Exhibit 10.1

LEASE AGREEMENT

by and between

CLEVELAND AMERICAN, LLC,

a Delaware limited liability company,

HOLDINGS CLEVELAND AMERICAN, LLC,

a Delaware limited liability company,

and

INOGEN, INC.,

a Delaware corporation

TABLE OF CONTENTS

|

Title |

|

|

Page |

|

|

|

|

|

|

LEASE SUMMARY |

|

1 |

|

|

1. |

PREMISES |

|

1 |

|

2. |

TERM |

|

3 |

|

3. |

RENT |

|

4 |

|

4. |

SECURITY DEPOSIT |

|

5 |

|

5. |

ADDITIONAL RENT |

|

6 |

|

6. |

PARKING |

|

10 |

|

7. |

PERMITTED USES |

|

10 |

|

8. |

ENVIRONMENTAL COMPLIANCE/HAZARDOUS MATERIALS |

|

11 |

|

9. |

UTILITIES |

|

13 |

|

10. |

REPAIRS BY LANDLORD |

|

13 |

|

11. |

REPAIRS BY TENANT |

|

14 |

|

12. |

TENANT’S TAXES AND ASSESSMENTS |

|

14 |

|

13. |

ALTERATION OF PREMISES |

|

15 |

|

14. |

INSURANCE |

|

17 |

|

15. |

WAIVER, EXCULPATION AND INDEMNITY |

|

19 |

|

16. |

CONSTRUCTION LIENS |

|

20 |

|

17. |

QUIET ENJOYMENT |

|

20 |

|

18. |

LANDLORD’S RIGHT OF ENTRY |

|

21 |

|

19. |

DESTRUCTION OF BUILDING |

|

21 |

|

20. |

EMINENT DOMAIN |

|

21 |

|

21. |

BANKRUPTCY |

|

22 |

|

22. |

DEFAULT |

|

22 |

|

23. |

SURRENDER OF PREMISES |

|

23 |

|

24. |

HOLDING OVER |

|

23 |

|

25. |

SURRENDER OF LEASE |

|

24 |

|

26. |

RULES AND REGULATIONS |

|

24 |

|

27. |

NOTICE |

|

24 |

|

28. |

ASSIGNMENT AND SUBLETTING |

|

25 |

|

29. |

ATTORNEYS’ FEES |

|

25 |

|

30. |

LITIGATION AND JUDGMENT COSTS |

|

25 |

|

31. |

BROKERS |

|

26 |

|

32. |

SUBORDINATION OF LEASE |

|

26 |

|

33. |

ESTOPPEL CERTIFICATES AND FINANCIAL STATEMENTS |

|

27 |

|

34. |

OPTION TO EXTEND |

|

27 |

|

35. |

RIGHT OF FIRST OFFER |

|

28 |

|

36. |

INTENTIONALLY DELETED |

|

29 |

|

37. |

INTENTIONALLY DELETED |

|

29 |

|

38. |

SIGNS |

|

29 |

|

39. |

INTENTIONALLY DELETED |

|

29 |

|

40. |

FORCE MAJEURE |

|

29 |

|

41. |

GENERAL PROVISIONS |

|

29 |

|

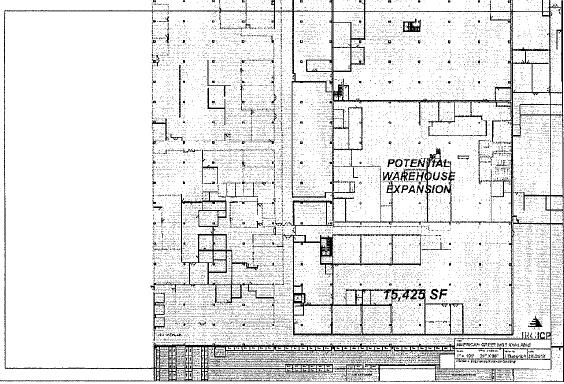

Exhibit A |

|

Premises |

|

Exhibit B-1 |

|

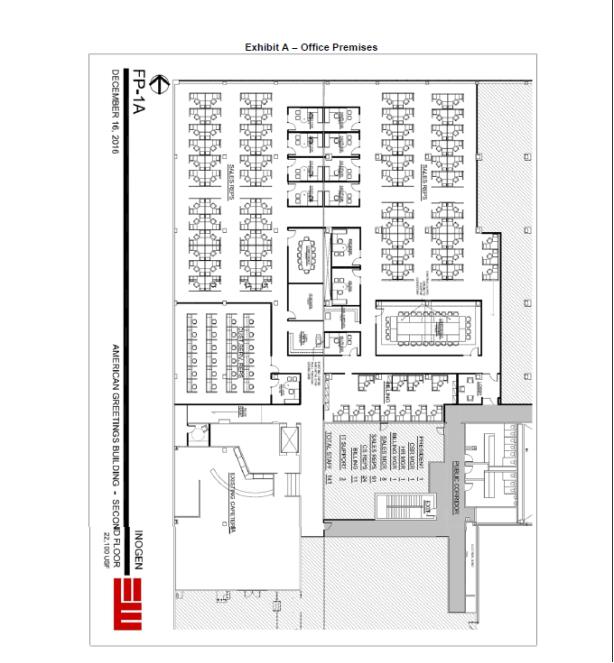

Potential Office Expansion Space |

|

Exhibit B-2 |

|

Office Increment – Base Rent Schedule |

|

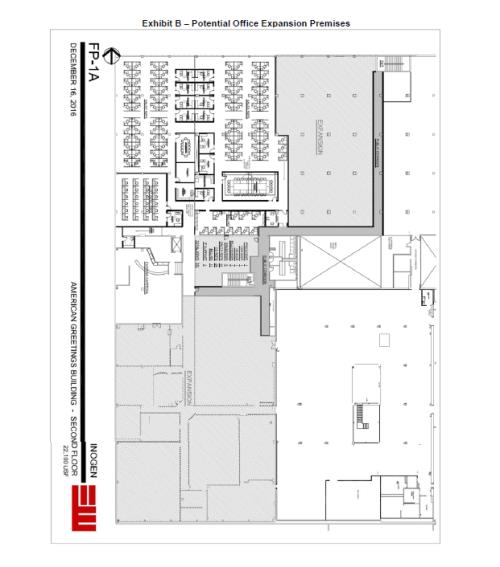

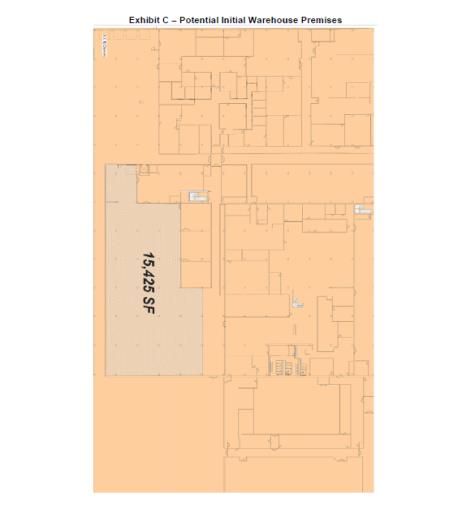

Exhibit C-1 |

|

Warehouse Space |

|

Exhibit C-2 |

|

Warehouse Space – Base Rent Schedule |

|

Exhibit C-3 |

|

Warehouse Space – Work |

|

Exhibit C-4 |

|

Potential Warehouse Expansion Space |

|

Exhibit D-1 |

|

Landlord’s Work |

|

Exhibit D-2 |

|

List of Landlord’s Work |

|

Exhibit D-3 |

|

Pre-Approved Initial Tenant Improvements |

|

Exhibit E |

|

Form of Lease Commencement Notice |

|

Exhibit F |

|

Exclusions from Office Common Expenses and Industrial Common Expenses |

|

Exhibit G |

|

Real Estate Commission Agreement |

|

|

|

|

Set forth below is a summary of certain terms and conditions of the Lease Agreement among Cleveland American, LLC, a Delaware limited liability company, and Holdings Cleveland American, LLC, a Delaware limited liability company, as Landlord, and Inogen, Inc., a Delaware corporation, as Tenant, solely for the convenience of the parties. In the event there is a conflict between this Lease Summary and the terms and conditions of the Lease Agreement, the terms and conditions of the Lease Agreement shall prevail.

|

A. |

Building means that certain multi-tenant building having the street address of 1 American Road, Cleveland, Ohio 44144. See Paragraph 1.1. |

|

B. |

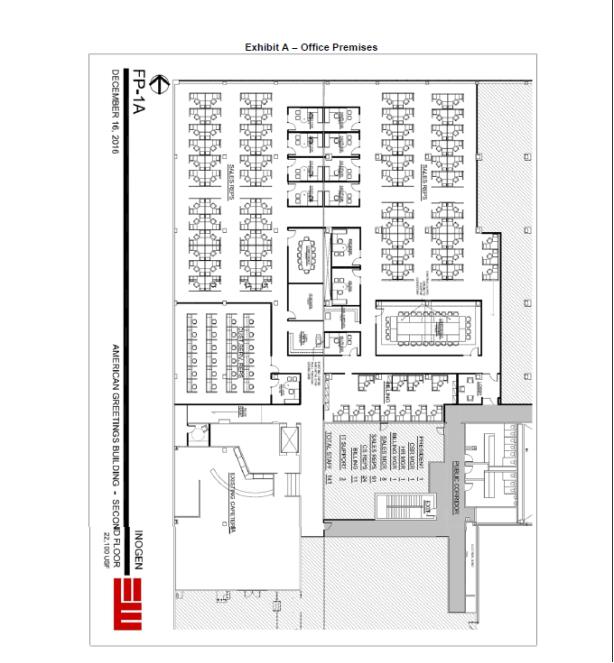

Premises means approximately 22,100 rentable square feet of office space on the second floor of the Building, as outlined on the site plan attached as Exhibit A. See Paragraph 1.2. |

|

C. |

Term means the period from the Occupancy Date through and including the day immediately preceding the seventh (7th) anniversary of the Commencement Date. See Paragraph 2.1. |

|

D. |

Commencement Date means the later to occur of the following: (i) the day that is ninety (90) days after the Occupancy Date; or (ii) August 1, 2017. See Paragraph 2.2. |

|

E. |

Occupancy Date means the date that possession of the Premises is delivered to Tenant in Ready for Occupancy as defined in Exhibits D-1 and D-2. See Paragraph 2.2 and Exhibits D-1 and D-2. |

|

F. |

Base Rent shall be calculated pursuant to the Base Rent schedule set forth in Paragraph 3.1 of the Lease Agreement and shall be paid in monthly installments beginning on the Commencement Date. All rent is due on the first day of each month and shall be paid to Landlord at c/o IRG Realty Advisors, LLC, 4020 Kinross Lakes Parkway, Suite 200, Richfield, Ohio 44286. See Paragraph 3.1. |

|

G. |

Security Deposit initially means $24,788.83, based on one month’s Base Rent. See Paragraph 4. |

|

H. |

Additional Rent means (i) Tenant’s Office Share of the increase in Office Project Expenses (calculated as increases over the Base Year) and (ii) Tenant’s Industrial Share of the increase in Industrial Project Expenses (calculated as increases over the Base Year), payable monthly in advance together with Base Rent. See Paragraph 5.1.A. |

|

I. |

Office Project Expenses means the sum of Office Common Expenses, Office Insurance Expenses, and Office Tax Expenses. See Paragraph 5.1.L. |

|

K. |

Tenant’s Office Share for the Premises is determined by dividing the 22,100 SF Rentable Area of the Premises by the 504,942 SF Rentable Office Area of the Building). See Paragraph 5.1.T. |

|

L. |

Industrial Project Expenses means the sum of Industrial Common Expenses, Industrial Insurance Expenses, and Industrial Tax Expenses. See Paragraph 5.1.F. |

|

M. |

Tenant’s Industrial Share for the Premises, when applicable, shall be determined by dividing the Rentable Area of the Warehouse Space (as hereinafter defined) by the 892,800 SF Rentable Industrial Area of the Building. See Paragraph 5.1.S. |

|

N. |

Permitted Use means office purposes and uses customarily associated therewith. In the event that Tenant expands into the Warehouse Space in accordance with the terms and conditions of the Lease Agreement, then Tenant shall use and occupy the Warehouse Space for warehouse and assembly purposes and uses customarily associated therewith. See Paragraph 7. |

|

L. |

Utilities. Tenant shall pay the cost of its Utilities. See Paragraph 9. |

|

M. |

Option to Extend. Tenant shall have one (1) Option to Extend the Term for five (5) additional years. See Paragraph 34. |

|

N. |

Right of First Refusal and Right of First Offer. See Paragraph 35. |

|

O. |

Taxpayer Identification Number for Tenant is 33-0989359. |

THIS LEASE AGREEMENT (“Lease”), dated as of May 31, 2017, is made by and among CLEVELAND AMERICAN, LLC, a Delaware limited liability company, and HOLDINGS CLEVELAND AMERICAN, LLC, a Delaware limited liability company (collectively, “Landlord”), and INOGEN, INC., a Delaware corporation (“Tenant”).

WITNESSETH

1.PREMISES

1.1.Property. Landlord owns that certain real property improved with a multi-tenant building (the “Building”) located at and having the street address of 1 American Road, Brooklyn, Ohio (the “Land”). The Building and the Land are collectively referred to herein as the “Property.”

1.2.Premises.

A. Premises. Landlord, for and in consideration of the rents, covenants, agreements, and stipulations contained herein, to be paid, kept and performed by Tenant, leases and rents to Tenant, and Tenant hereby leases and takes from Landlord upon the terms and conditions contained herein, approximately 22,100 rentable square feet of office space located in the Building, as outlined on the site plan attached as Exhibit A.

B.Temporary Space. In the event that Landlord does not deliver possession of the Premises to Tenant with Landlord’s Work substantially complete, subject to punchlist items and other items that do not materially interfere with Tenant’s operations from the Premises, within ninety (90) days after the execution of this Lease (the “Anticipated Completion Date”), then Landlord shall make available to Tenant temporary space in an area agreed upon by Landlord and Tenant (the “Temporary Space”) until Landlord’s Work is substantially complete. The occupancy by Tenant of the Temporary Space shall be upon the terms and conditions contained in the Lease, except that Tenant shall not be required to pay Base Rent or Additional Rent but Tenant shall be required to pay Utilities (as defined below) provided to the Temporary Space. The Temporary Space shall be delivered to Tenant in its “as-is” condition without any work to be performed by Landlord. Tenant may occupy the Temporary Space until Landlord’s Work to the Premises is substantially complete, subject to punchlist items and other items that do not materially interfere with Tenant’s operations from the Premises. In addition to the foregoing, promptly after the execution of this Lease, Landlord shall provide to Tenant temporary space in such areas as agreed upon between Landlord and Tenant (the “Initial Workspace”). The occupancy by Tenant of the Initial Workspace shall be upon the terms and conditions contained in the Lease, except that Tenant shall not be required to pay Base Rent or Additional Rent but Tenant shall be required to pay for Utilities provided to the Initial Workspace. The Initial Workspace shall be delivered to Tenant in its “as-is” condition without any work to be performed by Landlord. Tenant may occupy the Initial Workspace until the Commencement Date.

1.3.Office Expansion Option.

A.Office Expansion Right. During the first sixty (60) months of the Initial Term, so long as Tenant is not in Default of this Lease, beyond all applicable notice and cure periods, on the date of the exercise of its expansion rights as outlined herein, and so long as Tenant has not been in monetary or other material Default of this Lease more than two (2) times during any consecutive twelve month period of time during the Term, Tenant shall have the option to lease additional office space in the Building in the area identified as “EXPANSION” on Exhibit B-1 (the “Potential Office Expansion Space”), in increments of no less than 5,000 rentable square feet (each, an “Office Increment”) provided, however, in no event shall Tenant be permitted to expand into any portion of Area #2 as shown on Exhibit B-1 without first expanding into all areas of Area #1 as shown on Exhibit B-1. In order to exercise any expansion option the following shall apply: (a) Tenant delivers written notice (the “Office Expansion Notice”) to Landlord exercising Tenant’s right to expand into such Office Increment, which Office Expansion Notice stipulates the rentable square footage of such Office Increment; (b) such Office Increment is contiguous to

1

the Premises or any Office Increment then leased to Tenant; (c) such Office Expansion Notice is delivered to Landlord within 60 months after the Commencement Date; (d) such Office Increment is in a location and a configuration approved by Landlord; and (e) in no event shall Tenant be permitted to expand into any portion of Area #2 as shown on Exhibit B-1 without first expanding into all areas of Area #1 as shown on Exhibit B-1. Landlord agrees that it will not lease any portion of the Potential Office Expansion Space to a third party until the date that is sixty (60) months after the Occupancy Date, without obtaining Tenant’s prior written consent, which shall not be unreasonably withheld, conditioned or delayed. At Landlord’s option, Tenant and Landlord will promptly enter into an amendment to this Lease evidencing the expansion into an Office Increment. The lease of each Office Increment shall commence upon the date that Landlord delivers possession of such Office Increment to Tenant (the “Increment Possession Date”) and shall be upon the same terms and conditions set forth in this Lease as they relate to the Premises, including, a proportionate increase in Tenant’s Office Share effective as of the Increment Possession Date, except as otherwise set forth in this Lease.

B.Base Rent – Office Increment. Tenant’s obligation to pay Base Rent for any Office Increment shall commence on the applicable Office Increment Commencement Date (as hereinafter defined) and the per rentable square foot Base Rent for such Office Increment shall be based upon the schedule attached to this Lease as Exhibit B-2. The “Office Increment Commencement Date” for any Office Increment shall mean the later of (i) ninety (90) days after Landlord’s receipt of the Office Expansion Notice; and (ii) ninety (90) days after the applicable Increment Possession Date. For purposes of example only, in the event the Office Increment Commencement Date is the first day of Lease Year 5 and the applicable Office Increment contains 5,000 rentable square feet, then, during the fifth (5th) Lease Year, Tenant shall pay Base Rent of $4, 554.17 per month for such Office Increment (based on $10.93 per rentable square foot of such Office Increment per annum) and during the sixth (6th) Lease Year, Tenant shall pay Base Rent of $4,666.67 per month for such Office Increment (based on $11. 20 per rentable square foot of such Office Increment per annum) and shall thereafter increase as set forth on Exhibit B-2.

C. Term - Office Increment. The term of the lease of any Office Increment shall be coterminous with the term of the lease of the Premises. If Tenant properly exercises its right to expand into any Office Increment Tenant shall have the right to extend the Initial Term of this Lease for all space in the Building that Tenant is then occupying such that the expiration of the Term shall be five (5) years after the applicable Office Increment Commencement Date, provided, however, that (A) the applicable Office Expansion Notice stipulates that Tenant is exercising its right to extend the Initial Term for such five (5) year period; and (B) the expiration of such five (5) year period is after the expiration of the Initial Term, absent such extension. In the event that Tenant exercises its right to extend the Initial Term for said five (5) year period then Base Rent shall be as follows:

(i)Base Rent for the Premises shall continue as set forth in Paragraph 3.1 of this Lease, provided, that Base Rent for the Premises for Lease Year 8 shall be equal to the annual Base Rent for the Premises during Lease Year 7 increased by two and one-half percent (2.5%), and Base Rent for the Premises for each Lease Year thereafter shall increase by two and one-half percent (2.5%), on a cumulative basis.

(ii)Base Rent for each Office Increment leased by Tenant shall be based upon the schedule attached to this Lease as Exhibit B-2.

(iii)Base Rent for any Warehouse Space leased by Tenant shall be based upon the schedule attached to this Lease as Exhibit C-2.

D.Work. Tenant shall lease each Office Increment in its “as-is” condition Tenant, at Tenant’s option, shall have the right to an Office Increment Allowance, as set forth in Paragraph 13.F below, provided, however, that the Office Expansion Notice stipulates that (a) Tenant is exercising its right to such Office Increment Allowance and (b) Tenant is exercising its right to extend the Initial Term as set forth in Paragraph 1.3.C. above.

1.4.Warehouse Space.

A.Provided that Tenant is not then in Default, beyond all applicable notice and cure periods, under any of the terms hereof and has not been in monetary or other material Default more than two (2) times during the first year of the Term, Tenant shall have the option to lease all, but not a portion, of that certain 15,425 rentable square feet of space in the Building identified on Exhibit C-1 (the “Warehouse Space”) provided, however, that (i)

2

such Warehouse Space is not leased to another tenant or otherwise occupied; or (ii) Landlord is not in current, reciprocal written negotiations for the lease of all or part of such Warehouse Space with a third party; and (iii) by providing Landlord written notice of Tenant’s expansion right at any time during the first year of the Initial Term. Tenant and Landlord shall enter into an amendment to this Lease evidencing the expansion into the Warehouse Space. In the event that Tenant properly exercises its option to expand into the Warehouse Space, the lease of the Warehouse Space shall commence upon the date that Landlord delivers possession of the Warehouse Space to Tenant and shall be coterminous with the term of the Premises. The lease of the Warehouse Space shall be upon the same terms and conditions set forth in this Lease as they relate to the Premises, except as otherwise set forth in this Lease. In the event that Tenant properly expands into the Warehouse Space, then the term “Premises”, as used in this Lease, shall be deemed to include the Warehouse Space, except for Paragraphs 1.2, 1.3, 3.1, 5, 6, 10.B, 13.B, 13.C, 13.D, 13.E and 34.2.A.

B.Base Rent- Warehouse Space. Tenant’s obligation to pay Base Rent for the Warehouse Space shall commence on the Warehouse Commencement Date (as herein after defined) and the per rentable square foot Base Rent for such the Warehouse Space leased by Tenant shall be based upon the schedule attached to this Lease as Exhibit C-2. The “Warehouse Commencement Date” shall mean the later of (i) the Commencement Date and (ii) ninety (90) days after Landlord delivers possession of the Warehouse Space to Tenant. For purposes of example only, in the event that the Warehouse Commencement Date is the first day of the seventh (7th) month of the first Lease Year, then Base Rent for the twelve (12) month period following the Warehouse Commencement Date shall be as follows:

Warehouse Commencement Date through the end of Lease Year 1: $7.20 per rentable square foot of the Warehouse Space per annum.

Months 1 – 6 of Lease Year 2: $7.38 per rentable square foot of the Warehouse Space per annum.

C.Work. Tenant shall lease the Warehouse Space in its “as-is” condition except that Landlord shall complete the improvements to the Warehouse Space as set forth on Exhibit C-3 attached hereto.

1.5.Warehouse Expansion Right of First Offer. In the event that Tenant exercises its option right to expand into the Warehouse Space, then during the Initial Term, so long as Tenant is not in material, uncured Default of this Lease on the date of exercise of the option right and has not been in material or monetary Default of this Lease more than two (2) times during any 12-month period of time during the Term, Tenant shall have the right to lease additional warehouse space in the Building in the area identified as “Potential Warehouse Expansion Space” on Exhibit C-4 (the “Potential Warehouse Expansion Space”), in increments of no less than 5,000 rentable square feet (each, a “Warehouse Increment”), provided, however, that (i) such Warehouse Increment is not leased to another tenant or otherwise occupied; (ii) Landlord is not in current, reciprocal written negotiations for the lease of all or part of such portion of such Warehouse Increment with a third party; (iii) Tenant delivers written notice (the “Warehouse Increment Notice”) to Landlord prior to the expiration of the Initial Term, exercising Tenant’s right to expand into such Warehouse Increment; (iv) such Warehouse Increment is contiguous to the Warehouse Space or any Warehouse Increment then leased to Tenant; and (v) such Warehouse Increment is in a location and a configuration reasonably approved by Landlord. Tenant and Landlord will enter into an amendment to this Lease evidencing the expansion into a Warehouse Increment. The lease of each Warehouse Increment shall be upon the same terms and conditions set forth in this Lease as it relates to the Warehouse Space, including, without limit the Term, the per rentable square foot Base Rent rate for the Warehouse Space and Additional Rent (including a proportionate adjustment in Tenant’s Industrial Share), except that Tenant’s obligation to pay Base Rent for any Warehouse Increment shall commence on the applicable Warehouse Increment Commencement Date (as hereinafter defined). The “Warehouse Increment Commencement Date” for any Warehouse Increment shall mean the later of (i) ninety (90) days after Landlord’s receipt of the Warehouse Increment Notice and (ii) ninety (90) days after the date upon which Landlord delivers occupancy of such Warehouse Increment to Tenant.

1.6.Common Areas. In addition to the Premises, Tenant shall have the use of those certain common areas to be reasonably designated by Landlord from time to time on the Property (collectively, the “Common Areas”). Such Common Areas shall include, without limitation, parking areas, access roads and facilities, interior corridors and other common areas of the Building, sidewalks, driveways and landscaped and open areas. The Common Areas shall be for the non‑exclusive use of Tenant and Tenant’s employees, agents, suppliers, customers

3

and patrons, in common with Landlord, with all other tenants of the Property and with all other persons to whom Landlord has previously granted, or may hereafter grant, rights of usage. Such non‑exclusive use shall be expressly subject to such reasonable rules and regulations which may be adopted by Landlord from time to time. Landlord reserves the right to alter, modify, enlarge, diminish, reduce or eliminate the Common Areas from time to time in its sole discretion, so long as no such action unreasonably and materially interferes with Tenant’s use and occupancy of the Premises and the Parking Facilities. Landlord shall have the right to modify Common Areas, and if necessary, parts of the Premises, in order to implement any necessary improvements, and Landlord shall endeavor to minimize any adverse effect on Tenant’s use of the Premises. Tenant shall ensure that its use of the Premises and the Property does not block or interfere with any other tenants’ access to or use of the Common Areas. Tenant may not use the Common Areas for storage of goods, vehicles, refuse or any other items. If Tenant uses any of the Common Areas for storage of any items, and subject to any and all regulatory or municipal codes, laws and regulations, Tenant shall pay all fines imposed upon either Landlord or Tenant by any fire, building or other regulatory body, and Tenant shall pay all costs incurred by Landlord to clear and clean the Common Areas and dispose of such items.

2.1.Term. The term of this Lease (the “Initial Term”) shall commence on the Occupancy Date and expire on the day immediately preceding the seventh (7th) anniversary of the Commencement Date, unless extended or terminated earlier by law or by any provision of this Lease (as may be extended, the “Term”). If the last day of the Term shall fall on a day other than the last day of a calendar month, the Term shall be extended so as to end on the last day of such calendar month. The term “Lease Year” as used herein means any twelve (12) consecutive month period beginning on the Commencement Date (or, if the Commencement Date falls on a day other than the first day of a calendar month, beginning on the first day of the calendar month immediately following the Commencement Date) or beginning on any anniversary of the Commencement Date.

2.2.Occupancy Date; Commencement Date. The term “Occupancy Date” as used herein shall mean the date that the Premises are Ready for Occupancy as defined in Exhibit D-1 and D-2). The term “Commencement Date” as used herein shall mean the later to occur of the following: (i) the day that is ninety (90) days after the Occupancy Date; or (ii) August 1, 2017. When the Occupancy Date occurs, Landlord shall send to Tenant a factually correct written notice of such fact (a “Lease Commencement Notice”), in the form of Exhibit E. Tenant shall acknowledge the Lease Commencement Notice by executing a copy and returning it to Landlord. If Tenant fails to sign and return the Lease Commencement Notice to Landlord within ten (10) business days after Tenant’s receipt of the Lease Commencement Notice, then the Lease Commencement Notice as sent by Landlord shall be deemed to have correctly set forth the Occupancy Date and Commencement Date, provided, that Tenant shall have the right to dispute in good faith the Lease Commencement Notice by providing written notice of such dispute within such ten (10) business day period. Failure of Landlord to send the Lease Commencement Notice shall not affect the actual establishment of the Occupancy Date and Commencement Date. Tenant agrees to pay the Rent (as defined in Paragraph 5.1.O) required under this Lease within the time limits set forth in this Lease. In the event Tenant in good faith disputes the Occupancy Date set forth in the Lease Commencement Notice, Tenant shall nevertheless pay to Landlord the amount of Rent due and owing by Tenant, based upon the Commencement Date set forth in the Lease Commencement Notice (under protest), until such time as the parties mutually agree on a different date or Tenant receives a final judgment from a court of competent jurisdiction (or when arbitration is permitted, receives a final award from an arbitrator) relieving or mitigating Tenant’s obligation to pay such Rent.

3.RENT

3.1.Rent. Rent shall be due and payable in lawful money of the United States in advance on the first day of each month, beginning on the Commencement Date. Tenant shall pay to Landlord as base rent (“Base Rent”) for the Premises, without notice or demand and without abatement, deduction, offset or setoff, the following rent schedule:

|

Lease Year |

Base Rent PSF Per Annum |

|

Lease Year 1 |

$11.95 |

|

Lease Year 2 |

$12.19 |

4

Notwithstanding, there shall be a partial reduction in Base Rent as follows:

Months 1-6 of Lease Year 1: $5,975.00 per month

Months 7-12 of Lease Year 1: $11,950.00 per month

Months 1-6 of Lease Year 2: $18,285.00 per month

Months 7-12 of Lease Year 2: $22,449.92 per month

Lease Year 3: $22,891.92 per month

Lease Year 4: $23,352.33 per month

Lease Year 5: $23,831.17 per month

Lease Year 6: $24,291.58 per month

Lease Year 7: $24,788.83 per month

Rent for any period that is less than one (1) full calendar month shall be prorated based upon the actual number of days of the calendar month involved. Tenant shall pay to Landlord, upon execution of this Lease, the sum of $5,975.00 (representing Base Rent for the Premises for the first month of the Term), plus the Security Deposit (as defined in Paragraph 4)). Base Rent for any Option Term (as defined in Paragraph 34.1) shall be established in accordance with the provisions of Paragraph 34.2.

3.2.Place of Payment. All payments under this Lease to be made by Tenant to Landlord shall be made payable to Landlord, and mailed or personally delivered to Landlord at the following address or such other address designated by Landlord to Tenant from time to time: Cleveland American, LLC, c/o IRG Realty Advisors, LLC, 4020 Kinross Lakes Parkway, Suite 200, Richfield, Ohio, 44286.

3.3.Late Payment. Tenant hereby acknowledges that late payment by Tenant to Landlord of Rent pursuant to this Lease will cause Landlord to incur costs not contemplated by this Lease, the exact amount of which will be extremely difficult to ascertain. Accordingly, if any installment of Rent or other payment under this Lease is not received by Landlord on or before the fifth (5th) business day of the month in which such Rent or other payment is due, Tenant shall pay a late charge equal to five percent (5%) of such overdue amounts. Tenant shall also be responsible for a service fee equal to fifty dollars ($50.00) for any check returned for insufficient funds, together with such other costs and expenses as may be imposed by Landlord’s bank. The payment to and acceptance by Landlord of such late charge shall in no event constitute a waiver by Landlord of Tenant’s Default with respect to such overdue amounts, nor prevent Landlord from exercising any of the other rights and remedies available at law or in equity or pursuant to this Lease.

3.4.Payment on Account. No payment by Tenant or receipt by Landlord of a lesser amount than the Rent actually due hereunder shall be deemed to be other than a payment on account. No restrictive endorsement or statement on any check or any letter accompanying any check or payment (for example, a statement that such check or payment represents “payment in full”) shall be deemed an accord and satisfaction or have any effect whatsoever.

5

Landlord may accept such check or payment without prejudice to Landlord’s right to recover the balance or pursue any other remedy available at law or in equity or pursuant to this Lease.

4.SECURITY DEPOSIT

Upon execution of this Lease, Tenant shall pay to Landlord a security deposit for the faithful performance of Tenant’s obligations under this Lease in the amount of $24,788.83, based on one month’s Base Rent (the “Security Deposit”). Within ten (10) days after any increase in the Base Rent hereunder, Tenant shall pay to Landlord an amount necessary to increase the Security Deposit held by Landlord to an amount equal to the then-current monthly Base Rent. If Tenant fails to pay Rent or other charges due hereunder, or otherwise Defaults under this Lease, Landlord may use, apply or retain all or a portion of the Security Deposit to compensate Landlord for the amount due from Tenant (including reasonable attorneys’ fees) under this Lease. If Landlord uses or otherwise applies all or any portion of the Security Deposit, Tenant shall restore such Security Deposit within ten (10) days after written notice from Landlord. The Security Deposit shall be non‑interest bearing, and Landlord shall be entitled to retain such funds in its general accounts. The balance of the Security Deposit not applied or used by Landlord as permitted in this Paragraph 4 shall be refunded to Tenant thirty (30) days after the later of (A) the expiration or other termination of this Lease, and (B) the date on which Tenant has vacated the Premises.

5.ADDITIONAL RENT

5.1.Definitions.

A.“Additional Rent” shall mean (1) Tenant’s Office Share of the difference between (i) the Office Project Expenses during the Computation Year for which Additional Rent is being calculated, and (ii) the Office Project Expenses during the Base Year, with the Office Project Expenses in both cases subject to the Office Gross‑Up Provision (as defined in Paragraph 5.1.J); and (2) Tenant’s Industrial Share of the difference between (i) the Industrial Project Expenses during the Computation Year for which Additional Rent is being calculated, and (ii) the Industrial Project Expenses during the Base Year, with the Industrial Project Expenses in both cases subject to the Industrial Gross‑Up Provision (as defined in Paragraph 5.1.D);

B.“Base Year” means the 2018 calendar year.

C.“Computation Year” means each year during the Term commencing on January 1 and ending on December 31.

D. “Industrial Common Expenses” means the aggregate amount of the total costs and expenses paid or incurred by Landlord in any way connected with or related to (i) the operation, repair and maintenance of the Property (exclusive of the Office Rentable Area of the Building), including, without limitation, electricity, gas, water, sewer and other utilities; trash removal; security (none currently furnished by Landlord); snow plowing, sanding, salting and shoveling snow; landscaping, mowing and weed removal; on-site manager and employees and related expenses; rubbish removal and dumpster pickup; office expenses; maintenance, repair, and restoration of the Common Areas; electrical, plumbing, sprinkler and HVAC repair and maintenance; testing, maintenance and repair of alarm system, sprinkler system, and fire pump system; repair, resurfacing and restriping of all parking areas, loading and unloading areas, trash areas, roadways, driveways, and walkways; common signage; painting of the Building and Property; fence and gate repair and maintenance; repair and replacement of all lighting facilities; and any and all other repairs and maintenance, and (ii) the furnishing of or contracting for any service generally provided to the tenants of the Property by Landlord, including, without limitation, management fees (not to exceed five percent (5%) of Rent from the Property), and professional fees. Notwithstanding the foregoing or anything to the contrary contained in this Lease, Industrial Project Expenses shall expressly exclude those items listed on Exhibit F and any cost and expense to the extent such cost and expense is included in Office Project Expenses. If less than one hundred percent (100%) of the Industrial Rentable Area of the Building is occupied during any portion of any particular Computation Year (including the Base Year), then the variable portion of Industrial Project Expenses for such Computation Year (including the Base Year) shall be deemed to be equal to the total of the variable portion of Industrial Project Expenses that would have

6

been incurred by Landlord if one hundred percent (100%) of the Industrial Rentable Area of the Building had been occupied for the entirety of such Computation Year (including the Base Year), with all tenants paying full rent (as contrasted with free rent, half rent, or the like) (the “Industrial Gross‑Up Provision”). If any significant service or expense category is not included or provided during the entire Base Year but is subsequently included or provided in any other Computation Year, the Base Year shall be equitably adjusted.

E.“Industrial Insurance Expenses” means the Insurance Expenses allocated by Landlord to the Industrial Area of the Building, provided, however, Industrial Insurance Expenses shall expressly exclude any portion of the Insurance Expenses included in Office Insurance Expenses.

F. “Industrial Project Expenses” means the sum of Industrial Common Expenses, Industrial Insurance Expenses, and Industrial Tax Expenses.

G.“Industrial Tax Expenses” means the Taxes allocated by Landlord to the Industrial Area of the Building, provided, however, Industrial Tax Expenses shall expressly exclude any portion of the Taxes included in Office Tax Expenses.

H.“Industrial Rentable Area of the Building” means 892,800 agreed-upon square feet.

I.“Insurance Expenses” means the aggregate amount of the cost of fire, extended coverage, boiler, sprinkler, commercial general liability, property damage, rent, earthquake, terrorism and other insurance obtained by Landlord in connection with the Property, including insurance required pursuant to Paragraph 14.1, and the commercially reasonable deductible portion of any insured loss otherwise covered by such insurance.

J.“Office Common Expenses” means the aggregate amount of the total costs and expenses pursuant to GAAP, consistently applied, paid or incurred by Landlord in any way connected with or related to (i) the operation, repair and maintenance of the Property (exclusive of the Industrial Rentable Area of the Building), including, without limitation, electricity, gas, water, sewer and other utilities; trash removal; security (none currently furnished by Landlord); snow plowing, sanding, salting and shoveling snow; landscaping, mowing and weed removal; on-site manager and employees and related expenses; office expenses; maintenance, repair, and restoration of the Common Areas; electrical, plumbing, sprinkler and HVAC repair and maintenance; testing, maintenance and repair of alarm system, sprinkler system, and fire pump system; repair, resurfacing and restriping of all parking areas, loading and unloading areas, trash areas, roadways, driveways, and walkways; common signage; painting of the Building and Property; fence and gate repair and maintenance; repair and replacement of all lighting facilities; and any and all other repairs and maintenance, and (ii) the furnishing of or contracting for any service generally provided to the tenants of the Property by Landlord, including, without limitation, management fees (not to exceed five percent (5%) of the Rent from the Property), and professional fees. Notwithstanding the foregoing or anything to the contrary contained in this Lease, Office Project Expenses shall expressly exclude those items listed on Exhibit F and any cost and expense to the extent such cost and expense is included in Industrial Project Expenses. If less than one hundred percent (100%) of the Office Rentable Area of the Building is occupied during any portion of any particular Computation Year (including the Base Year), then the variable portion of Office Project Expenses for such Computation Year (including the Base Year) shall be deemed to be equal to the total of the variable portion of Office Project Expenses that would have been incurred by Landlord if one hundred percent (100%) of the Office Rentable Area of the Building had occupied for the entirety of such Computation Year (including the Base Year), with all tenants paying full rent (as contrasted with free rent, half rent, or the like) (the “Office Gross‑Up Provision”). If any significant service or expense category is not included or provided during the entire Base Year but is subsequently included or provided in any other Computation Year, the Base Year shall be equitably adjusted.

K.“Office Insurance Expenses” means the Insurance Expenses allocated by Landlord to the Office Area of the Building, provided, however, Office Insurance Expenses shall expressly exclude any portion of the Insurance Expenses included in Industrial Insurance Expenses.

7

L. “Office Project Expenses” means the sum of Office Common Expenses, Office Insurance Expenses, and Office Tax Expenses.

M.“Office Tax Expenses” means the Taxes allocated by Landlord to the Office Area of the Building, provided, however, Office Tax Expenses shall expressly exclude any portion of the Taxes included in Industrial Tax Expenses.

N.“Office Rentable Area of the Building” means 504,942 agreed-upon square feet.

O. “Rent” or “rent” means the total of all sums due to Landlord from Tenant hereunder, including, without limitation, Base Rent, Additional Rent, Utilities (as defined in Paragraph 9) (if the same are not paid for directly by Tenant), as well as all damages, costs, expenses, and sums that Landlord may suffer or incur, or that may become due, by reason of any Default of Tenant or failure by Tenant to comply with the terms and conditions of this Lease.

P. “Rentable Area of the Premises” means 22,100 rentable square feet.

Q.“Rentable Area of the Warehouse Space” means the rentable square feet contained in any portion of Warehouse Space in the Building leased by Tenant. In the event that Tenant expands into the Warehouse Space, the Rentable Area of the Warehouse Space shall be identified and stated in an amendment to this Lease.

R.“Taxes” means all taxes, assessments and charges levied upon or with respect to the Property or any personal property of Landlord used in the operation thereof, or Landlord’s interest in the Property or such personal property. Taxes shall include, without limitation, all general real property taxes and general and special assessments, occupancy taxes, commercial rental taxes, charges, fees or assessments for transit, housing, police, fire or other governmental services or purported benefits to the Property, service payments in lieu of taxes, and any tax, fee or excise on the act of entering into any lease for space in the Property, or on the use or occupancy of the Property or any part thereof, or on the rent payable under any lease or in connection with the business of renting space in the Property, that are now or hereafter levied or assessed against Landlord by the United States of America, the state in which the Property is located, or any political subdivision, public corporation, district or other political or public entity, whether due to increased rate and/or valuation, additional improvements, change of ownership, or any other events or circumstances, and shall also include any other tax, fee or other excise, however described, that may be levied or assessed as a substitute for or as an addition to, as a whole or in part, any other Taxes, whether or not now customary or in the contemplation of the parties on the date of this Lease. Taxes shall not include franchise, transfer, inheritance or capital stock taxes or income taxes measured by the net income of Landlord from all sources unless, due to a change in the method of taxation, any of such taxes is levied or assessed against Landlord as a substitute for or as an addition to, as a whole or in part, any other tax that would otherwise constitute a Tax. Taxes shall also include reasonable legal fees, costs and disbursements incurred in connection with proceedings to contest, determine or reduce Taxes. If any Taxes are specially assessed by reason of the occupancy or activities of one or more tenants of the Property and not the occupancy or activities of the tenants of the Property as a whole, such Taxes shall be allocated by Landlord to the tenant or tenants whose occupancy or activities brought about such assessment.

S.Tenant’s Industrial Share means the percentage computed by dividing the Rentable Area of the Warehouse Space by the Industrial Rentable Area of the Building. In the event that either the Rentable Area of the Warehouse Space or the Industrial Rentable Area of the Building is changed, Tenant’s Industrial Share will be appropriately adjusted by Landlord. For purposes of the Computation Year in which such change occurs, Tenant’s Industrial Share shall be determined on the basis of the number of days during such Computation Year at each such percentage. In addition, for purposes of computing Tenant’s Industrial Share of Industrial Project Expenses for any calendar year, in no event shall "Controllable Expenses" for any calendar year increase by more than five percent (5%) over the Controllable Expenses from the immediately preceding calendar year. "Controllable Expenses" means all Industrial Project Expenses excluding (i) Industrial Tax Expenses; (ii) Industrial Insurance Expenses; (iii) snow removal cost; and (iv) costs of utilities for the Common Areas. Initially, Tenant’s Industrial Share is 0%. Notwithstanding

8

the foregoing, for purposes of computing Tenant’s Industrial Share of Industrial Tax Expenses for any calendar year, in no event shall Industrial Tax Expenses for any calendar year increase by more than ten percent (10%), calculated on a cumulative and compounded basis, over the Industrial Tax Expenses from the immediately preceding calendar year.

T.Tenant’s Office Share means 4.38%, computed by dividing the Rentable Area of the Premises by the Office Rentable Area of the Building. In the event that either the Rentable Area of the Premises or the Office Rentable Area of the Building is changed, Tenant’s Office Share will be appropriately adjusted by Landlord. For purposes of the Computation Year in which such change occurs, Tenant’s Office Share shall be determined on the basis of the number of days during such Computation Year at each such percentage. In addition, for purposes of computing Tenant’s Office Share of Office Project Expenses for any calendar year, in no event shall "Controllable Expenses" for any calendar year increase by more than five percent (5%) over the Controllable Expenses from the immediately preceding calendar year. "Controllable Expenses" means all Office Project Expenses excluding (i) Office Tax Expenses; (ii) Office Insurance Expenses; (iii) snow removal cost; and (iv) costs of utilities for the Common Areas. Notwithstanding the foregoing, for purposes of computing Tenant’s Office Share of Office Tax Expenses for any calendar year, in no event shall Office Tax Expenses for any calendar year increase by more than ten percent (10%), calculated on a cumulative and compounded basis, over the Office Tax Expenses from the immediately preceding calendar year.

5.2.Payments. In addition to Base Rent, beginning on the first day of the first month after the Base Year, Tenant shall pay to Landlord, monthly, in advance, one-twelfth (1/12) of the Additional Rent due for each Computation Year, in an amount estimated by Landlord and billed by Landlord to Tenant (the “Estimated Expenses”). Landlord shall have the right to revise the Estimated Expenses from time to time and to adjust Tenant’s monthly payments accordingly. If either the Commencement Date or the expiration of the Term shall occur on a date other than the first or last day of a Computation Year, respectively, the Additional Rent for such Computation Year shall be equal to the number of days this Lease was in effect during such Computation Year divided by 365. With reasonable promptness after the end of each Computation Year (including the Base Year), Landlord shall furnish Tenant with a statement setting forth in reasonable detail Landlord’s calculation of the actual Additional Rent that should have been paid by Tenant for such Computation Year (the “Actual Expenses”). If the Actual Expenses for such Computation Year exceed the Estimated Expenses paid by Tenant for such Computation Year, then Tenant shall, within thirty (30) days after the receipt of the Actual Expenses statement, pay to Landlord the difference between the Actual Expenses and the Estimated Expenses paid by Tenant. If the Estimated Expenses paid by Tenant for such Computation Year exceed the Actual Expenses for such Computation Year, then such excess shall be credited against the next installments of Additional Rent due from Tenant to Landlord hereunder. Neither Landlord’s failure to deliver, nor late delivery of, the Estimated Expenses or Actual Expenses shall constitute a default by Landlord hereunder or a waiver of Landlord’s right to collect any payment provided for herein.

5.3.Excessive Expenses. In addition to any other sums payable hereunder, Tenant shall pay to Landlord any excessive or extraordinary operating or insurance costs as Landlord may reasonably determine to be incurred (A) due to Tenant’s excessive or extraordinary use of the Premises or other facilities of the Property, as compared to other similar tenants of the Property (including, without limitation, use beyond the normal business work week), and (B) due to Tenant’s breach or Default of its obligations under this Lease. Landlord may reasonably estimate the amount of such use and costs, and bill Tenant periodically for the same.

5.4.Disputes. If there is any dispute as to any Additional Rent due under this Paragraph 5 for any Computation Year, Tenant shall have the right, during the twenty-four (24)-month period after Tenant’s receipt of Landlord’s statement of Actual Expenses for such Computation Year (and during the thirty-six (36) month period after the end of the Base Year for the Base Year) (the “Audit Period”), at reasonable times and upon reasonable notice, to have a reputable operating expense audit firm, at Tenant’s sole cost, inspect Landlord’s accounting records at Landlord’s accounting office or conduct an audit, at Tenant’s sole cost. Tenant’s failure to provide Landlord with notice of any dispute as to Actual Expenses and/or Additional Rent during the Audit Period shall constitute a waiver by Tenant to dispute or audit the Additional Rent, or any component thereof, for such Computation Year. If Tenant still disputes such Actual Expenses and/or Additional Rent after such inspection, then, upon Tenant’s written request therefor, a certification as to the proper amount of Additional Rent that should have been paid by Tenant, and the

9

amount due to or payable by Tenant, shall be made by an independent accounting firm selected by Landlord and Tenant. If Landlord and Tenant are unable to agree upon an accounting firm, Landlord and Tenant shall each select an accounting firm and the two (2) firms so selected shall select a third firm, which shall make the certification requested hereunder. Tenant agrees to pay all costs and expenses incurred in connection with such certification, unless such certification reveals that Landlord has overcharged Tenant by more than $6,000 for any Computation Year (in which case Landlord shall pay all costs and expenses incurred in connection with such audit and certification). Such certification shall be final and conclusive as to all parties. Notwithstanding the foregoing, in no event shall Tenant be entitled to withhold payment of Rent (including Additional Rent) during the certification process, and Tenant shall remain obligated to pay all Rent (including Additional Rent) due as otherwise set forth in this Lease. In the event Tenant shall prevail in the certification process, Landlord, at its election, shall either promptly refund any excess Additional Rent payments to Tenant or shall apply such excess as a credit against future Base Rent due from Tenant.

6.PARKING

So long as Tenant complies with the terms, provisions and conditions of this Lease, Landlord shall maintain and operate (or cause to be maintained and operated) automobile parking facilities (the “Parking Facilities”) adjacent to or within a reasonable distance from the Building. The Parking Facilities shall initially contain at least ten (10) surface spaces per one thousand (1,000) rentable square feet of the Premises in the parking area(s) located adjacent to the Premises free of charge during the Term or any extension thereof. Landlord, at its cost, shall have the right to reasonably relocate the Parking Facilities to another location, in Landlord’s reasonable discretion, to facilitate development of the Property, provided, however, that at all times Tenant shall have the right, to the nonexclusive use of six (6) surface spaces per one thousand (1,000) rentable square feet of the Premises in the parking area(s) located adjacent to the Premises. At Tenant’s option, Tenant shall have the right to preferred parking spaces at a ratio not to exceed one (1) surface space per one thousand (1,000) rentable square feet of the Premises. Costs associated with marking or reserved signage shall be at Tenant’s cost. The location of shall be designated by Landlord, acting reasonably. All automobiles, trucks, trailers and/or other vehicles parked in the Parking Facilities by Tenant or by any Tenant Representative (as defined in Paragraph 8.2) shall be in operable condition, and shall be licensed and insured as required under applicable law. Except for damages or injuries, which arise from Landlord’s willful misconduct, Tenant assumes total responsibility and liability for all vehicles of Tenant or any Tenant Representative parked or stored in the Parking Facilities, and Landlord assumes no liability whatsoever for any damage to, loss of, or theft of any such vehicles or any personal property in such vehicles. Except for damages or injuries, which arise from Landlord’s gross negligence or intentional misconduct, NOTWITHSTANDING ANYTHING TO THE CONTRARY CONTAINED IN THIS LEASE, TENANT ACKNOWLEDGES AND AGREES THAT TENANT AND ALL TENANT REPRESENTATIVES SHALL USE ANY PARKING FACILITIES AT THEIR SOLE RISK AND THAT LANDLORD SHALL HAVE NO RESPONSIBILITY TO PREVENT, AND SHALL NOT BE LIABLE TO TENANT, TO ANY TENANT REPRESENTATIVE OR TO ANY OTHER PERSON FOR, DAMAGES OR INJURIES TO PERSONS OR PROPERTY PARKED OR OTHERWISE LOCATED ON OR ABOUT THE PROPERTY.

7.PERMITTED USES

Tenant shall use and occupy the Premises throughout the Term of this Lease for office purposes and uses customarily associated therewith, and for no other purpose. In particular, no use shall be made or permitted to be made of the Premises, nor acts done which will increase the existing rate of insurance upon the Building or the Property, unless Tenant pays for such increase, or cause a cancellation of any insurance policy covering the Building or the Property, nor shall Tenant sell, or permit to be kept, used, or sold, in or about the Premises, any article which may be prohibited by the standard form of fire insurance policies. Notwithstanding the foregoing, Landlord will not unreasonably withhold its consent to a proposed change in Tenant’s use of the Premises so long as such change in use: (i) will not, in Landlord’s sole opinion, impact the Property in a negative way, including, without limitation, any potential environmental concerns; (ii) will not, in Landlord’s sole opinion, cause any odors or excessive noise; (iii) will not affect zoning requirements; (iii) is substantially similar to the then permitted use; and (iv) is permitted by applicable legal requirements. Landlord makes no representation or warranty, implied or otherwise, as to the quality or condition of the Premises, as to whether Tenant’s intended use complies with applicable laws, or as to the suitability of the Premises for Tenant’s intended use. Tenant shall comply with all laws, ordinances, rules, regulations and codes of all municipal, county, state and federal authorities pertaining to Tenant’s use and

10

occupation of the Premises. Tenant shall not commit, or suffer to be committed, any waste upon the Premises or any public or private nuisance, or other act or thing which disturbs the quiet enjoyment of any other tenant of the Property. Tenant shall not permit the storage of any items that cause objectionable odors to escape or be emitted from the Premises. In the event that Tenant properly expands into the Warehouse Space, then Tenant shall use and occupy the Warehouse Space throughout the Term of this Lease for warehouse purposes and uses customarily associated therewith, and for no other purpose, provided, however, that all other terms and conditions of this Paragraph 7, shall apply to the Warehouse Space.

8.ENVIRONMENTAL COMPLIANCE/HAZARDOUS MATERIALS

8.1.Definitions. “Hazardous Materials” means (A) any material, substance or waste that is or has the characteristic of being hazardous, toxic, ignitable, reactive, flammable, explosive, radioactive, mutagenic or corrosive, including, without limitation, petroleum or any petroleum derivative, solvents, heavy metals, acids, pesticides, paints, printing ink, PCBs, asbestos, materials commonly known to cause cancer or reproductive problems and those materials, substances and/or wastes, including wastes which are or later become regulated by any local governmental authority, the state in which the Property is located or the United States Government, including, without limitation, substances defined as “hazardous substances,” “hazardous materials,” “toxic substances” or “hazardous wastes” in the Comprehensive Environmental Response, Compensation and Liability Act, as amended (42 U.S.C. §§9601, et seq.), the Hazardous Materials Transportation Act, as amended (49 U.S.C. §§5101, et seq.), the Resource Conservation and Recovery Act, as amended (42 U.S.C. §§6901 et seq.), any environmental law of the state where the Property is located, or any other environmental law, regulation or ordinance now existing or hereinafter enacted; (B) any other substance or matter which results in liability to any person or entity from exposure to such substance or matter under any statutory or common law theory; and (C) any substance or matter which is in excess of relevant and appropriate levels set forth in any applicable federal, state or local law or regulation pertaining to any hazardous or toxic substance, material or waste, or for which any applicable federal, state or local agency orders or otherwise requires removal, remediation or treatment. “Hazardous Materials Laws” means all present and future federal, state and local laws, ordinances and regulations, prudent industry practices, requirements of governmental entities and manufacturer’s instructions relating to industrial hygiene, environmental protection or the use, analysis, generation, manufacture, storage, presence, disposal or transportation of any Hazardous Materials, including, without limitation, the laws, regulations and ordinances referred to in the preceding sentence.

8.2.Use of Premises by Tenant. Tenant hereby agrees that Tenant and Tenant’s officers, employees, representatives, agents, consultants, contractors, subcontractors, successors, assigns, subtenants, concessionaires, invitees, any other occupants of the Premises, and any others acting for or on behalf of Tenant (collectively, “Tenant Representatives”) shall not cause or permit any Hazardous Materials to be used, generated, manufactured, refined, produced, processed, stored or disposed of, on, under or about the Premises or the Property or transported to or from the Premises or the Property without the express prior written consent of Landlord (subject, however, to the last sentence of this Paragraph 8.2). Tenant shall at its own expense procure, maintain in effect and comply with all conditions of any and all permits, licenses and other governmental and regulatory approvals required for the storage or use by Tenant or any Tenant Representative of Hazardous Materials on the Premises or the Property. Notwithstanding the foregoing, Tenant shall be entitled to use and store in the Premises common cleaning solutions and office supplies used by Tenant in its ordinary operations, so long as the same are used in compliance with all Hazardous Materials Laws, stored in appropriate containers in compliance with all Hazardous Materials Laws, and disposed of in compliance with all Hazardous Materials Laws.

8.3.Remediation. If at any time during the Term any contamination of the Premises or the Property by Hazardous Materials shall occur where such contamination is caused by the act or omission of Tenant or of any Tenant Representative (“Tenant’s Contamination”), then Tenant, at Tenant’s sole cost and expense, shall promptly and diligently remove such Hazardous Materials from the Premises, the Property or the groundwater underlying the Premises or the Property to the extent required to comply with applicable Hazardous Materials Laws in order to restore the Premises or the Property to the same or better condition which existed before the Tenant’s Contamination. Tenant shall not take any required remedial action in response to any Tenant’s Contamination in or about the Premises or the Property, or enter into any settlement agreement, consent, decree or other compromise in respect to any claims relating to any Tenant’s Contamination, without first obtaining the prior written consent of Landlord, which may be subject to conditions imposed by Landlord in Landlord’s sole discretion; provided,

11

however, that Landlord’s prior written consent shall not be necessary to the extent that the presence of Hazardous Materials on, under or about the Premises or the Property (A) poses an immediate threat to the health, safety or welfare of any individual or (B) is of such a nature that an immediate remedial response is necessary and it is not possible to obtain Landlord’s consent before taking such action. Landlord and Tenant shall jointly prepare a remediation plan in compliance with all Hazardous Materials Laws and the provisions of this Lease. In addition to all other rights and remedies of Landlord hereunder, if Tenant does not promptly and diligently take all steps to prepare and obtain all necessary approvals of a remediation plan for any Tenant’s Contamination, and thereafter commence the required remediation of any Hazardous Materials released or discharged in connection with Tenant’s Contamination within thirty (30) days after all necessary approvals and consents have been obtained and thereafter continue to prosecute such remediation to completion in accordance with an approved remediation plan, then Landlord, at its sole discretion, shall have the right, but not the obligation, to cause such remediation to be accomplished, and Tenant shall reimburse Landlord within fifteen (15) days after Landlord’s demand for reimbursement of all amounts reasonably paid by Landlord (together with interest on such amounts at 15% per annum (or, if less, the maximum lawful rate) from the date paid by Landlord), when such demand is accompanied by reasonable proof of payment by Landlord of the amounts demanded. Tenant shall promptly deliver to Landlord, legible copies of hazardous waste manifests reflecting the legal and proper disposal of all Hazardous Materials removed from the Premises or the Property as part of Tenant’s remediation of any Tenant’s Contamination.

8.4.Notice of Hazardous Materials Matters. Tenant shall immediately notify Landlord in writing of: (A) any enforcement, cleanup, removal or other governmental or regulatory action instituted, contemplated or threatened concerning the Premises pursuant to any Hazardous Materials Laws; (B) any claim made or threatened by any person against Tenant or the Premises relating to damage contribution, cost recovery, compensation, loss or injury resulting from or claimed to result from any Hazardous Materials on or about the Premises; (C) any reports made to any environmental agency arising out of or in connection with any Hazardous Materials in or removed from the Premises, including any complaints, notices, warnings or asserted violations in connection therewith, all upon receipt by Tenant of actual knowledge of any of the foregoing matters; or (D) any spill, release, discharge or disposal of any Hazardous Materials in, on or under the Premises, the Property, or any portion thereof. Tenant shall also supply to Landlord as promptly as possible, and in any event within five (5) days after Tenant first receives or sends the same, with copies of all claims, reports, complaints, notices, warnings or asserted violations relating in any way to the Premises or Tenant’s use thereof.

8.5.Indemnification by Tenant. Provided Landlord delivers to Tenant relevant reports with reference to the Premises that Landlord has in its possession, and allows Tenant, the right to contact Landlord’s preferred vendors who have inspected the Property, Building and Premises (provided that any such communication with Landlord’s preferred vendors also includes a representative of Landlord in any such communications), and provided Tenant is allowed access to conduct its own Phase I prior to the execution of this Lease, Tenant shall indemnify, defend (by counsel reasonably acceptable to Landlord), protect, and hold Landlord, each of Landlord’s directors, managers, officers, shareholders, members, partners, employees, representatives, agents, and attorneys, any lender having a lien on or covering the Property or any part thereof, any entity or person named or required to be named as an additional insured in Paragraph 14.2, and the respective successors and assigns of all of the foregoing persons free and harmless from and against any and all claims, actions, causes of action (including, without limitation, remedial and enforcement actions of any kind, informal or formal administrative or judicial proceedings, and orders or judgments arising therefrom), liabilities, penalties, forfeitures, damages (including, without limitation, damages for the loss or restriction or use of rentable space or any amenity of the Premises or the Property, diminution in the value of the Premises or the Property, fines, injunctive relief, losses or expenses (including, without limitation, the costs of investigation and testing and reasonable consultants’ and attorneys’ fees and costs) or death of or injury to any person or damage to any property whatsoever, to the extent arising from or caused, in whole or in part, directly or indirectly, by (A) any Tenant’s Contamination, (B) Tenant’s or any Tenant’s Representative’s failure to comply with any Hazardous Materials Laws with respect to the Premises, or (C) offsite disposal or transportation of Hazardous Materials on, from, under or about the Premises or the Property by Tenant or any Tenant’s Representative. Tenant’s obligations hereunder shall include without limitation, and whether foreseeable or unforeseeable, all costs of any required or necessary repair, cleanup or detoxification or decontamination of the Premises, and the preparation and implementation of any closure, remedial action or other required plans in connection therewith. For purposes of the indemnity provisions hereof, any acts or omissions of Tenant or by any Tenant Representative (whether or not they are negligent, intentional, willful or unlawful) shall be strictly attributable to Tenant.

12

8.6.Indemnification by Landlord. Landlord shall indemnify, defend (by counsel reasonably acceptable to Tenant), protect, and hold Tenant, each of Tenant’s directors, managers, officers, shareholders, members, partners, employees, representatives, agents, and attorneys, and the respective successors and assigns of all of the foregoing persons free and harmless from and against any and all claims, actions, causes of action (including, without limitation, remedial and enforcement actions of any kind, informal or formal administrative or judicial proceedings, and orders or judgments arising therefrom), liabilities, penalties, forfeitures, damages, fines, injunctive relief, losses or expenses (including, without limitation, the costs of investigation and testing and reasonable consultants’ and attorneys’ fees and costs) or death of or injury to any person or damage to any property whatsoever, to the extent arising from or caused, in whole or in part, directly or indirectly, by (i) any prior contamination, pre-existing condition, or contamination caused by Landlord in violation of a Hazardous Material Law and (ii) any contamination existing as of the Occupancy Date in violation of a Hazardous Material Law. Landlord’s obligations hereunder shall include without limitation, and whether foreseeable or unforeseeable, all costs of any required or necessary repair, cleanup or detoxification or decontamination of the Premises, and the preparation and implementation of any closure, remedial action or other required plans in connection therewith. Landlord’s obligations under this Paragraph 8.6 shall be specifically limited to affirmative acts of Landlord, and shall not include the acts or omissions of any other tenants of the Property or other persons.

8.7.Compliance with Environmental Laws. Tenant shall at all times and in all respects comply with (and shall cause all Tenant Representatives to comply with) all Hazardous Materials Laws in connection with their use and occupancy of the Premises and the Property. All reporting obligations imposed by Hazardous Materials Laws and arising from Tenant’s (or any Tenant Representative’s) use and occupancy of the Premises and the Property are strictly the responsibility of Tenant.

8.8.Exclusivity. The allocations of responsibility between, obligations and liabilities undertaken by, and indemnifications given by Landlord and Tenant under this Paragraph 8, shall be the exclusive provisions under this Lease applicable to the subject matter treated in this Paragraph 8, and any other conflicting or inconsistent provisions contained in this Lease shall not apply with respect to such subject matter. Landlord and Tenant have been informed that certain judicial decisions have held that, notwithstanding the specific language of a lease, courts may impose the responsibility for complying with legal requirements and for performing improvements, maintenance and repairs on a landlord or tenant based on the court’s assessment of the parties’ intent in light of certain equitable factors. Landlord and Tenant have each been advised by their respective legal counsel about the provisions of this Lease allocating responsibility for compliance with laws and for performing improvements, maintenance and repairs between Landlord and Tenant. Landlord and Tenant expressly agree that the allocation of responsibility for compliance with laws and for performing improvements, maintenance and repairs set forth in this Lease represents Landlord’s and Tenant’s intent with respect to this issue.

8.9.Survival and Duration of Obligations. All covenants, representations, warranties, obligations and indemnities made or given under this Paragraph 8 shall survive the expiration or earlier termination of this Lease.

9.UTILITIES

Tenant shall pay all service charges and utility deposits and fees for water, electricity, sewage, janitorial, gas, telephone, pest control and any other utility services furnished to the Premises (“Utilities”) during the entire Term of this Lease. Tenant shall pay for all Utilities in addition to Rent. Except for damages or injuries caused by Landlord’s gross negligence or willful misconduct, Landlord shall not be liable for any reason for any loss or damage resulting from an interruption of any of the Utility services. Landlord may elect to separately meter any of the Utilities at Landlord’s expense. If any Utilities are not separately metered or billed to Tenant for the Premises but rather are billed to and paid by Landlord, Tenant shall pay to Landlord, as additional Rent, Tenant’s share of the cost of such services, as reasonably determined by Landlord. If any Utilities are not separately metered, Landlord shall have the right to determine Tenant’s consumption by submetering, survey or other methods designed to measure consumption with reasonable accuracy.

13

10.REPAIRS AND SERVICES BY LANDLORD

A.Landlord shall maintain, repair, and replace as needed (i) the exterior walls and other structural components of the Building, including, without limitation, the foundation, slab, roof, roof membrane, roof systems and components, exterior walls, load-bearing interior walls, gutters, downspouts, windows and frames (including glass and all exterior doors), (ii) all Building systems, including, without limitation, the lighting, life safety, HVAC, electrical and plumbing systems leading to, but not exclusively serving, the Premises, (iii) all utilities and utility installations leading to, but not exclusively serving, the Premises, (iv) the Common Areas both inside and outside the Building (including, without limitation, the Parking Facilities), and (v) the grounds surrounding the Building (including snow plowing, sanding, salting and shoveling snow; paving; and mowing of grass, care of shrubs and general landscaping) in good order and repair; provided that any repairs, maintenance or replacements rendered necessary by the negligence or intentional acts of Tenant or of any Tenant Representative shall be repaired by Tenant at Tenant’s sole cost and expense. The costs of all of the foregoing items shall be included in the Office Common Expenses and/or the Industrial Common Expenses unless such item is expressly excluded on Exhibit F. Tenant shall promptly report in writing to Landlord any condition known to Tenant to be defective which Landlord is required to repair, and failure to so report such conditions shall make Tenant responsible to Landlord for any liability incurred by Landlord by reason of such conditions. Landlord shall be required to commence such repairs within a reasonable period of time after receipt of Tenant’s notice.

B.Landlord shall furnish HVAC to the Premises, Monday through Friday, from 7:00 a.m. to 6:00 p.m. and on Saturday from 9:00 am to 1:00 p.m., except for New Year’s Day, Memorial Day, Independence Day, Labor Day, Thanksgiving, Christmas and two other holidays reasonably designated by Landlord ("Business Hours"). The costs of providing HVAC to the Premises during Business Hours shall be included in Office Common Expenses. Tenant, at its sole cost, shall have the right to utilize HVAC outside of Business Hours, on a direct dial control "DDC" demand basis. Within ten (10) days after receipt of invoice from Landlord, Tenant shall reimburse Landlord for Landlord’s actual cost of providing HVAC to Tenant outside of Business Hours, provided, however, in no event shall Tenant pay more than $20.00 per hour for the cost of providing HVAC outside of Business Hours. Notwithstanding anything to the contrary contained in this Lease, this Paragraph 10.B shall only apply to office space leased by Tenant and shall not apply to any warehouse space leased by Tenant.

11.REPAIRS BY TENANT

Except as otherwise specifically provided in this Lease, and except for latent defects, which cannot be discovered by ordinary reasonable visual inspection, Tenant accepts the Premises in its present “As-Is” condition and specifically acknowledges that the Premises are suited for the uses intended by Tenant. Subject to the provisions of Paragraph 13, Tenant shall make any other desired or required improvements to the Premises. Except for the specific items that are Landlord’s responsibility pursuant to Paragraph 10, Tenant shall at its own cost and expense keep and maintain the Premises in good order and repair, promptly making all necessary repairs and replacements, including, without limitation, all fixtures within the Premises, ceilings, floors, non‑load-bearing interior walls, finish work, windows, glass and doors within the Premises, lighting fixtures, bulbs and ballasts within the Premises, utility connections and facilities within the Premises, plumbing and electrical systems within the Premises, termite and pest extermination, and damage to Common Areas caused by Tenant or by any Tenant Representative. Tenant, in keeping the Premises in good order, condition and repair, shall exercise and perform good maintenance practices. Tenant’s obligations shall include restorations, replacements or renewals when necessary to keep the Premises and all improvements thereon or a part thereof in good order, condition and state of repair. Tenant shall be permitted to implement its own reasonable security measures in the Premises, subject to prior approval by Landlord (which approval shall not be unreasonably withheld, conditioned or delayed). Any security implemented by Tenant shall not interfere with any security measures that might be implemented on the Property by Landlord. Notwithstanding anything to the contrary herein, Tenant acknowledges and agrees that it shall be solely responsible for providing adequate security for (A) the Premises, (B) any cars or other vehicles on the Property or in the Parking Facilities, and (C) Tenant’s use of the Property and Premises. Landlord shall have no responsibility to prevent, and shall not be liable to Tenant, to any Tenant Representative, or to any of their respective agents, employees, contractors, visitors or invitees, for losses due to theft, burglary or other criminal activity, or for damages or injuries to persons or property resulting from persons gaining access to the Premises or any part of the Property, and Tenant hereby releases Landlord and its agents and employees from all liabilities for such losses,

14

damages or injury, regardless of the cause thereof, unless such losses, damage, or injury results from Landlord’s gross negligence or intentional misconduct. Tenant shall be responsible for complying with all laws applicable to the Property as a result of Tenant’s specific use of the Premises. Tenant shall be responsible, at its sole cost and expense, for providing all janitorial services to the Premises.

12.TENANT’S TAXES AND ASSESSMENTS

Tenant shall pay promptly, when due, all personal property taxes or other taxes and assessments levied and assessed by any governmental authority upon the removable property of Tenant in, upon or about the Premises.

13.ALTERATION OF PREMISES

A.After the Commencement Date, Tenant shall not repair or change the Premises at a cost in excess of $15,000.00 (“Tenant Repairs”) without the prior written consent of Landlord, which consent shall not be unreasonably withheld, conditioned or delayed, provided, however, that Tenant will make no structural changes or alterations to the Premises or changes to any Building systems without Landlord’s consent, which may be withheld in Landlord’s sole discretion. Landlord has pre-approved the Initial Tenant Improvements (as defined on Exhibit D-3) and none of the Initial Tenant Improvements will be considered an alteration or be subject to removal at the end of the Term. All alterations, improvements or changes shall remain a part of and be surrendered with the Premises, (A) unless Landlord directs their removal under Paragraph 23, or (B) unless Landlord and Tenant agree otherwise prior to installation of such alterations, improvements or changes. Tenant shall procure and keep in force, at Tenant’s sole cost and expense, any permits, licenses, and other governmental and regulatory approvals required for any such alterations or improvements. All alterations and improvements shall be performed by licensed contractors, who shall satisfy the insurance requirements in Paragraph 14.4. From the Occupancy Date through and including the date immediately preceding the Commencement Date, Landlord, at its sole cost, shall supply temporary power, a materials staging area, restroom access, freight elevator access, and an area for a dumpster in connection with the Initial Tenant Improvements. Tenant shall perform the Initial Tenant Improvements, at Tenant’s sole cost, except as otherwise set forth herein.