Inogen, Inc. Overview 40th Annual J.P. Morgan HealthCare Conference January 12, 2022 Exhibit 99.2

Notice Regarding Forward-Looking Statements These slides and the accompanying oral presentation (the “Presentation”) include forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, which are based on current expectations, estimates and projections based on information currently available to management. These forward-looking statements include, among others, statements relating to our business strategy; expected fourth quarter and full year 2021 revenue, as well as future revenue growth and expected profitability; our expectations regarding changing reimbursement rates on both our rental revenue and the oxygen therapy market generally; the size and estimates of growth in the oxygen therapy market; our estimates concerning market penetration; our expectation regarding market headwinds and the impact on HME providers; our expectations regarding the impact of the COVID-19 pandemic on our business and demand for our products; expectations with respect to the Company’s supply chain, including the availability of semiconductor chips used in its batteries and POCs; our hiring expectations; product development; expectations related to the Company’s rental strategy and overall growth prospects. All statements other than statements of historical facts contained in this Presentation, including statements regarding our future results of operations and financial position, business strategy, prospective products, plans and objectives of management for future operations, and future results of current and anticipated products are forward-looking statements. Forward-looking statements are typically identified by words like “believe,” “anticipate,” “could,” “should,” “estimate,” “expect,” “intend,” “plan,” “project,” “will,” “forecast,” “budget,” “pro forma,” and similar terms. Forward-looking statements are subject to numerous risks and uncertainties that could cause actual results to differ materially from currently anticipated results, including but not limited to, risks arising from the possibility that we will not realize anticipated revenue; the impact of reduced reimbursement rates; the possible loss of key employees, customers, or suppliers; risks related to regulatory clearance and our ability to sell our products; and intellectual property risks if we are unable to secure and maintain patent or other intellectual property protection for the intellectual property used in our products. In addition, our business is subject to numerous additional risks and uncertainties, including, among others, risks relating to market acceptance of our products; our ability to successfully launch new products and applications; competition; our sales, marketing and distribution capabilities; our planned sales, marketing, and research and development activities; interruptions or delays in the supply of components or materials for, or manufacturing of, our products; seasonal variations; unanticipated increases in costs or expenses; and risks associated with international operations. The known risks and uncertainties are described in detail under the caption “Risk Factors” and elsewhere in our Annual Report on Form 10-K for the year ended December 31, 2020. Additional information is also set forth in our Quarterly Report on Form 10-Q for the period ended September 30, 2021 and our subsequent reports filed with the Securities and Exchange Commission, or SEC. Accordingly, our actual results may materially differ from our current expectations, estimates and projections. Unless otherwise specified herein, forward-looking statements represent our management’s beliefs and assumptions only as of our January 10, 2022 earnings release, and we undertake no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by applicable law. For more complete information about Inogen, Inc., please read our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and other documents that we have filed and may file from time to time with the SEC. These documents can be obtained by visiting EDGAR on the SEC Web site at www.sec.gov. Certain financial data for 2021 included in this Presentation is based off our preliminary, unaudited estimates. Inogen is in the process of finalizing its results of operations for the year ended December 31, 2021, and therefore, final results are not yet available. These preliminary estimates are based solely upon information available to management as of the date of this Presentation. Inogen’s actual results may differ from these estimates due to the completion of its year-end closing procedures, final adjustments and developments that may arise between now and the time its financial results for the year ended December 31, 2021 are finalized. You should read Inogen’s audited consolidated financial statements for the year ended December 31, 2021 once they become available.

2 A global oxygen therapy medical device company Favorable demographic and market trends An accredited HME with significant patient reach Executing on strategic transformation to capitalize on strong foundation, market position and drive growth and value Attractive financial position with opportunity to support revenue growth, and return to profitability in medium term World class leadership team with proven track record

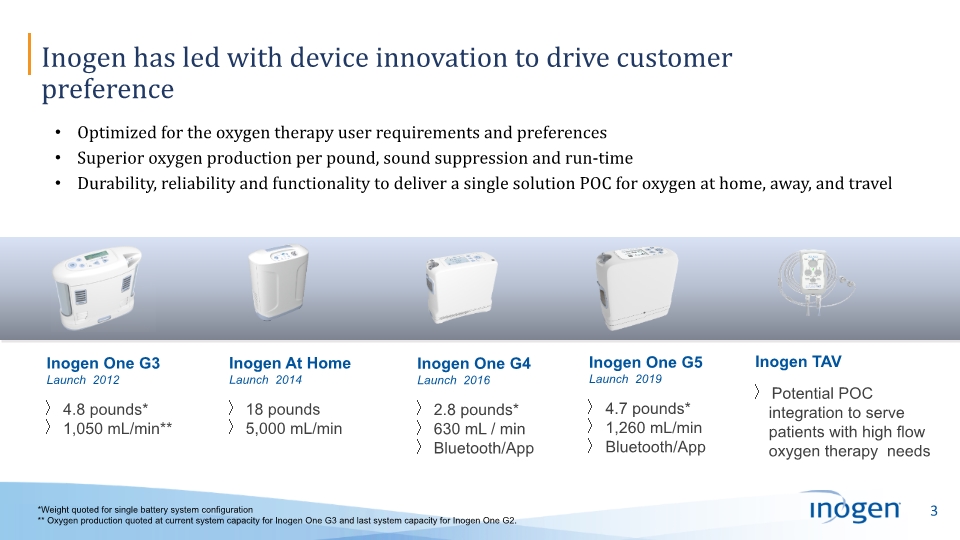

Inogen has led with device innovation to drive customer preference Optimized for the oxygen therapy user requirements and preferences Superior oxygen production per pound, sound suppression and run-time Durability, reliability and functionality to deliver a single solution POC for oxygen at home, away, and travel Inogen One G3 Launch 2012 4.8 pounds* 1,050 mL/min** Inogen At Home Launch 2014 18 pounds 5,000 mL/min Inogen One G4 Launch 2016 2.8 pounds* 630 mL / min Bluetooth/App Inogen One G5 Launch 2019 4.7 pounds* 1,260 mL/min Bluetooth/App Inogen TAV Potential POC integration to serve patients with high flow oxygen therapy needs *Weight quoted for single battery system configuration ** Oxygen production quoted at current system capacity for Inogen One G3 and last system capacity for Inogen One G2.

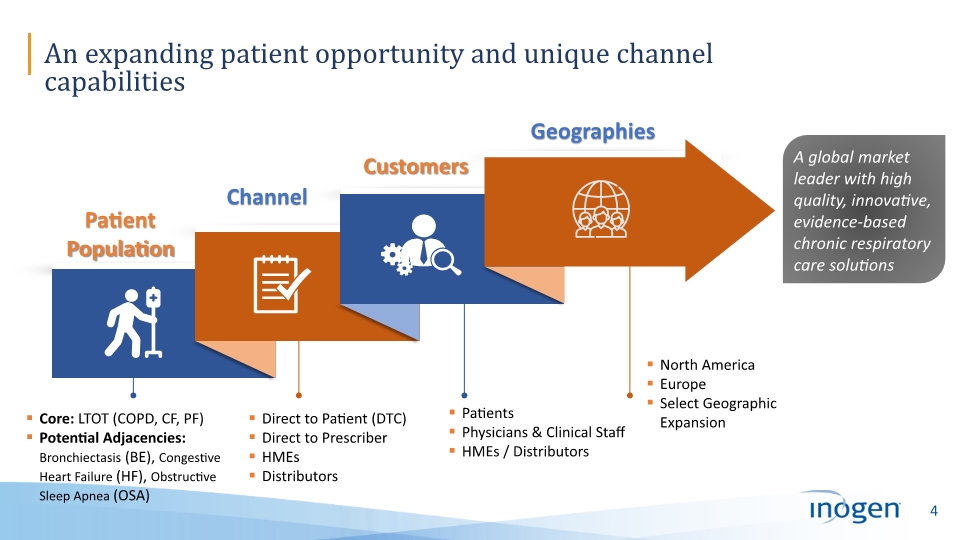

An expanding patient opportunity and unique channel capabilities A global market leader with high quality, innovative, evidence-based chronic respiratory care solutions

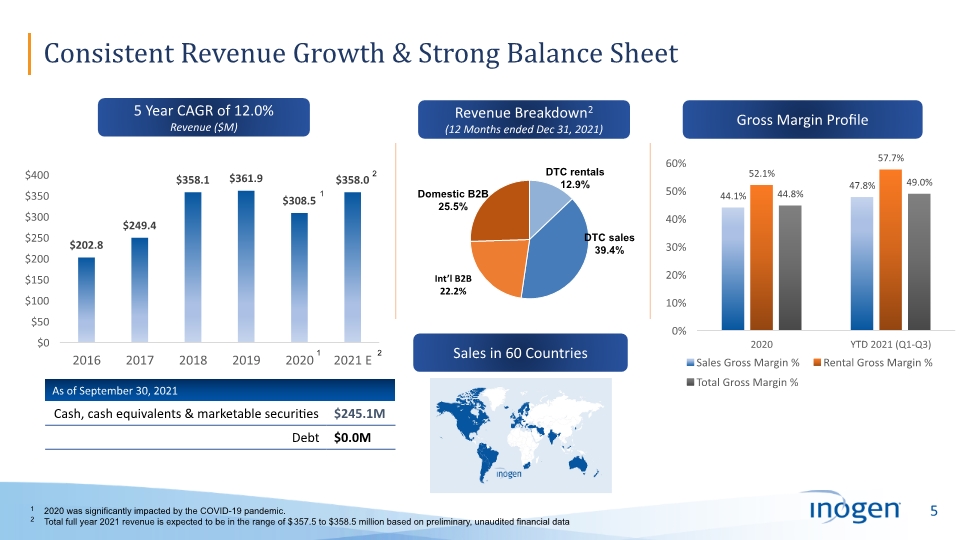

Consistent Revenue Growth & Strong Balance Sheet 1 2020 was significantly impacted by the COVID-19 pandemic. 2 Total full year 2021 revenue is expected to be in the range of $357.5 to $358.5 million based on preliminary, unaudited financial data 1 1 Revenue Breakdown2 (12 Months ended Dec 31, 2021) Sales in 60 Countries 5 Year CAGR of 12.0% Revenue ($M) Gross Margin Profile 2 2

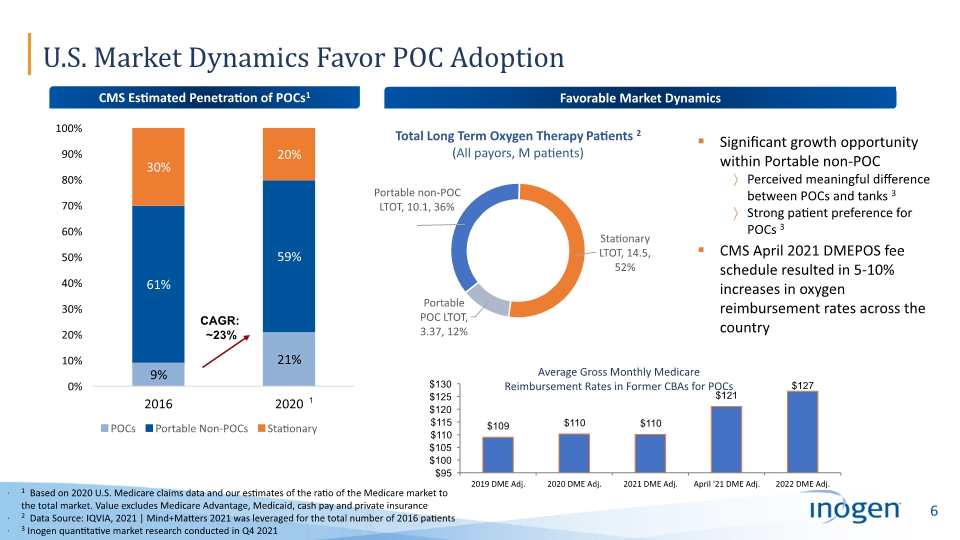

U.S. Market Dynamics Favor POC Adoption 1 Based on 2020 U.S. Medicare claims data and our estimates of the ratio of the Medicare market to the total market. Value excludes Medicare Advantage, Medicaid, cash pay and private insurance 2 Data Source: IQVIA, 2021 | Mind+Matters 2021 was leveraged for the total number of 2016 patients 3 Inogen quantitative market research conducted in Q4 2021 CMS Estimated Penetration of POCs1 Average Gross Monthly Medicare Reimbursement Rates in Former CBAs for POCs Favorable Market Dynamics CAGR: ~23% 1 Significant growth opportunity within Portable non-POC Perceived meaningful difference between POCs and tanks 3 Strong patient preference for POCs 3 CMS April 2021 DMEPOS fee schedule resulted in 5-10% increases in oxygen reimbursement rates across the country

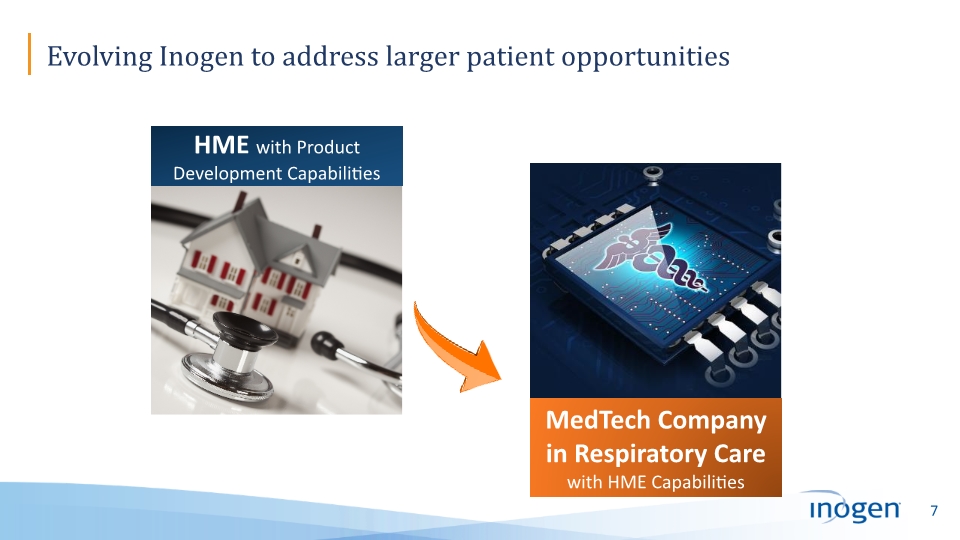

Evolving Inogen to address larger patient opportunities

Strengthen the Fundamentals Unlock Existing Growth Potential in the Core Business Accelerate Growth & Diversify the Portfolio through Strategic Transactions A Strategic Evolution: Strengthen, stabilize, and grow

Significant progress over past year in strengthening overall capabilities Strengthening fundamentals and laying the foundation for growth

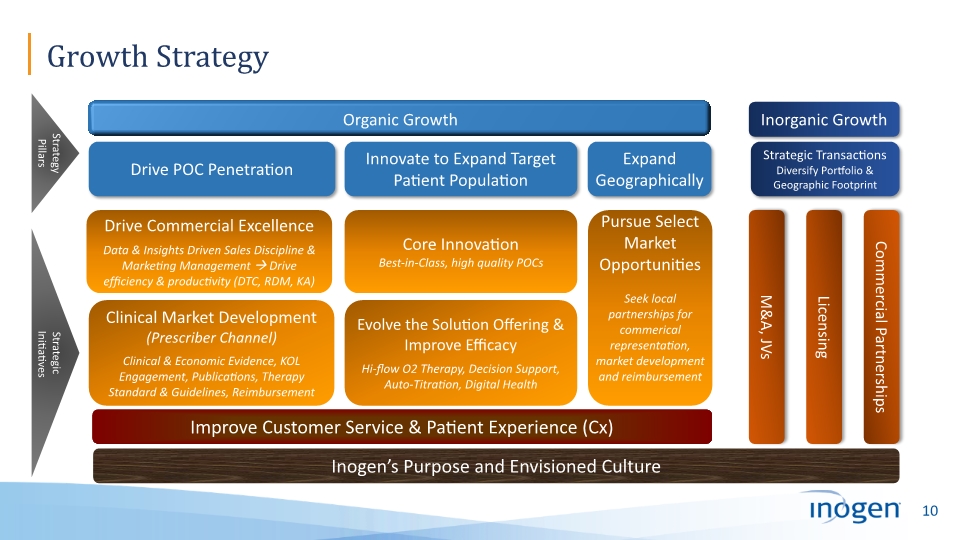

Growth Strategy Drive POC Penetration Clinical Market Development (Prescriber Channel) Clinical & Economic Evidence, KOL Engagement, Publications, Therapy Standard & Guidelines, Reimbursement Expand Geographically Organic Growth Drive Commercial Excellence Data & Insights Driven Sales Discipline & Marketing Management Drive efficiency & productivity (DTC, RDM, KA) Improve Customer Service & Patient Experience (Cx) Strategic Initiatives Strategy Pillars Pursue Select Market Opportunities Seek local partnerships for commerical representation, market development and reimbursement Inogen’s Purpose and Envisioned Culture

Patient Channel: Drive Commercial Excellence Improve productivity, shorten sales cycle, and accelerate conversion rates

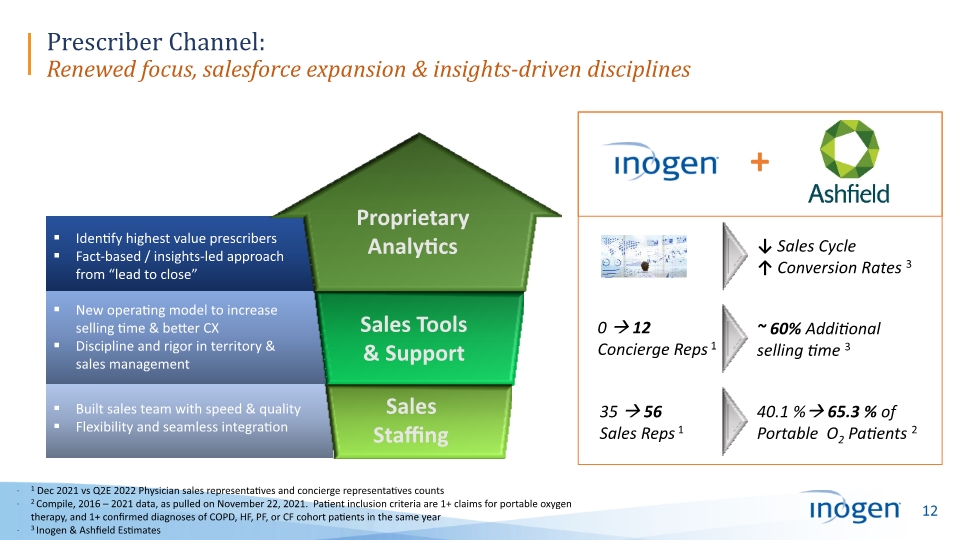

35 56 Sales Reps 1 1 Dec 2021 vs Q2E 2022 Physician sales representatives and concierge representatives counts 2 Compile, 2016 – 2021 data, as pulled on November 22, 2021. Patient inclusion criteria are 1+ claims for portable oxygen therapy, and 1+ confirmed diagnoses of COPD, HF, PF, or CF cohort patients in the same year 3 Inogen & Ashfield Estimates 40.1 % 65.3 % of Portable O2 Patients 2 0 12 Concierge Reps 1 ~ 60% Additional selling time 3 Prescriber Channel: Renewed focus, salesforce expansion & insights-driven disciplines ↓ Sales Cycle ↑ Conversion Rates 3 +

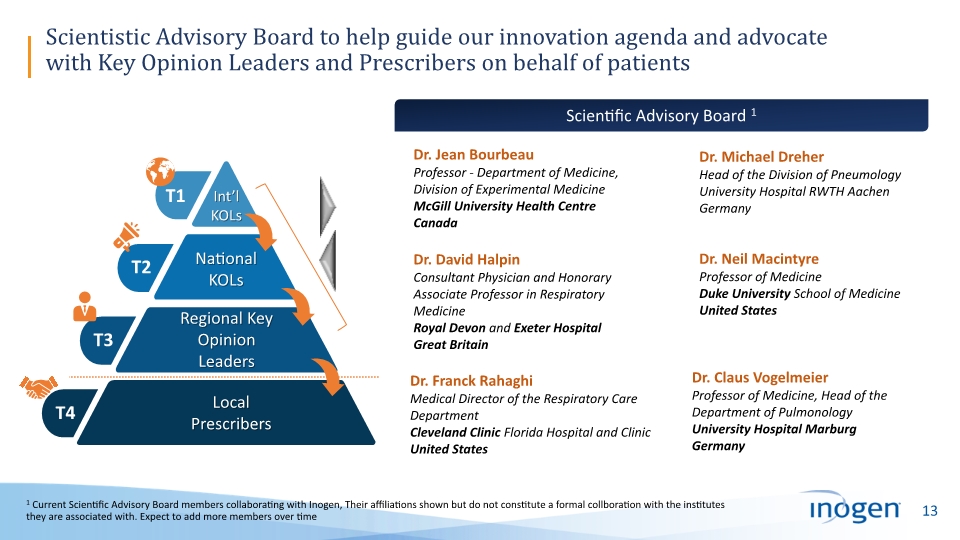

Scientistic Advisory Board to help guide our innovation agenda and advocate with Key Opinion Leaders and Prescribers on behalf of patients Scientific Advisory Board 1 1 Current Scientific Advisory Board members collaborating with Inogen, Their affiliations shown but do not constitute a formal collboration with the institutes they are associated with. Expect to add more members over time Dr. Jean Bourbeau Professor - Department of Medicine, Division of Experimental Medicine McGill University Health Centre Canada Dr. Michael Dreher Head of the Division of Pneumology University Hospital RWTH Aachen Germany Dr. David Halpin Consultant Physician and Honorary Associate Professor in Respiratory Medicine Royal Devon and Exeter Hospital Great Britain Dr. Neil Macintyre Professor of Medicine Duke University School of Medicine United States Dr. Franck Rahaghi Medical Director of the Respiratory Care Department Cleveland Clinic Florida Hospital and Clinic United States Dr. Claus Vogelmeier Professor of Medicine, Head of the Department of Pulmonology University Hospital Marburg Germany

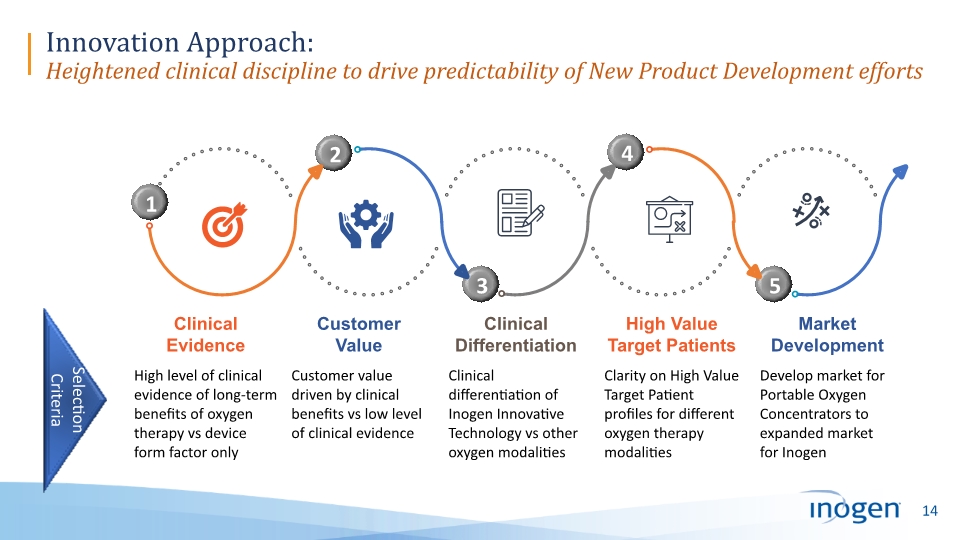

Innovation Approach: Heightened clinical discipline to drive predictability of New Product Development efforts 3 1 2 4 5 High level of clinical evidence of long-term benefits of oxygen therapy vs device form factor only Customer value driven by clinical benefits vs low level of clinical evidence Clinical differentiation of Inogen Innovative Technology vs other oxygen modalities Clarity on High Value Target Patient profiles for different oxygen therapy modalities Develop market for Portable Oxygen Concentrators to expanded market for Inogen Clinical Evidence Customer Value Clinical Differentiation High Value Target Patients Market Development Selection Criteria

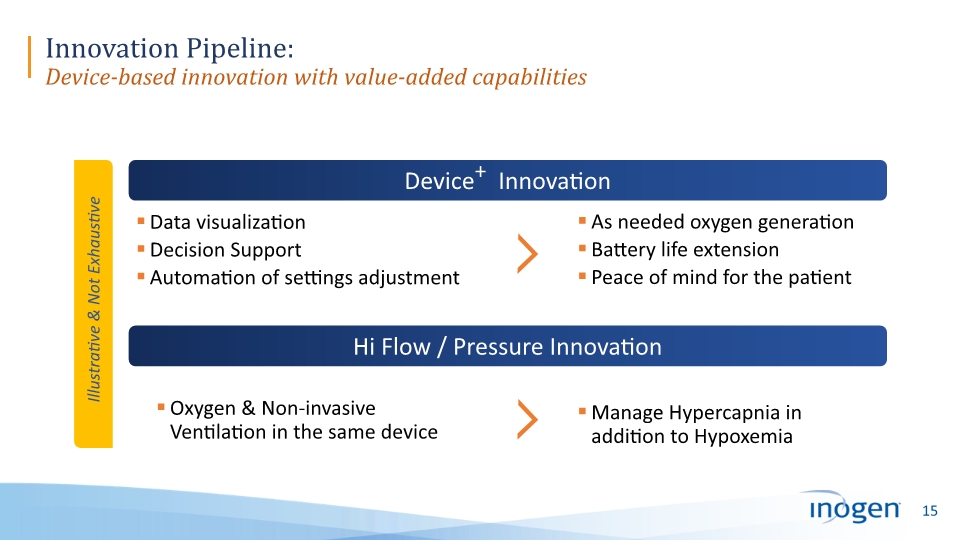

Innovation Pipeline: Device-based innovation with value-added capabilities Device+ Innovation Data visualization Decision Support Automation of settings adjustment As needed oxygen generation Battery life extension Peace of mind for the patient Hi Flow / Pressure Innovation Oxygen & Non-invasive Ventilation in the same device Manage Hypercapnia in addition to Hypoxemia Illustrative & Not Exhaustive

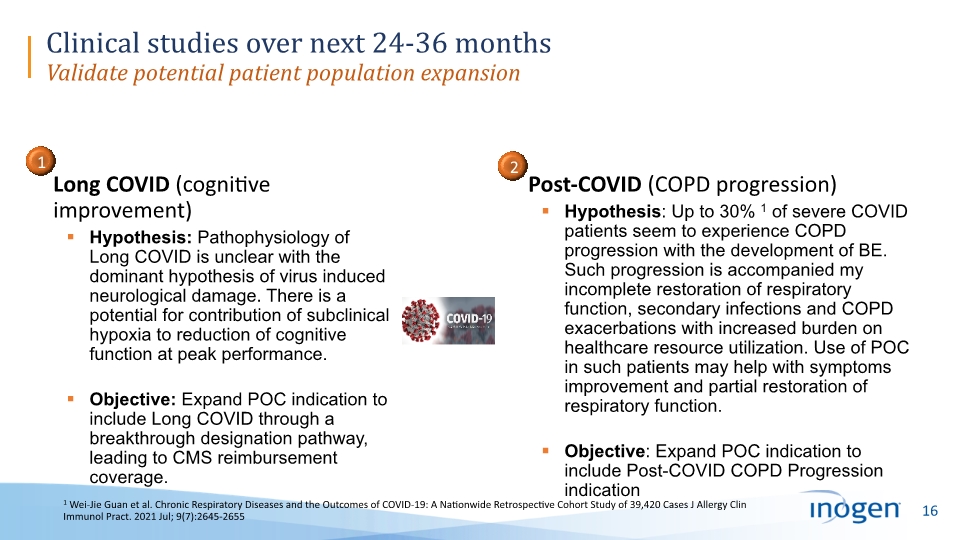

Clinical studies over next 24-36 months Validate potential patient population expansion Long COVID (cognitive improvement) Hypothesis: Pathophysiology of Long COVID is unclear with the dominant hypothesis of virus induced neurological damage. There is a potential for contribution of subclinical hypoxia to reduction of cognitive function at peak performance. Objective: Expand POC indication to include Long COVID through a breakthrough designation pathway, leading to CMS reimbursement coverage. 1 Post-COVID (COPD progression) Hypothesis: Up to 30% 1 of severe COVID patients seem to experience COPD progression with the development of BE. Such progression is accompanied my incomplete restoration of respiratory function, secondary infections and COPD exacerbations with increased burden on healthcare resource utilization. Use of POC in such patients may help with symptoms improvement and partial restoration of respiratory function. Objective: Expand POC indication to include Post-COVID COPD Progression indication 2 1 Wei-Jie Guan et al. Chronic Respiratory Diseases and the Outcomes of COVID-19: A Nationwide Retrospective Cohort Study of 39,420 Cases J Allergy Clin Immunol Pract. 2021 Jul; 9(7):2645-2655

17 A strong management team with proven track record 30+ years of leadership with Becton Dickinson, SC Johnson / Diversey, and in various pharmaceutical and consumer goods companies. Extensive experience in running global businesses, accelerating growth through portfolio innovation, solution and market development, commercial strategies and execution, and organizational transformation 40+ years experience in treasury, finance, accounting, risk management, and investor relations at Kimball Electronics 29+ years of experience leading commercial organizations, driving innovation, managing strategic accounts, building strong product portfolios and brands, and delivering exceptional customer experience globally in healthcare, consumer and industrial industries with Becton Dickinson, SC Johnson / Diversey and private equity portfolio companies. 30+ years of manufacturing and operations leadership experience, with 18 years in Danaher Corporation (Cepheid, Molecular Devices, Fluke Corporation) 30+ years of corporate leadership experience with Zeiss, Invitrogen / Life Technologies, and Alaris Medical Systems in Human Resources and Commercial Operations 25+ years of medical affairs experience with Becton Dickinson, Adocia S.A., Novo Nordisk, Inc., and Sanofi S.A. Doctor of medicine from Moscow State University of Medicine and Dentistry and an MBA from California Coast University. Experienced General Counsel with 20 years’ experience working with public and private companies in securities, M&A, corporate governance, compliance, commercial contracting, IP management and litigation management. Managed legal departments in Canada, Europe and China. Nabil Shabshab President, Chief Executive Officer, BOD Member Mike Sergesketter Interim Chief Financial Officer, Executive Vice President, Finance & Corporate Treasurer George Parr Executive Vice President, Chief Commercial Officer Bart Sanford Executive Vice President, Operations Jim Runchey Executive Vice President, Human Resources Dr. Stanislav Glezer Executive Vice President, Chief Technology Officer Jason Somer Executive Vice President, General Counsel & Corporate Secretary

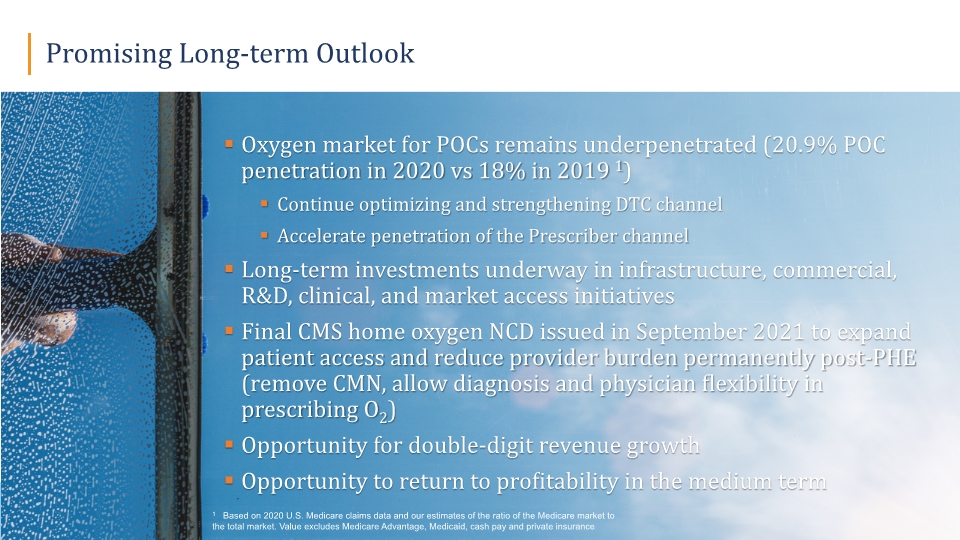

Promising Long-term Outlook Oxygen market for POCs remains underpenetrated (20.9% POC penetration in 2020 vs 18% in 2019 1) Continue optimizing and strengthening DTC channel Accelerate penetration of the Prescriber channel Long-term investments underway in infrastructure, commercial, R&D, clinical, and market access initiatives Final CMS home oxygen NCD issued in September 2021 to expand patient access and reduce provider burden permanently post-PHE (remove CMN, allow diagnosis and physician flexibility in prescribing O2) Opportunity for double-digit revenue growth Opportunity to return to profitability in the medium term 1 Based on 2020 U.S. Medicare claims data and our estimates of the ratio of the Medicare market to the total market. Value excludes Medicare Advantage, Medicaid, cash pay and private insurance

19 Improving lives through respiratory care