochemistry from the University of California at Berkeley. The Board believes that he is qualified to serve as a director

-10-

of Inogen because of his extensive industry experience and experience as a venture capital investor and a board member for several venture-backed healthcare companies.

Raymond Huggenberger has served as a Member of our Board since January 1, 2008. Mr. Huggenberger previously served as our Chief Executive Officer from January 1, 2008 until March 1, 2017 and as our President from January 1, 2008 until January 1, 2016. Prior to joining our company, Mr. Huggenberger held various management positions with Sunrise Medical Inc., a global manufacturer and distributor of durable medical equipment, including: Vice President of Marketing for Sunrise’s German subsidiary from 1994 to 1996, President of Sunrise’s German division from 1998 until 2000, President of the European Operating Group from 2000 to 2002, President and Chief Operating Officer from 2002 until 2004, and President of European Operations 2006 to 2007. Mr. Huggenberger also held a consultant position with McDermott and Bull Inc., an executive search firm, from 2005 to 2006 and the position of Managing Director in the healthcare division of TA Triumph Adler AG, a document process management firm, from 1996 to 1998. Mr. Huggenberger currently serves on the Board of Directors of Wellfount Corporation, a pharmacy services company, Tactile Systems Technology Inc., a publicly-traded medical device company (TCMD), and Clarify Medical Inc., a medical device company. Mr. Huggenberger previously served on the Board of Directors of IYIA Technologies, a healthcare company. Mr. Huggenberger graduated from AKAD University in Rendsburg, Germany in Economics and completed the Advanced Marketing Strategies Program at INSEAD, Fontainebleau, France. The Board believes that he is qualified to serve as a director of Inogen because of his deep understanding of our business, operations and strategy and extensive executive and director roles with healthcare companies.

Loren McFarland has served as a Member of our Board since 2013. He has been President and Managing Member of Santa Barbara Financial Services, LLC since 2008. Prior to founding Santa Barbara Financial Services, he served as the Chief Financial Officer and Treasurer of Mentor Corporation, a medical equipment company, from 2004 to 2007. Prior to that, Mr. McFarland fulfilled various finance and accounting roles at Mentor from 1985 to 2004. He worked as a Certified Public Accountant and Audit Supervisor with Touche Ross & Co., an accounting firm, from 1981 to 1985 and served in the North Dakota Army National Guard from 1978 to 1984. He currently serves on the Board of Directors and as the Chief Financial Officer of Cure Medical, LLC, a privately held manufacturer of disposable urology products, on the Board of Directors of the MIT Enterprise Forum of the Central Coast and chairs the parish finance council for St. Mark’s University Parish, Isla Vista, CA. Previously, Mr. McFarland served on the Board of Directors of Patient Safety Technologies, Inc., an acquired publicly-traded medical device company, as the Financial Expert on the Audit Committee and as a Member of the Compensation, Nominating and Governance Committee. Mr. McFarland has a Bachelor of Arts degree in Accounting from the University of North Dakota and an M.B.A. from the University of California, Los Angeles. He completed an ISS Director Certification Program in October 2008 at the University of California, Los Angeles’ Anderson School. The Board believes that he is qualified to serve as a director of Inogen because of his leadership experience and his extensive experience in finance and accounting.

Benjamin Anderson-Ray has served as a Member of our Board since 2013. He has been a Partner and Advisor with Trinitas Advisors, a consulting firm, since 2009. Prior to joining Trinitas Advisors, he served as the Chief Executive Officer of three manufacturing companies: Hubbardton Forge, LLC from 2008 to 2009, Chromcraft Revington, Inc. from 2005 to 2008 and Gravograph New Hermes from 2002 to 2004. Prior to that, Mr. Anderson-Ray held various senior leadership roles at Sunrise Medical, Inc., a global manufacturer and distributor of durable medical equipment, including President of the Global Business Group in 2001, President of the Continuing Care Group from 1998 to 2000, and President of the Mobility Products Division from 1996 to 2001. Earlier in his career, Mr. Anderson-Ray held management and marketing roles at GE Lighting, a lighting solutions company, from 1984 to 1993, Black & Decker Home Products, a product manufacturing company, from 1993 to 1994, and Rubbermaid Home Products, a manufacturer and distributor of household items, from 1994 to 1996. He currently serves on the Board of Directors of Sommetrics, Inc., Shacksbury, Inc. and the Episcopal Church Foundation. Mr. Anderson-Ray has Bachelor of Art and Science degrees in Marketing and Horticulture from Michigan State University and an M.B.A. from the University of Michigan. The Board believes that he is qualified to serve as a director of Inogen because of his leadership experience and his extensive industry experience.

Scott Wilkinson has served as our Chief Executive Officer and President since March 1, 2017, and a Member of our Board since January 1, 2017. Previously, he served as our President and Chief Operating Officer from January 1, 2016 until March 1, 2017, and our Executive Vice President, Sales and Marketing from 2008 through December 31, 2015, and

-11-

in this role he oversaw Inogen’s global operations in sales, marketing, customer service, product management, medical billing, and clinical services. Prior to that, he served as our Director of Product Management from 2005 to 2006 and Vice President, Product Management from 2006 to 2008. From 2000 to 2005, Mr. Wilkinson worked for Invacare Corporation, a designer and manufacturer of oxygen products, as a Group Product Manager and helped launch their $100 million oxygen product line segment. From 1999 to 2000, Mr. Wilkinson served as a Product Line Director with Johnson & Johnson, a healthcare company. From 1988 to 1999, Mr. Wilkinson worked as a Research Scientist, Product Manager, and Project Leader at Kimberly Clark, a consumer products company. Mr. Wilkinson received a Bachelor of Science degree in Chemical Engineering from the University of Akron and an M.B.A. from University of Wisconsin, Oshkosh. The Board believes that he is qualified to serve as a director of Inogen due to his considerable knowledge and understanding of our business together with his extensive industry experience.

Our common stock is listed on the NASDAQ Global Select Market. Under the rules of the NASDAQ Global Select Market, independent directors must comprise a majority of a listed company’s Board of Directors. In addition, the rules of the NASDAQ Global Select Market require that, subject to specified exceptions, each member of a listed company’s Audit and Compensation, Nominating and Governance Committee be independent. Under the rules of the NASDAQ Global Select Market, a director will only qualify as an “independent director” if, in the opinion of that company’s Board of Directors, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

Our Board has undertaken a review of its composition, the composition of its committees and the independence of each of our directors and considered whether any director has a material relationship with us that could compromise his or her ability to exercise independent judgment in carrying out his or her responsibilities. Based upon information requested from and provided by each director concerning his or her background, employment and affiliations, including family relationships, our Board has determined that none of Mr. Anderson-Ray, Mr. McFarland, Mr. Greer, Dr. Lukatch, Ms. Rider and Mr. Beardsley, representing six of our eight directors, has a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that each of these directors is “independent” as that term is defined under the rules of the NASDAQ Global Select Market. Our Board also determined that Mr. Greer (Chairperson), Mr. McFarland and Mr. Anderson-Ray, who comprise our Audit Committee, and Ms. Rider (Chairperson), Dr. Lukatch and Mr. Beardsley, who comprise our Compensation, Nominating and Governance Committee, satisfy the independence standards for those committees established by applicable Securities and Exchange Commission, or SEC, rules and the listing standards of the NASDAQ Global Select Market.

In making this determination, our Board considered the relationships that each non-employee director has with us and all other facts and circumstances our Board deemed relevant in determining independence, including the beneficial ownership of our capital stock by each non-employee director.

Dr. Lukatch currently serves as the chairperson of our Board. Our Board believes the current board leadership structure provides effective independent oversight of management while allowing our Board and management to benefit from Dr. Lukatch’s leadership and years of experience as a venture capital investor in the biotech industry. Dr. Lukatch is best positioned to identify strategic priorities, lead critical discussion and execute our strategy and business plans. Dr. Lukatch possesses detailed in-depth knowledge of the issues, opportunities, and challenges facing us. Independent directors and management sometimes have different perspectives and roles in strategy development. Our Board believes that Dr. Lukatch’s role enables strong leadership, creates clear accountability, facilitates information flow between management and our Board, and enhances our ability to communicate our message and strategy clearly and consistently to stockholders.

During 2017, our Board held seven meetings (including regularly scheduled and special meetings), and each director attended at least 75% of the aggregate of (i) the total number of meetings of our Board held during the period for which he

-12-

served as a director and (ii) the total number of meetings held by all committees of our Board on which he or she served during the periods that he or she served.

It is the policy of our Board to regularly have separate meeting times for independent directors without management. Although we do not have a formal policy regarding attendance by members of our Board at Annual Meetings of Stockholders, we encourage, but do not require, our directors to attend. All eight members of our Board attended our 2017 Annual Meeting of Stockholders.

We have established an Audit Committee and a Compensation, Nominating and Governance Committee. We believe that the composition of these committees meets the criteria for independence under, and the functioning of these committees comply with the requirements of, the Sarbanes-Oxley Act of 2002, the rules of the NASDAQ Global Select Market, and SEC rules and regulations. We intend to comply with the requirements of the NASDAQ Global Select Market with respect to committee composition of independent directors. Each committee has the composition and responsibilities described below.

The members of our Audit Committee are Messrs. Greer (Chairperson), McFarland and Anderson-Ray, each of whom is a non-employee member of our Board. The composition of our Audit Committee meets the requirements for independence under current NASDAQ Global Select Market listing standards and SEC rules and regulations. Each member of our Audit Committee also meets the financial literacy requirements of the NASDAQ Global Select Market listing standards. Our Audit Committee Chairman, Mr. Greer, is our Audit Committee financial expert, as that term is defined under the SEC rules implementing Section 407 of the Sarbanes-Oxley Act of 2002, and possesses financial sophistication, as defined under the listing standards of the NASDAQ Global Select Market. Mr. McFarland served as the Chairperson of our Audit Committee until December 31, 2017. Mr. Greer became the Chairperson of our Audit Committee starting January 1, 2018. Our Audit Committee oversees our corporate accounting and financial reporting process and assists our Board in monitoring our financial systems. Our Audit Committee also:

|

|

• |

approves the hiring, discharging and compensation of our independent auditors; |

|

|

• |

oversees the work of our independent auditors; |

|

|

• |

approves engagements of the independent auditors to render any audit or permissible non-audit services; |

|

|

• |

reviews the qualifications, independence and performance of the independent auditors; |

|

|

• |

reviews our financial statements and our critical accounting policies and estimates; |

|

|

• |

oversees risk management matters; |

|

|

• |

reviews the submission and treatment of complaints to the whistle-blower hotline of suspected violations regarding accounting, internal accounting controls or auditing matters, harassment, fraud and policy violations; |

|

|

• |

reviews the adequacy and effectiveness of our internal controls; and |

|

|

• |

reviews and discusses with management and the independent auditors the results of our annual audit, our annual and quarterly financial statements and our publicly filed reports. |

Our Audit Committee operates under a written charter that satisfies the applicable rules and regulations of the SEC and the listing requirements of the NASDAQ Global Select Market. A copy of the charter of our Audit Committee is available on our website at www.inogen.com in the Corporate Overview – Governance Documents section of our Investors webpage. During 2017, our Audit Committee held nine meetings.

Compensation, Nominating and Governance Committee

The current members of our Compensation, Nominating and Governance Committee are Ms. Rider, Dr. Lukatch and Mr. Beardsley. Dr. Lukatch served as the Chairperson of our Compensation, Nominating and Governance Committee

-13-

until December 31, 2017. Ms. Rider became the Chairperson of our Compensation, Nominating and Governance Committee starting January 1, 2018. The composition of our Compensation, Nominating and Governance Committee meets the requirements for independence under current NASDAQ Global Select Market listing standards and SEC rules and regulations. Each member of the Compensation, Nominating and Governance Committee is also a non-employee director, as defined pursuant to Rule 16b-3 promulgated under the Exchange Act. Our Compensation, Nominating and Governance Committee oversees our compensation policies, plans and benefits programs. Our Compensation, Nominating and Governance Committee also:

|

|

• |

assists the Board in providing oversight of the Company’s overall compensation plans and benefits programs; |

|

|

• |

reviews and approves, or makes recommendations for approval by the independent members of the Board regarding corporate goals and objectives relevant to compensation of our chief executive officer and other senior officers; |

|

|

• |

evaluates the performance of our officers in light of established goals and objectives; |

|

|

• |

reviews and approves, or make recommendations regarding compensation of our officers based on its evaluations; |

|

|

• |

administers the issuance of stock options and other awards under our stock plans; |

|

|

• |

evaluates and makes recommendations regarding the organization, governance and remuneration of our Board and its committees; |

|

|

• |

evaluates and proposes nominees for election to our Board; |

|

|

• |

assesses the performance of members of our Board and makes recommendations regarding committee and chairperson assignments; |

|

|

• |

recommends desired qualifications for our Board membership and conducts searches for potential members of our Board; and |

|

|

• |

reviews and makes recommendations with respect to our corporate governance guidelines. |

Our Compensation, Nominating and Governance Committee operates under a written charter that satisfies the listing standards of NASDAQ Global Select Market. A copy of the charter of our Compensation, Nominating and Governance Committee is available on our website at www.inogen.com in the Corporate Overview - Governance Documents section of our Investors webpage. During 2017, our Compensation, Nominating and Governance Committee held six meetings.

Compensation, Nominating and Governance Committee Interlocks

None of the members of our Compensation, Nominating and Governance Committee (which includes Ms. Rider, Dr. Lukatch and Mr. Beardsley) is or has at any time during the past year been an officer or employee of our Company. None of our executive officers currently serves, or in the past year has served, as a member of the Board of Directors or Compensation Committee (or other board committee performing equivalent functions) of any entity that has one or more of its executive officers serving on our Board or Compensation, Nominating and Governance Committee.

Identifying and Evaluating Nominees for Director

The Compensation, Nominating and Governance Committee will use the following procedures to identify and evaluate any individual recommended or offered for nomination to the Board:

|

|

• |

The Compensation, Nominating and Governance Committee will consider candidates recommended by stockholders in the same manner as candidates recommended to the Committee from other sources. |

|

|

• |

In its evaluation of director candidates, including the members of the Board eligible for re-election, the Compensation, Nominating and Governance Committee will consider the following: |

|

|

– |

the current size and composition of the Board and the needs of the Board and the respective committees of the Board; |

-14-

|

|

– |

other factors that the Compensation, Nominating and Governance Committee deems appropriate. |

The Compensation, Nominating and Governance Committee also focuses on issues of diversity, such as diversity of gender, race and national origin, education, professional experience and differences in viewpoints and skills. The committee does not have a formal policy with respect to diversity; however, our Board and the Compensation, Nominating and Governance Committee believe that it is essential that members of our Board represent diverse viewpoints.

The Compensation, Nominating and Governance Committee requires the following minimum qualifications to be satisfied by any nominee for a position on the Board:

|

|

• |

the highest personal and professional ethics and integrity; |

|

|

• |

proven achievement and competence in the nominee’s field and the ability to exercise sound business judgment; |

|

|

• |

skills that are complementary to those of the existing Board; |

|

|

• |

the ability to assist and support management and make significant contributions to the Company’s success; and |

|

|

• |

an understanding of the fiduciary responsibilities that is required of a member of the Board and the commitment of time and energy necessary to diligently carry out those responsibilities. |

If the Compensation, Nominating and Governance Committee determines that an additional or replacement director is required, the Compensation, Nominating and Governance Committee may take such measures that it considers appropriate in connection with its evaluation of a director candidate, including candidate interviews, inquiry of the person or persons making the recommendation or nomination, engagement of an outside search firm to gather additional information, or reliance on the knowledge of the members of the Compensation, Nominating and Governance Committee, the Board or management.

The Compensation, Nominating and Governance Committee may propose to the Board a candidate recommended or offered for nomination by a stockholder as a nominee for election to the Board.

Stockholder Recommendations for Nominations to the Board

It is the policy of the Compensation, Nominating and Governance Committee of the Board to consider recommendations for candidates to the Board from stockholders holding no less than one percent (1%) of the outstanding shares of the Company’s common stock continuously for at least twelve (12) months prior to the date of the submission of the recommendation or nomination.

A stockholder that wants to recommend a candidate for election to the Board should direct the recommendation in writing by letter to the Company, attention of the Corporate Secretary, at 326 Bollay Drive, Goleta, CA 93117. The recommendation must include the candidate’s name, home and business contact information, detailed biographical data, relevant qualifications, a signed letter from the candidate confirming willingness to serve, information regarding any relationships between the candidate and the Company and evidence of the recommending stockholder’s ownership of Company stock. Such recommendations must also include a statement from the recommending stockholder in support of the candidate, particularly within the context of the criteria for Board membership, including issues of character, integrity, judgment, diversity of experience, independence, area of expertise, corporate experience, length of service, potential conflicts of interest, other commitments and the like and personal references.

-15-

A stockholder that instead desires to nominate a person directly for election to the Board at an Annual Meeting of the Stockholders must meet the deadlines and other requirements set forth in Section 2.4 of the Company’s Bylaws and the rules and regulations of the Securities and Exchange Commission. Section 2.4 of the Company’s Bylaws requires that a stockholder who seeks to nominate a candidate for director must provide a written notice to the Corporate Secretary of the Company not later than the 45th day nor earlier than the 75th day before the one-year anniversary of the date on which the corporation first mailed its proxy materials or a notice of availability of proxy materials (whichever is earlier) for the preceding year’s Annual Meeting; provided, however, that in the event that no Annual Meeting was held in the previous year or if the date of the Annual Meeting is advanced by more than 30 days prior to or delayed by more than 60 days after the one-year anniversary of the date of the previous year’s Annual Meeting, then notice by the stockholder to be timely must be so received by the Corporate Secretary of the Company not earlier than the close of business on the 120th day prior to such Annual Meeting and not later than the close of business on the later of (i) the 90th day prior to such Annual Meeting and (ii) the 10th day following the day on which Public Announcement (as defined below) of the date of such Annual Meeting is first made. That notice must state the information required by Section 2.4 of the Company’s Bylaws, and otherwise must comply with applicable federal and state law. The Corporate Secretary of the Company will provide a copy of the Bylaws upon request in writing from a stockholder. “Public Announcement” shall mean disclosure in a press release reported by the Dow Jones News Service, Associated Press or a comparable national news service or in a document publicly filed by the corporation with the Securities and Exchange Commission pursuant to Section 13, 14 or 15(d) of the Securities Exchange Act of 1934, as amended, or any successor thereto.

The Board believes that management speaks for the Company. Individual Board members may, from time to time, communicate with various constituencies that are involved with the Company, but it is expected that Board members would do this with knowledge of management and, in most instances, only at the request of management.

In cases where stockholders and other interested parties wish to communicate directly with our non-management directors, messages can be sent to our Corporate Secretary, at Inogen, Inc., 326 Bollay Drive, Goleta, California 93117, Attn: Corporate Secretary. Our Corporate Secretary monitors these communications and will provide a summary of all received messages to the Board at each regularly scheduled meeting of the Board. Our Board generally meets on a quarterly basis. Where the nature of a communication warrants, our Corporate Secretary may determine, in his or her judgment, to obtain the more immediate attention of the appropriate committee of the Board or non-management director, of independent advisors or of Company management, as our Corporate Secretary considers appropriate.

Our Corporate Secretary may decide in the exercise of his or her judgment whether a response to any stockholder or interested party communication is necessary.

This procedure for stockholder and other interested party communications with the non-management directors is administered by the Company’s Compensation, Nominating and Governance Committee. This procedure does not apply to (a) communications to non-management directors from officers or directors of the Company who are stockholders, (b) stockholder proposals submitted pursuant to Rule 14a-8 under the Securities and Exchange Act of 1934, as amended, or (c) communications to the Audit Committee pursuant to the Complaint Procedures for Accounting and Auditing Matters.

Corporate Governance Principles and Code of Ethics and Conduct

Our Board has adopted Corporate Governance Principles. These principles address items such as the qualifications and responsibilities of our directors and director candidates and corporate governance policies and standards applicable to us in general. In addition, our Board has adopted a Code of Ethics and Conduct that applies to all of our employees, officers and directors, including our Chief Executive Officer, Chief Financial Officer, and other executive and senior financial officers. The full text of our Corporate Governance Principles and our Code of Ethics and Conduct is posted on our website at www.inogen.com in the Corporate Overview – Governance Documents section of our Investors webpage. We intend to post any amendments to our Code of Ethics and Conduct, and any waivers of our Code of Ethics and Conduct for directors and executive officers, on the same website.

-16-

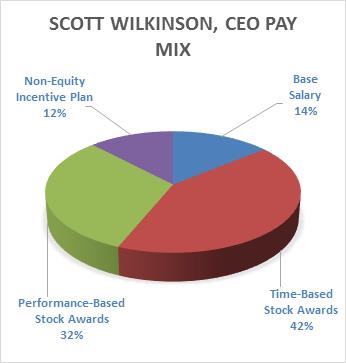

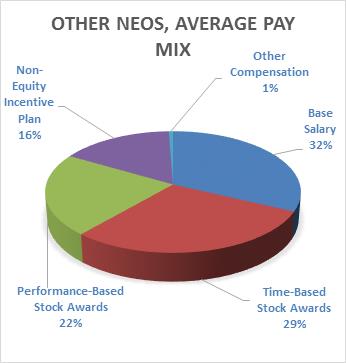

Risk is inherent with every business, and we face a number of risks, including strategic, financial, business and operational, legal and compliance, and reputational. We have designed and implemented processes to manage risk in our operations. Management is responsible for the day-to-day management of risks the Company faces, while our Board, as a whole and assisted by its committees, has responsibility for the oversight of risk management. In its risk oversight role, our Board has the responsibility to satisfy itself that the risk management processes designed and implemented by management are appropriate and functioning as designed.