Company Overview September 2019 Exhibit 99.1

Notice regarding forward-looking statements These slides and the accompanying oral presentation (the “Presentation”) include forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, which are based on current expectations, estimates and projections based on information currently available to management. These forward-looking statements include, among others, statements relating to our GAAP and non-GAAP guidance as of August 7, 2019, including our estimates of 2019 revenue, Adjusted EBITDA, net income, operating income, tax rate, and related margin expectations; our expectations regarding decreasing reimbursement rates on both our rental revenue and the oxygen therapy market generally; the size and estimates of growth in the oxygen therapy market; our estimates concerning market penetration; our expectation regarding market headwinds and the impact on HME providers; our hiring expectations; product development; and our expectations for positive cash flow and our needs for additional capital and our expectations related to our recent acquisition of New Aera and the TAV technology. All statements other than statements of historical facts contained in this Presentation, including statements regarding our future results of operations and financial position, business strategy, prospective products, plans and objectives of management for future operations, and future results of current and anticipated products are forward-looking statements. Forward-looking statements are typically identified by words like “believe,” “anticipate,” “could,” “should,” “estimate,” “expect,” “intend,” “plan,” “project,” “will,” “forecast,” “budget,” “pro forma,” and similar terms. Forward-looking statements are subject to numerous risks and uncertainties that could cause actual results to differ materially from currently anticipated results, including but not limited to, risks arising from the possibility that we will not realize anticipated revenue; the impact of reduced reimbursement rates; the possible loss of key employees, customers, or suppliers; and intellectual property risks if we are unable to secure and maintain patent or other intellectual property protection for the intellectual property used in our products. In addition, our business is subject to numerous additional risks and uncertainties, including, among others, risks relating to market acceptance of our products; our ability to successfully launch new products and applications; competition; our sales, marketing and distribution capabilities; our planned sales, marketing, and research and development activities; interruptions or delays in the supply of components or materials for, or manufacturing of, our products; seasonal variations; unanticipated increases in costs or expenses; and risks associated with international operations. The known risks and uncertainties are described in detail under the caption “Risk Factors” and elsewhere in our Annual Report on Form 10-K for the year ended December 31, 2018. Additional information is also set forth in our Quarterly Report on Form 10-Q for the quarter ended June 30, 2019 and our subsequent reports filed with the Securities and Exchange Commission, or SEC. Accordingly, our actual results may materially differ from our current expectations, estimates and projections. Unless otherwise specified herein, forward-looking statements represent our management’s beliefs and assumptions only as of our August 7, 2019 earnings release, and we undertake no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by applicable law. For more complete information about Inogen, Inc., please read our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and other documents that we have filed and may file from time to time with the SEC. These documents can be obtained by visiting EDGAR on the SEC Web site at www.sec.gov. Use of Non-GAAP Financial Measures This Presentation includes certain non-GAAP financial measures as defined by SEC rules. The non-GAAP financial measures are not intended to be considered in isolation or as a substitute for results prepared in accordance with GAAP. Management believes that non-GAAP financial measures, taken in conjunction with U.S. GAAP financial measures, provide useful information for both management and investors by excluding certain non-cash and other expenses that are not indicative of Inogen's core operating results. Management uses non-GAAP measures to compare Inogen's performance relative to forecasts and strategic plans, to benchmark Inogen's performance externally against competitors, and for certain compensation decisions. Because the non-GAAP measures included in this presentation relate to future periods, we are unable to provide a quantitative reconciliation of these non-GAAP financial measures without unreasonable effort as a result of the uncertainty regarding, and the potential variability of, the amounts of interest income, interest expense, provision for income taxes, depreciation and amortization, stock-based compensation, and certain other infrequently occurring items that may be incurred in the future. Reconciliations between U.S. GAAP and non-GAAP results for prior periods are presented in the accompanying tables to this presentation and tables within our earnings release dated August 7, 2019.

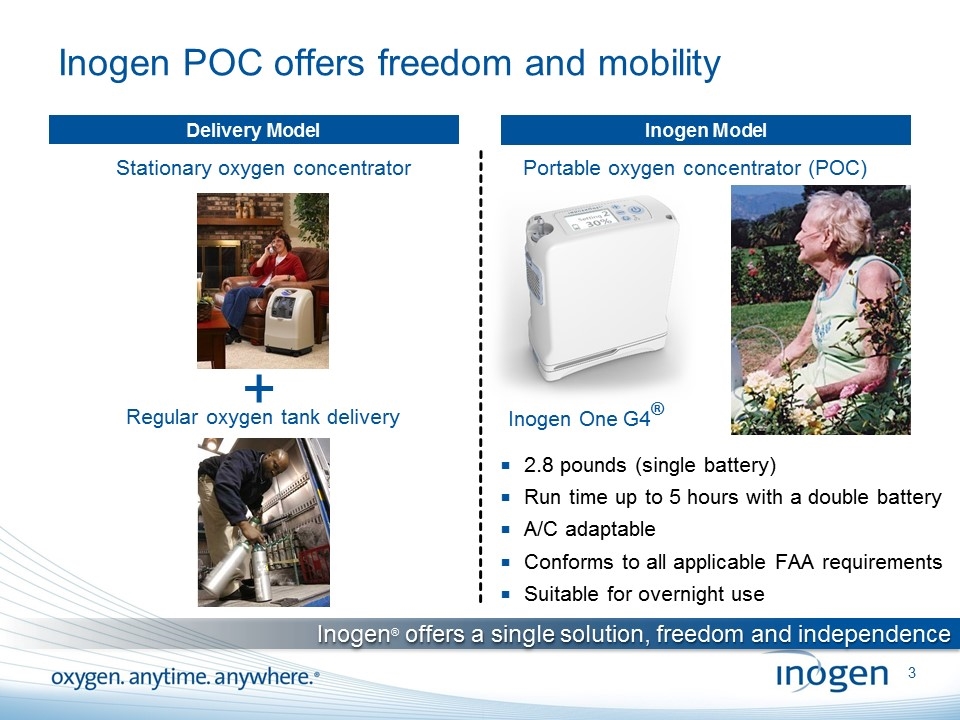

Inogen POC offers freedom and mobility Stationary oxygen concentrator + Regular oxygen tank delivery Delivery Model Inogen Model 2.8 pounds (single battery) Run time up to 5 hours with a double battery A/C adaptable Conforms to all applicable FAA requirements Suitable for overnight use Portable oxygen concentrator (POC) Inogen® offers a single solution, freedom and independence Inogen One G4®

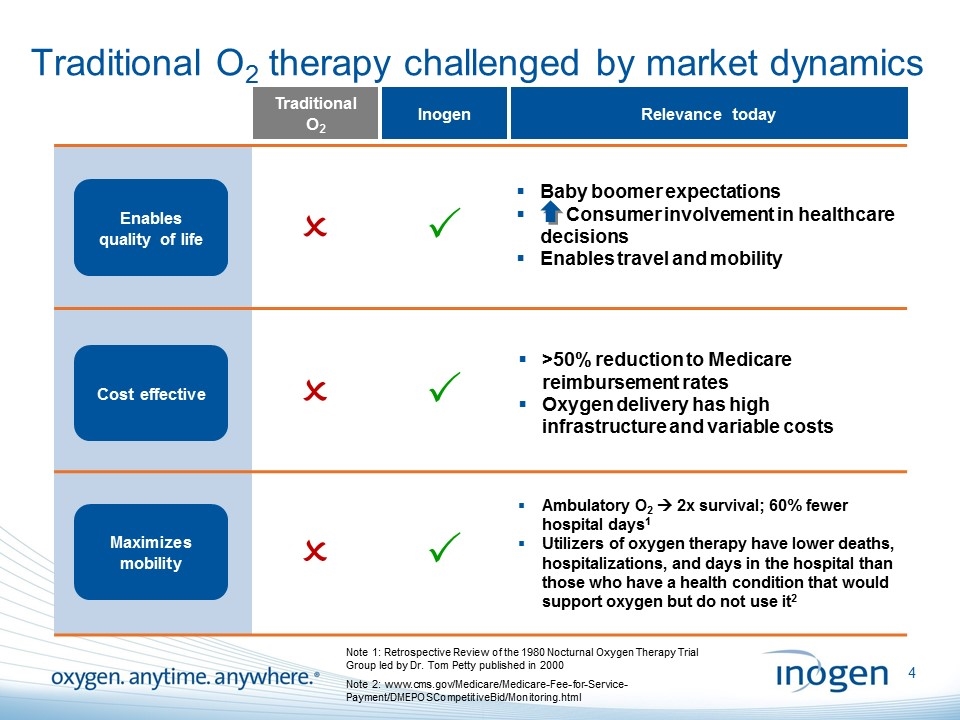

Traditional O2 therapy challenged by market dynamics Traditional O2 P Inogen Cost effective Maximizes mobility P P O O O Relevance today >50% reduction to Medicare reimbursement rates Oxygen delivery has high infrastructure and variable costs Ambulatory O2 à 2x survival; 60% fewer hospital days1 Utilizers of oxygen therapy have lower deaths, hospitalizations, and days in the hospital than those who have a health condition that would support oxygen but do not use it2 Baby boomer expectations Consumer involvement in healthcare decisions Enables travel and mobility Cost effective Enables quality of life Note 2: www.cms.gov/Medicare/Medicare-Fee-for-Service-Payment/DMEPOSCompetitiveBid/Monitoring.html Note 1: Retrospective Review of the 1980 Nocturnal Oxygen Therapy Trial Group led by Dr. Tom Petty published in 2000

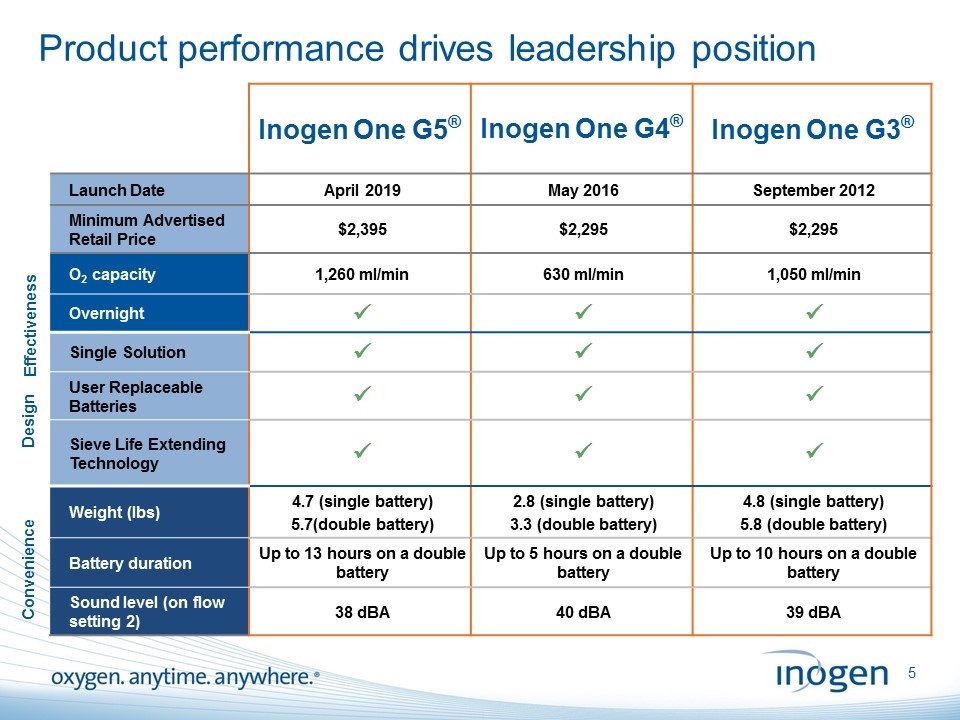

Product performance drives leadership position Inogen One G5® Inogen One G4® Inogen One G3® Launch Date April 2019 May 2016 September 2012 Minimum Advertised Retail Price $2,395 $2,295 $2,295 O2 capacity 1,260 ml/min 630 ml/min 1,050 ml/min Overnight ü ü ü Single Solution ü ü ü User Replaceable Batteries ü ü ü Sieve Life Extending Technology ü ü ü Weight (lbs) 4.7 (single battery) 5.7(double battery) 2.8 (single battery) 3.3 (double battery) 4.8 (single battery) 5.8 (double battery) Battery duration Up to 13 hours on a double battery Up to 5 hours on a double battery Up to 10 hours on a double battery Sound level (on flow setting 2) 38 dBA 40 dBA 39 dBA Effectiveness Design Convenience

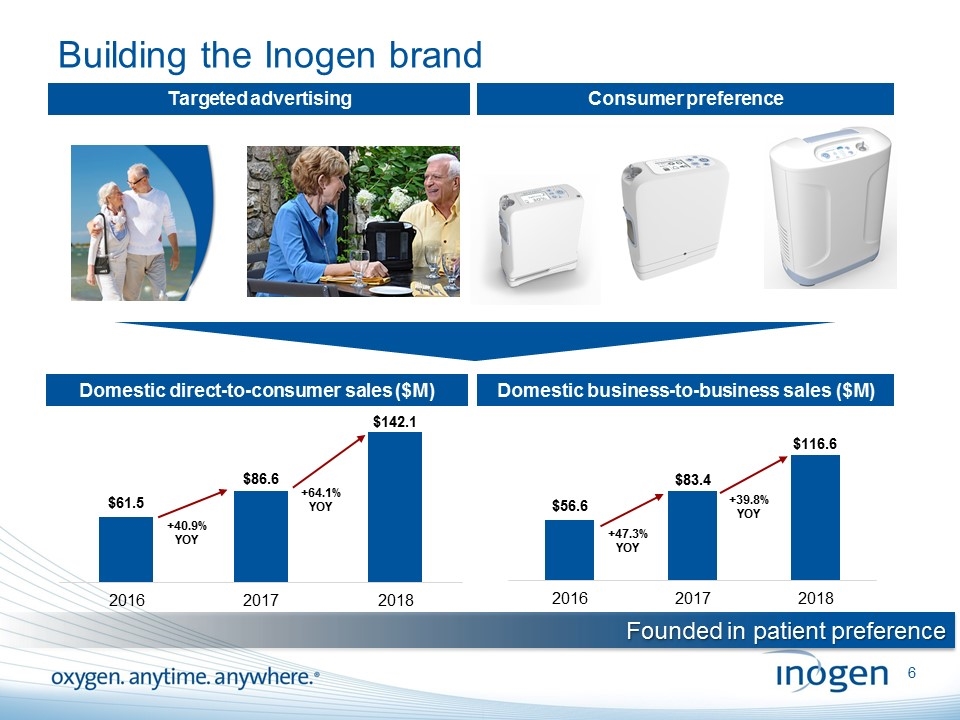

Building the Inogen brand Targeted advertising Consumer preference Domestic direct-to-consumer sales ($M) Domestic business-to-business sales ($M) +40.9% YOY +39.8% YOY Founded in patient preference +64.1% YOY +47.3% YOY $61.5 $86.6 $142.1 2016 2017 2018 $56.6 $83.4 $116.6 2016 2017 2018

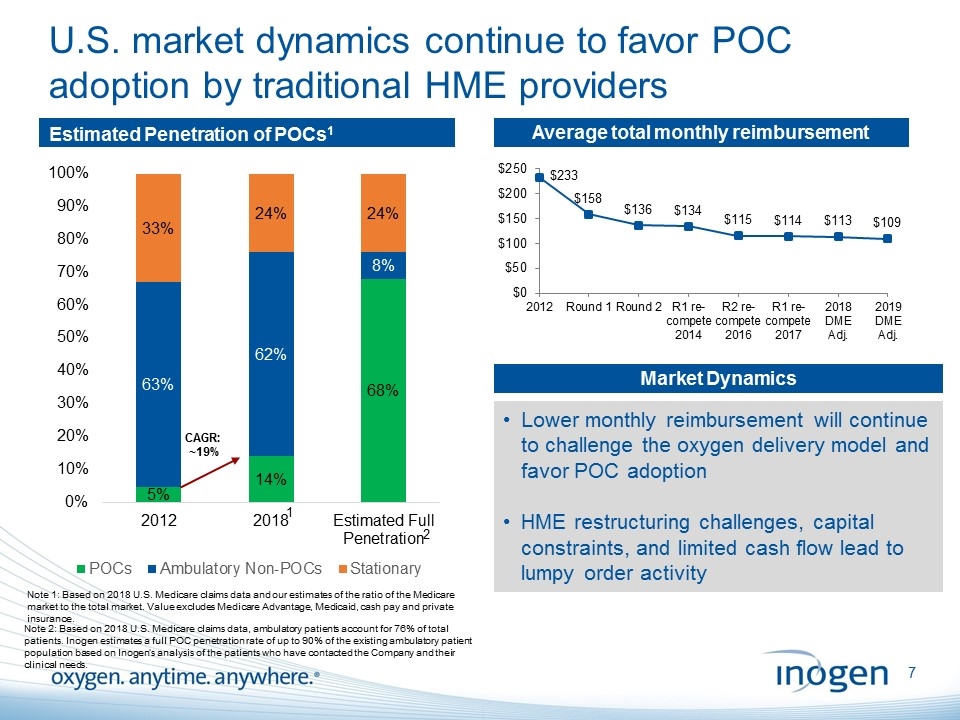

U.S. market dynamics continue to favor POC adoption by traditional HME providers Estimated Penetration of POCs1 Average total monthly reimbursement Note 1: Based on 2018 U.S. Medicare claims data and our estimates of the ratio of the Medicare market to the total market. Value excludes Medicare Advantage, Medicaid, cash pay and private insurance. CAGR: ~19% 1 2 Note 2: Based on 2018 U.S. Medicare claims data, ambulatory patients account for 76% of total patients. Inogen estimates a full POC penetration rate of up to 90% of the existing ambulatory patient population based on Inogen’s analysis of the patients who have contacted the Company and their clinical needs. Market Dynamics Lower monthly reimbursement will continue to challenge the oxygen delivery model and favor POC adoption HME restructuring challenges, capital constraints, and limited cash flow lead to lumpy order activity $233 $158 $136 $134 $115 $114 $113 $109 $0 $50 $100 $150 $200 $250 2012 Round 1 Round 2 R1 re- compete 2014 R2 re- compete 2016 R1 re- compete 2017 2018 DME Adj. 2019 DME Adj. 5% 14% 68% 63% 62% 8% 33% 24% 24% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 2012 2018 Estimated Full Penetration POCs Ambulatory Non-POCs Stationary

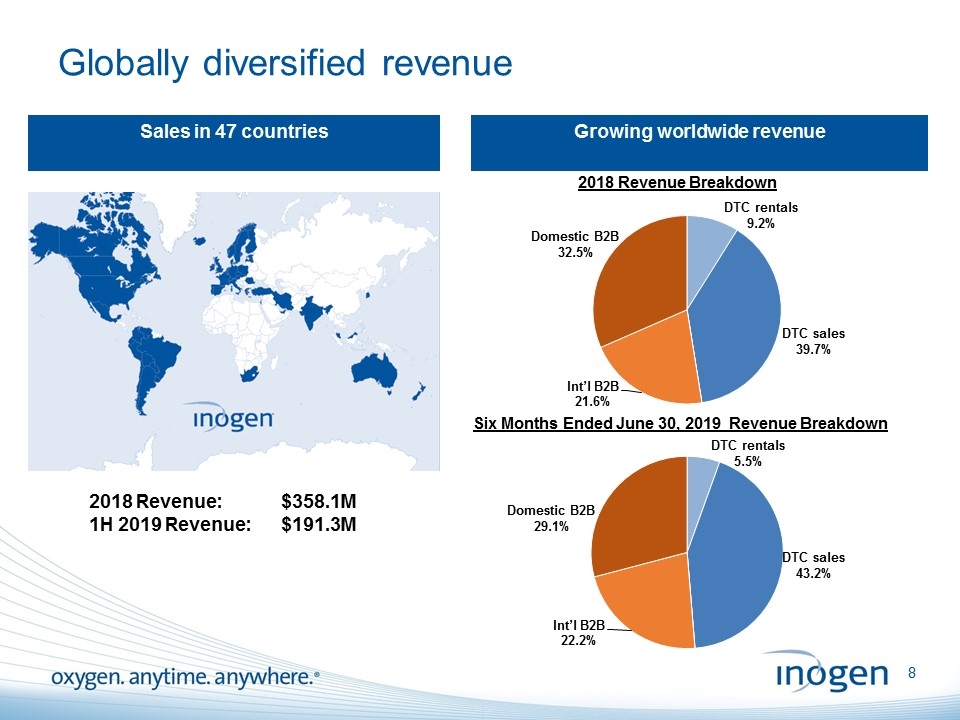

Globally diversified revenue Sales in 47 countries Growing worldwide revenue 2018 Revenue:$358.1M 1H 2019 Revenue:$191.3M 2018 Revenue Breakdown Domestic B2B 32.5% DTC rentals 9.2% DTC sales 39.7% Int’l B2B 21.6% Six Months Ended June 30, 2019 Revenue Breakdown DTC rentals 5.5% Domestic B2B 29.1% DTC sales 43.2% Int’l B2B 22.2%

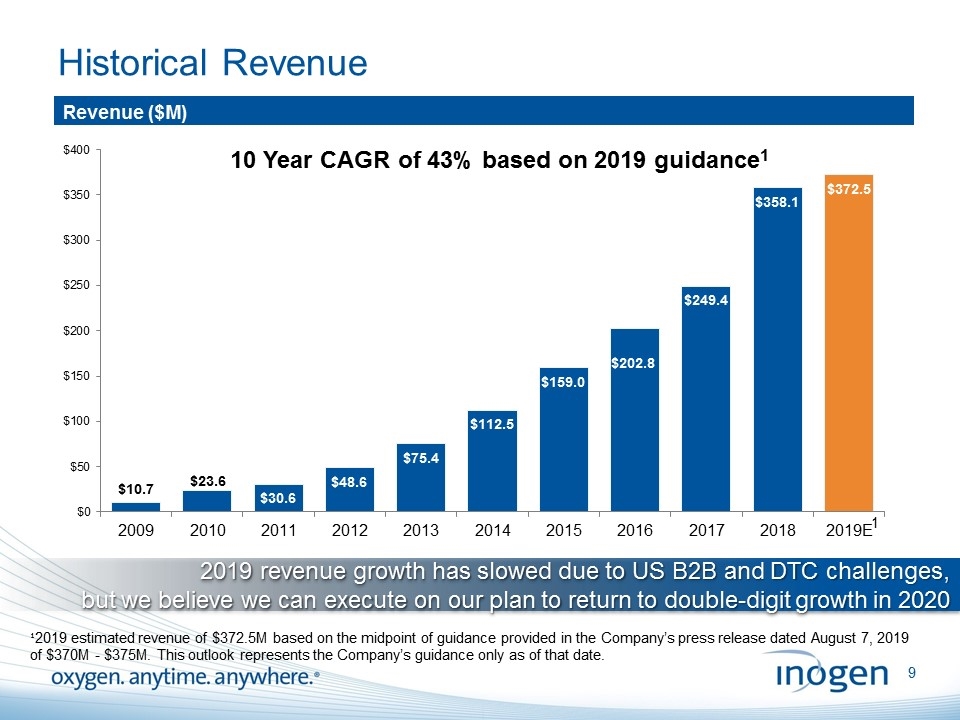

Historical Revenue Revenue ($M) 10 Year CAGR of 43% based on 2019 guidance1 ¹2019 estimated revenue of $372.5M based on the midpoint of guidance provided in the Company’s press release dated August 7, 2019 of $370M - $375M. This outlook represents the Company’s guidance only as of that date. 1 2019 revenue growth has slowed due to US B2B and DTC challenges, but we believe we can execute on our plan to return to double-digit growth in 2020 $10.7 $23.6 $30.6 $48.6 $75.4 $112.5 $159.0 $202.8 $249.4 $358.1 $372.5 $0 $50 $100 $150 $200 $250 $300 $350 $400 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019E

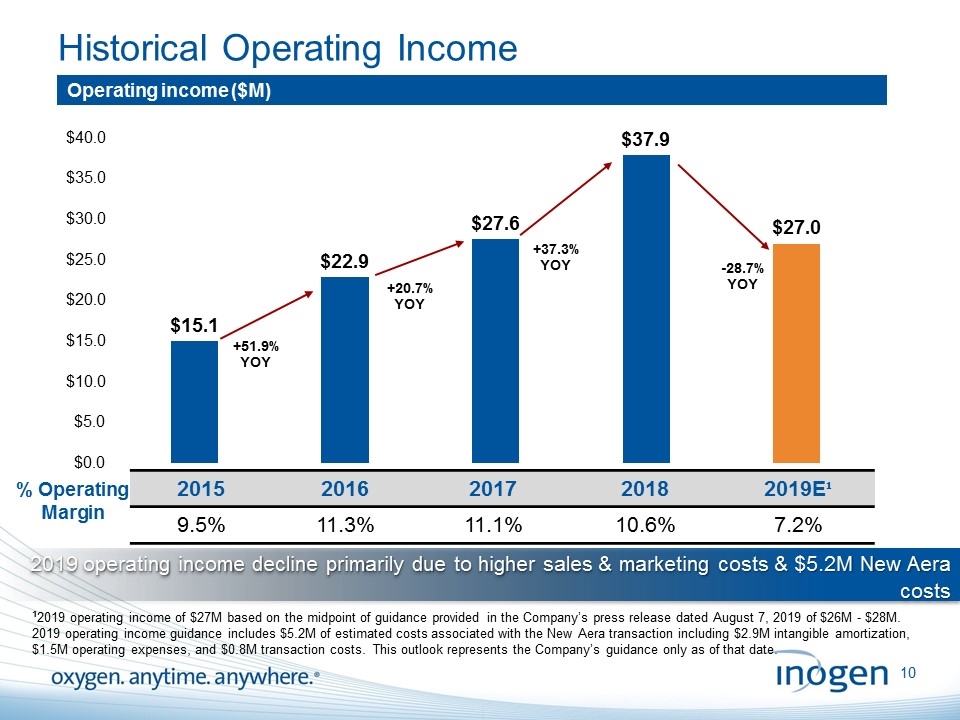

Historical Operating Income % Operating Margin 2015 2016 2017 2018 2019E¹ 9.5% 11.3% 11.1% 10.6% 7.2% +20.7% YOY -28.7% YOY +51.9% YOY ¹2019 operating income of $27M based on the midpoint of guidance provided in the Company’s press release dated August 7, 2019 of $26M - $28M. 2019 operating income guidance includes $5.2M of estimated costs associated with the New Aera transaction including $2.9M intangible amortization, $1.5M operating expenses, and $0.8M transaction costs. This outlook represents the Company’s guidance only as of that date. Operating income ($M) 2019 operating income decline primarily due to higher sales & marketing costs & $5.2M New Aera costs $15.1 $22.9 $27.6 $37.9 $27.0 $0.0 $5.0 $10.0 $15.0 $20.0 $25.0 $30.0 $35.0 $40.0 +37.3% YOY

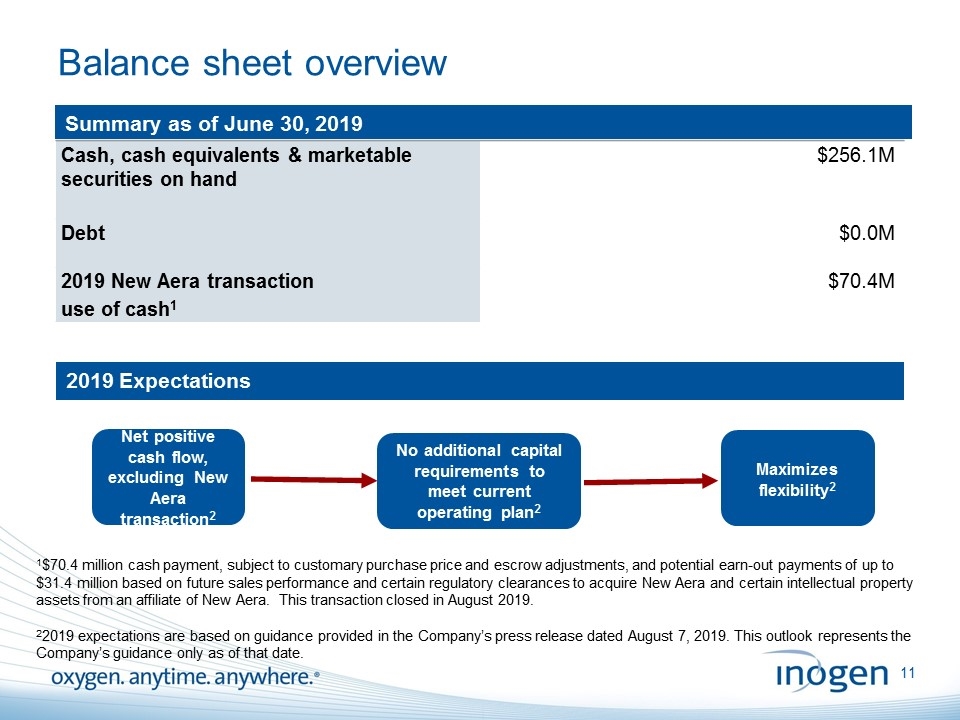

Balance sheet overview [Insert object title] Cash, cash equivalents & marketable securities on hand $256.1M Debt $0.0M 2019 New Aera transaction use of cash1 $70.4M No additional capital requirements to meet current operating plan2 Net positive cash flow, excluding New Aera transaction2 Maximizes flexibility2 2019 Expectations 1$70.4 million cash payment, subject to customary purchase price and escrow adjustments, and potential earn-out payments of up to $31.4 million based on future sales performance and certain regulatory clearances to acquire New Aera and certain intellectual property assets from an affiliate of New Aera. This transaction closed in August 2019. 22019 expectations are based on guidance provided in the Company’s press release dated August 7, 2019. This outlook represents the Company’s guidance only as of that date. Summary as of June 30, 2019

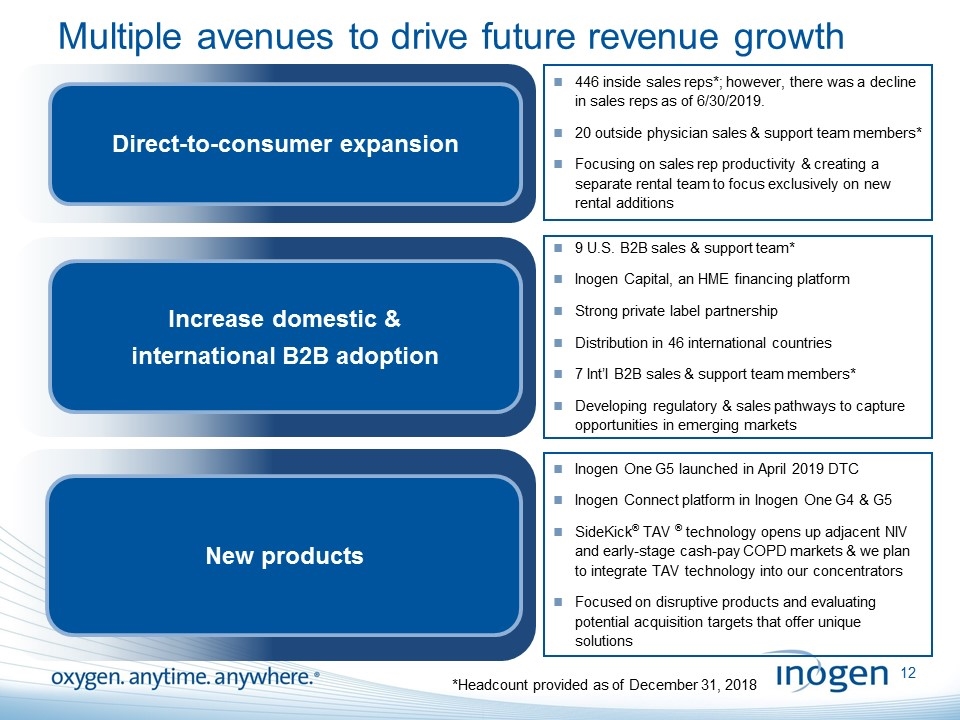

Multiple avenues to drive future revenue growth Direct-to-consumer expansion Increase domestic & international B2B adoption 446 inside sales reps*; however, there was a decline in sales reps as of 6/30/2019. 20 outside physician sales & support team members* Focusing on sales rep productivity & creating a separate rental team to focus exclusively on new rental additions 9 U.S. B2B sales & support team* Inogen Capital, an HME financing platform Strong private label partnership Distribution in 46 international countries 7 Int’l B2B sales & support team members* Developing regulatory & sales pathways to capture opportunities in emerging markets New products Inogen One G5 launched in April 2019 DTC Inogen Connect platform in Inogen One G4 & G5 SideKick® TAV ® technology opens up adjacent NIV and early-stage cash-pay COPD markets & we plan to integrate TAV technology into our concentrators Focused on disruptive products and evaluating potential acquisition targets that offer unique solutions *Headcount provided as of December 31, 2018

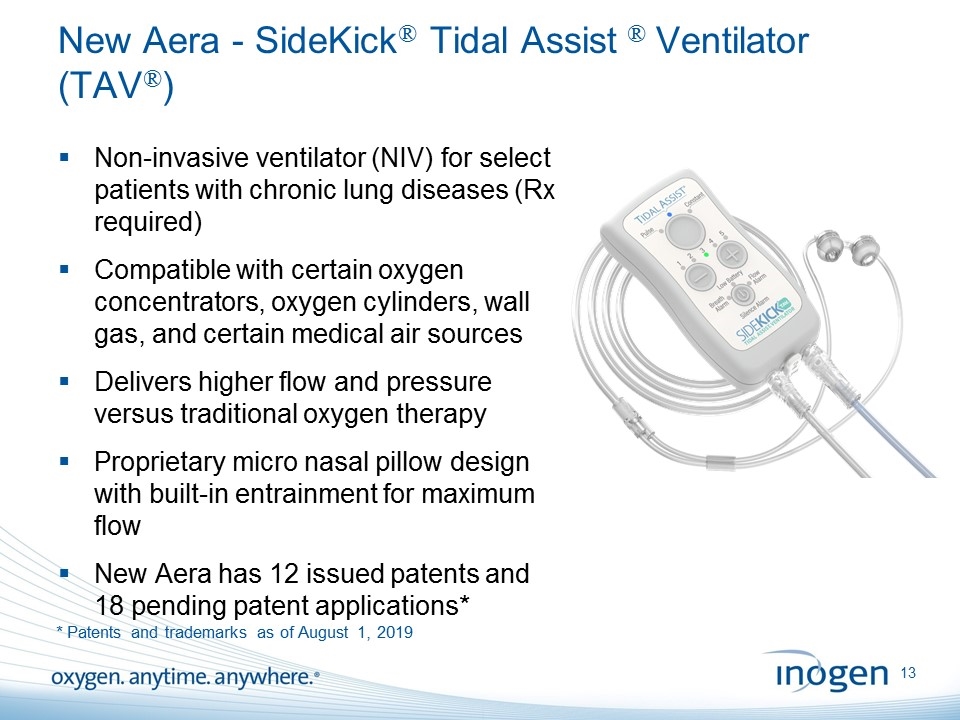

New Aera - SideKick® Tidal Assist ® Ventilator (TAV®) Non-invasive ventilator (NIV) for select patients with chronic lung diseases (Rx required) Compatible with certain oxygen concentrators, oxygen cylinders, wall gas, and certain medical air sources Delivers higher flow and pressure versus traditional oxygen therapy Proprietary micro nasal pillow design with built-in entrainment for maximum flow New Aera has 12 issued patents and 18 pending patent applications* * Patents and trademarks as of August 1, 2019

Strategic value of New Aera Complementary Sales Opportunity Enhances Financial Profile Strengthens Technology Leadership Expansion into NIV Market

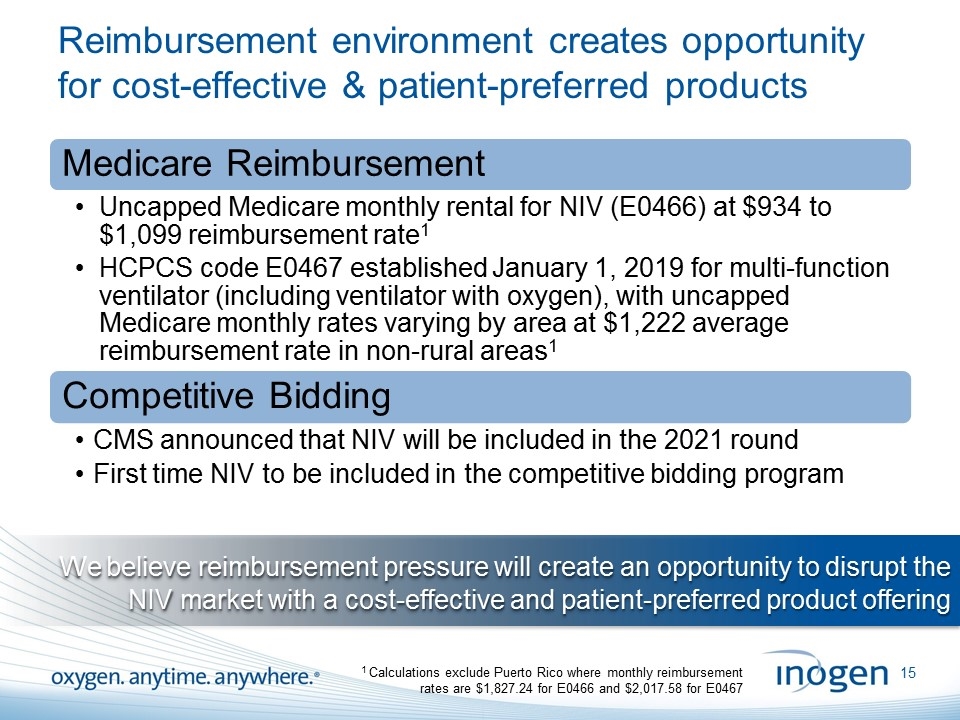

Reimbursement environment creates opportunity for cost-effective & patient-preferred products 1 Calculations exclude Puerto Rico where monthly reimbursement rates are $1,827.24 for E0466 and $2,017.58 for E0467 We believe reimbursement pressure will create an opportunity to disrupt the NIV market with a cost-effective and patient-preferred product offering Medicare Reimbursement Uncapped Medicare monthly rental for NIV (E0466) at $934 to $1,099 reimbursement rate 1 Competitive Bidding CMS announced that NIV will be included in the 2021 round HCPCS code E0467 established January 1, 2019 for multi-function ventilator (including ventilator with oxygen), with uncapped Medicare monthly rates varying by area at $1,222 average reimbursement rate in non-rural areas 1 First time NIV to be included in the competitive bidding program

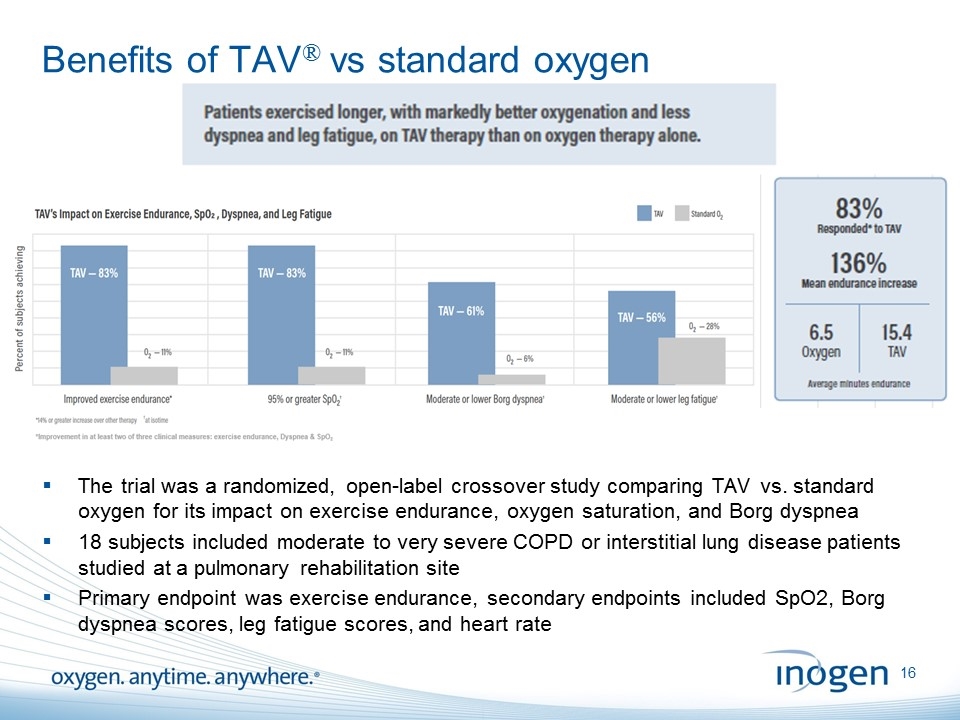

Benefits of TAV® vs standard oxygen The trial was a randomized, open-label crossover study comparing TAV vs. standard oxygen for its impact on exercise endurance, oxygen saturation, and Borg dyspnea 18 subjects included moderate to very severe COPD or interstitial lung disease patients studied at a pulmonary rehabilitation site Primary endpoint was exercise endurance, secondary endpoints included SpO2, Borg dyspnea scores, leg fatigue scores, and heart rate

Company highlights Market leader in large, global, underpenetrated market DTC model enables innovation and customer access Differentiated product portfolio with commitment to R&D Seasoned management team with proven track record Attractive financial profile

Proprietary and Confidential

Supplemental Information September 2019

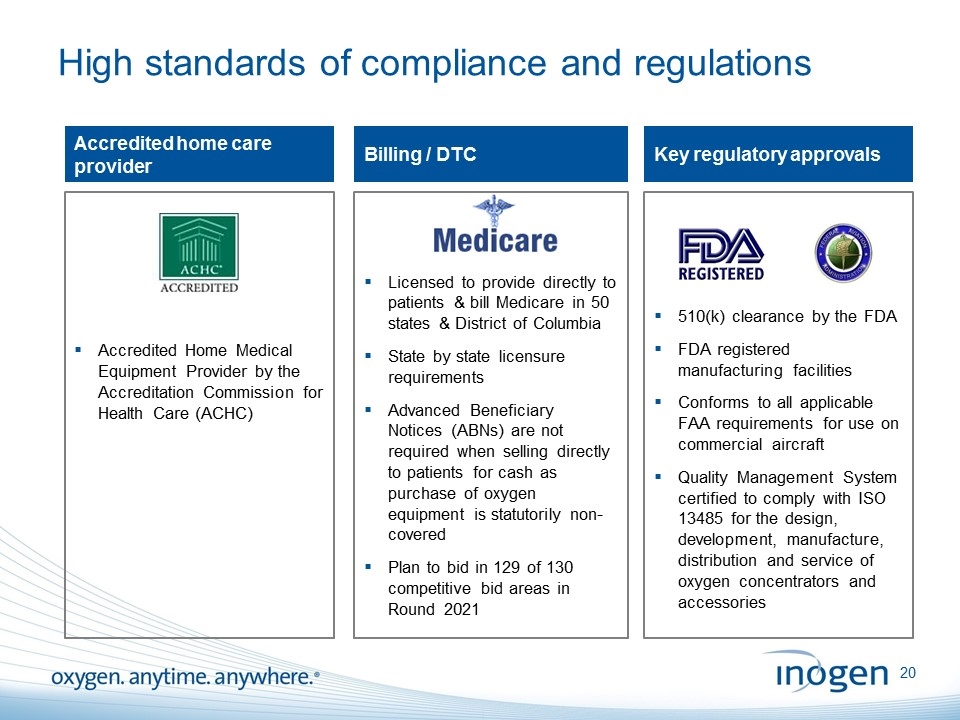

510(k) clearance by the FDA FDA registered manufacturing facilities Conforms to all applicable FAA requirements for use on commercial aircraft Quality Management System certified to comply with ISO 13485 for the design, development, manufacture, distribution and service of oxygen concentrators and accessories Licensed to provide directly to patients & bill Medicare in 50 states & District of Columbia State by state licensure requirements Advanced Beneficiary Notices (ABNs) are not required when selling directly to patients for cash as purchase of oxygen equipment is statutorily non-covered Plan to bid in 129 of 130 competitive bid areas in Round 2021 Accredited Home Medical Equipment Provider by the Accreditation Commission for Health Care (ACHC) High standards of compliance and regulations Accredited home care provider Billing / DTC Key regulatory approvals

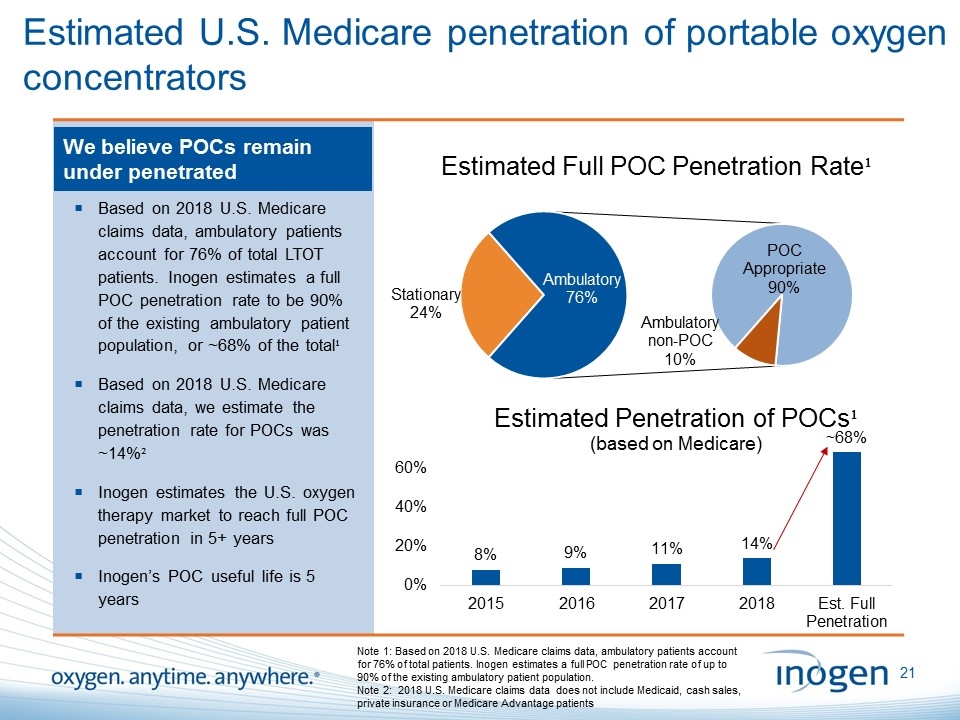

Estimated U.S. Medicare penetration of portable oxygen concentrators We believe POCs remain under penetrated Based on 2018 U.S. Medicare claims data, ambulatory patients account for 76% of total LTOT patients. Inogen estimates a full POC penetration rate to be 90% of the existing ambulatory patient population, or ~68% of the total¹ Based on 2018 U.S. Medicare claims data, we estimate the penetration rate for POCs was ~14%² Inogen estimates the U.S. oxygen therapy market to reach full POC penetration in 5+ years Inogen’s POC useful life is 5 years Note 1: Based on 2018 U.S. Medicare claims data, ambulatory patients account for 76% of total patients. Inogen estimates a full POC penetration rate of up to 90% of the existing ambulatory patient population. Note 2: 2018 U.S. Medicare claims data does not include Medicaid, cash sales, private insurance or Medicare Advantage patients Estimated Full POC Penetration Rate¹ Stationary 24% POC Appropriate 90% Ambulatory non - POC 10% Ambulatory 76% 8% 9% 11% 14% ~68% 0% 20% 40% 60% 2015 2016 2017 2018 Est. Full Penetration Estimated Penetration of POCs ¹ (based on Medicare)

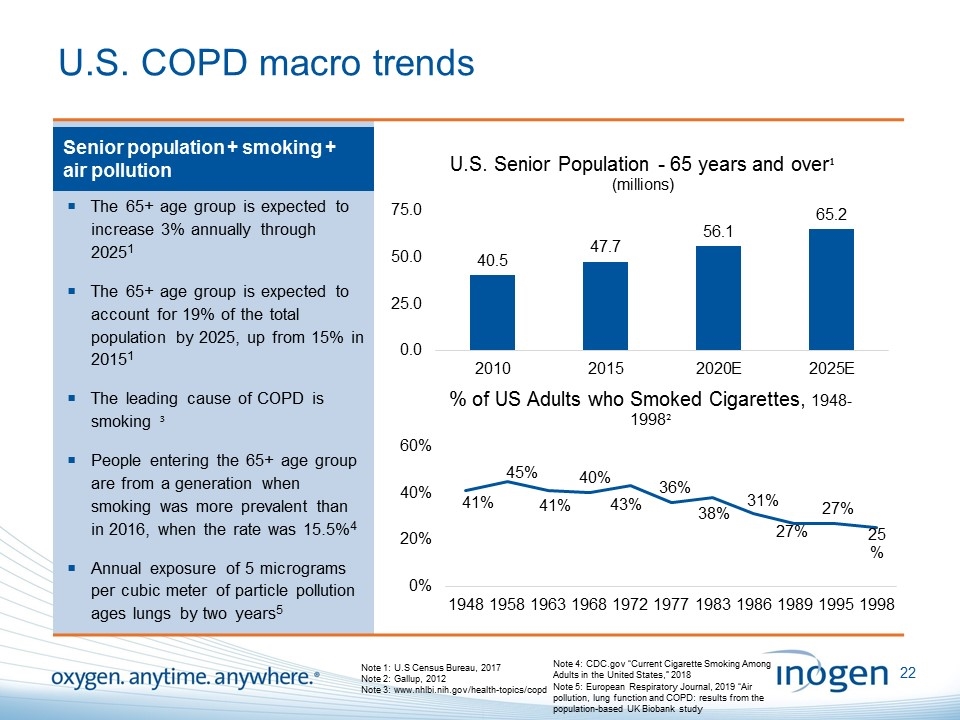

U.S. COPD macro trends Senior population + smoking + air pollution The 65+ age group is expected to increase 3% annually through 20251 The 65+ age group is expected to account for 19% of the total population by 2025, up from 15% in 20151 The leading cause of COPD is smoking ³ People entering the 65+ age group are from a generation when smoking was more prevalent than in 2016, when the rate was 15.5%4 Annual exposure of 5 micrograms per cubic meter of particle pollution ages lungs by two years5 Note 1: U.S Census Bureau, 2017 Note 2: Gallup, 2012 Note 3: www.nhlbi.nih.gov/health-topics/copd Note 4: CDC.gov “Current Cigarette Smoking Among Adults in the United States,” 2018 Note 5: European Respiratory Journal, 2019 “Air pollution, lung function and COPD: results from the population-based UK Biobank study 40.5 47.7 56.1 65.2 0.0 25.0 50.0 75.0 2010 2015 2020E 2025E U.S. Senior Population - 65 years and over ¹ (millions) 41% 45% 41% 40% 43% 36% 38% 31% 27% 27% 25% 0% 10% 20% 30% 40% 50% 60% 1948 1958 1963 1968 1972 1977 1983 1986 1989 1995 1998 % of US Adults who Smoked Cigarettes, 1948 - 1998 ²

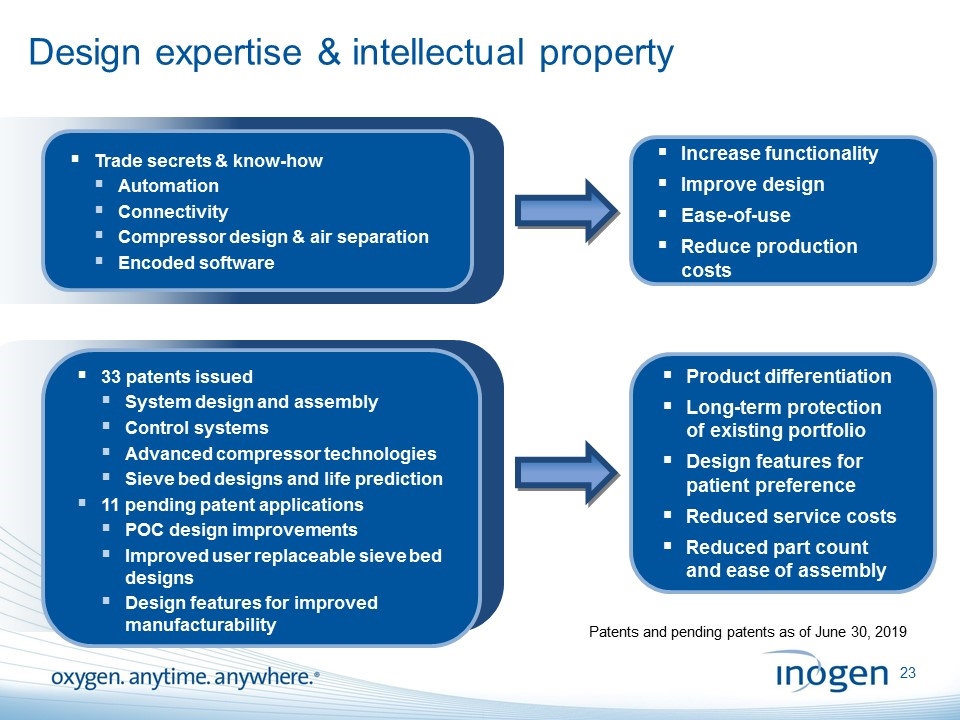

Design expertise & intellectual property 33 patents issued System design and assembly Control systems Advanced compressor technologies Sieve bed designs and life prediction 11 pending patent applications POC design improvements Improved user replaceable sieve bed designs Design features for improved manufacturability Trade secrets & know-how Automation Connectivity Compressor design & air separation Encoded software Product differentiation Long-term protection of existing portfolio Design features for patient preference Reduced service costs Reduced part count and ease of assembly Increase functionality Improve design Ease-of-use Reduce production costs Patents and pending patents as of June 30, 2019

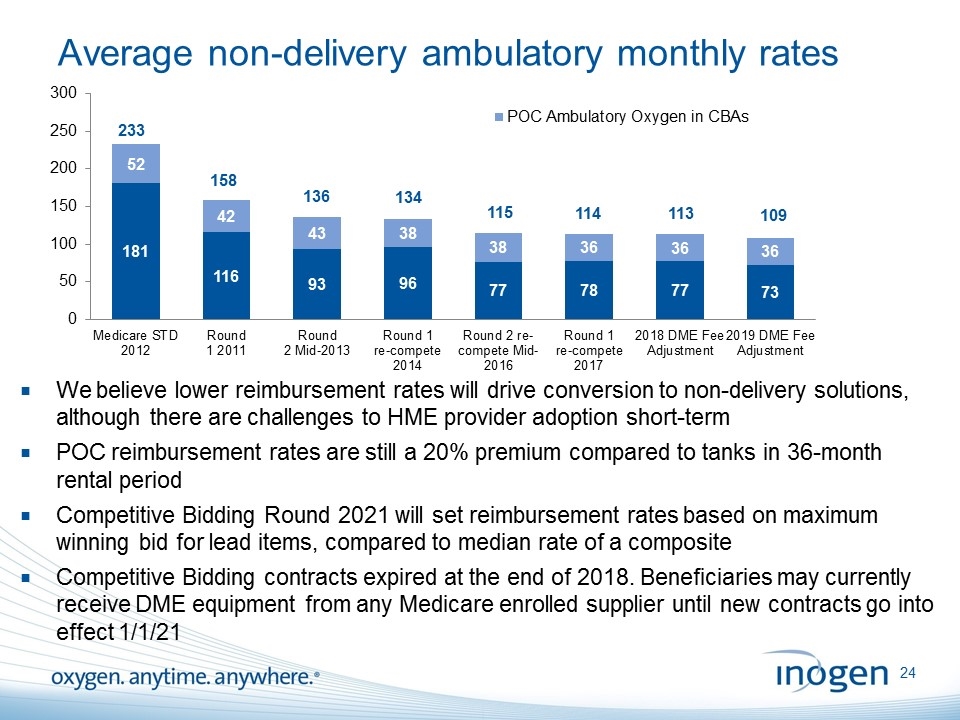

Average non-delivery ambulatory monthly rates 233 136 134 We believe lower reimbursement rates will drive conversion to non-delivery solutions, although there are challenges to HME provider adoption short-term POC reimbursement rates are still a 20% premium compared to tanks in 36-month rental period Competitive Bidding Round 2021 will set reimbursement rates based on maximum winning bid for lead items, compared to median rate of a composite Competitive Bidding contracts expired at the end of 2018. Beneficiaries may currently receive DME equipment from any Medicare enrolled supplier until new contracts go into effect 1/1/21 158 115 114 113 109 181 116 93 96 77 78 77 73 52 42 43 38 38 36 36 36 0 50 100 150 200 250 300 Medicare STD 2012 Round 1 2011 Round 2 Mid-2013 Round 1 re-compete 2014 Round 2 re- compete Mid- 2016 Round 1 re-compete 2017 2018 DME Fee Adjustment 2019 DME Fee Adjustment POC Ambulatory Oxygen in CBAs Stationary/Nocturnal Oxygen in CBAs

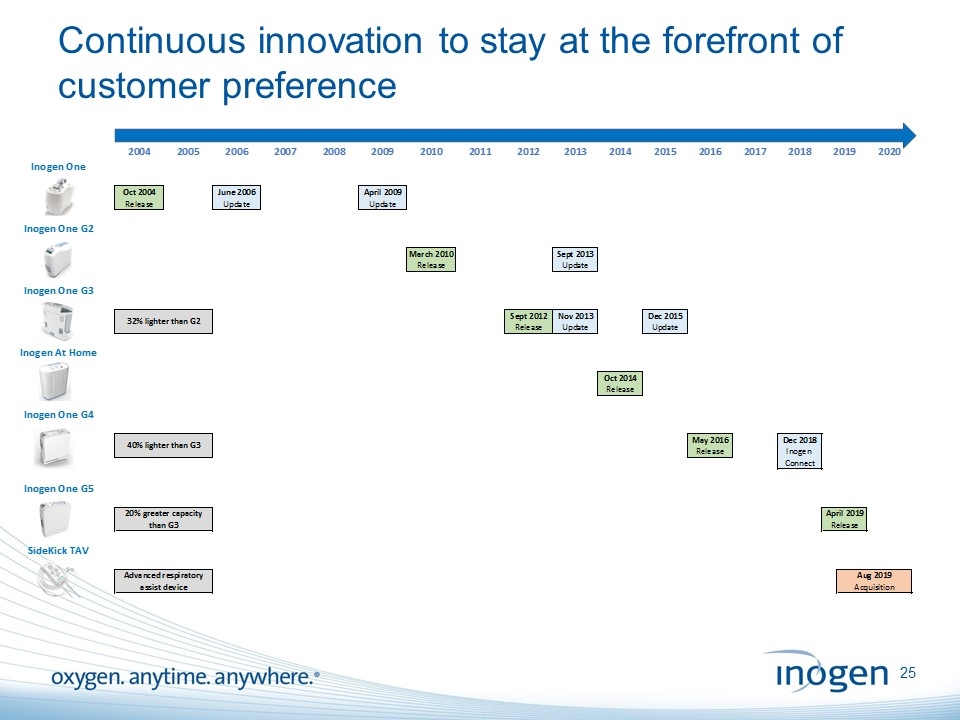

Continuous innovation to stay at the forefront of customer preference 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Inogen one Oct 2004 June 2006 April 2009 Release Update Update Inogen one G2 March 2010 Sept 2013 Release Update Inogen One G3 Sept 2012 Nov 2013 Dec 2015 32% lighter than G2 Release Update Update Inogen at home Oct 2014 Release Inogen One G4 May 2016 Dec 2018 40% lighter than G3 Release Inogen Connect Inogen one G5 20% greater capacity April 2019 than G3 Release Sidekick TAV Advanced respiratory Aug 2019 assist device Acquisition

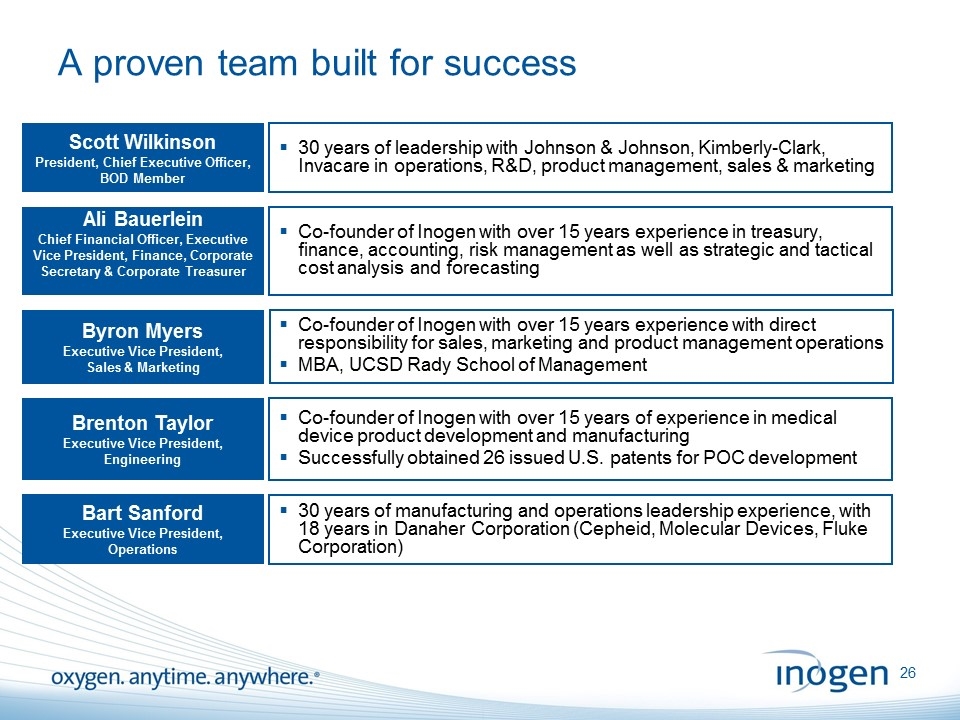

A proven team built for success Ali Bauerlein Chief Financial Officer, Executive Vice President, Finance, Corporate Secretary & Corporate Treasurer Scott Wilkinson President, Chief Executive Officer, BOD Member Co-founder of Inogen with over 15 years experience in treasury, finance, accounting, risk management as well as strategic and tactical cost analysis and forecasting 30 years of leadership with Johnson & Johnson, Kimberly-Clark, Invacare in operations, R&D, product management, sales & marketing Bart Sanford Executive Vice President, Operations 30 years of manufacturing and operations leadership experience, with 18 years in Danaher Corporation (Cepheid, Molecular Devices, Fluke Corporation) Brenton Taylor Executive Vice President, Engineering Co-founder of Inogen with over 15 years of experience in medical device product development and manufacturing Successfully obtained 26 issued U.S. patents for POC development Byron Myers Executive Vice President, Sales & Marketing Co-founder of Inogen with over 15 years experience with direct responsibility for sales, marketing and product management operations MBA, UCSD Rady School of Management

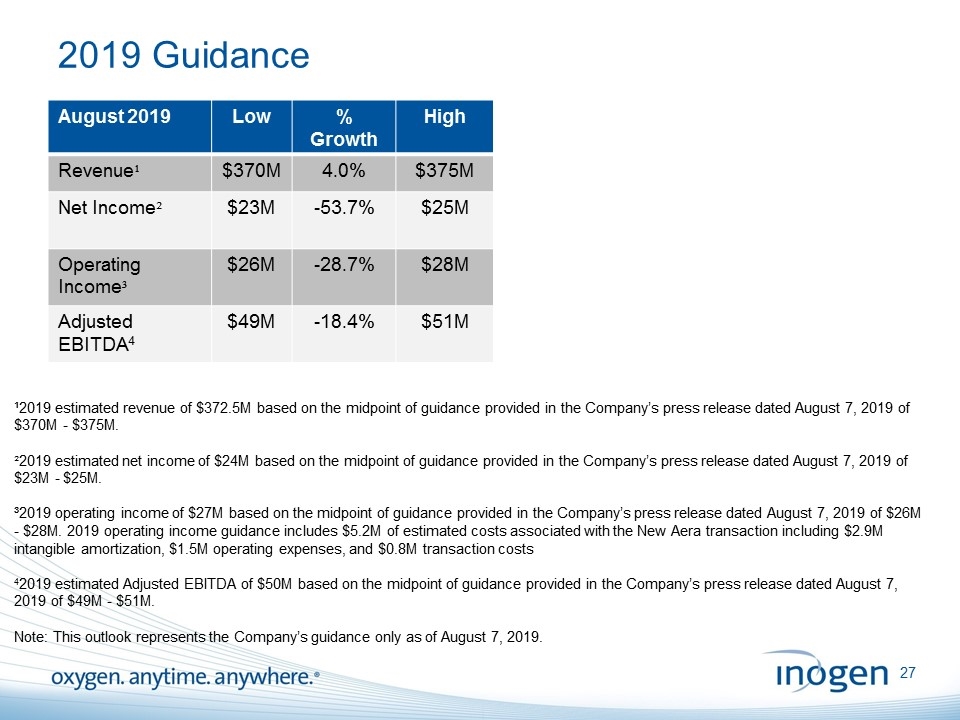

2019 Guidance ¹2019 estimated revenue of $372.5M based on the midpoint of guidance provided in the Company’s press release dated August 7, 2019 of $370M - $375M. ²2019 estimated net income of $24M based on the midpoint of guidance provided in the Company’s press release dated August 7, 2019 of $23M - $25M. ³2019 operating income of $27M based on the midpoint of guidance provided in the Company’s press release dated August 7, 2019 of $26M - $28M. 2019 operating income guidance includes $5.2M of estimated costs associated with the New Aera transaction including $2.9M intangible amortization, $1.5M operating expenses, and $0.8M transaction costs 42019 estimated Adjusted EBITDA of $50M based on the midpoint of guidance provided in the Company’s press release dated August 7, 2019 of $49M - $51M. Note: This outlook represents the Company’s guidance only as of August 7, 2019. August 2019 Low % Growth High Revenue¹ $370M 4.0% $375M Net Income² $23M -53.7% $25M Operating Income³ $26M -28.7% $28M Adjusted EBITDA4 $49M -18.4% $51M